13+ Risks and methods of money laundering and terrorist financing info

Home » money laundering Info » 13+ Risks and methods of money laundering and terrorist financing infoYour Risks and methods of money laundering and terrorist financing images are available in this site. Risks and methods of money laundering and terrorist financing are a topic that is being searched for and liked by netizens now. You can Download the Risks and methods of money laundering and terrorist financing files here. Download all free images.

If you’re searching for risks and methods of money laundering and terrorist financing images information related to the risks and methods of money laundering and terrorist financing topic, you have come to the ideal site. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

Risks And Methods Of Money Laundering And Terrorist Financing. Terrorist funding involves the use of funds for an unlawful political reason although the funds are not always obtained from illegal proceeds. The risk of non-face to face identification due to digital on-boarding. Money laundering and terrorist financing can harm the soundness of a countrys financial sector. Under Part 4 of the 2010 Act credit and financial institutions are obliged to take measures to prevent the financing of terrorism such as carrying out customer due diligence ongoing monitoring reporting of suspicious.

Money Laundering And Terrorist Financing Risk Assessment 2020 Lexology From lexology.com

Money Laundering And Terrorist Financing Risk Assessment 2020 Lexology From lexology.com

The risk of non-face to face identification due to digital on-boarding. Terrorist financing TF risks is an essential part of dismantling and disrupting terrorist networks as well as the effective implementation of the risk-based approach RBA of counter terrorist financing. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. MONEY LAUNDERING AND TERRORISM FINANCING. Laundering money intended for terrorism serves to finance terrorist acts. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Terrorists and terrorist organizations also rely on money to sustain themselves and to carry out terrorist acts.

The methods used to move money to support terrorist activities are nearly identical to those used for moving and laundering money for general criminal purposes. MONEY LAUNDERING AND TERRORISM FINANCING. Money laundering and terrorist financing can harm the soundness of a countrys financial sector. Money Laundering and Terrorist Financing Risks in the E-Money Sector. Increased activities of non-profit organisations in countries with a higher risk of money laundering or terrorist financing. AN OVERVIEW Jean-François Thony1 The purpose of this overview is to examine why and how criminal and terrorists organizations use legitimate financial institutions to move and store assets and how lawmakers have built on that fact to propose innovative and more efficient responses to crime problems.

