13+ Reverse repo money market instrument info

Home » money laundering idea » 13+ Reverse repo money market instrument infoYour Reverse repo money market instrument images are ready. Reverse repo money market instrument are a topic that is being searched for and liked by netizens now. You can Get the Reverse repo money market instrument files here. Find and Download all free photos.

If you’re searching for reverse repo money market instrument pictures information linked to the reverse repo money market instrument keyword, you have pay a visit to the right site. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Reverse Repo Money Market Instrument. Money market instruments are securities that provide businesses banks and the government with large amounts of low-cost capital for a short time. Repo and reverse repo means repurchase agreement and reverse repurchase agreement respectively. Repo allows collateralized borrowing and lending through purchasesale operations in debt instruments. The BI 7-Day Reverse Repo Rate instrument was introduced as the new policy rate due to its rapid influence on the money market banking industry and real sector.

Money Market From studylib.net

Money Market From studylib.net

It stimulates commercial banks to invest or store excess funds with the federal bank to earn higher returns. Again it is a money money market instrument. The accounting for repos depends on whether 1 it is a repurchase-to-maturity transaction and 2 the transfer of the underlying financial asset qualifies for sale accounting under ASC 860-10-40-5. Repurchase Agreements Repo is a money market instrument which enables co-lateralised short term borrowing and lending through salepurchase operations in debt instruments. All repurchase-to-maturity transactions as defined should be accounted for as secured borrowings as mandated by ASC 860-10-40-24A. G One party sells bonds to the other while simultaneously agreeing to repurchase.

The accounting for repos depends on whether 1 it is a repurchase-to-maturity transaction and 2 the transfer of the underlying financial asset qualifies for sale accounting under ASC 860-10-40-5.

Understanding repo and the repo markets 4 Euroclear March 2009. The period is overnight or a few days weeks or even months but always less than a year. Dealers talk about. Repo is a money market instrument which enables collateralised short term borrowing and lending through salepurchase operations in debt instruments. The Fed launched its reverse repo program RRP in 2013 to mop up extra cash in the repo market and create a strict floor under its policy rate or the effective fed funds rate currently in a. Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate.

Source: studylib.net

Source: studylib.net

The repo market also offers institutional investors such as asset managers MMFs and corporations with undeployed cash balances an option to invest cash on a secured basis. There are two usually two parties to a repo transaction. Repurchase agreements or repos are a form of short-term borrowing used in the money markets which involve the purchase of securities with the. Repo allows collateralized borrowing and lending through purchasesale operations in debt instruments. Side as the reverse repo.

Source: slidetodoc.com

Source: slidetodoc.com

Reverse repo means an instrument for lending funds by purchasing securities with an agreement to resell the securities on a mutually agreed future date at an agreed price which includes interest for the funds. Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate. Dealers talk about. Backed securities and various money market instruments including negotiable bank certificates of deposit prime bankers acceptances and commercial paperIf executed properly an RP agreement is a low-risk flexible short-term investment vehicle adaptable to a wide range of uses. Inter Corporate Deposits 8.

Source: slidetodoc.com

Source: slidetodoc.com

In reverse repo RBI is the lender. For instance dealers use repo and reverse repo. Backed securities and various money market instruments including negotiable bank certificates of deposit prime bankers acceptances and commercial paperIf executed properly an RP agreement is a low-risk flexible short-term investment vehicle adaptable to a wide range of uses. Reverse repo means an instrument for lending funds by purchasing securities with an agreement to resell the securities on a mutually agreed future date at an agreed price which includes interest for the funds. A high rate helps in injecting liquidity into the economy.

