16+ Reverse yield gap ideas

Home » money laundering Info » 16+ Reverse yield gap ideasYour Reverse yield gap images are ready. Reverse yield gap are a topic that is being searched for and liked by netizens now. You can Download the Reverse yield gap files here. Find and Download all royalty-free photos.

If you’re looking for reverse yield gap images information connected with to the reverse yield gap keyword, you have pay a visit to the right site. Our website always provides you with hints for viewing the highest quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

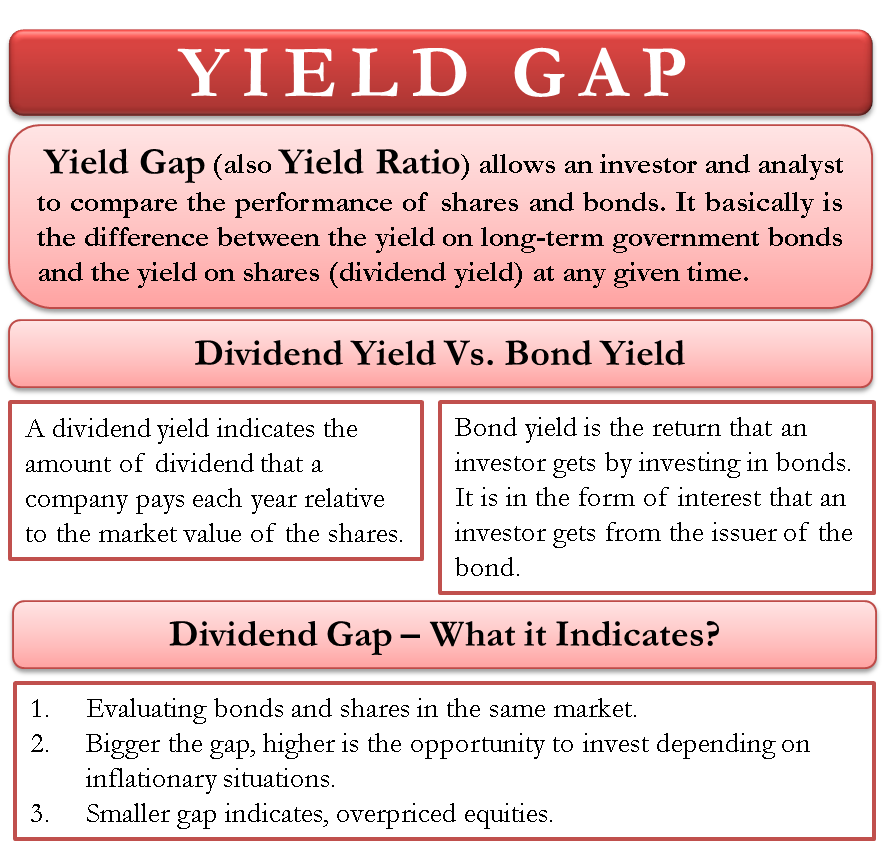

Reverse Yield Gap. This was justified during this period by earnings growth within businesses and therefore dividend growth an inflationary environment partly contributing to that nominal earnings growth and simply share price escalation providing an additional element of investment return over and above the dividend yield. During periods of stable prices the yield gap is usually positive. It is the amount by which bonds yield exceeds the yield o equity. The reverse yield gap is the amount by which the yield on bonds exceeds the yield on equity or in other words the amount by which the interest on loans and bonds exceeds the cost of equity.

Yield Gap What It Means And How To Interpret It From efinancemanagement.com

Yield Gap What It Means And How To Interpret It From efinancemanagement.com

Reverse yield gap - Oxford Reference An excess of returns on gilt-edged securities above those on equities. Yield gap Agriculture. This is the definition of reverse yield gap. 2 The reverse yield gap refers to equity yields being higher than debt yields 3 Disintermediation arises where borrowers deal directly with lending individuals A. Give produce gap submit concede crop lacuna surrender indulge hiatus breach return discontinuity gape bow chasm separation compliance aperture succumb milk arc opening bear cede disgorge bloom defer temporize render break buckle interregnum stoop bend subscribe pan gulf filler pay consign fall close. The reverse yield gap RYG is generally given to be the difference between the gross redemption yield on long-term government bonds and the dividend yield Armah.

The reverse yield gap is the amount by which the yield on bonds exceeds the yield on equity or in other words the amount by which the interest on loans and bonds exceeds the cost of equity.

