14++ Risk rating categories ideas

Home » money laundering Info » 14++ Risk rating categories ideasYour Risk rating categories images are available. Risk rating categories are a topic that is being searched for and liked by netizens today. You can Find and Download the Risk rating categories files here. Download all free vectors.

If you’re looking for risk rating categories images information related to the risk rating categories interest, you have pay a visit to the ideal blog. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

Risk Rating Categories. The risk level for each threat event category is then calculated. Conceptually they are more similar to the country ceilings that are produced by some of the major CRAs. Assessed Rating Bands. Low Risk - Rating of 3 or 4 Even if the risk is low there may be things you can still do to bring the risk rating back down to Minimal.

Risk Analysis From onlinelibrary.wiley.com

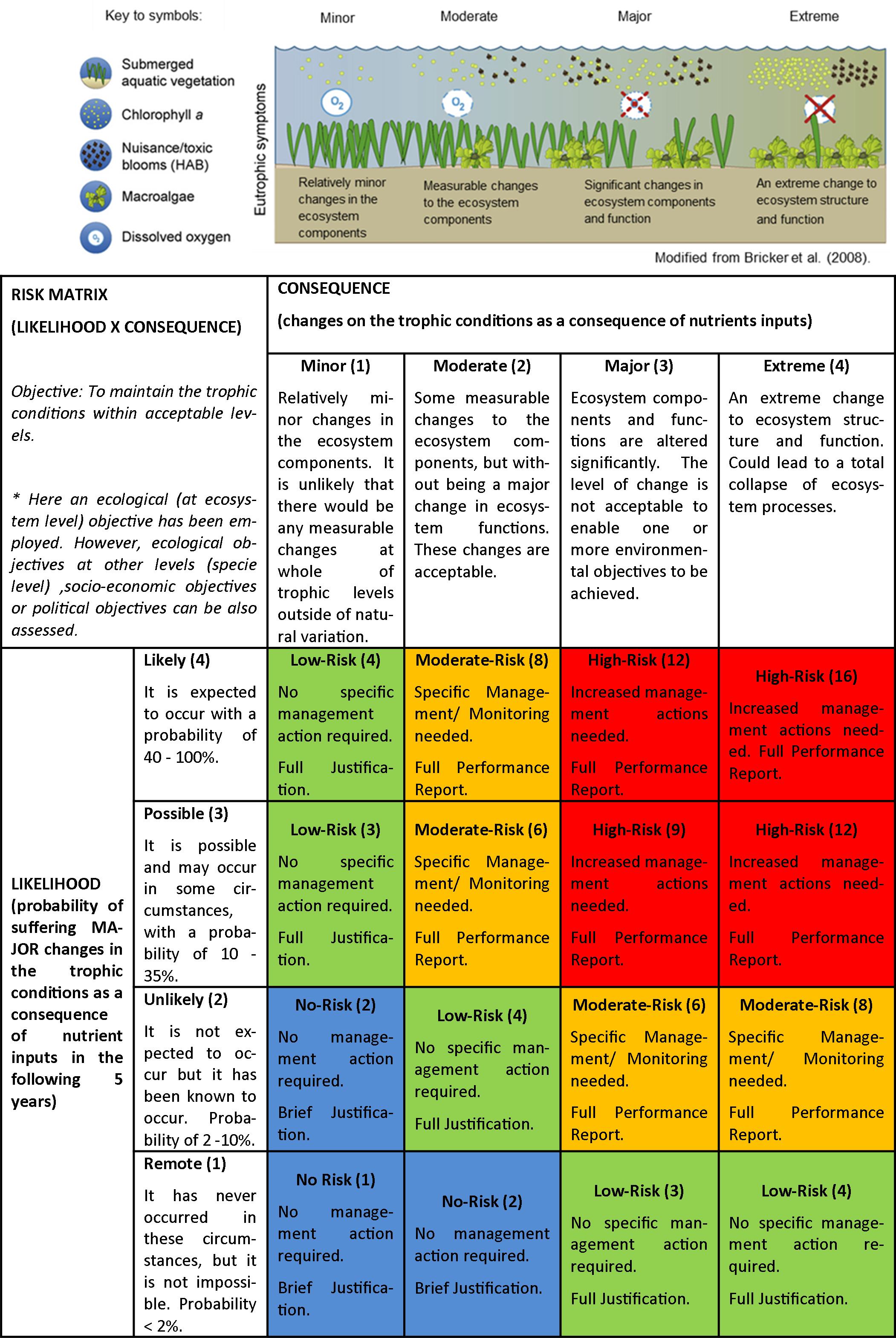

Risk Analysis From onlinelibrary.wiley.com

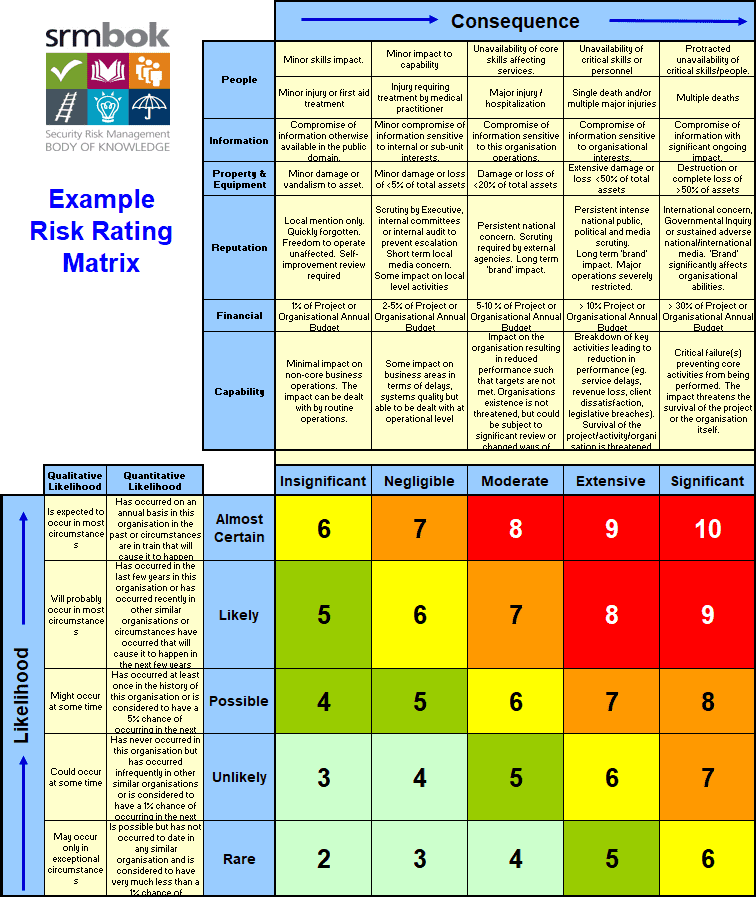

43 - 61 M oderate 4. Additionally the recipe that makes up the security rating will vary from vendor to vendor. Pathway Lendings risk rating matrix segments its small business portfolio into two. Low Risk - Rating of 3 or 4 Even if the risk is low there may be things you can still do to bring the risk rating back down to Minimal. Select the appropriate Likelihood or Frequency rating of the Risk Event occurring for the selected Consequence level given the controls are in place. The focus will be on categorization of applications and segregating them into high medium and low risk applications based on the overall risk rating well derive through ahybrid approach discussedin this article.

Technical risk includes facets such as poor design over-complexity unclear expectations and technical failures.