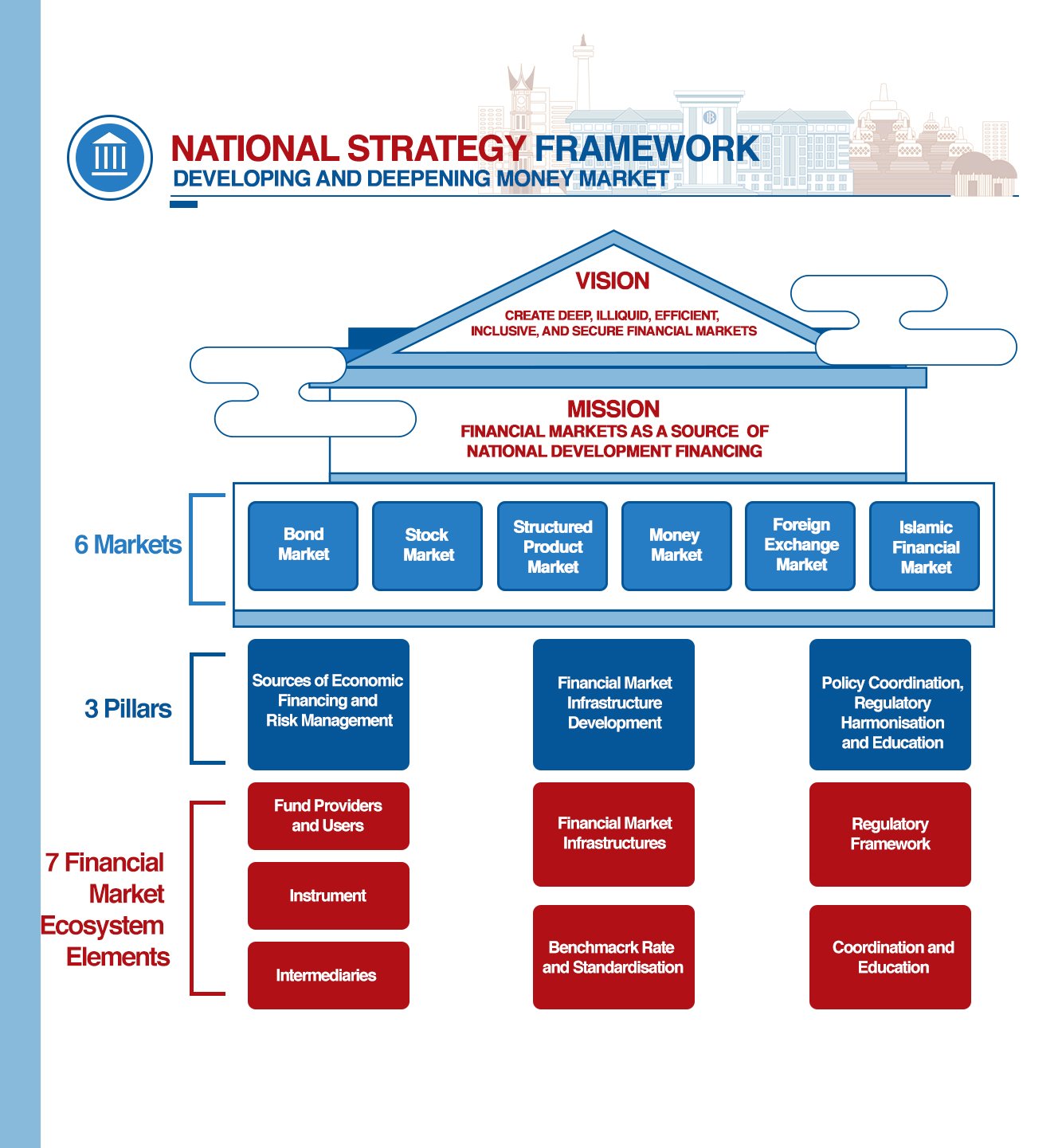

Source: bi.go.id

Source: bi.go.id

Certificate of Deposits 6. Repo and reverse repo means repurchase agreement and reverse repurchase agreement respectively. Side as the reverse repo. Repo allows collateralized borrowing and lending through purchasesale operations in debt instruments. Backed securities and various money market instruments including negotiable bank certificates of deposit prime bankers acceptances and commercial paperIf executed properly an RP agreement is a low-risk flexible short-term investment vehicle adaptable to a wide range of uses.

