13+ Reverse repo fed info

Home » money laundering idea » 13+ Reverse repo fed infoYour Reverse repo fed images are ready in this website. Reverse repo fed are a topic that is being searched for and liked by netizens now. You can Download the Reverse repo fed files here. Get all free photos.

If you’re looking for reverse repo fed images information connected with to the reverse repo fed topic, you have visit the right site. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

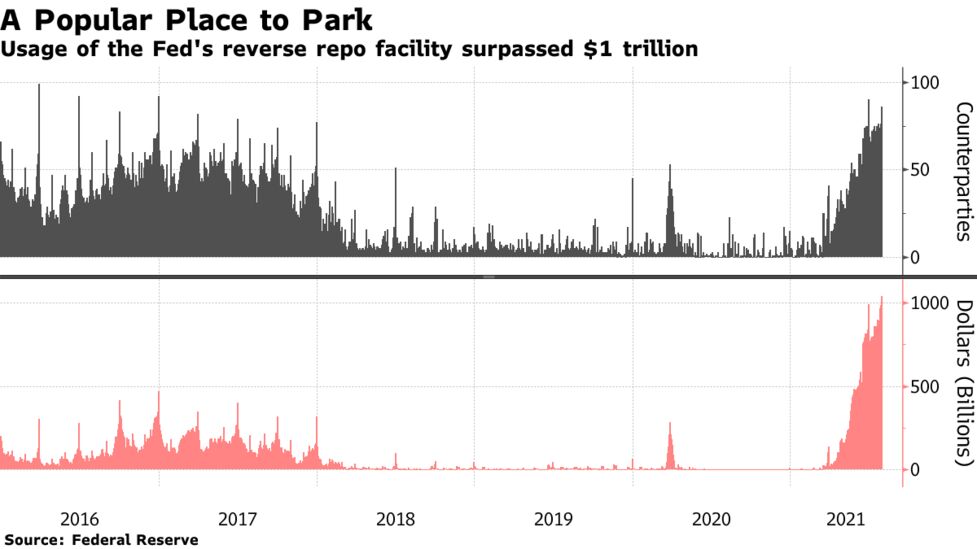

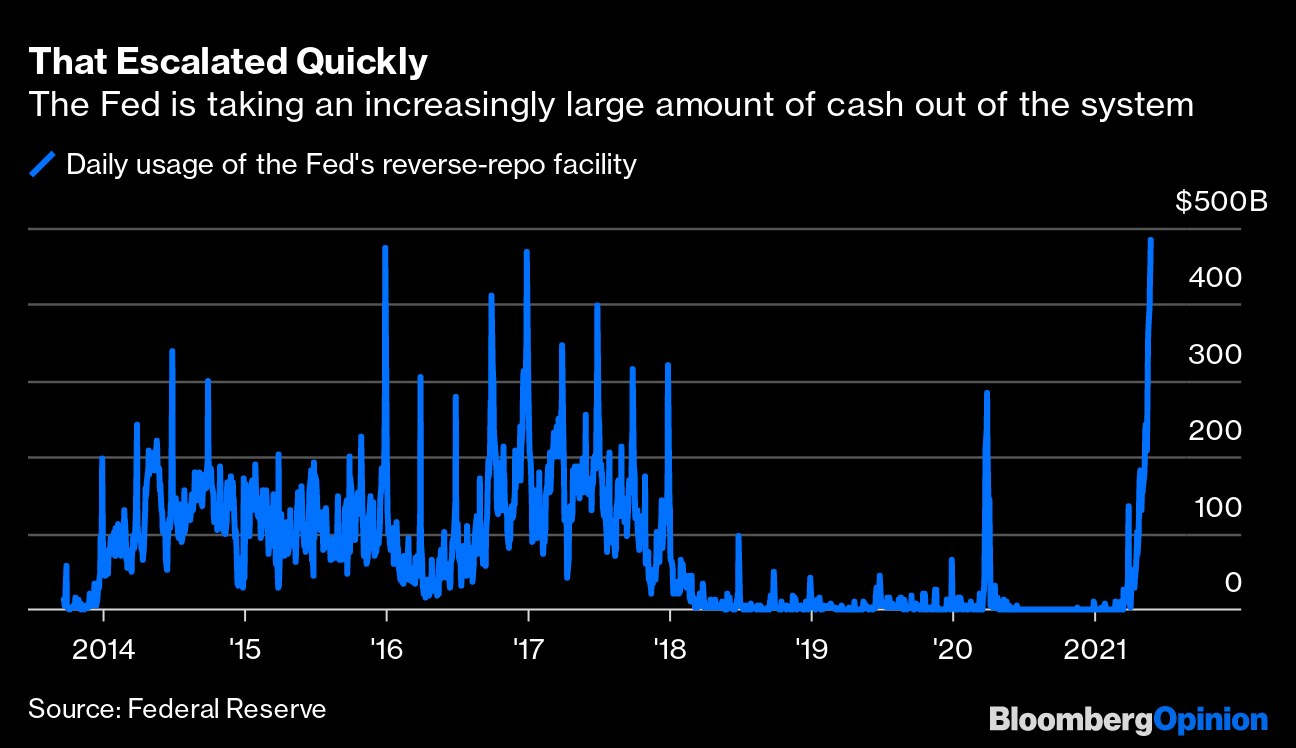

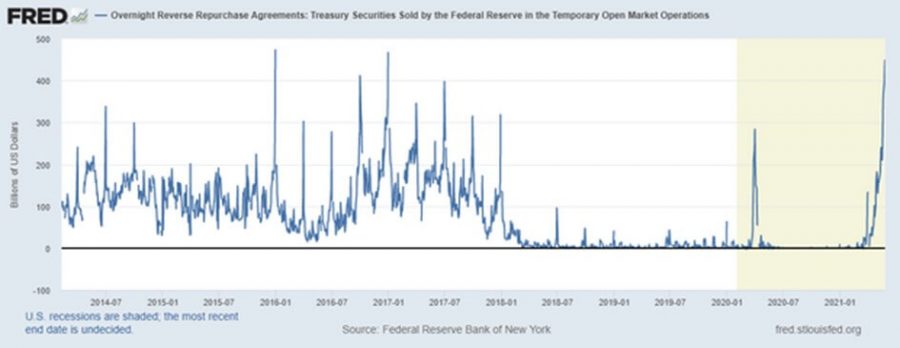

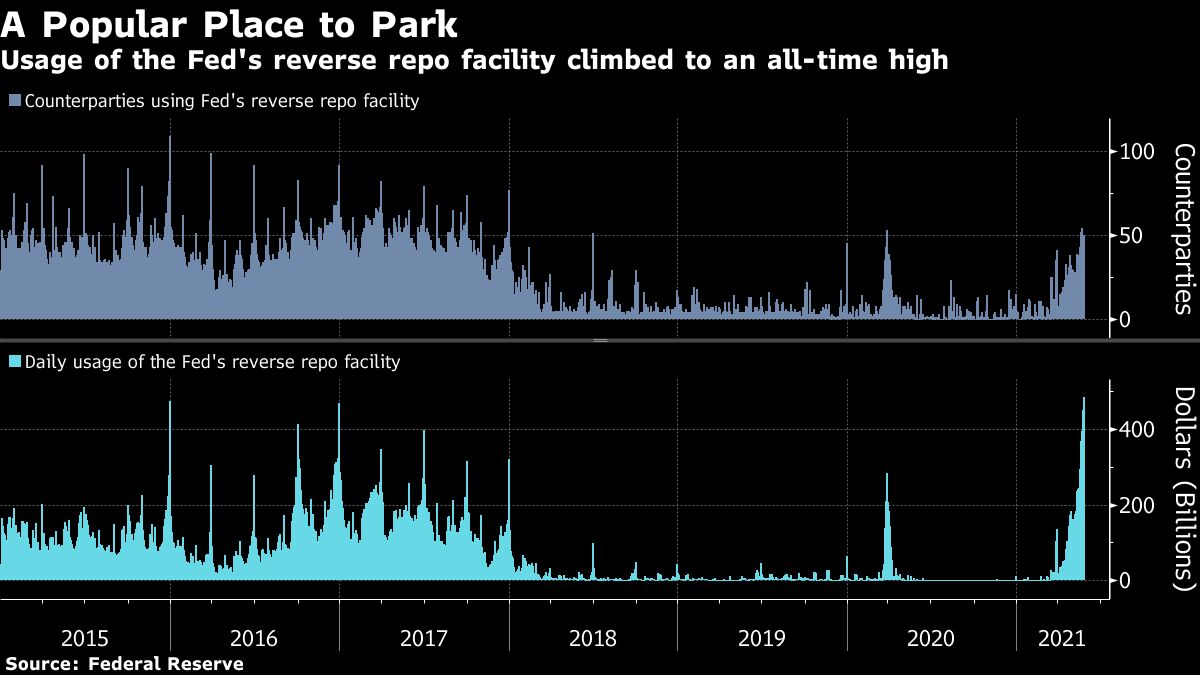

Reverse Repo Fed. The Fed is still buying about 120 billion per month in Treasury securities and mortgage-backed securities thereby adding liquidity. A reverse repurchase agreement known as reverse repo or RRP is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. Eighty-six participants on Friday placed an unprecedented total of 104 trillion at the Federal Reserves overnight reverse repurchase facility in. The Fed said firms parked 104 trillion overnight at the reverse repo facility on Friday.

Investors Rush To Stash Cash With Fed After Interest Rate Tweak World News Curatory From telegraf.id

Investors Rush To Stash Cash With Fed After Interest Rate Tweak World News Curatory From telegraf.id

A reverse repurchase agreement known as reverse repo or RRP is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. A reverse repo is where feds receive money from institutions such as hedge funds or banks due to borrowed securities. The Fed said firms parked 104 trillion overnight at