13++ Risk of money laundering in the us hsbc case study ideas

Home » money laundering Info » 13++ Risk of money laundering in the us hsbc case study ideasYour Risk of money laundering in the us hsbc case study images are ready in this website. Risk of money laundering in the us hsbc case study are a topic that is being searched for and liked by netizens now. You can Get the Risk of money laundering in the us hsbc case study files here. Find and Download all free images.

If you’re searching for risk of money laundering in the us hsbc case study pictures information linked to the risk of money laundering in the us hsbc case study keyword, you have come to the ideal site. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Risk Of Money Laundering In The Us Hsbc Case Study. In addition to the award Celent has published an in-depth case study that details HSBCs strategy implementation benefits and learnings with ARIC HSBC. Naheem Mohammed Ahmad Journal. Dollar services and access to the US. HSBC holds an indication of what is coming.

Brunei Darussalam The Asia Pacific Group On Money Laundering From yumpu.com

Brunei Darussalam The Asia Pacific Group On Money Laundering From yumpu.com

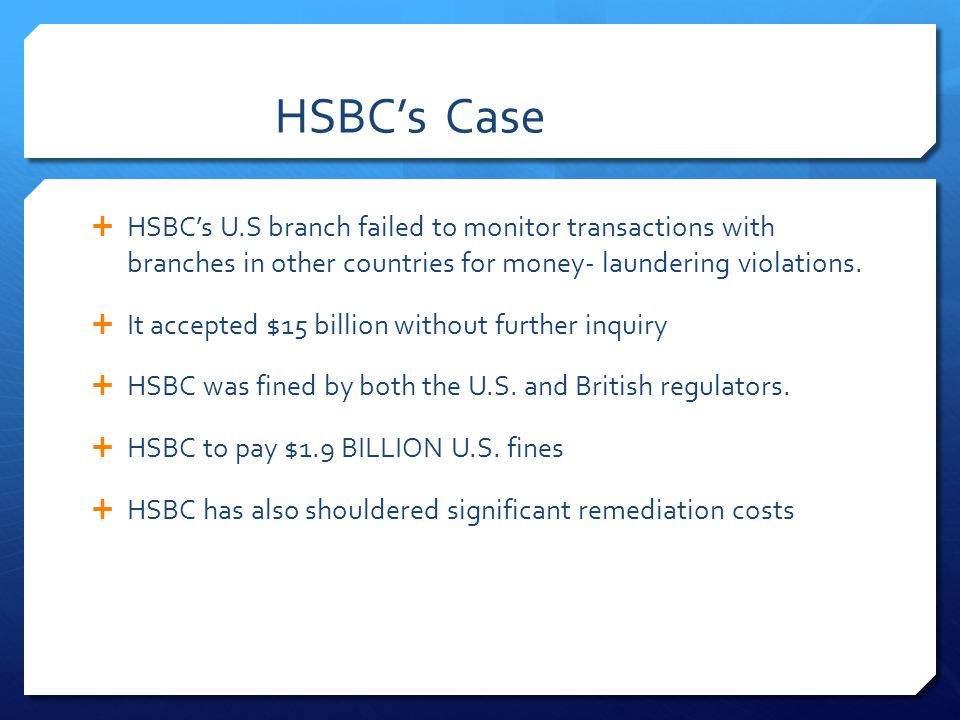

Insurance-Focused Transaction Monitoring Solution Powered by Machine Learning and Cloud. HSBC case study Naheem Mohammed Ahmad 2016-07-04 000000 Running head. HSBC holds an indication of what is coming. The challenge for those working on anti-money laundering. Financial system to high risk affiliates high risk correspondent banks and high risk clients using HSBC as a case study. HSBC case study There have been a number of recent cases of money laundering using the formal financial services which have highlighted the risks that banks can be exposed to from criminal activity Murray 2012.

HSBC Money-Laundering Case HSBC is a bank that originated from Hong Kong in 1865 with the original purpose to help trade between Europe and Asia take place.

Affiliate to provide US. At times in fact HSBC has failed to take the opportunities presented to establish a global leadership role in the area of human resources and employee rights and in 2005 the organization was accused of severe violations of both Federal and State labor laws regarding a class action suit based on call center employees in New York Virginia Illinois Nevada and other US locations Workers Sue 2005. This was an electronic funds transfer of money from the illegal drug sales. In both 2003 and 2010 US. HSBC holds an indication of what is coming. After prompting from US regulators HBUS found out that the travellers cheques were being bought in Russia - a country at high-risk of money laundering.

Source: issuu.com

Source: issuu.com

HSBC exposed US financial system to money laundering drug terrorist financing risks from permanent subcommittee on investigations. Naheem Mohammed Ahmad Journal. At times in fact HSBC has failed to take the opportunities presented to establish a global leadership role in the area of human resources and employee rights and in 2005 the organization was accused of severe violations of both Federal and State labor laws regarding a class action suit based on call center employees in New York Virginia Illinois Nevada and other US locations Workers Sue 2005. In addition to the award Celent has published an in-depth case study that details HSBCs strategy implementation benefits and learnings with ARIC HSBC. The Subcommittee hearing examined the issue of money laundering and terrorist financing vulnerabilities created when a global bank uses its US.