Source: e-elgar.com

Source: e-elgar.com

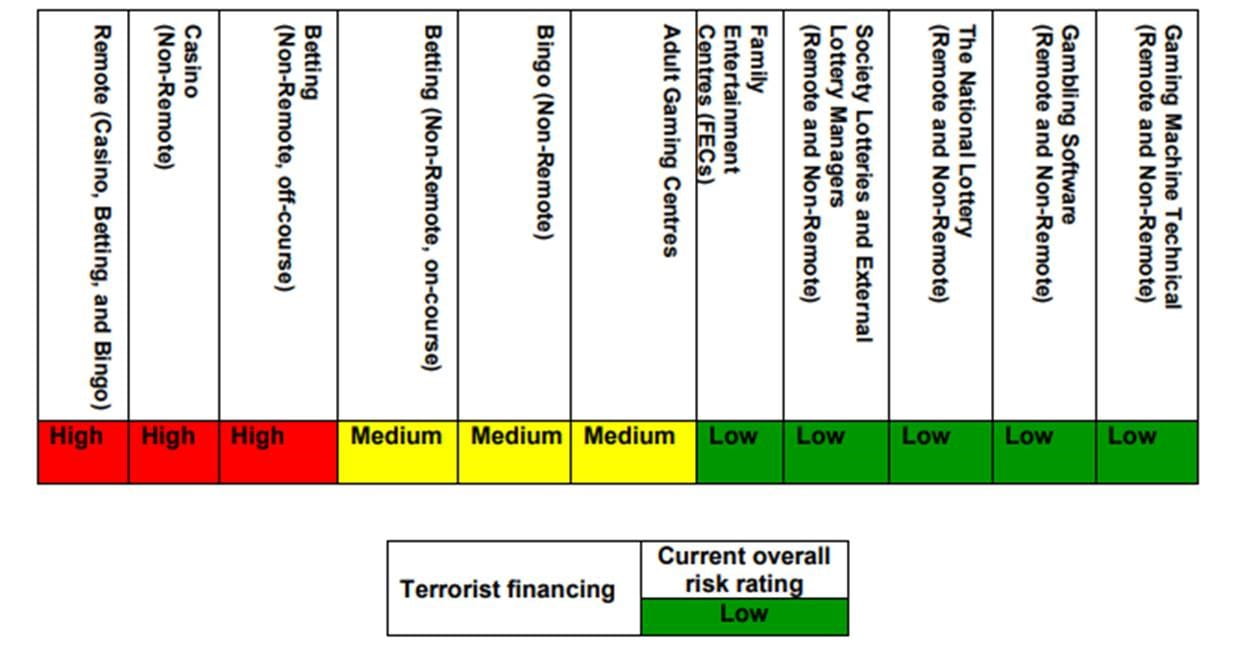

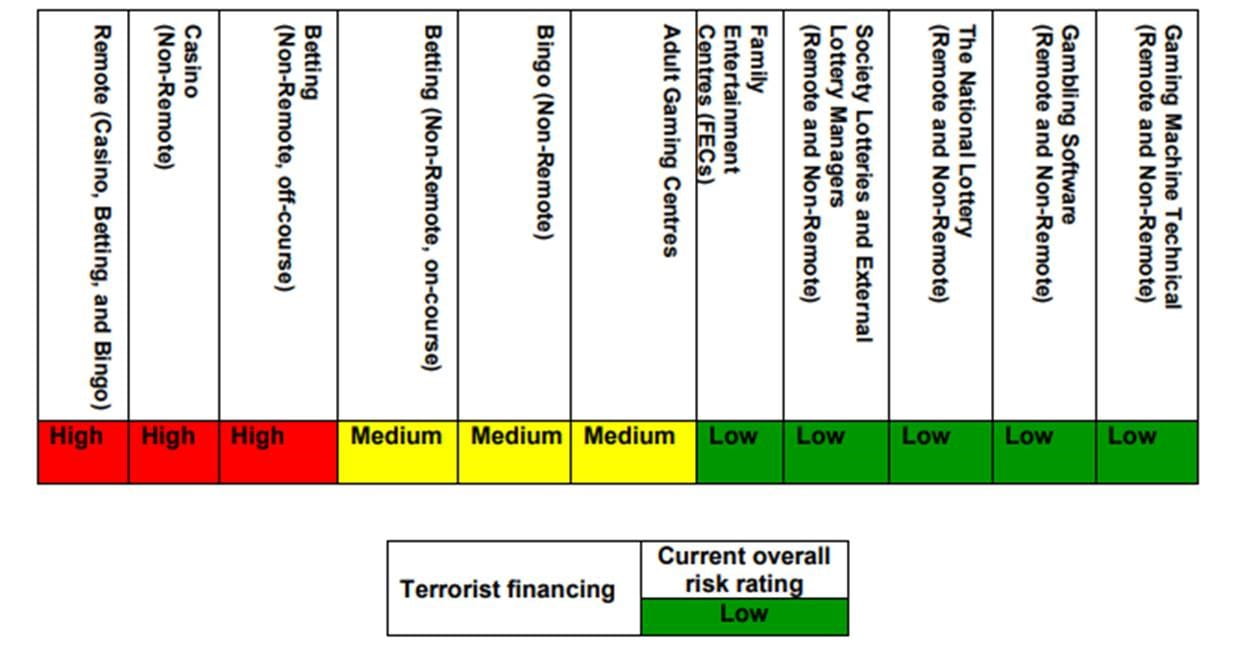

The FATF found that the UK has a robust understanding of its money laundering and terrorist financing risks and that our national AML and CTF policies strategies and activities seek to address the risks identified in our public National Risk Assessments NRAs. Laundering money intended for terrorism serves to finance terrorist acts. Increased activities of non-profit organisations in countries with a higher risk of money laundering or terrorist financing. The most fundamental distinction between terrorism fundraising and money laundering is the source of the funds. This research will assist countries in identifying assessing and understanding the money laundering and terrorist financing risks that they are exposed to.

Source: bi.go.id

Source: bi.go.id

AN OVERVIEW Jean-François Thony1 The purpose of this overview is to examine why and how criminal and terrorists organizations use legitimate financial institutions to move and store assets and how lawmakers have built on that fact to propose innovative and more efficient responses to crime problems. The Basel Committee has amended Sound management of risks related to money laundering and financing of terrorism to introduce guidelines on cooperation and information exchange among prudential and AMLCFT supervisors for banks. AN OVERVIEW Jean-François Thony1 The purpose of this overview is to examine why and how criminal and terrorists organizations use legitimate financial institutions to move and store assets and how lawmakers have built on that fact to propose innovative and more efficient responses to crime problems. Increased activities of non-profit organisations in countries with a higher risk of money laundering or terrorist financing. Global anti-money laundering AML and counter terrorist financing CFT efforts and the application of the FATF Standards in this context.

Source: bi.go.id

Source: bi.go.id

It explores the emerging terrorist financing threats and vulnerabilities posed by foreign terrorist fighters FTFs fundraising through social media. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Increased activities of non-profit organisations in countries with a higher risk of money laundering or terrorist financing. The Emerging Terrorist Financing Risks report the result of the call for further research into terrorist financing provides an overview of the various financing mechanisms and financial management practices used by terrorists and terrorist organisations. In many cases criminal organizations and terrorists employ the services of the same money professionals including accountants and lawyers to help move their funds.

Source: bi.go.id

Source: bi.go.id

Controls may be weakened by disjointed processes and remote handovers. The FATF found that the UK has a robust understanding of its money laundering and terrorist financing risks and that our national AML and CTF policies strategies and activities seek to address the risks identified in our public National Risk Assessments NRAs. They can negatively affect the stability of individual banks or other financial institutions such as securities firms and insurance companies. This guidance paper provides a summary of the challenges good practices and policy responses to new money laundering and terrorist financing threats and vulnerabilities arising from the. The methods used to move money to support terrorist activities are nearly identical to those used for moving and laundering money for general criminal purposes.

