17+ Risk rating of customer ideas in 2021

Home » money laundering idea » 17+ Risk rating of customer ideas in 2021Your Risk rating of customer images are ready. Risk rating of customer are a topic that is being searched for and liked by netizens now. You can Get the Risk rating of customer files here. Download all free photos.

If you’re searching for risk rating of customer pictures information linked to the risk rating of customer topic, you have visit the right blog. Our website always provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

Risk Rating Of Customer. It is essential to have up-to-date data when checking your customers. Risk Rating Customers Rick Small of Citigroup and John Byrne formerly ABA and Bank of America prepared this presentation on the customer risk rating processThe 19-page set of slides is originally from Citigroup and addresses a risk based approach to customer due diligence. Ongoing monitoring is the AML control process applied to check high-risk customers. How KYC Risk Rating Works.

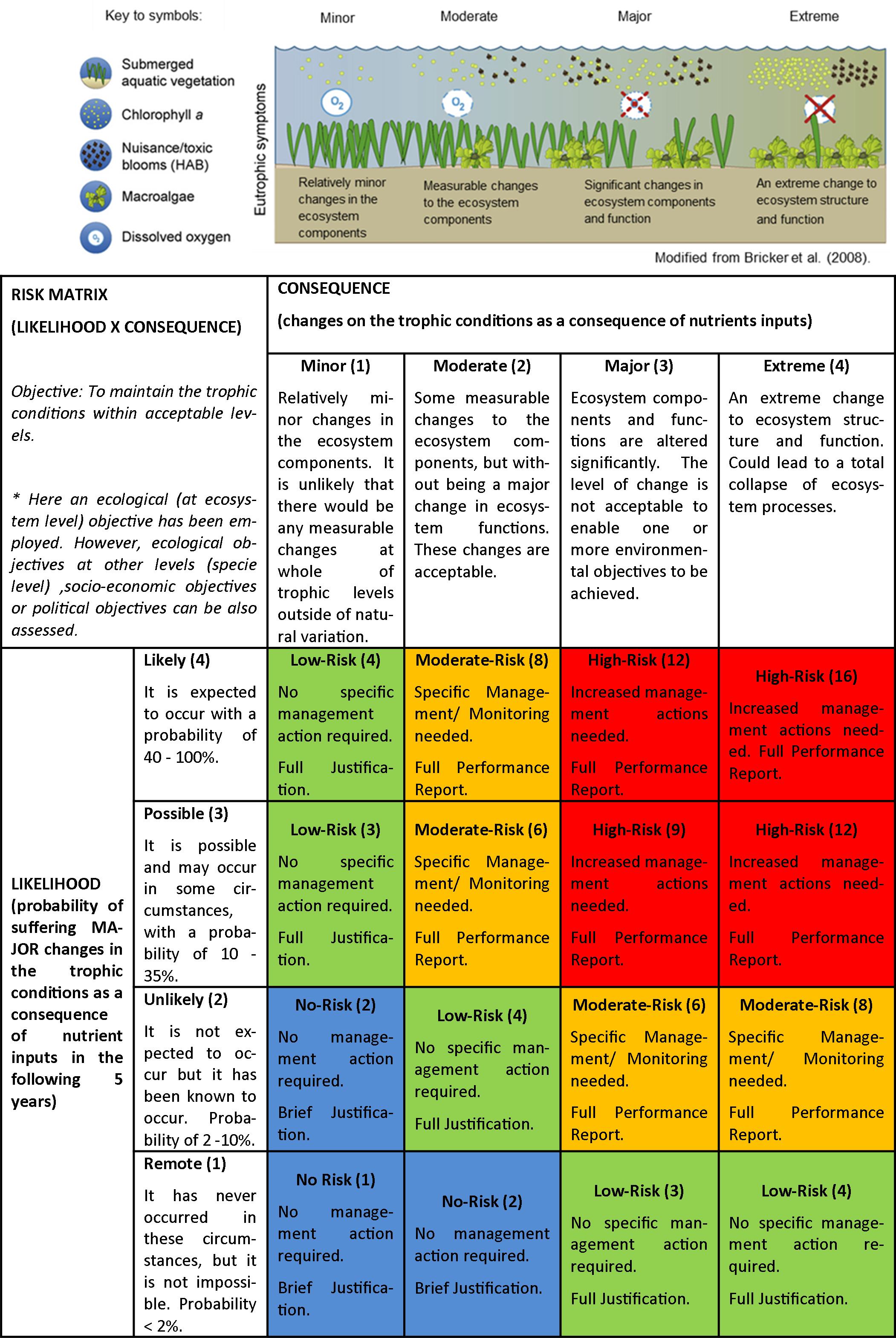

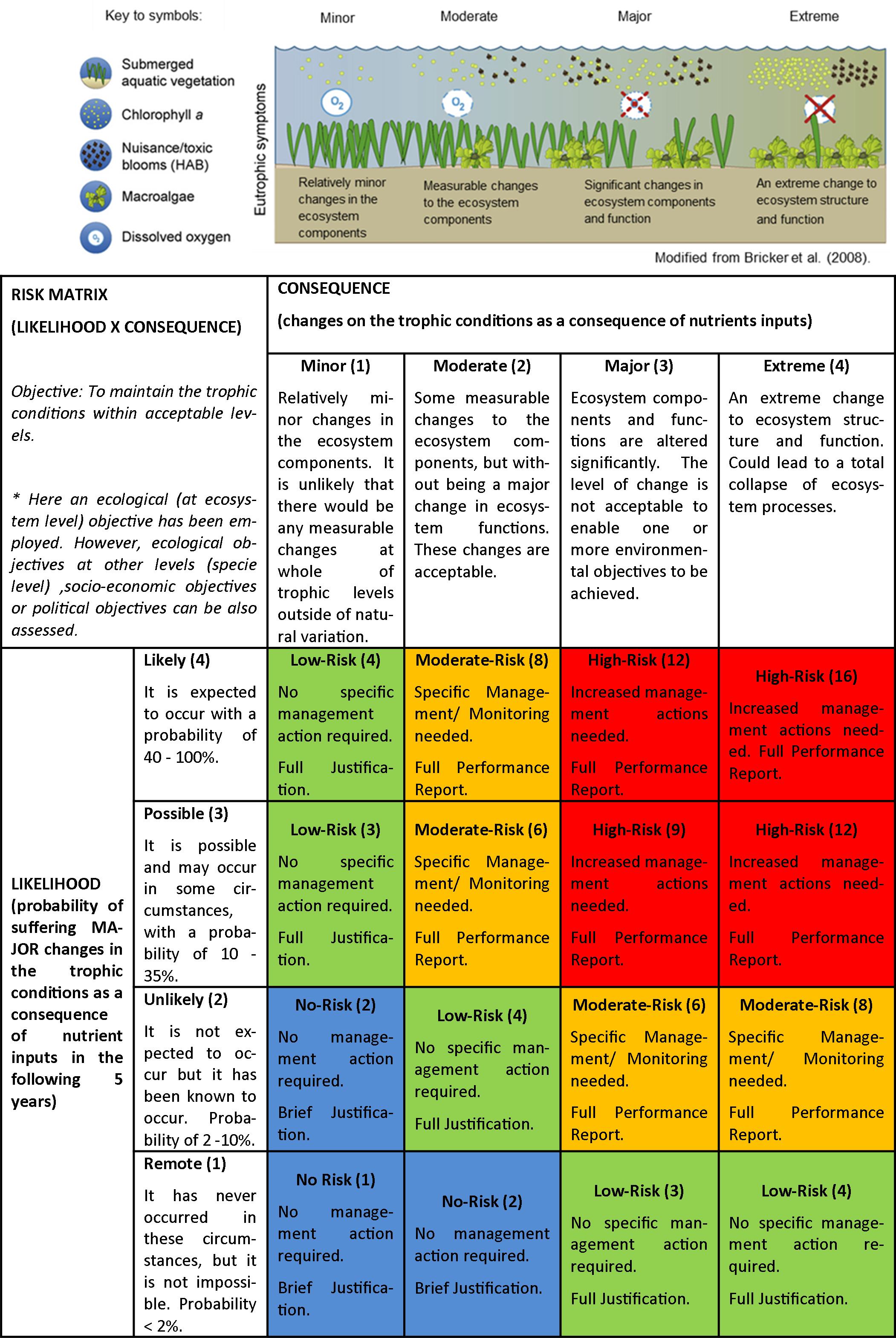

Qualitative Risk Analysis Consequence X Likelihood Perseus From perseus-net.eu

Qualitative Risk Analysis Consequence X Likelihood Perseus From perseus-net.eu

Low medium and high. The following checklist is intended to provide an example of how to assess risk for your client relationships. What is KYC Risk Rating. Classification of the customers is done under three risk categories viz. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Customers identity Socialfinancial status Nature of business activity Information about the clients business and their location etc.

