10++ Risk based approach money laundering uk ideas

Home » money laundering Info » 10++ Risk based approach money laundering uk ideasYour Risk based approach money laundering uk images are available in this site. Risk based approach money laundering uk are a topic that is being searched for and liked by netizens now. You can Find and Download the Risk based approach money laundering uk files here. Find and Download all free vectors.

If you’re searching for risk based approach money laundering uk pictures information connected with to the risk based approach money laundering uk interest, you have visit the ideal blog. Our site always gives you hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

Risk Based Approach Money Laundering Uk. In relation to obliged entities there is a requirement that appropriate steps are taken to identify and assess risk whether these be. To view the full document sign-in or register for a free trial excludes LexisPSL Practice Compliance Practice Management and Risk and Compliance. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations.

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs From taxguru.in

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs From taxguru.in

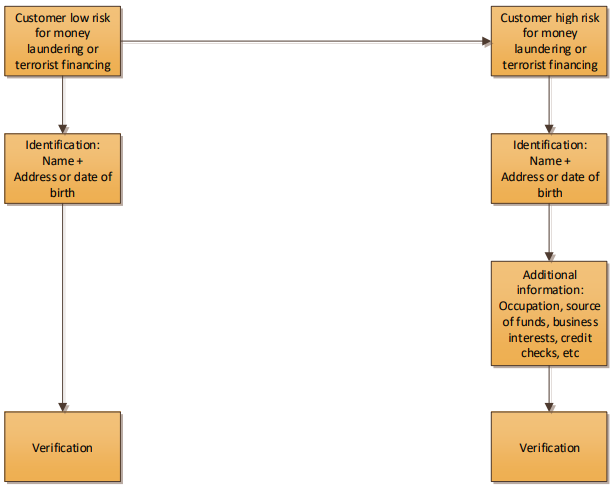

Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations. This QA explains what the risk-based approach RBA is in relation to anti-money laundering AML and what it means for businesses caught by the Money Laundering Regulations 2017 MLR 2017. The risk-based approach shifts the focus of AML compliance from post-analysis of data to proactive judgment. AML risk and the risk-based approach. The risk-based approach Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent money laundering.

Authority under theMoney Laundering Regulations.

To view the full document sign-in or register for a free trial excludes LexisPSL Practice Compliance Practice Management and Risk and Compliance. Anti-money laundering supervision of banks real estate agents and accountants in the United Kingdom. Most jurisdictions have implemented the risk-based approach RBA to anti-money laundering AML compliance. The risk-based approach to anti-money laundering. Instituting a Risk-Based Approach To Anti-Money Laundering To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. In March 2008 theFSAconducted a review of firmsimplementation of a risk-based approach to anti-money laundering.

Source: slideplayer.com

Source: slideplayer.com

That couldnt be further from the truth. It also outlines your day-to-day responsibilities under the Money Laundering Regulations. AML risk and the risk-based approach. With the amount of airtime given to the Risk-Based Approach RBA by the UKs AML regulators and supervisors youd be forgiven for thinking its an idea that had been formulated relatively recently in response to evidence of UK PLCs increasing ineffectiveness at AML controls. Please check back later for.

Source: taxguru.in

Source: taxguru.in

AML risk and the risk-based approach. Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. The risk-based approach means a focus on outputs. This guide gives an overview of the risk-based approach and helps you to carry out a risk assessment of your business. AML risk and the risk-based approach.

Source: docplayer.net

Source: docplayer.net

Anti-money laundering supervision of banks real estate agents and accountants in the United Kingdom. To view the full document sign-in or register for a free trial excludes LexisPSL Practice Compliance Practice Management and Risk and Compliance. Authority under theMoney Laundering Regulations. Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations.

Source: pideeco.be

Source: pideeco.be

Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent. Most jurisdictions have implemented the risk-based approach RBA to anti-money laundering AML compliance. Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. To view the full document sign-in or register for a free trial excludes LexisPSL Practice Compliance Practice Management and Risk and Compliance. AML risk and the risk-based approach.

Source:

With the amount of airtime given to the Risk-Based Approach RBA by the UKs AML regulators and supervisors youd be forgiven for thinking its an idea that had been formulated relatively recently in response to evidence of UK PLCs increasing ineffectiveness at AML controls. The risk-based approach means a focus on outputs. Authority under theMoney Laundering Regulations. The risk-based approach Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent money laundering. Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets.

