12+ Risk factors in customer risk rating information

Home » money laundering idea » 12+ Risk factors in customer risk rating informationYour Risk factors in customer risk rating images are available in this site. Risk factors in customer risk rating are a topic that is being searched for and liked by netizens today. You can Download the Risk factors in customer risk rating files here. Download all free vectors.

If you’re looking for risk factors in customer risk rating pictures information linked to the risk factors in customer risk rating topic, you have come to the right site. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Risk Factors In Customer Risk Rating. The business relationship is conducted in unusual circumstances eg. Significant unexplained geographic distance between the financial institution and the customer. The CER score is derived after considering all the different parameters. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Risk Assessment Matrix Providing Colored Risk Categories Plus Observed Download Scientific Diagram From researchgate.net

Risk Assessment Matrix Providing Colored Risk Categories Plus Observed Download Scientific Diagram From researchgate.net

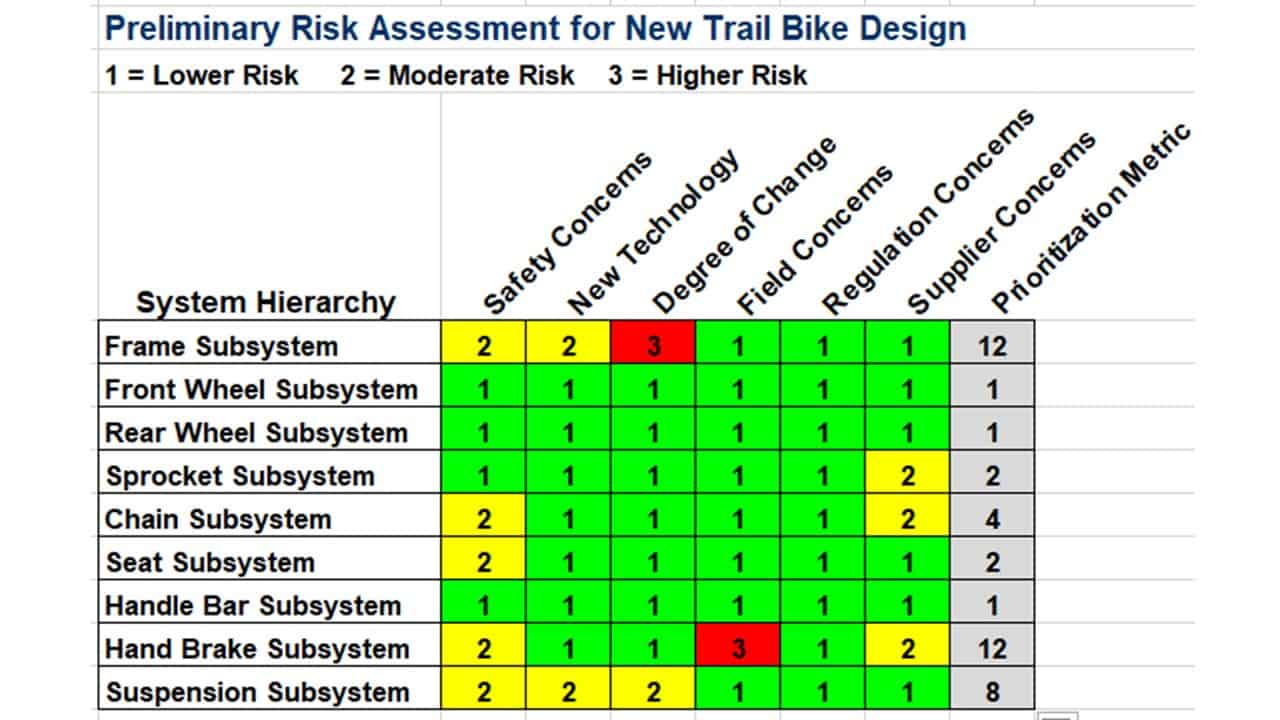

Time owned or managed the business 1 year 1 year and 3 years 3 years 2. Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat. The customer pursues activity commonly associated with a higher risk of corruption. Look hard at your contracts and your length of engagement. Different Types of Customer Risk This presentation explores different types of risk your customers or clients consider when they are purchasing your solution. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating.