the reverse repo facility on Friday. Reverse repo RRP reverse repurchase agreements is a transaction that central banks implement when they want to reduce excess cash in the market. In the case of the May 21 Reverse Repo which fell on a Friday that deal was not an overnight operation but lasted throughout the weekend maturing on Monday May 24. A reverse repo works in the opposite directionSo a bank will access the repo rate if they want to borrow money from the Fed and put up collateral.

As the name suggests it is a repo in reverse.

A reverse repo works in the opposite directionSo a bank will access the repo rate if they want to borrow money from the Fed and put up collateral. The aim of reverse repo transactions is to control the short-term interest rates. Repo and Reverse Repo Agreements The New York Fed is authorized by the Federal Open Market Committee FOMC to conduct repo and reverse repo operations for the System Open Market Account SOMA to the extent necessary to carry out the most recent FOMC directive. Banks are using the program to shed. REPO REVERSE REPO FED The Federal Reserve the Fed started overnight reverse repo transactions in 2013. In the case of the May 21 Reverse Repo which fell on a Friday that deal was not an overnight operation but lasted throughout the weekend maturing on Monday May 24.

Source: pinterest.com

Source: pinterest.com

Usually due to cash flow issues. Fed sees record 756 billion demand for reverse repo program and may hit 1 trillion. June 30 2021 at 253 pm. Bloomberg – While money-market funds are flocking to the Federal Reserves overnight reverse repurchase agreement facility for the yield large US. A reverse repurchase agreement known as reverse repo or RRP is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future.