Some firms only have low and high risk classification. This allows bank management and examiners to monitor changes and trends. An example is shown in Appendix A. Fitch may also disclose issues relating to a rated issuer that are not and have not been rated. The risk grades which usually range from four to eight can be grouped into two categories. Investment grade categories indicate relatively low to moderate credit risk while ratings in the speculative categories signal either a higher level of credit risk or that a default has already occurred.

Source: itsecurity.uiowa.edu

Source: itsecurity.uiowa.edu

Some firms only have low and high risk classification. An example is shown in Appendix A. Minimal Risk - Rating of 1 or 2. Conceptually they are more similar to the country ceilings that are produced by some of the major CRAs. The risk rating matrix segments the loan portfolio by level of risk.

Source: researchgate.net

Source: researchgate.net

Assessed Rating Bands. Additionally the recipe that makes up the security rating will vary from vendor to vendor. The risk grades which usually range from four to eight can be grouped into two categories. Pathway Lendings risk rating matrix segments its small business portfolio into two. The focus will be on categorization of applications and segregating them into high medium and low risk applications based on the overall risk rating well derive through ahybrid approach discussedin this article.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

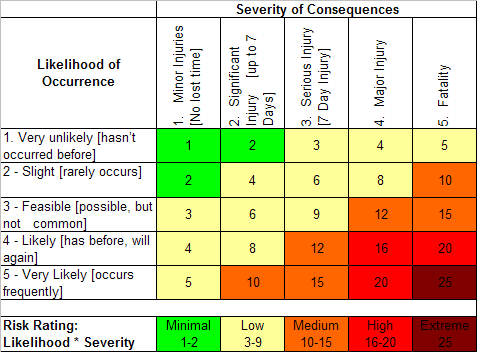

62 - 81 Low 3. By risk category financial operational strategic compliance and sub-category market credit liquidity etc for business units corporate functions and capital projects. Low Risk - Rating of 3 or 4 Even if the risk is low there may be things you can still do to bring the risk rating back down to Minimal. Assessed Rating Bands. Minimal Risk - Rating of 1 or 2.

Source: sectara.com

Source: sectara.com

Conceptually they are more similar to the country ceilings that are produced by some of the major CRAs. Additionally the recipe that makes up the security rating will vary from vendor to vendor. Low Risk - Rating of 3 or 4 Even if the risk is low there may be things you can still do to bring the risk rating back down to Minimal. 82 - 100 U ndoubted 2. Some firms only have low and high risk classification.