Source: piranirisk.com

Source: piranirisk.com

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. AN OVERVIEW Jean-François Thony1 The purpose of this overview is to examine why and how criminal and terrorists organizations use legitimate financial institutions to move and store assets and how lawmakers have built on that fact to propose innovative and more efficient responses to crime problems. The Emerging Terrorist Financing Risks report the result of the call for further research into terrorist financing provides an overview of the various financing mechanisms and financial management practices used by terrorists and terrorist organisations. Laundering money intended for terrorism serves to finance terrorist acts. Money Laundering and Terrorist Financing Risks in the E-Money Sector.

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Laundering money intended for terrorism serves to finance terrorist acts. Terrorist funding involves the use of funds for an unlawful political reason although the funds are not always obtained from illegal proceeds. The methods used to move money to support terrorist activities are nearly identical to those used for moving and laundering money for general criminal purposes. In many cases criminal organizations and terrorists employ the services of the same money professionals including accountants and lawyers to help move their funds.

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. This research will assist countries in identifying assessing and understanding the money laundering and terrorist financing risks that they are exposed to. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. The Criminal Justice Money Laundering and Terrorist Financing Act 2010 as amended by the Criminal Justice Act 2018 sets out the measures to be taken to prevent terrorist financing. The Basel Committee has amended Sound management of risks related to money laundering and financing of terrorism to introduce guidelines on cooperation and information exchange among prudential and AMLCFT supervisors for banks.

Source: amlcompliance.ie

Source: amlcompliance.ie

The FATF found that the UK has a robust understanding of its money laundering and terrorist financing risks and that our national AML and CTF policies strategies and activities seek to address the risks identified in our public National Risk Assessments NRAs. Businesses that are suffering from the crisis are misused for money laundering. Global anti-money laundering AML and counter terrorist financing CFT efforts and the application of the FATF Standards in this context. Terrorist funding involves the use of funds for an unlawful political reason although the funds are not always obtained from illegal proceeds. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Source: in.pinterest.com

Source: in.pinterest.com

The methods used to move money to support terrorist activities are nearly identical to those used for moving and laundering money for general criminal purposes. Consistent with the goals and objectives of the standards issued by the Financial Action Task Force FATF and. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. They can negatively affect the stability of individual banks or other financial institutions such as securities firms and insurance companies. Increased activities of non-profit organisations in countries with a higher risk of money laundering or terrorist financing.

Source: lexology.com

Source: lexology.com

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Consistent with the goals and objectives of the standards issued by the Financial Action Task Force FATF and. In many cases criminal organizations and terrorists employ the services of the same money professionals including accountants and lawyers to help move their funds. Money-laundering is the method by which criminals disguise the illegal origins of their wealth and protect their asset bases so as to avoid the suspicion of law enforcement agencies and prevent leaving a trail of incriminating evidence. Money Laundering and Terrorist Financing Risks in the E-Money Sector.

Source: piranirisk.com

Source: piranirisk.com

The Emerging Terrorist Financing Risks report the result of the call for further research into terrorist financing provides an overview of the various financing mechanisms and financial management practices used by terrorists and terrorist organisations. The Emerging Terrorist Financing Risks report the result of the call for further research into terrorist financing provides an overview of the various financing mechanisms and financial management practices used by terrorists and terrorist organisations. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Source: bi.go.id

Source: bi.go.id

Laundering risks and ways laundering can occur through vehicle sellers Structuring cash deposits below the reporting threshold purchasing vehicles w sequentially numbered checks or money orders Trading in vehicles and conductive successive transactions of buying and selling new and used vehicles to produce complex layers of transactions. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Under Part 4 of the 2010 Act credit and financial institutions are obliged to take measures to prevent the financing of terrorism such as carrying out customer due diligence ongoing monitoring reporting of suspicious. Consistent with the goals and objectives of the standards issued by the Financial Action Task Force FATF and. Money-laundering is the method by which criminals disguise the illegal origins of their wealth and protect their asset bases so as to avoid the suspicion of law enforcement agencies and prevent leaving a trail of incriminating evidence.

Source: pinterest.com

Source: pinterest.com

Laundering risks and ways laundering can occur through vehicle sellers Structuring cash deposits below the reporting threshold purchasing vehicles w sequentially numbered checks or money orders Trading in vehicles and conductive successive transactions of buying and selling new and used vehicles to produce complex layers of transactions. Under Part 4 of the 2010 Act credit and financial institutions are obliged to take measures to prevent the financing of terrorism such as carrying out customer due diligence ongoing monitoring reporting of suspicious. Terrorists and terrorist organizations also rely on money to sustain themselves and to carry out terrorist acts. The most fundamental distinction between terrorism fundraising and money laundering is the source of the funds. Terrorist funding involves the use of funds for an unlawful political reason although the funds are not always obtained from illegal proceeds.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risks and methods of money laundering and terrorist financing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.