15++ Risk factors of money laundering ideas in 2021

Home » money laundering idea » 15++ Risk factors of money laundering ideas in 2021Your Risk factors of money laundering images are ready in this website. Risk factors of money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Risk factors of money laundering files here. Download all free images.

If you’re looking for risk factors of money laundering images information linked to the risk factors of money laundering interest, you have come to the ideal blog. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

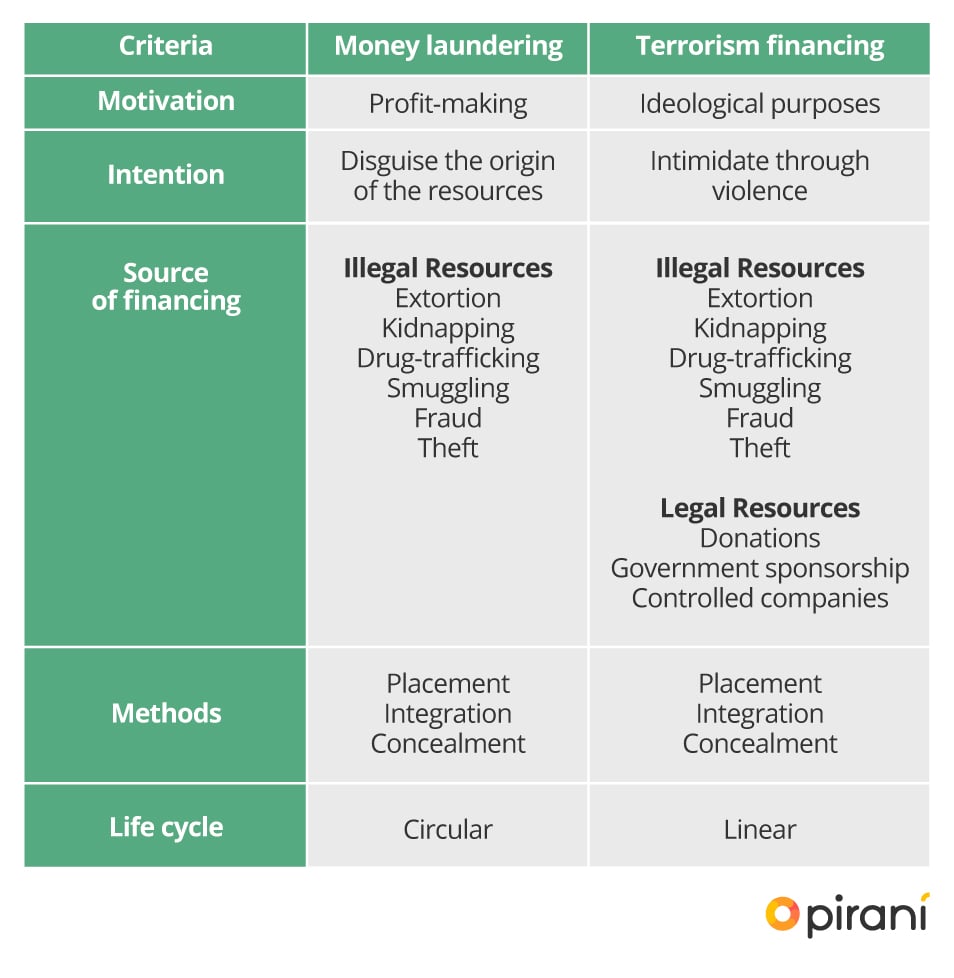

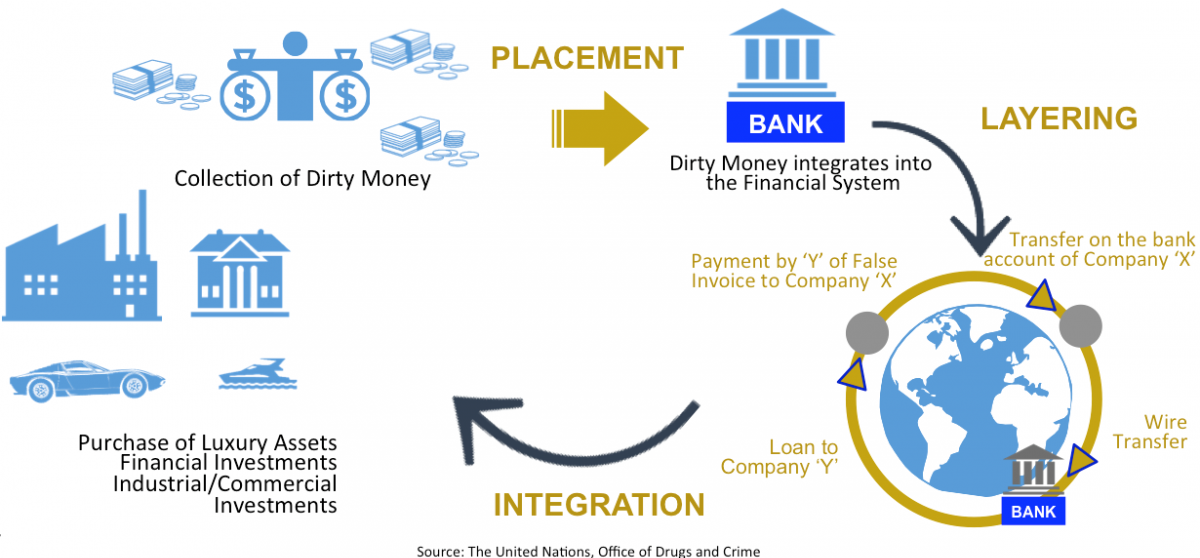

Risk Factors Of Money Laundering. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Money Launderers accumulate enormous profits through drug trafficking international frauds arms dealing etc. Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. He can be contacted on 44 020 7105 7394 or by email.

