18++ Sar form money laundering information

Home » money laundering Info » 18++ Sar form money laundering informationYour Sar form money laundering images are ready. Sar form money laundering are a topic that is being searched for and liked by netizens today. You can Get the Sar form money laundering files here. Find and Download all royalty-free images.

If you’re looking for sar form money laundering images information related to the sar form money laundering interest, you have come to the ideal site. Our website always gives you hints for viewing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

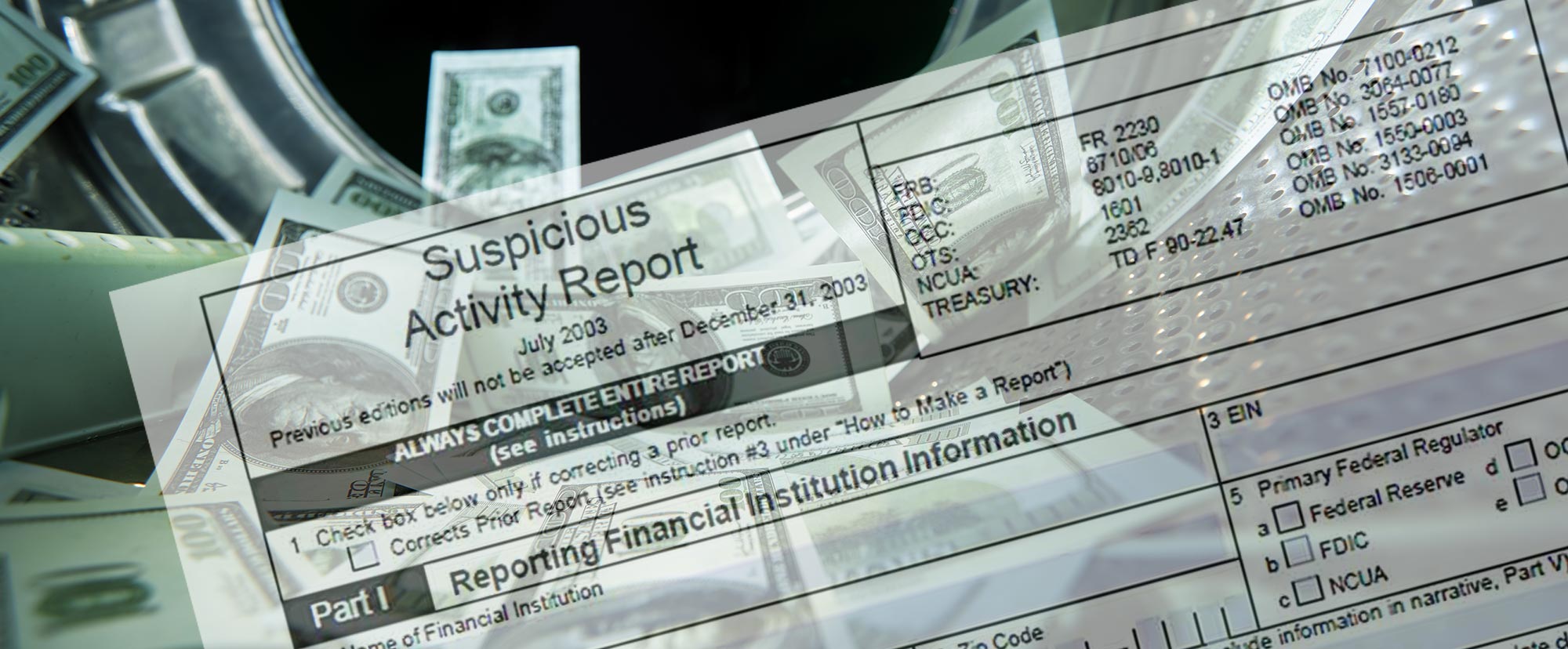

Sar Form Money Laundering. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. This is where you should enter key information including whether you are seeking a DAML. Keep a copy of the report and any supporting documentation for 5 years from the date of filing the report. To prevent any confusion it is essential that insurance companies complete the SAR-SF forms for filing as followsOn Page 2 Part IV 36-Name of financial institution or sole proprietorship.

Pin On Newsresuts In From pinterest.com

Pin On Newsresuts In From pinterest.com

In most countries the reporting of suspicious activity takes place via the submission of a suspicious activity report SAR a document sent by a financial institution to the appropriate authority according to compliance regulations. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. What is particularly notable about the case is that the SEC targeted GWFS for enforcement for allegedly filing 297 deficient SARs between September 2015 through October 2018 the Relevant Period despite GWFS having a seemingly otherwise robust anti-money laundering AML program a designated and capable BSAAML Officer a SAR review committee written supervisory procedures that stressed the. Alternatively search Google for SAR. If its not practical. SAR Type Select the type of report being made.

These reports are required under the United States Bank Secrecy Act BSA of 1970.

SAR Type Select the type of report being made. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the financial intelligence gathered from SARs. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of. Share SAR Money Laundering Abbreviation page. Submit completed SAR to.

Source: pinterest.com

Source: pinterest.com

Report by MSB SAR-MSB form available at wwwmsbgov or by calling the IRS Forms Distribution Center. The SAR became the standard form to report suspicious activity in 1996. Share SAR Money Laundering Abbreviation page. Banks and other businesses use suspicious activity reports SARs to report cases of suspected money laundering and terrorism financing to the United Kingdom Financial Intelligence Unit. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA.