Source: pideeco.be

Source: pideeco.be

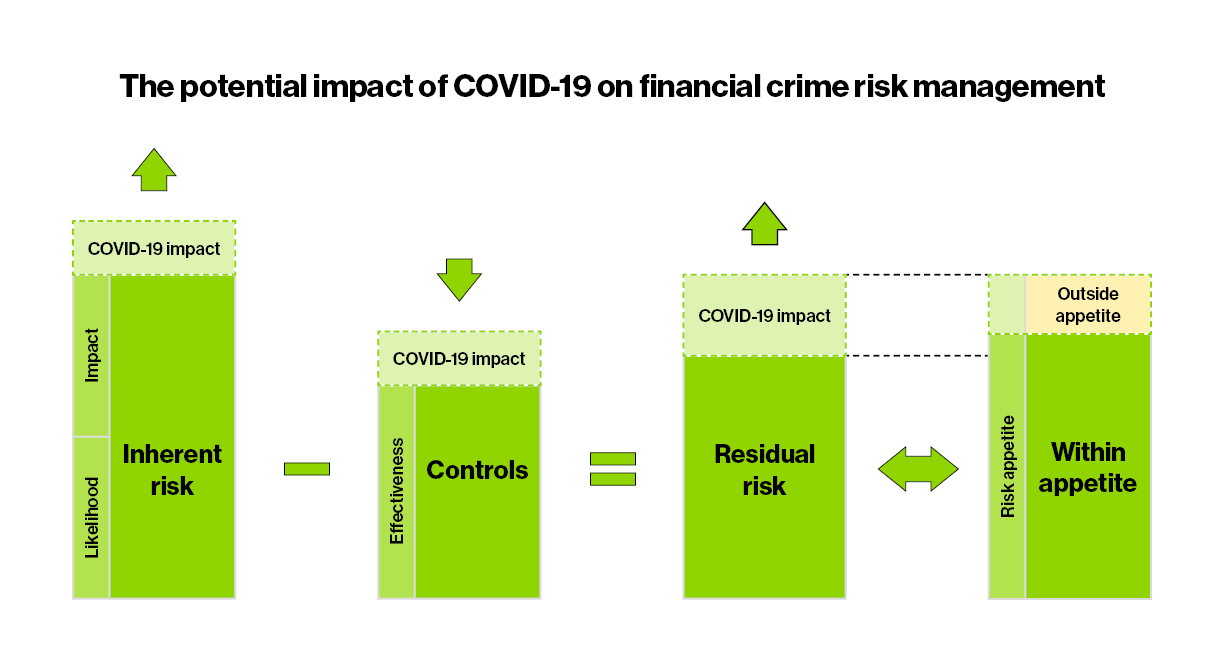

Anti-money laundering supervision in practice. As the FATF guidelines state in their rationale for taking a Risk Based Approach. The risk-based approach Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent money laundering. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations. Both the Bank of International Settlements 2016 and the G7 Financial Action Task Force on Money Laundering FATF 2014 mandate that a Risk-Based Approach RBA should be used for Anti Money Laundering and Counter-Terrorist Financing.

Source: amazon.com

Source: amazon.com

Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure. This guide gives an overview of the risk-based approach and helps you to carry out a risk assessment of your business. Anti-money laundering supervision of banks real estate agents and accountants in the United Kingdom. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations.