Originally a yield gap meaning that shares returned more in income than government bonds it swiftly moved to a reverse position as inflation eroded the. During periods of stable prices the yield gap is usually positive. In other words it is the amount by which interest on bonds and loans exceeds the cost of equity. A greater yield on equities is needed to compensate investors for their relative riskiness. During periods of stable prices the yield gap is. The yield gap or yield ratio is the ratio of the dividend yield of an equity and the yield of a long-term government bond.

Source: fao.org

Source: fao.org

Give produce gap submit concede crop lacuna surrender indulge hiatus breach return discontinuity gape bow chasm separation compliance aperture succumb milk arc opening bear cede disgorge bloom defer temporize render break buckle interregnum stoop bend subscribe pan gulf filler pay consign fall close. Reverse yield gap - Oxford Reference An excess of returns on gilt-edged securities above those on equities. During periods of stable prices the yield gap is. In other words it is the amount by which interest on bonds and loans exceeds the cost of equity. The reverse yield gap is the amount by which the yield on bonds exceeds the yield on equity or in other words the amount by which the interest on loans and bonds exceeds the cost of equity.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The gap between bond and equity yields is becoming a critical issue in financial markets. But the reverse is now starkly. Typically equities have a higher yield as a percentage of the market price of the equity thus reflecting the higher risk of holding an equity. The second objective of this paper is to evaluate the gain from allowing lagged equity and bond yields to freely enter the forecasting equation. Of the GEYR LGEYR and the reverse yield gap RYG defined as the difference between the yields on bonds and equity rather than their ratio.

Source: investopedia.com

Source: investopedia.com

The reverse yield gap RYG is generally given to be the difference between the gross redemption yield on long-term government bonds and the dividend yield Armah. In other words it is the amount by which interest on bonds and loans exceeds the cost of equity. A greater yield on equities is needed to compensate investors for their relative riskiness. An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. This is likely to occur during periods of We use cookies to.

Source: mdpi.com

Source: mdpi.com

This is likely to occur during periods of high inflation because equities are expected to provide capital gains to compensate for inflation while gilt-edged securities are not. During periods of stable prices the yield gap is. An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. This is likely to occur during periods of We use cookies to. Davis Fagan 1997 or the earnings yield on domestic equities Maio 2013.

Source: efinancemanagement.com

Source: efinancemanagement.com

So although the 1975 bear market pushed equity yields to 13 per cent gilt returns soared to 15 per cent leaving a reverse yield gap of 2 per cent. An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. The reverse yield gap RYG is generally given to be the difference between the gross redemption yield on long-term government bonds and the dividend yield Armah. A greater yield on equities is needed to compensate investors for their relative riskiness. This reversal of the yield gap was generally attributed to the argument that equities provided growth in both capital and income and hence investors could be satisfied with a lower yield at the outset given the potential for long-term growth.

Source: washingtonpost.com

Source: washingtonpost.com

Reverse yield ratio mainly comes in use when an average yield on bonds is higher than the dividend yield on stocks. In other words it is the amount by which interest on bonds and loans exceeds the cost of equity. It is the amount by which bonds yield exceeds the yield o equity. The reverse yield gap has been narrowing over the course of the bear market in equities representing the greater demand for fixed-interest securities. The gap between bond and equity yields is becoming a critical issue in financial markets.

Source:

The reverse yield gap is the amount by which the yield on bonds exceeds the yield on equity or in other words the amount by which the interest on loans and bonds exceeds the cost of equity. The gap between bond and equity yields is becoming a critical issue in financial markets. This is likely to occur during periods of We use cookies to. Typically equities have a higher yield as a percentage of the market price of the equity thus reflecting the higher risk of holding an equity. An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

A greater yield on equities is needed to compensate investors for their relative riskiness. This is likely to occur during periods of We use cookies to. Reverse Yield Gap. Give produce gap submit concede crop lacuna surrender indulge hiatus breach return discontinuity gape bow chasm separation compliance aperture succumb milk arc opening bear cede disgorge bloom defer temporize render break buckle interregnum stoop bend subscribe pan gulf filler pay consign fall close. 100 words for yield gap - Reverse Dictionary.

Source: fao.org

Source: fao.org

This is likely to occur during periods of high inflation because equities are expected to provide capital gains to compensate for inflation while gilt-edged securities are not. Reverse Yield Gap. The reverse yield gap has been narrowing over the course of the bear market in equities representing the greater demand for fixed-interest securities. Reverse yield ratio mainly comes in use when an average yield on bonds is higher than the dividend yield on stocks. So although the 1975 bear market pushed equity yields to 13 per cent gilt returns soared to 15 per cent leaving a reverse yield gap of 2 per cent.