Source: present5.com

Source: present5.com

For instance dealers use repo and reverse repo. Repo and Reverse Repo 4. The accounting for repos depends on whether 1 it is a repurchase-to-maturity transaction and 2 the transfer of the underlying financial asset qualifies for sale accounting under ASC 860-10-40-5. The Fed launched its reverse repo program RRP in 2013 to mop up extra cash in the repo market and create a strict floor under its policy rate or the effective fed funds rate currently in a. Backed securities and various money market instruments including negotiable bank certificates of deposit prime bankers acceptances and commercial paperIf executed properly an RP agreement is a low-risk flexible short-term investment vehicle adaptable to a wide range of uses.

Source: slideplayer.com

Source: slideplayer.com

Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate. Repo rate and Reverse repo rate as an instrument of money market were introduced post economic reforms of 1991. Backed securities and various money market instruments including negotiable bank certificates of deposit prime bankers acceptances and commercial paperIf executed properly an RP agreement is a low-risk flexible short-term investment vehicle adaptable to a wide range of uses. The period is overnight or a few days weeks or even months but always less than a year. Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate.

Source: slidetodoc.com

Source: slidetodoc.com

G One party sells bonds to the other while simultaneously agreeing to repurchase. Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate. The Fed launched its reverse repo program RRP in 2013 to mop up extra cash in the repo market and create a strict floor under its policy rate or the effective fed funds rate currently in a. The repo market also offers institutional investors such as asset managers MMFs and corporations with undeployed cash balances an option to invest cash on a secured basis. Understanding repo and the repo markets 4 Euroclear March 2009.

Source: slideplayer.com

Source: slideplayer.com

A high rate helps in injecting liquidity into the economy. The BI 7-Day Reverse Repo Rate instrument was introduced as the new policy rate due to its rapid influence on the money market banking industry and real sector. Repos and reverse repos are used for short-term borrowing and lending often. In baskets of collateral is transforming repo into a truly secured money market instrument delivering the best of both worlds. Additionally repos and reverse repos are often carried out by the Federal Reserve in order to.

Source: slidetodoc.com

Source: slidetodoc.com

Call MoneyNotice MoneyTerm Money 2. Repo allows collateralized borrowing and lending through purchasesale operations in debt instruments. The accounting for repos depends on whether 1 it is a repurchase-to-maturity transaction and 2 the transfer of the underlying financial asset qualifies for sale accounting under ASC 860-10-40-5. For instance dealers use repo and reverse repo. A high rate helps in injecting liquidity into the economy.

Repurchase Agreements Repo is a money market instrument which enables co-lateralised short term borrowing and lending through salepurchase operations in debt instruments. Call MoneyNotice MoneyTerm Money 2. A high rate helps in injecting liquidity into the economy. The BI 7-Day Reverse Repo Rate instrument was introduced as the new policy rate due to its rapid influence on the money market banking industry and real sector. Additionally repos and reverse repos are often carried out by the Federal Reserve in order to.

Source: slideplayer.com

Source: slideplayer.com

Definition of a Repo g The term Repo is from Sale and Repurchase Agreement Repo is a money market instrument. Money market instruments are securities that provide businesses banks and the government with large amounts of low-cost capital for a short time. The Fed launched its reverse repo program RRP in 2013 to mop up extra cash in the repo market and create a strict floor under its policy rate or the effective fed funds rate currently in a. Reverse repo means an instrument for lending funds by purchasing securities with an agreement to resell the securities on a mutually agreed future date at an agreed price which includes interest for the funds. A high rate helps in injecting liquidity into the economy.

Source: studylib.net

Source: studylib.net

Repurchase agreements or repos are a form of short-term borrowing used in the money markets which involve the purchase of securities with the. Repurchase Agreements Repo is a money market instrument which enables co-lateralised short term borrowing and lending through salepurchase operations in debt instruments. For instance dealers use repo and reverse repo. Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate. In reverse repo RBI is the lender.

Under a repo transaction a holder of securities sells them to an investor with an agreement to repurchase at a predetermined date and rate. A reverse repo is a short-term agreement to purchase securities in order to sell them back at a slightly higher price. A high rate helps in injecting liquidity into the economy. Reverse repo means an instrument for lending funds by purchasing securities with an agreement to resell the securities on a mutually agreed future date at an agreed price which includes interest for the funds. Definition of a Repo g The term Repo is from Sale and Repurchase Agreement Repo is a money market instrument.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reverse repo money market instrument by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.