Source: academia.edu

Source: academia.edu

Risk of money laundering in the US. In both 2003 and 2010 US. HSBC exposed US financial system to money laundering drug terrorist financing risks from permanent subcommittee on investigations. 2016 Risk of money laundering in the US. More on this story HSBC agrees 19bn US.

It was illegal from Federal Government of the United States and many other state governments. The contributing factors include fast expansion of operations through. Journal of Money Laundering Control Issue Date. After prompting from US regulators HBUS found out that the travellers cheques were being bought in Russia - a country at high-risk of money laundering. Affiliate to provide US.

Source: researchgate.net

Source: researchgate.net

Dollar services and access to the US. More on this story HSBC agrees 19bn US. The case is about money-laundering of HSBC bank in 2012. HSBC case study Naheem Mohammed Ahmad 2016-07-04 000000 Running head. In addition to the award Celent has published an in-depth case study that details HSBCs strategy implementation benefits and learnings with ARIC HSBC.

Source: slideplayer.com

Source: slideplayer.com

The contributing factors include fast expansion of operations through. This paper draws lessons from the case. Journal of Money Laundering Control Issue Date. In March 2018 HSBC launched a Global Social Network Analytics platform to tackle financial crimes like money laundering human trafficking and terrorist financing. After prompting from US regulators HBUS found out that the travellers cheques were being bought in Russia - a country at high-risk of money laundering.

Source: researchgate.net

Source: researchgate.net

2016 Risk of money laundering in the US. Noncompliance with Anti-Money Laundering regulation resulted in penalties being imposed on HSBC to the extent of USD 19 billion. Regulators ordered HSBC to strengthen its anti-money laundering practices. Risk of money laundering in the US. Journal of Money Laundering Control Issue Date.

Source: researchgate.net

Source: researchgate.net

And The ability to identify new risk scenarios and typologies earlier than before. This was an electronic funds transfer of money from the illegal drug sales. HSBC conducted a transaction involving illegal activities on the behalf of some clients. The contributing factors include fast expansion of operations through. It withdrew from about 20 countries and 100 business lines under Stuart Gullivers leadership in the early and mid-2010s partly because of money-laundering risks after a 13 billion deferred prosecution agreement in the US.

Source: researchgate.net

Source: researchgate.net

Risk of money laundering in the US. HSBC case study There have been a number of recent cases of money laundering using the formal financial services which have highlighted the risks that banks can be exposed to from criminal activity Murray 2012. The Subcommittee hearing examined the issue of money laundering and terrorist financing vulnerabilities created when a global bank uses its US. It withdrew from about 20 countries and 100 business lines under Stuart Gullivers leadership in the early and mid-2010s partly because of money-laundering risks after a 13 billion deferred prosecution agreement in the US. After prompting from US regulators HBUS found out that the travellers cheques were being bought in Russia - a country at high-risk of money laundering.

HSBC case study Author. In October 2010 the United States OCC issued a Cease and Desist Order requiring HSBC to strengthen multiple aspects of its Anti-Money Laundering AML program. Naheem Mohammed Ahmad Journal. HSBC conducted a transaction involving illegal activities on the behalf of some clients. The contributing factors include fast expansion of operations through.

Source: wikiwand.com

Source: wikiwand.com

HSBC case study Journal of Money Laundering Control Vol. And The ability to identify new risk scenarios and typologies earlier than before. HSBC case study Journal of Money Laundering Control Vol. The case is about money-laundering of HSBC bank in 2012. This platform provides a comprehensive view of the banks customers through entity resolution and network analytics to leverage data dynamically empowering the investigators to identify financial activity.

Source: yumpu.com

Source: yumpu.com

HSBC exposed US financial system to money laundering drug terrorist financing risks from permanent subcommittee on investigations. Noncompliance with Anti-Money Laundering regulation resulted in penalties being imposed on HSBC to the extent of USD 19 billion. In both 2003 and 2010 US. Risk of money laundering in the US. HSBC AML Case Study.

Source: researchgate.net

Source: researchgate.net

Insurance-Focused Transaction Monitoring Solution Powered by Machine Learning and Cloud. This paper draws lessons from the case. From these roots HSBC has blossomed into existing branches in nearly 66 countries and territories HSBC 2019. Journal of Money Laundering Control Issue Date. This platform provides a comprehensive view of the banks customers through entity resolution and network analytics to leverage data dynamically empowering the investigators to identify financial activity.

Source: academia.edu

Source: academia.edu

HSBC case study Naheem Mohammed Ahmad 2016-07-04 000000 Running head. This paper draws lessons from the case. More on this story HSBC agrees 19bn US. HSBC AML Case Study. After prompting from US regulators HBUS found out that the travellers cheques were being bought in Russia - a country at high-risk of money laundering.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk of money laundering in the us hsbc case study by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.