20++ Reverse funding definition information

Home » money laundering idea » 20++ Reverse funding definition informationYour Reverse funding definition images are available in this site. Reverse funding definition are a topic that is being searched for and liked by netizens today. You can Download the Reverse funding definition files here. Get all royalty-free photos.

If you’re looking for reverse funding definition pictures information linked to the reverse funding definition keyword, you have visit the ideal site. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Reverse Funding Definition. In a word a reverse mortgage is a loan. FLEXIBLE With the flexible payment option you decide how much or how little to pay each month towards your reverse mortgage loan principal and interest. The engine has indexed several million definitions so far and at. New Rules for Pre-Marketing Funds and Reverse Solicitation.

An Introduction To Reverse Convertible Notes Rcns From investopedia.com

An Introduction To Reverse Convertible Notes Rcns From investopedia.com

It simply looks through tonnes of dictionary definitions and grabs the ones that most closely match your search query. The engine has indexed several million definitions so far and at. The way Reverse Dictionary works is pretty simple. A homeowner who is 62 or older and has considerable home equity can borrow against the value of their home and receive funds as a lump sum fixed monthly. In a word a reverse mortgage is a loan. Terrorist financing is a term used to describe activities that are carried out in order to provide financial support for terrorism.

Reverse solicitation consists of providing information regarding an AIF and making units or shares of that AIF available for purchase by a potential investor.

Reverse solicitation consists of providing information regarding an AIF and making units or shares of that AIF available for purchase by a potential investor. A reverse takeover RTO is a process whereby private companies can become publicly-traded companies without going through an initial public offering IPO. Reverse repurchase agreements RRPs are the buyer end of a repurchase agreement. This term is often used to describe a form of reverse money laundering because. These financial instruments are also called collateralized loans buysell back loans and sellbuy back loans. For example if you type something like longing for a time in the past then the engine will return nostalgia.

Source: reversefunding.com

Source: reversefunding.com

For example where a relevant investor has. The way Reverse Dictionary works is pretty simple. A practice in which a bank or other financial institution buys securities or another asset with the proviso that it will resell these same securities or asset to the same seller for an agreed-upon price on a certain day often the next day. The own exclusive initiative test or reverse enquiry as it is also known means that as long as the initial initiative to receive services or information on fundsproducts was taken by the investor rather than the firm the firm can accept the request for services or information from the investor. FLEXIBLE With the flexible payment option you decide how much or how little to pay each month towards your reverse mortgage loan principal and interest.

Source: bankomb.org.nz

Source: bankomb.org.nz

The Cross-border Distribution Directive EU20191160 CBDD and Cross-border Distribution Regulation EU20191156 CBDR amend the Alternative Investment Fund Managers Directive AIFMD and introduce new rules for the pre-marketing of alternative investment funds. For example if you type something like longing for a time in the past then the engine will return nostalgia. Reverse repurchase agreements RRPs are the buyer end of a repurchase agreement. These financial instruments are also called collateralized loans buysell back loans and sellbuy back loans. Customer disputes authorization reversal and refunding payment.

Source: wikibanks.cz

Source: wikibanks.cz

New Rules for Pre-Marketing Funds and Reverse Solicitation. This follows enquiry by the investor or an agent of the investor made without any solicitation by the AIF or its AIFM or an intermediary acting on their behalf in relation to the relevant fund. A reverse takeover RTO is a process whereby private companies can become publicly-traded companies without going through an initial public offering IPO. Your reverse mortgage loan is customizable meaning you choose how to receive your funds either as a lump sum line of credit monthly advances or any combination of these. Terrorist financing is a term used to describe activities that are carried out in order to provide financial support for terrorism.