Risk Rating is assessing the risks involved in the daily activities of a business and classifying them low medium high risk on the basis of the impact on the business. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in some cases negating the risk. Your risk assessment tool has to be appropriate for your specific business needs which means that it may have to be. Low medium and high. The following checklist is intended to provide an example of how to assess risk for your client relationships.

Source: pinterest.com

Source: pinterest.com

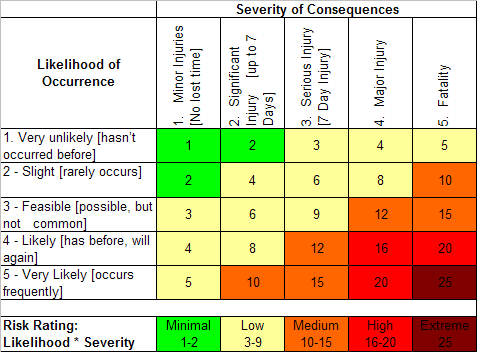

A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. Client and Business Relationships. 255 rows To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. What is KYC Risk Rating. Classification of the customers is done under three risk categories viz.

Source: thehealthandsafetyconsultancy.co.uk

Source: thehealthandsafetyconsultancy.co.uk

What is KYC Risk Rating. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. After completion of the evaluation process an overall score and risk rating is automatically determined. Most institutions calculate both of these risk ratings as each of them is equally important. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Source: pinterest.com

Source: pinterest.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. The following checklist is intended to provide an example of how to assess risk for your client relationships. How KYC Risk Rating Works. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. Risk Rating is assessing the risks involved in the daily activities of a business and classifying them low medium high risk on the basis of the impact on the business.

Source: pinterest.com

Source: pinterest.com

The risk you take on by catering to a huge primary customer should be rewarded by greater profitability from that account. The following checklist is intended to provide an example of how to assess risk for your client relationships. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. Your task is to lower mitigate or eliminate those risks.

Source: pinterest.com

Source: pinterest.com

Low medium and high. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Your risk assessment tool has to be appropriate for your specific business needs which means that it may have to be. Customers identity Socialfinancial status Nature of business activity Information about the clients business and their location etc. Medium Risk - Rating of 6 or 8 If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk.

Source: pinterest.com

Source: pinterest.com

Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. How KYC Risk Rating Works. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. The risk you take on by catering to a huge primary customer should be rewarded by greater profitability from that account. Risk Rating Customers Rick Small of Citigroup and John Byrne formerly ABA and Bank of America prepared this presentation on the customer risk rating processThe 19-page set of slides is originally from Citigroup and addresses a risk based approach to customer due diligence.

Source: proxsisgroup.com

Source: proxsisgroup.com

255 rows To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. It is essential to have up-to-date data when checking your customers. This is only a starting point and you should customize the checklist for your business. Medium Risk - Rating of 6 or 8 If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk.

Source: xenongroup.co.uk

Source: xenongroup.co.uk

255 rows To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. Classification of the customers is done under three risk categories viz. 255 rows To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. Based on the customers risk score the KYC system determines the next review date.

Source: researchgate.net

Source: researchgate.net

After completion of the evaluation process an overall score and risk rating is automatically determined. Medium Risk - Rating of 6 or 8 If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. Based on the customers risk score the KYC system determines the next review date. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in some cases negating the risk.

Source: pinterest.com

Source: pinterest.com

Ongoing monitoring is the AML control process applied to check high-risk customers. Are some of the parameters in the risk assessment strategy of the financial institutions. Your task is to lower mitigate or eliminate those risks. It is essential to have up-to-date data when checking your customers. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers.