Why Do Most Aml Programs Fail From pideeco.be

Why Do Most Aml Programs Fail From pideeco.be

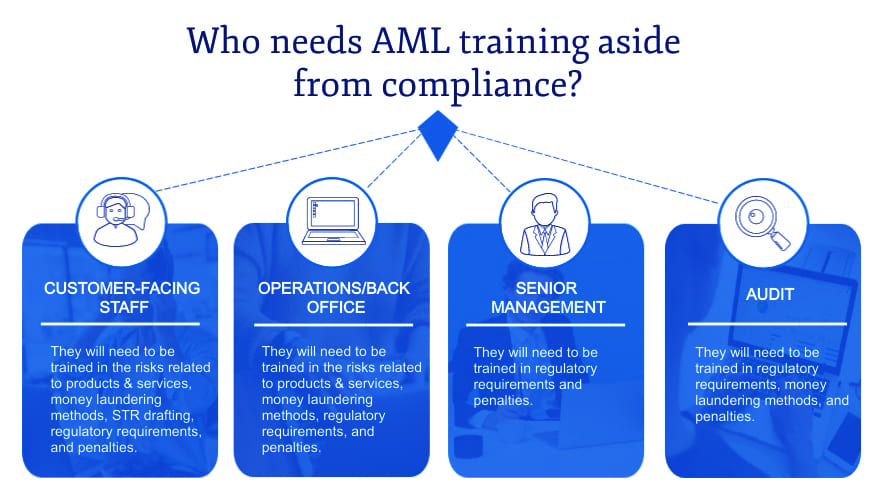

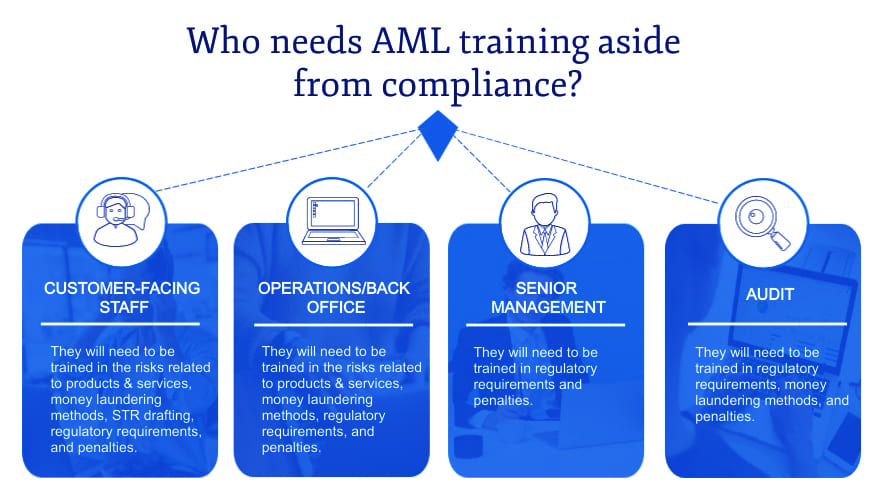

1 products and services 2 customers and entities and 3 geographic location. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. The study of money laundering risk should be based on three main types of risk. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. All that is needed is a good understanding of the importance of Money Laundering and Terrorist Financing risk assessment as it is a critical variable that leads to good cooperation and good. What are the 3 main factors to consider in determining AML risk.

All that is needed is a good understanding of the importance of Money Laundering and Terrorist Financing risk assessment as it is a critical variable that leads to good cooperation and good.

As with the company refunding the money improperly overcharged even where one is acting with the best of intentions the risk of inadvertently committing a money laundering offence should not be overlooked. To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved. Jeremy Summers is a partner at Osborne Clarke LLP. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. Soudijn and Reuter 2016 and opaque company ownership eg Blum et al. Inherent BSAAML risk falls into three main categories.

Source: in.pinterest.com

Source: in.pinterest.com

All that is needed is a good understanding of the importance of Money Laundering and Terrorist Financing risk assessment as it is a critical variable that leads to good cooperation and good. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. All that is needed is a good understanding of the importance of Money Laundering and Terrorist Financing risk assessment as it is a critical variable that leads to good cooperation and good. Money Launderers accumulate enormous profits through drug trafficking international frauds arms dealing etc.