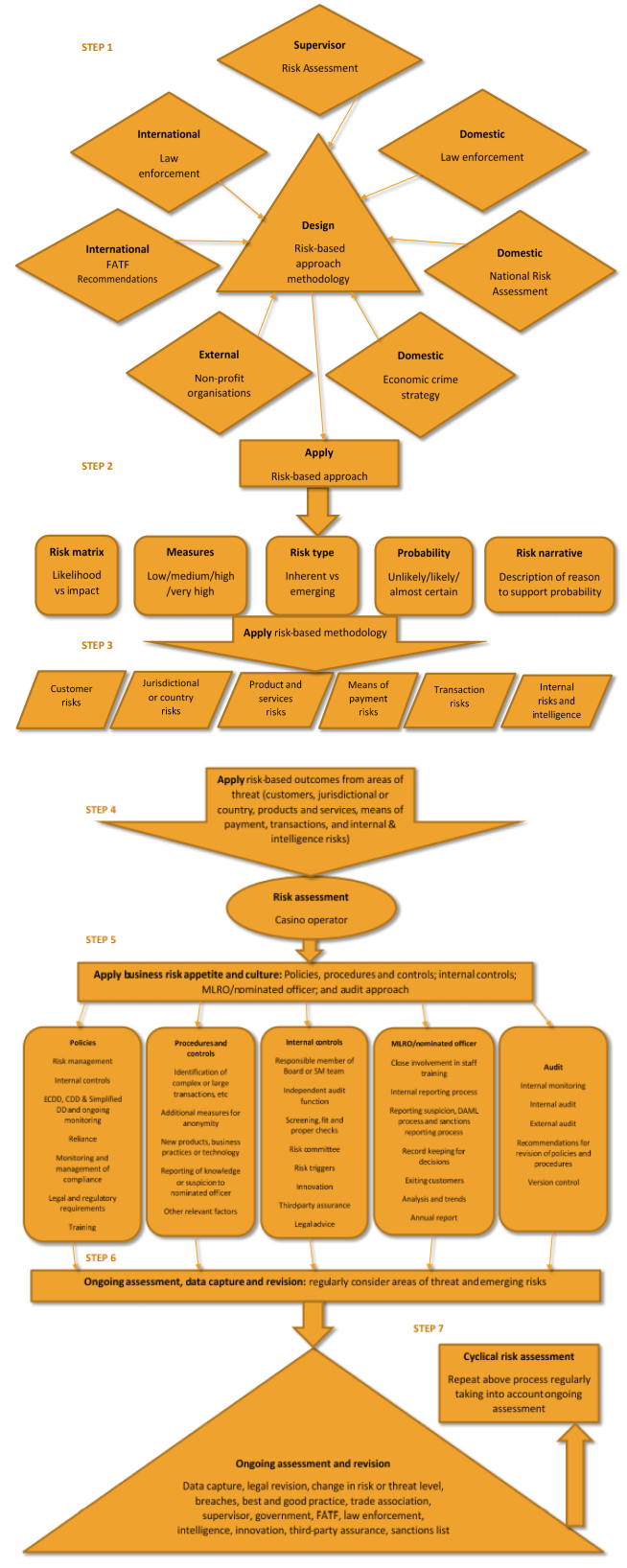

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

The risk-based approach shifts the focus of AML compliance from post-analysis of data to proactive judgment. It also outlines your day-to-day responsibilities under the Money Laundering Regulations. This guide gives an overview of the risk-based approach and helps you to carry out a risk assessment of your business. This followed the move to a more principles-based regulatory strategy from August 2006 when we replaced the detailed rules contained in the Money Laundering sourcebook. Association of Accounting Technicians.

Source: guidehouse.com

Source: guidehouse.com

The risk-based approach to anti-money laundering. As the FATF guidelines state in their rationale for taking a Risk Based Approach. The risk-based approach Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent money laundering. In relation to obliged entities there is a requirement that appropriate steps are taken to identify and assess risk whether these be. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations.

Source: yumpu.com

Source: yumpu.com

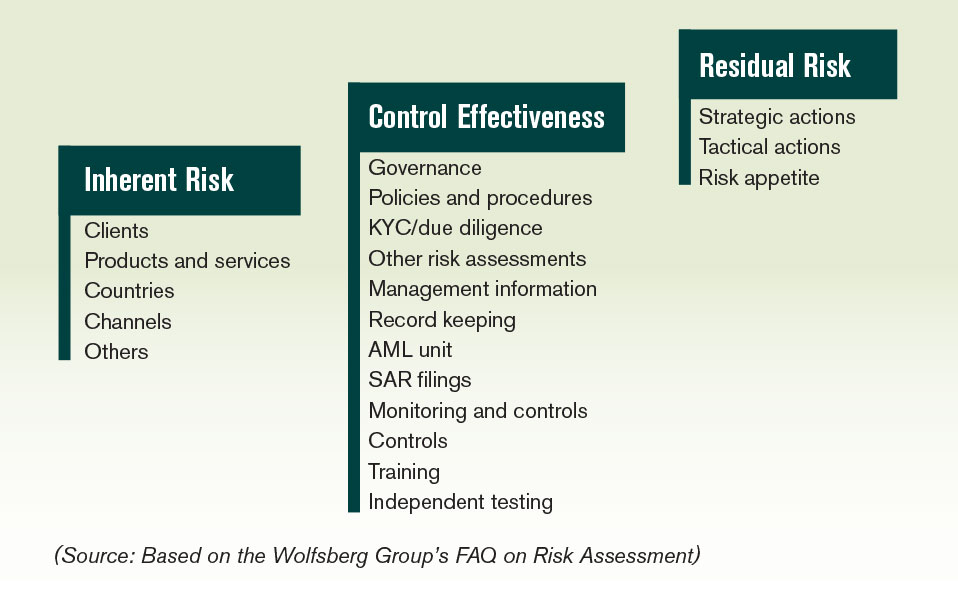

Anti-money laundering supervision in practice. Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure. It means that supervisors financial institutions and intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. This is reiterated in the European Union 4th Money Laundering Directive which states that Underpinning the risk-based approach is the need for Member States and the Union to identify understand and mitigate the risks of money laundering EU 2015. The National Crime Agency NCA believes that there is a realistic possibility that money laundering is in the hundreds of billions of pounds annually.

Source: globalfinance.mu

Source: globalfinance.mu

Authority under theMoney Laundering Regulations. This is an advance summary of a forthcoming entry in the Encyclopedia of Law. This is reiterated in the European Union 4th Money Laundering Directive which states that Underpinning the risk-based approach is the need for Member States and the Union to identify understand and mitigate the risks of money laundering EU 2015. It means that supervisors financial institutions and intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. Anti-money laundering supervision of banks real estate agents and accountants in the United Kingdom.

Source: acamstoday.org

Source: acamstoday.org

It also outlines your day-to-day responsibilities under the Money Laundering Regulations. The three areas of risk the guides focus on geographic risk client risk and service risk. The risk-based approach Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent money laundering. Please check back later for. Both the Bank of International Settlements 2016 and the G7 Financial Action Task Force on Money Laundering FATF 2014 mandate that a Risk-Based Approach RBA should be used for Anti Money Laundering and Counter-Terrorist Financing.

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

It means that supervisors financial institutions and intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations. Please check back later for. With the amount of airtime given to the Risk-Based Approach RBA by the UKs AML regulators and supervisors youd be forgiven for thinking its an idea that had been formulated relatively recently in response to evidence of UK PLCs increasing ineffectiveness at AML controls. This is an advance summary of a forthcoming entry in the Encyclopedia of Law.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk based approach money laundering uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.