Types Of KYC Risk Rating.

The customer is a voluntary organisationwhose primary activity is to raise or. Significant unexplained geographic distance between the financial institution and the customer. Rating Credit Risk Comptrollers Handbook April 2001. Both of these can provide you with good opportunities to mitigate risk. The customers activity is associated with a higher risk of MLFT. Direct knowledge of customers credit needs and financial conditions.

Source: pinterest.com

Source: pinterest.com

Risk Factors High Risk 3 Moderate Risk 2 Low Risk 1 Risk Rating 1. Time owned or managed the business 1 year 1 year and 3 years 3 years 2. Commonly referred to as the customer risk rating. 1 Adverse selection occurs when pricing or other underwriting and marketing factors cause too few desirable risk prospects relative to undesirable risk. Risk assessment parameters vary based on the customer type.

Source: researchgate.net

Source: researchgate.net

The customers activity is associated with a higher risk of MLFT. A Customer risk factors. Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat. The customers activity is associated with a higher risk of MLFT. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile.

Source: pinterest.com

Source: pinterest.com

255 rows To determine a customers overall risk rating a select list of variables are assessed and. Your task is to lower mitigate or eliminate those risks. Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat. Look hard at your contracts and your length of engagement. The CER score is derived after considering all the different parameters.

Source: pinterest.com

Source: pinterest.com

Commonly referred to as the customer risk rating. Customer Risk Examples of MLFT high risk indicators vis-à-vis customer cont. Rating Credit Risk Comptrollers Handbook April 2001. The reproduction or modification is prohibited. Types Of KYC Risk Rating.