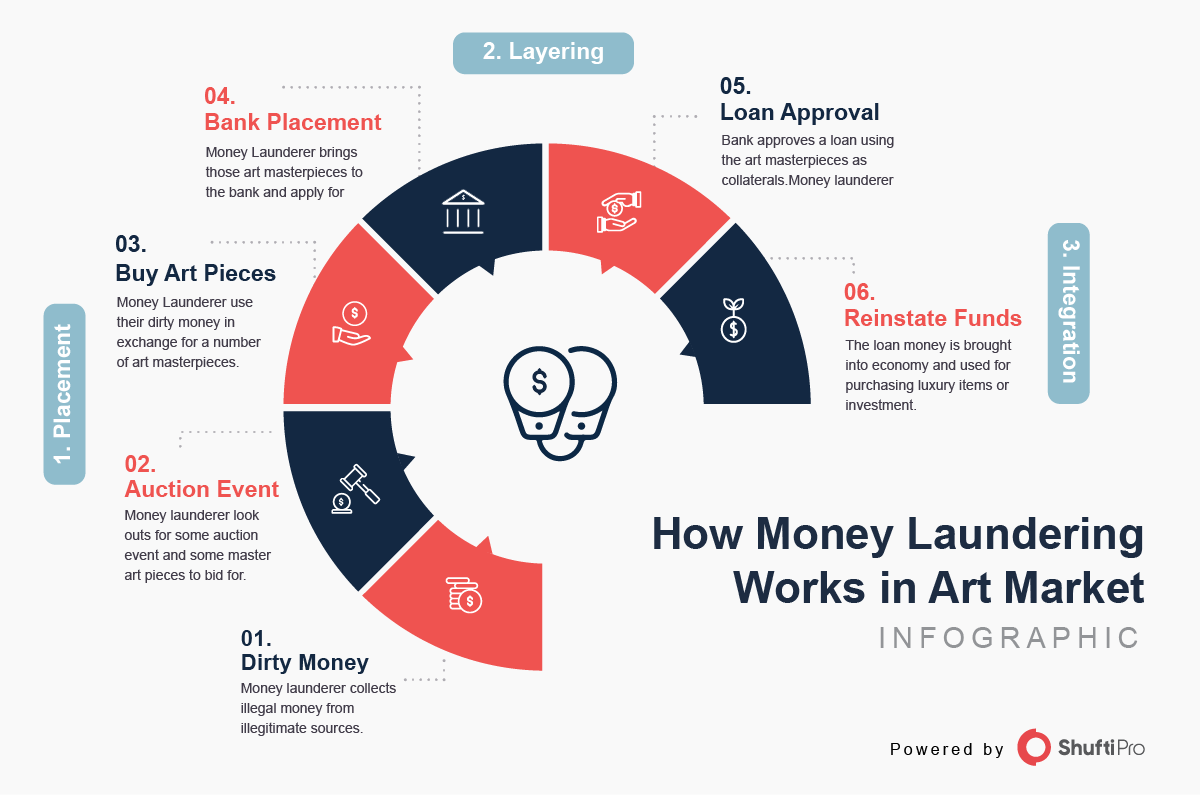

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. Money Launderers accumulate enormous profits through drug trafficking international frauds arms dealing etc. High-risk industries include for example cash-intensive businesses or companies or trusts that tend to be used as personal asset-holding vehicles etc. Soudijn and Reuter 2016 and opaque company ownership eg Blum et al. Geographic and country risk entities and clients risks and lastly product and.

Source: piranirisk.com

Source: piranirisk.com

The literature has recently speculated on which factors increase money laundering risks such as the use of cash eg Europol 2015. 3 Individual customers employer. The study of money laundering risk should be based on three main types of risk. Money Laundering is not an independent crime it depends upon another crime predicate offence the proceeds of which is the subject matter of the crime in money laundering. What is money laundering risk assessment.

Source: pinterest.com

Source: pinterest.com

To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved. Van der Does de Willebois et al. Inherent BSAAML risk falls into three main categories. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. 3 Individual customers employer.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Soudijn and Reuter 2016 and opaque company ownership eg Blum et al. Money LaunderingTerrorist Financing Risk Assessment. What is money laundering risk assessment. The study of money laundering risk should be based on three main types of risk. To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved.

Source: researchgate.net

Source: researchgate.net

What is money laundering risk assessment. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. Money Launderers accumulate enormous profits through drug trafficking international frauds arms dealing etc. As with the company refunding the money improperly overcharged even where one is acting with the best of intentions the risk of inadvertently committing a money laundering offence should not be overlooked. Geographic and country risk entities and clients risks and lastly product and.

Source: shuftipro.com

Source: shuftipro.com

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. High-risk industries include for example cash-intensive businesses or companies or trusts that tend to be used as personal asset-holding vehicles etc. Van der Does de Willebois et al. He can be contacted on 44 020 7105 7394 or by email. What are the 3 main factors to consider in determining AML risk.