Source: yumpu.com

Source: yumpu.com

FinCEN has issued frequently asked questions to assist financial institutions in completing the FinCEN SAR which as of April 1 2013 is the. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the financial intelligence gathered from SARs. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. Reports alert law enforcement to potential instances of money laundering or terrorist financing. Institutions and individuals should submit a Suspicious Activity Report SAR using the Suspicious Activity Report SAR Form.

Source: researchgate.net

Source: researchgate.net

ABC Life Insurance Co. Reasons for the report Signed Date of signature To be completed by the MLRO Action Taken. Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. The nominated officer must normally suspend the transaction if they suspect money laundering or terrorist financing. Banks and other businesses use suspicious activity reports SARs to report cases of suspected money laundering and terrorism financing to the United Kingdom Financial Intelligence Unit.

Source: pinterest.com

Source: pinterest.com

What is particularly notable about the case is that the SEC targeted GWFS for enforcement for allegedly filing 297 deficient SARs between September 2015 through October 2018 the Relevant Period despite GWFS having a seemingly otherwise robust anti-money laundering AML program a designated and capable BSAAML Officer a SAR review committee written supervisory procedures that stressed the. Reasons for the report Signed Date of signature To be completed by the MLRO Action Taken. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. Detroit Computing Center Attn. The National Money Laundering Strategy established by the Secretary of the Treasury and the Attorney General describes the goals objectives and priorities for combating money laundering terrorism and related financial crimes.

Source: arachnys.com

Source: arachnys.com

Submit completed SAR to. If its not practical. Share SAR Money Laundering Abbreviation page. Detroit Computing Center Attn. Reports alert law enforcement to potential instances of money laundering or terrorist financing.

Source: researchgate.net

Source: researchgate.net

A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. Detroit Computing Center Attn. Through money laundering the monetary proceeds derived from criminal activity are transformed into funds with an apparently legal source. In most countries the reporting of suspicious activity takes place via the submission of a suspicious activity report SAR a document sent by a financial institution to the appropriate authority according to compliance regulations. Banks and other businesses use suspicious activity reports SARs to report cases of suspected money laundering and terrorism financing to the United Kingdom Financial Intelligence Unit.

Source: researchgate.net

Source: researchgate.net

Box 33117 Detroit MI 48232-5980. Submit completed SAR to. Detroit Computing Center Attn. To prevent any confusion it is essential that insurance companies complete the SAR-SF forms for filing as followsOn Page 2 Part IV 36-Name of financial institution or sole proprietorship. Box 33117 Detroit MI 48232-5980.

Source: in.pinterest.com

Source: in.pinterest.com

In most countries the reporting of suspicious activity takes place via the submission of a suspicious activity report SAR a document sent by a financial institution to the appropriate authority according to compliance regulations. The SAR Online reporting form Step 1 SAR Header SECTION INFORMATION TIPS SAMPLE TEXT Your Reference Include your own internal reference number here All fields marked with a red asterisk must be completed. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. Share SAR Money Laundering Abbreviation page. The nominated officer must normally suspend the transaction if they suspect money laundering or terrorist financing.

Source: researchgate.net

Source: researchgate.net

Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. Reasons for the report Signed Date of signature To be completed by the MLRO Action Taken. A Suspicious Activity Report SAR is a document that financial institutions must file with the Financial Crimes Enforcement Network FinCEN following a suspected incident of money laundering or fraud. They do this by making a Suspicious Activity Report SAR. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing.

Source: in.pinterest.com

Source: in.pinterest.com

MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of. What is particularly notable about the case is that the SEC targeted GWFS for enforcement for allegedly filing 297 deficient SARs between September 2015 through October 2018 the Relevant Period despite GWFS having a seemingly otherwise robust anti-money laundering AML program a designated and capable BSAAML Officer a SAR review committee written supervisory procedures that stressed the. These reports are required under the United States Bank Secrecy Act BSA of 1970. Report by MSB SAR-MSB form available at wwwmsbgov or by calling the IRS Forms Distribution Center.

Source: pinterest.com

Source: pinterest.com

Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. Institutions and individuals should submit a Suspicious Activity Report SAR using the Suspicious Activity Report SAR Form. Report by MSB SAR-MSB form available at wwwmsbgov or by calling the IRS Forms Distribution Center. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports.

Source: pinterest.com

Source: pinterest.com

These reports are required under the United States Bank Secrecy Act BSA of 1970. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the financial intelligence gathered from SARs. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. Submit completed SAR to. FinCEN has issued frequently asked questions to assist financial institutions in completing the FinCEN SAR which as of April 1 2013 is the.

Source: complyadvantage.com

Source: complyadvantage.com

Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of. To prevent any confusion it is essential that insurance companies complete the SAR-SF forms for filing as followsOn Page 2 Part IV 36-Name of financial institution or sole proprietorship. The National Money Laundering Strategy established by the Secretary of the Treasury and the Attorney General describes the goals objectives and priorities for combating money laundering terrorism and related financial crimes. SAR Type Select the type of report being made. FinCEN has issued frequently asked questions to assist financial institutions in completing the FinCEN SAR which as of April 1 2013 is the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sar form money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.