Source: hebergementwebs.com

Source: hebergementwebs.com

In the case of the May 21 Reverse Repo which fell on a Friday that deal was not an overnight operation but lasted throughout the weekend maturing on Monday May 24. Reverse repos have the opposite effect of QE. The Fed is still buying about 120 billion per month in Treasury securities and mortgage-backed securities thereby adding liquidity. Eighty-six participants on Friday placed an unprecedented total of 104 trillion at the Federal Reserves overnight reverse repurchase facility in. Usually due to cash flow issues.

Source: bloomberg.com

Source: bloomberg.com

June 30 2021 at 253 pm. REPO REVERSE REPO FED The Federal Reserve the Fed started overnight reverse repo transactions in 2013. Reverse repo RRP reverse repurchase agreements is a transaction that central banks implement when they want to reduce excess cash in the market. Essentially the Fed is keen to reduce cash balances in. Basically money funds prefer to receive a 0.

Source: bloomberg.com

Source: bloomberg.com

As the name suggests it is a repo in reverse. The reason an institution would borrow money from the feds is because they dont have other cash reserves. REPO REVERSE REPO FED The Federal Reserve the Fed started overnight reverse repo transactions in 2013. Reverse repos have the opposite effect of QE. A reverse repo works in the opposite directionSo a bank will access the repo rate if they want to borrow money from the Fed and put up collateral.