Source: perseus-net.eu

Source: perseus-net.eu

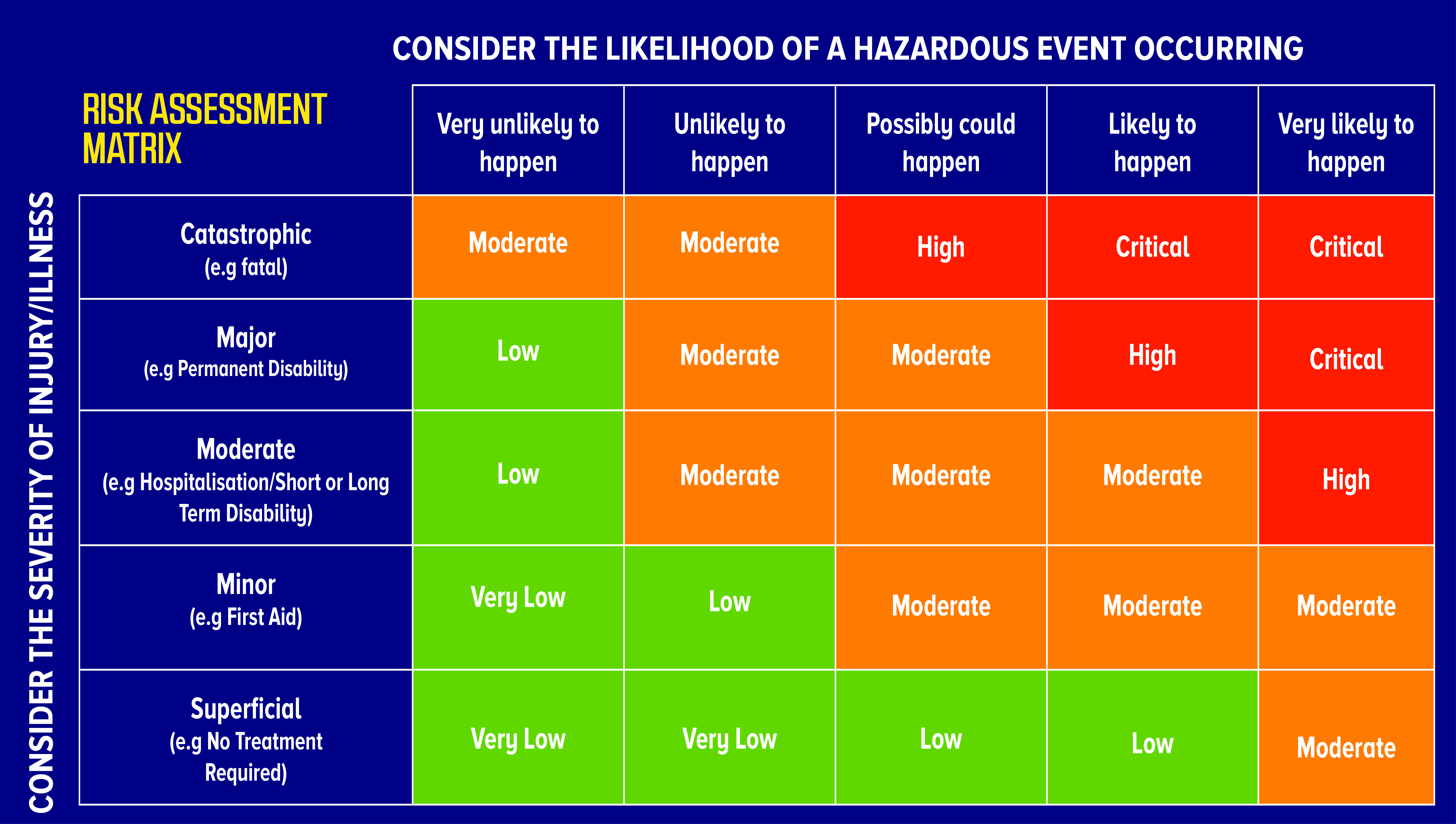

If a customer has contracted with you over a longer time period. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Commonly referred to as the customer risk rating. Low Risk SDD- Standard Due Diligence. A Customer risk factors.