Source: greenclimate.fund

Source: greenclimate.fund

Jeremy Summers is a partner at Osborne Clarke LLP. Risk-based approach means an approach whereby competent authorities and firms. 3 Individual customers employer. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Because non-PEP customers may be a risk for corruption-related money laundering depending on these factors reporting institutions should take steps to understand such risk outside the context of identifying and monitoring PEPs.

As with the company refunding the money improperly overcharged even where one is acting with the best of intentions the risk of inadvertently committing a money laundering offence should not be overlooked. Risks you cant ignore 3 Gathering securing and preserving evidence Technology is an essential component of almost every investigation. Van der Does de Willebois et al. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products. 3 Individual customers employer.

Source: pinterest.com

Source: pinterest.com

The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Riccardi and Levi 2017. To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved. Van der Does de Willebois et al. Risk-based approach means an approach whereby competent authorities and firms.

Source: shuftipro.com

Source: shuftipro.com

Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. What are the 3 main factors to consider in determining AML risk. Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. As with the company refunding the money improperly overcharged even where one is acting with the best of intentions the risk of inadvertently committing a money laundering offence should not be overlooked. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues.

Source: gov.si

Source: gov.si

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. Inherent BSAAML risk falls into three main categories. The study of money laundering risk should be based on three main types of risk. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering.

Source: pideeco.be

Source: pideeco.be

Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. Money LaunderingTerrorist Financing Risk Assessment. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title risk factors of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.