10+ Reverse hammer candlestick ideas in 2021

Home » money laundering idea » 10+ Reverse hammer candlestick ideas in 2021Your Reverse hammer candlestick images are available in this site. Reverse hammer candlestick are a topic that is being searched for and liked by netizens today. You can Find and Download the Reverse hammer candlestick files here. Find and Download all royalty-free photos and vectors.

If you’re looking for reverse hammer candlestick images information connected with to the reverse hammer candlestick keyword, you have visit the right site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

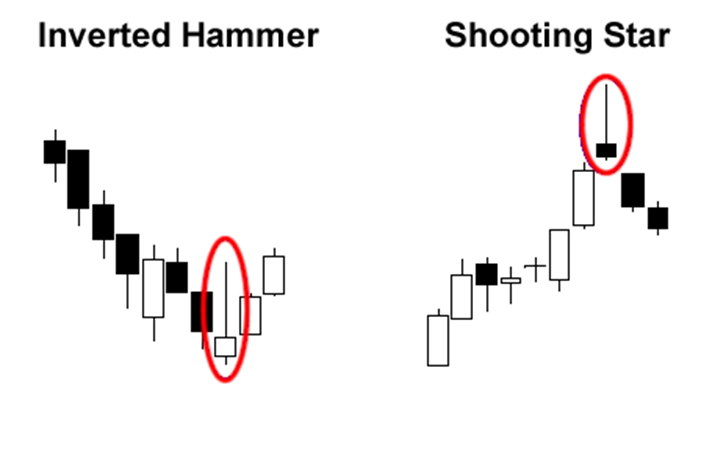

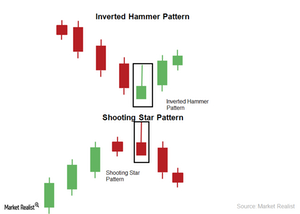

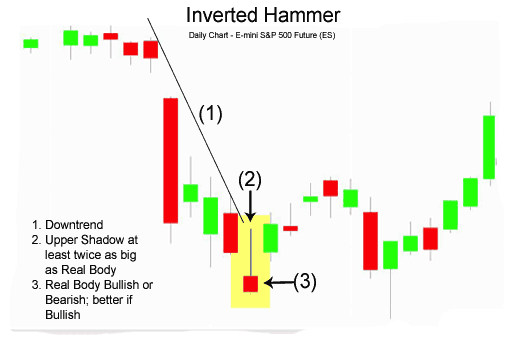

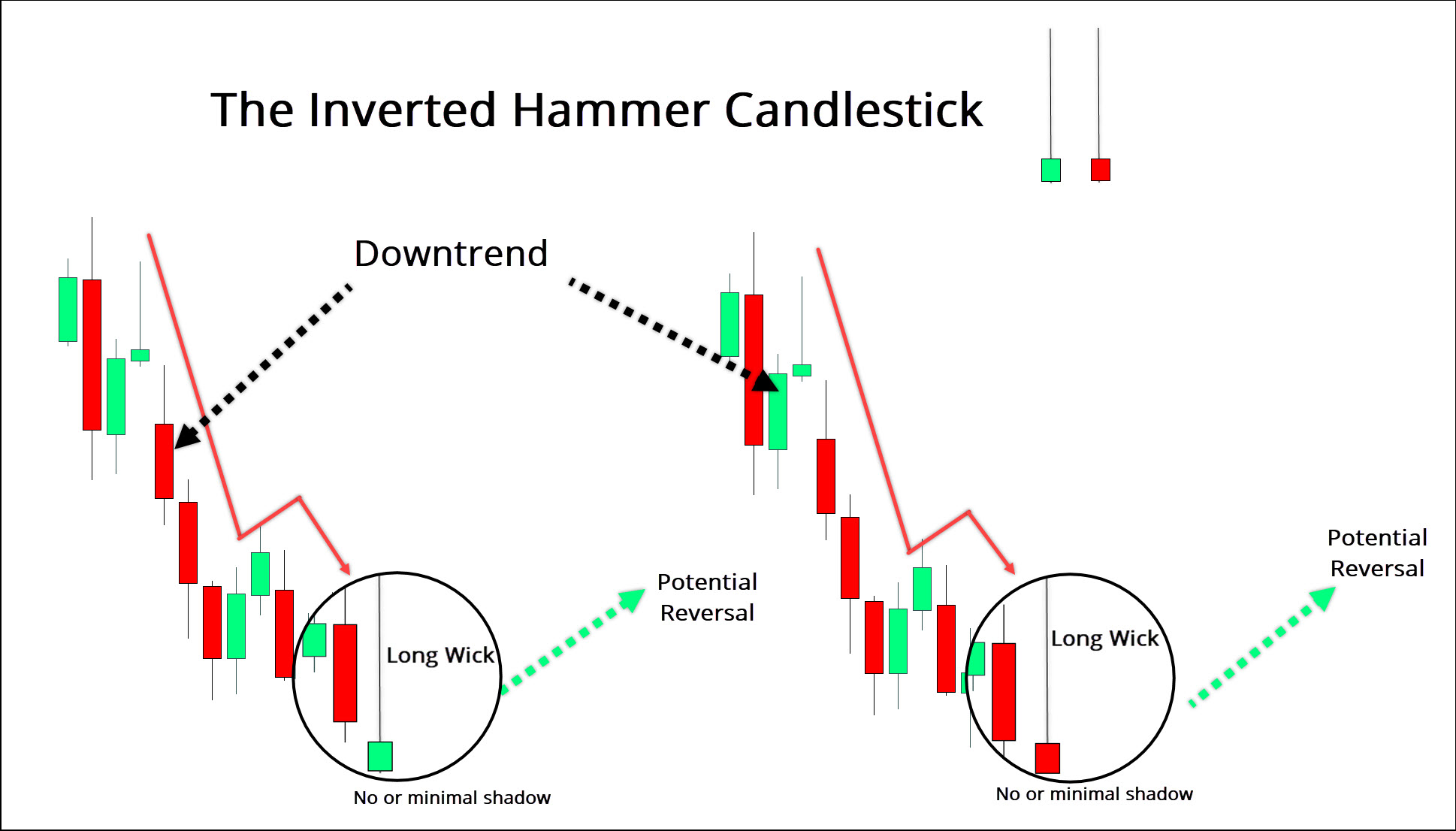

Reverse Hammer Candlestick. Ad All The Tools Youll Need For Any Situation. The inverted hammer is a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal. After a downtrend the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside.

Trading The Inverted Hammer Candle From dailyfx.com

Trading The Inverted Hammer Candle From dailyfx.com

Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Below you can find the schemes and explanations of the most common reversal candlestick patterns. After a downtrend the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. The Hammer helps traders visualize where support and demand are located. Buying entered the market and was strong enough to reverse the price higher to close just above or below open price. Look for bullish candlestick reversal in securities trading near support with positive divergences and signs of buying pressure.

Hammer is a popular single candlestick pattern.

The Hammer helps traders visualize where support and demand are located. It is often referred to as a bullish pin bar or bullish rejection candle. Bullish Engulfing candlestick pattern. Inverted hammer is the mirror opposite Forms a candlestick with a long lower shadow tail and a small body with little or no wicklooks like a hammer or mallet. Hammer candlestick is used by many traders as a part of an overall trading strategy. Bullish Harami Reversal Candlestick Pattern.

Source: finvids.com

Source: finvids.com

Hammer is a popular single candlestick pattern. As it is a well-known bullish reversal pattern it mainly occurs at the end of a downtrend. A hammer candlestick pattern is a sort of bullish reversal pattern which consists of only one candle and develops after a downtrend in the chart. Inverted hammer is the. A number of signals came together for IBM in early October.

Source: ig.com

Source: ig.com

Piercing Line Candlestick Pattern. What happens on the next day after the Inverted Hammer pattern is what gives traders an idea as to whether or not prices will go higher or lower. You will be surprised to know that this pattern actually works better in an uptrend. When candles of different shapes are arranged in a certain way on the chart they can indicate the next price movement. A number of signals came together for IBM in early October.