Source: entirelysafe.com

Source: entirelysafe.com

Functions of a Credit Risk Rating System. These factors can increase depending on the type of project your running for example if your project includes use of hazardous materialsgoods. Additionally the recipe that makes up the security rating will vary from vendor to vendor. The country risk classifications are not sovereign risk classifications and therefore should not be compared with the sovereign risk classifications of private credit rating agencies CRAs. Low Risk - Rating of 3 or 4 Even if the risk is low there may be things you can still do to bring the risk rating back down to Minimal.

Source: perseus-net.eu

Source: perseus-net.eu

Investment grade categories indicate relatively low to moderate credit risk while ratings in the speculative categories signal either a higher level of credit risk or that a default has already occurred. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Technical risk includes facets such as poor design over-complexity unclear expectations and technical failures. For the given Risk Event select the relevant Consequence categories and apply a rating. The risk level for each threat event category is then calculated.

Source: slideteam.net

Source: slideteam.net

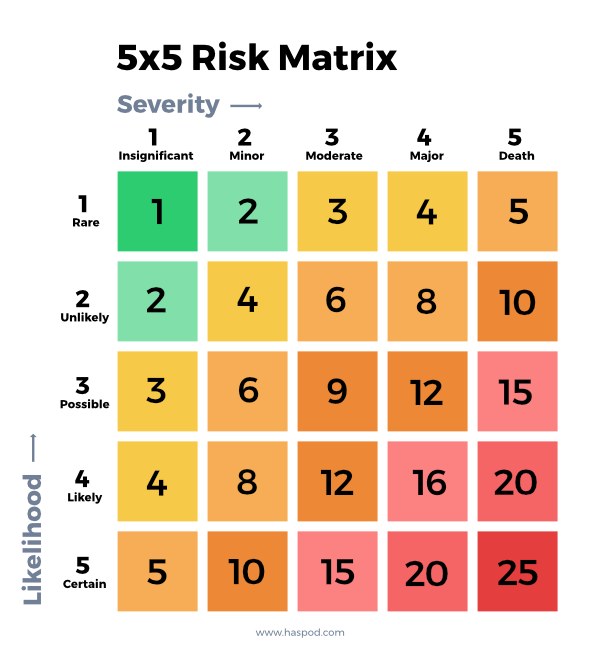

For the given Risk Event select the relevant Consequence categories and apply a rating. The risk rating matrix segments the loan portfolio by level of risk. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating. Investment grade categories indicate relatively low to moderate credit risk while ratings in the speculative categories signal either a higher level of credit risk or that a default has already occurred. Conceptually they are more similar to the country ceilings that are produced by some of the major CRAs.

Source: haspod.com

Source: haspod.com

Some firms only have low and high risk classification. At this stage a wide net is cast to understand the universe of risks making up the enterprises risk profile. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Of the four categories of cyber risk data compromised systems diligence breach. Events and user behavior compromised systems is the most difficult category to.

Source: researchgate.net

Source: researchgate.net

The risk rating matrix segments the loan portfolio by level of risk. The focus will be on categorization of applications and segregating them into high medium and low risk applications based on the overall risk rating well derive through ahybrid approach discussedin this article. The risk grades which usually range from four to eight can be grouped into two categories. Poor design of the Finance IT system will have an impact on Financial and other processes however the risk category is ICT as the root cause of the risk is ICTsystems related and needs to be controlled and treated as an ICT systems issue. Technical risk includes facets such as poor design over-complexity unclear expectations and technical failures.

Risk Rating Level of Risk Consequence x Likelihood. Events and user behavior compromised systems is the most difficult category to. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. The risk rating matrix segments the loan portfolio by level of risk. 62 - 81 Low 3.

Source: acs.org

Source: acs.org

Technical risk includes facets such as poor design over-complexity unclear expectations and technical failures. While each risk captured may be important to management. Assessed Rating Bands. Events and user behavior compromised systems is the most difficult category to. Fitch may also disclose issues relating to a rated issuer that are not and have not been rated.

Source: thehealthandsafetyconsultancy.co.uk

Source: thehealthandsafetyconsultancy.co.uk

The country risk classifications are not sovereign risk classifications and therefore should not be compared with the sovereign risk classifications of private credit rating agencies CRAs. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Generating a Customer Risk Rating The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Pathway Lendings risk rating matrix segments its small business portfolio into two. The focus will be on categorization of applications and segregating them into high medium and low risk applications based on the overall risk rating well derive through ahybrid approach discussedin this article.

Source: researchgate.net

Source: researchgate.net

For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. The risk rating matrix segments the loan portfolio by level of risk. This allows bank management and examiners to monitor changes and trends. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Functions of a Credit Risk Rating System.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk rating categories by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.