Source: accendoreliability.com

Source: accendoreliability.com

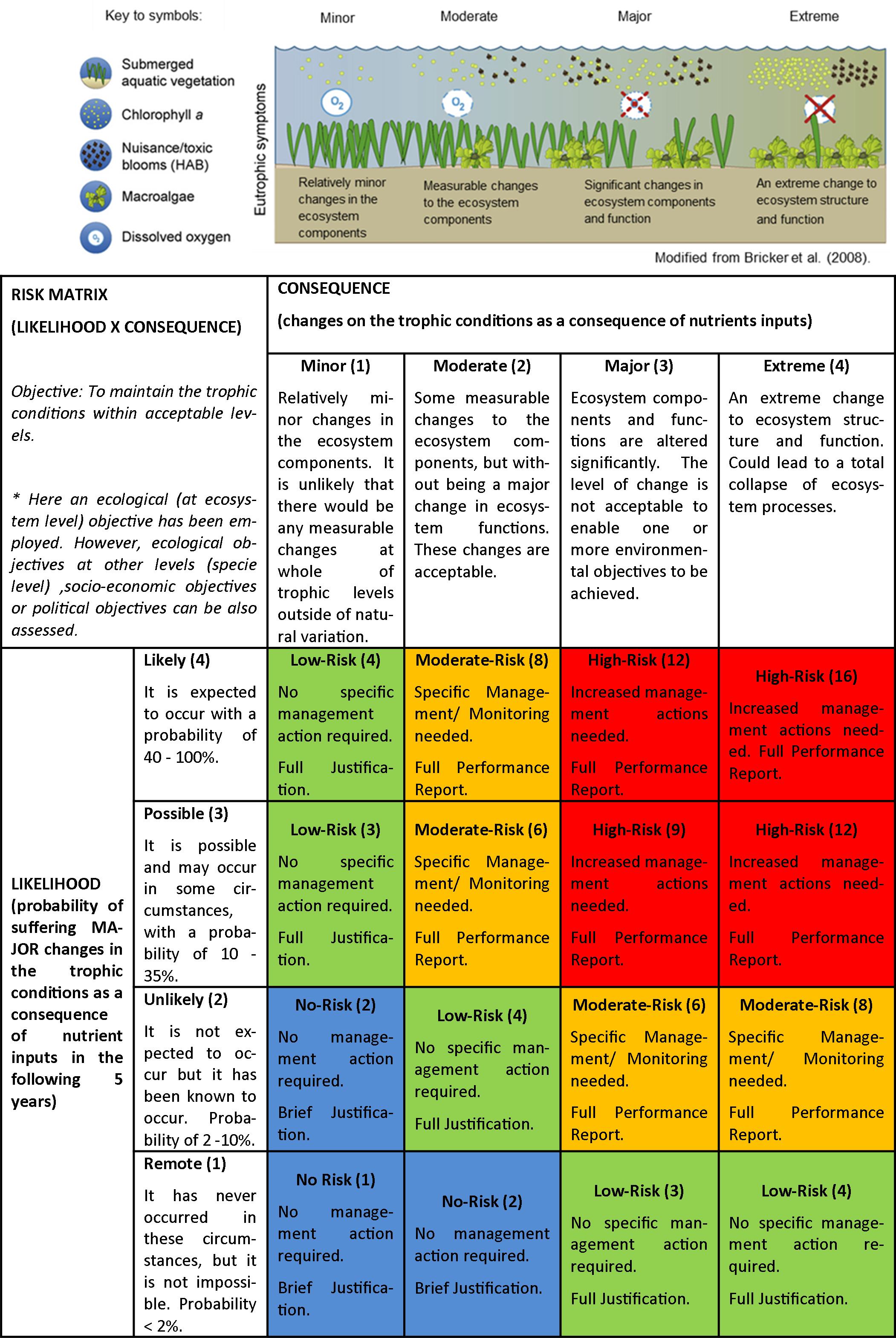

Direct knowledge of customers credit needs and financial conditions. The business relationship is conducted in unusual circumstances eg. A Customer risk factors. To calculate a Quantative Risk Rating begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive at the Rating. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Source: sitesafe.org.nz

Source: sitesafe.org.nz

A significant amount of your customers will typically require a standard due diligence program. For more information about the different types of risk model refer to the section Risk Assessment Model on page 9. Look hard at your contracts and your length of engagement. Direct knowledge of customers credit needs and financial conditions. Low Risk SDD- Standard Due Diligence.

Source: pinterest.com

Source: pinterest.com

Time owned or managed the business 1 year 1 year and 3 years 3 years 2. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. Time owned or managed the business 1 year 1 year and 3 years 3 years 2. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Standard due diligence are generally situations where there is a potential risk but it is unlikely that these risks will be realized.

Source: researchgate.net

Source: researchgate.net

Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Further a spectrum of risks may be identifiable even within the same category of customers. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Source: pinterest.com

Source: pinterest.com

Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat. Low Risk SDD- Standard Due Diligence. Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. For more information about the different types of risk model refer to the section Risk Assessment Model on page 9.

Source: pinterest.com

Source: pinterest.com

255 rows To determine a customers overall risk rating a select list of variables are assessed and. Both of these can provide you with good opportunities to mitigate risk. Does the business operate as an agent of another entity. Risk Factors High Risk 3 Moderate Risk 2 Low Risk 1 Risk Rating 1. 1 Adverse selection occurs when pricing or other underwriting and marketing factors cause too few desirable risk prospects relative to undesirable risk.

Source: pinterest.com

Source: pinterest.com

Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat. The CER score is derived after considering all the different parameters. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. Risk Factor Rating Score Customer exceeds 5 transactions per month in cashmanagers chequeswire transfers H 3 Customer does NOT exceed 5 transactions per month in cashmanagers chequesinternational funds transfers L 0 Copyright -This document is the property of the CFATF Secretariat.

Source: researchgate.net

Source: researchgate.net

Both of these can provide you with good opportunities to mitigate risk. Commonly referred to as the customer risk rating. Significant unexplained geographic distance between the financial institution and the customer. Rating Credit Risk Comptrollers Handbook April 2001. The number to be allocated is set out in the table below.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk factors in customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.