Source: dailyfx.com

Source: dailyfx.com

Get Quick Low-Cost Shipping Anywhere. The price must start moving up following the hammer. Inverted hammer is the. The Hammer helps traders visualize where support and demand are located. In terms of market psychology a hammer candlestick indicates a complete rejection of bears by the bulls.

Source: hsb.co.id

Source: hsb.co.id

Hammer is a popular single candlestick pattern. A number of signals came together for IBM in early October. Generally an inverted hammer is a type of candlestick pattern treated as a possible trend-reversal signal. Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. It is a bullish candlestick pattern and it generally indicates a bullish reversal.

Source: dstockmarket.com

Source: dstockmarket.com

Bullish Hammer Candlestick Pattern Bullish Pin Bar 10. Inverted hammer is the mirror opposite Forms a candlestick with a long lower shadow tail and a small body with little or no wicklooks like a hammer or mallet. It is often referred to as a bullish pin bar or bullish rejection candle. As it is a well-known bullish reversal pattern it mainly occurs at the end of a downtrend. Inverted hammer is the.

Source: marketrealist.com

Source: marketrealist.com

The Hammer helps traders visualize where support and demand are located. What Does the Hammer Candlestick Look. It is often referred to as a bullish pin bar or bullish rejection candle. Hammer candlesticks indicate a potential price reversal to the upside. Hammer candlestick is used by many traders as a part of an overall trading strategy.

Source: ig.com

Source: ig.com

The Hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. What happens on the next day after the Inverted Hammer pattern is what gives traders an idea as to whether or not prices will go higher or lower. It is often referred to as a bullish pin bar or bullish rejection candle. What Does the Hammer Candlestick Look. They can be either bullish reversal or bearish reversal indications.

Source: dailyfx.com

Source: dailyfx.com

The hammer candle has a small body little to no upper wick and a long lower wick -. You will be surprised to know that this pattern actually works better in an uptrend. The inverted hammer has a remarkable shape and clear-cut. A number of signals came together for IBM in early October. What Does the Hammer Candlestick Look.

Source: pngeans.com

Source: pngeans.com

Inverted hammer is the mirror opposite Forms a candlestick with a long lower shadow tail and a small body with little or no wicklooks like a hammer or mallet. Hammer candlestick is used by many traders as a part of an overall trading strategy. The inverted hammer looks like an upside down version of the hammer candlestick pattern and when it appears in an uptrend is called a shooting star. You will be surprised to know that this pattern actually works better in an uptrend. The Inverted Hammer candlestick formation occurs mainly at the bottom of downtrends and can act as a warning of a potential bullish reversal pattern.

Source: pngeans.com

Source: pngeans.com

And it indicates that although strong selling with within the trend happened. Look for bullish candlestick reversal in securities trading near support with positive divergences and signs of buying pressure. The inverted hammer has a remarkable shape and clear-cut. A number of signals came together for IBM in early October. In terms of market psychology a hammer candlestick indicates a complete rejection of bears by the bulls.

Source: forexboat.com

Source: forexboat.com

Inverted hammer is the. Bullish Hammer Candlestick Pattern Bullish Pin Bar 10. The hammer candle has a small body little to no upper wick and a long lower wick -. The inverted hammer has a remarkable shape and clear-cut. Inverted hammer is the.

Source: dailyfx.com

Source: dailyfx.com

A hammer has a long lower wick and a short body at the top of the candlestick with almost no upper wick as shown in the image below. Look for bullish candlestick reversal in securities trading near support with positive divergences and signs of buying pressure. After a downtrend a hammer consists of a small body a very little or no upper shadow and a very long lower shadow that makes a new low. The hammer candlestick appears at the bottom of a down trend and signals a bullish reversal. Inverted hammer is the mirror opposite Forms a candlestick with a long lower shadow tail and a small body with little or no wicklooks like a hammer or mallet.

Source: learnstockmarket.in

Source: learnstockmarket.in

Hammer is a popular single candlestick pattern. A hammer has a long lower wick and a short body at the top of the candlestick with almost no upper wick as shown in the image below. At its core the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. Like all candlestick reversal patterns the success. It can signal an end of the bearish trend a bottom or a support level.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reverse hammer candlestick by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.