Source: itsecurity.uiowa.edu

Source: itsecurity.uiowa.edu

Different Types of Customer Risk This presentation explores different types of risk your customers or clients consider when they are purchasing your solution. Medium Risk - Rating of 6 or 8 If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. Risk Rating Customers Rick Small of Citigroup and John Byrne formerly ABA and Bank of America prepared this presentation on the customer risk rating processThe 19-page set of slides is originally from Citigroup and addresses a risk based approach to customer due diligence. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Master value pricing and transform your business profits and client satisfaction Get the Master Class 5.

Source: perseus-net.eu

Source: perseus-net.eu

Classification of the customers is done under three risk categories viz. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. Customers identity Socialfinancial status Nature of business activity Information about the clients business and their location etc.

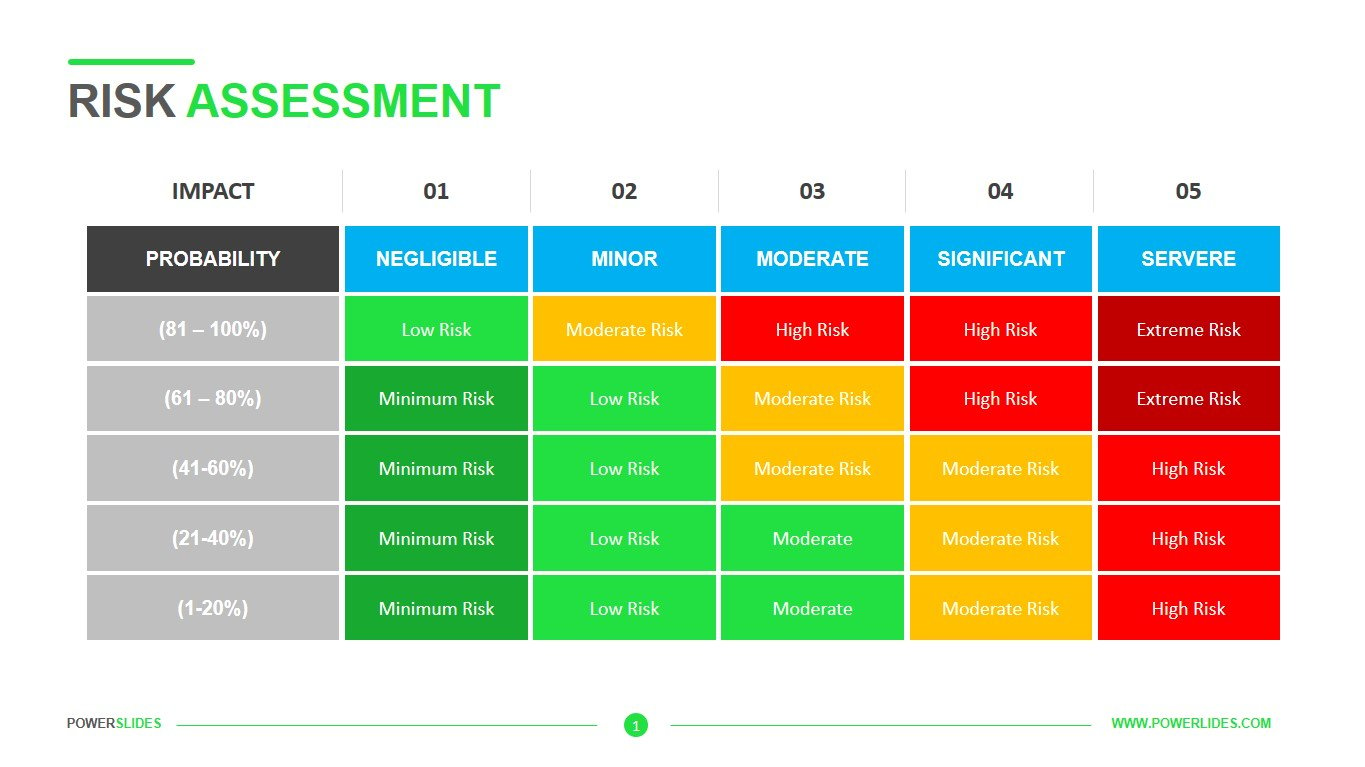

Source: powerslides.com

Source: powerslides.com

Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. It is essential to have up-to-date data when checking your customers. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk rating of customer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.