Source: efinancemanagement.com

Source: efinancemanagement.com

Typically equities have a higher yield as a percentage of the market price of the equity thus reflecting the higher risk of holding an equity. Yield gap Agriculture. The reverse yield gap has been narrowing over the course of the bear market in equities representing the greater demand for fixed-interest securities. This is the definition of reverse yield gap. Of the GEYR LGEYR and the reverse yield gap RYG defined as the difference between the yields on bonds and equity rather than their ratio.

Source: thebreakthrough.org

Source: thebreakthrough.org

Reverse yield gap in A Dictionary of Economics. An excess of returns on gilt-edged securities above those on equities. This reversal of the yield gap was generally attributed to the argument that equities provided growth in both capital and income and hence investors could be satisfied with a lower yield at the outset given the potential for long-term growth. A greater yield on equities is needed to compensate investors for their relative riskiness. Typically equities have a higher yield as a percentage of the market price of the equity thus reflecting the higher risk of holding an equity.

Source: blog.moneymanagedproperly.com

Source: blog.moneymanagedproperly.com

Typically equities have a higher yield as a percentage of the market price of the equity thus reflecting the higher risk of holding an equity. Of the GEYR LGEYR and the reverse yield gap RYG defined as the difference between the yields on bonds and equity rather than their ratio. Any single measure of the equity-bond yield. The yield gap or yield ratio is the ratio of the dividend yield of an equity and the yield of a long-term government bond. The gap between bond and equity yields is becoming a critical issue in financial markets.

Source:

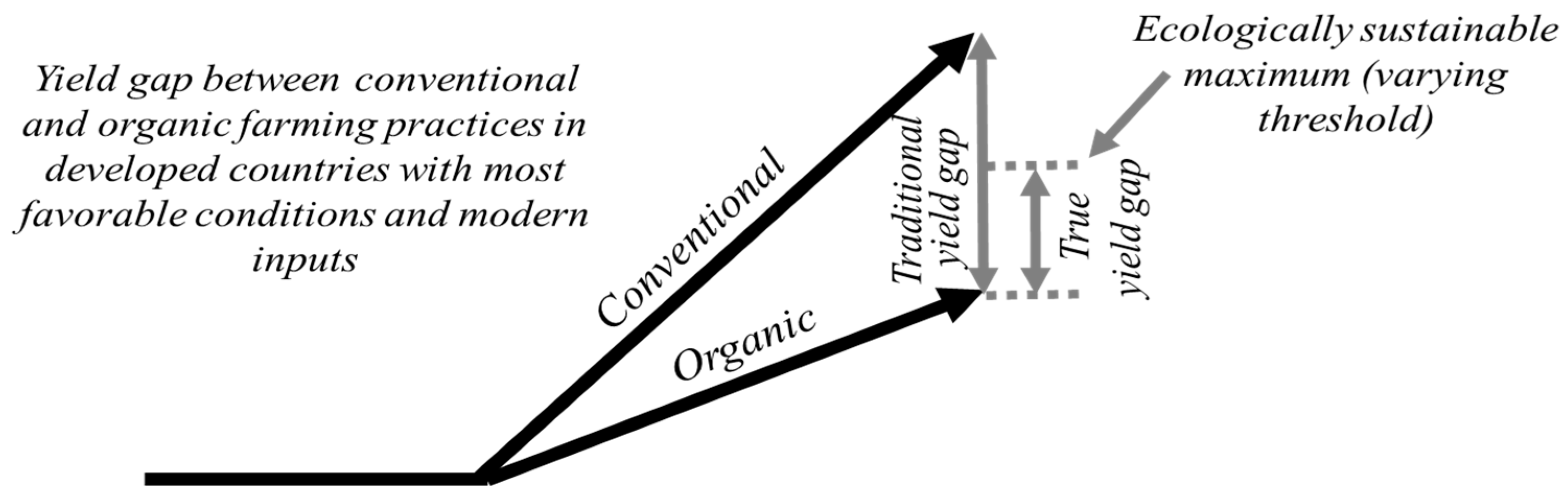

Yield gap Agriculture. Reverse yield gap in A Dictionary of Economics. Reverse yield gap - Oxford Reference An excess of returns on gilt-edged securities above those on equities. Reverse Yield Gap. So although the 1975 bear market pushed equity yields to 13 per cent gilt returns soared to 15 per cent leaving a reverse yield gap of 2 per cent.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reverse yield gap by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.