Source: bloomberg.com

Source: bloomberg.com

A reverse repurchase agreement known as reverse repo or RRP is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. As the name suggests it is a repo in reverse. The Fed is still buying about 120 billion per month in Treasury securities and mortgage-backed securities thereby adding liquidity. If it raises that rate it raises all interest rates in the economy since they are all based on the zero risk. July 1 2021 at 1210 pm.

Source: arzualvan.com

Source: arzualvan.com

The aim of reverse repo transactions is to control the short-term interest rates. A reverse repo is where feds receive money from institutions such as hedge funds or banks due to borrowed securities. Bloomberg – While money-market funds are flocking to the Federal Reserves overnight reverse repurchase agreement facility for the yield large US. With RRPs now at 992 billion the Fed has undone over 8 months of QE at 120 billion per month. Ninety participants on Wednesday parked a total of 992 billion at the overnight reverse repurchase facility in which counterparties like money-market.

Source: mishtalk.com

Source: mishtalk.com

The reason an institution would borrow money from the feds is because they dont have other cash reserves. A reverse repo works in the opposite directionSo a bank will access the repo rate if they want to borrow money from the Fed and put up collateral. Eighty-six participants on Friday placed an unprecedented total of 104 trillion at the Federal Reserves overnight reverse repurchase facility in. A reverse repo is where feds receive money from institutions such as hedge funds or banks due to borrowed securities. REPO REVERSE REPO FED The Federal Reserve the Fed started overnight reverse repo transactions in 2013.

Source: telegraf.id

Source: telegraf.id

That would suggest that all else equal the Fed doing reverse repos is contractionary. Banks are using the program to shed. Reverse repos have the Fed playing the role of borrower and the Wall Street firm playing the role of lender. RRPs are a liability on the Feds balance sheet cash that it owes the counterparties. There were 86 bidders including money market funds and other eligible financial institutions.

Source: pinterest.com

Source: pinterest.com

Fed sees record 756 billion demand for reverse repo program and may hit 1 trillion. But with its reverse repos of 485 billion the Fed undid four months of QE. The Fed said firms parked 104 trillion overnight at the reverse repo facility on Friday. Or they will access the reverse repo. A reverse repo is where feds receive money from institutions such as hedge funds or banks due to borrowed securities.

Source: mishtalk.com

Source: mishtalk.com

As the name suggests it is a repo in reverse. The Fed said firms parked 104 trillion overnight at the reverse repo facility on Friday. Reverse Repo A reverse repurchase agreement RRP is an act of buying securities with the intention of returning or reselling those same assets back in the future at a profit. The reason an institution would borrow money from the feds is because they dont have other cash reserves. The Fed is still buying about 120 billion per month in Treasury securities and mortgage-backed securities thereby adding liquidity.

Source: bloomberg.com

Source: bloomberg.com

The Fed said firms parked 104 trillion overnight at the reverse repo facility on Friday. Essentially the Fed is keen to reduce cash balances in. There were 86 bidders including money market funds and other eligible financial institutions. During the last week of May the Feds overnight Reverse Repos ranged from 369 billion on May 21 to an all-time historic high of 485 billion on May 27. The Fed said firms parked 104 trillion overnight at the reverse repo facility on Friday.

Source: id.pinterest.com

Source: id.pinterest.com

Reverse Repo allows the Fed to set a floor on the interest rates in the economy. July 1 2021 at 1210 pm. June 30 2021 at 253 pm. Reverse repos have the Fed playing the role of borrower and the Wall Street firm playing the role of lender. The reason an institution would borrow money from the feds is because they dont have other cash reserves.

Source: voicepress.com

Source: voicepress.com

June 30 2021 at 253 pm. If it raises that rate it raises all interest rates in the economy since they are all based on the zero risk. Reverse Repo A reverse repurchase agreement RRP is an act of buying securities with the intention of returning or reselling those same assets back in the future at a profit. The Fed is still buying about 120 billion per month in Treasury securities and mortgage-backed securities thereby adding liquidity. Banks are using the program to shed.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reverse repo fed by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.