Source: wikibanks.cz

Source: wikibanks.cz

The Cross-border Distribution Directive EU20191160 CBDD and Cross-border Distribution Regulation EU20191156 CBDR amend the Alternative Investment Fund Managers Directive AIFMD and introduce new rules for the pre-marketing of alternative investment funds. A payment reversal is when a customer receives back the funds from a transaction. For example where a relevant investor has. The Reverse Exchange is the opposite of the Delayed Exchange. Reverse consolidation is the process of taking a business loan specifically meant to cover the costs of paying back.

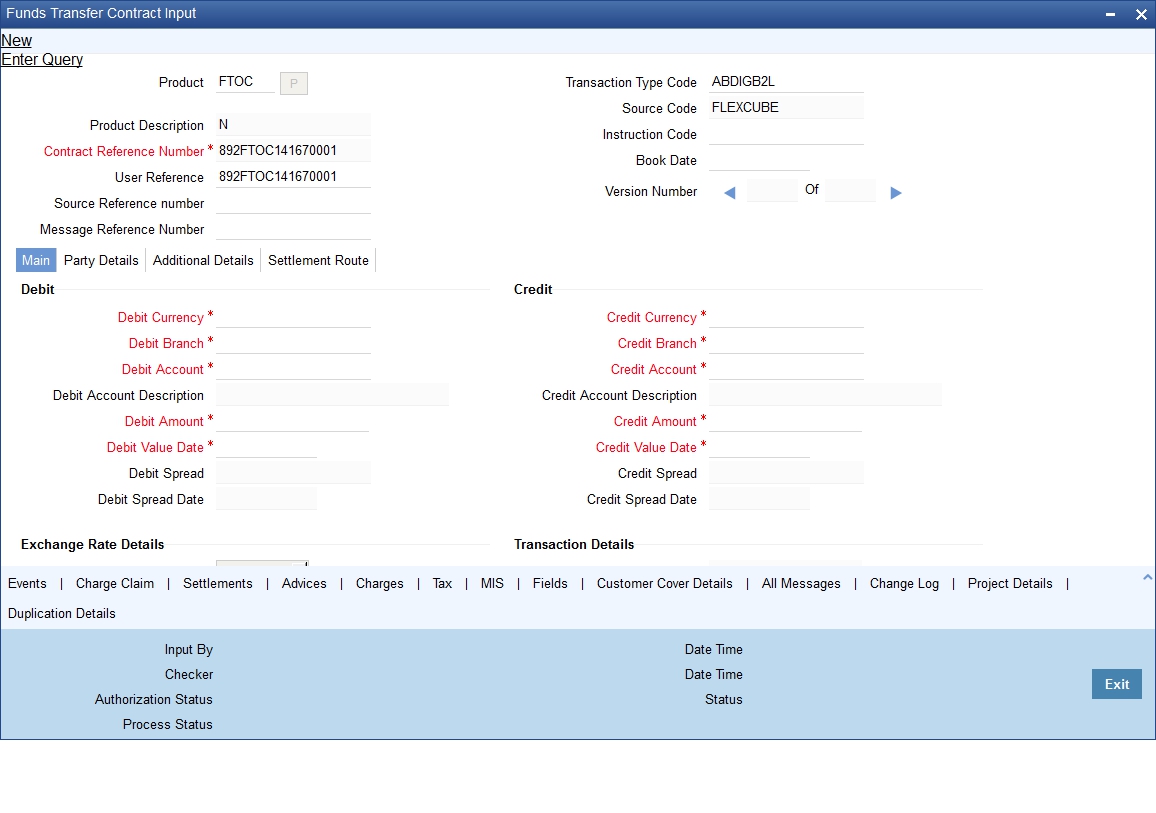

Source: docs.oracle.com

Source: docs.oracle.com

The engine has indexed several million definitions so far and at. If you believe a reverse exchange could be right for you give us a call. Where the Delayed Exchange requires the Exchangor to relinquish property before he acquires property the Reverse Exchange allows the Exchangor to acquire property first and relinquish property second. For example where a relevant investor has. A payment reversal is a situation in which funds from a transaction are returned to the cardholders bank account.

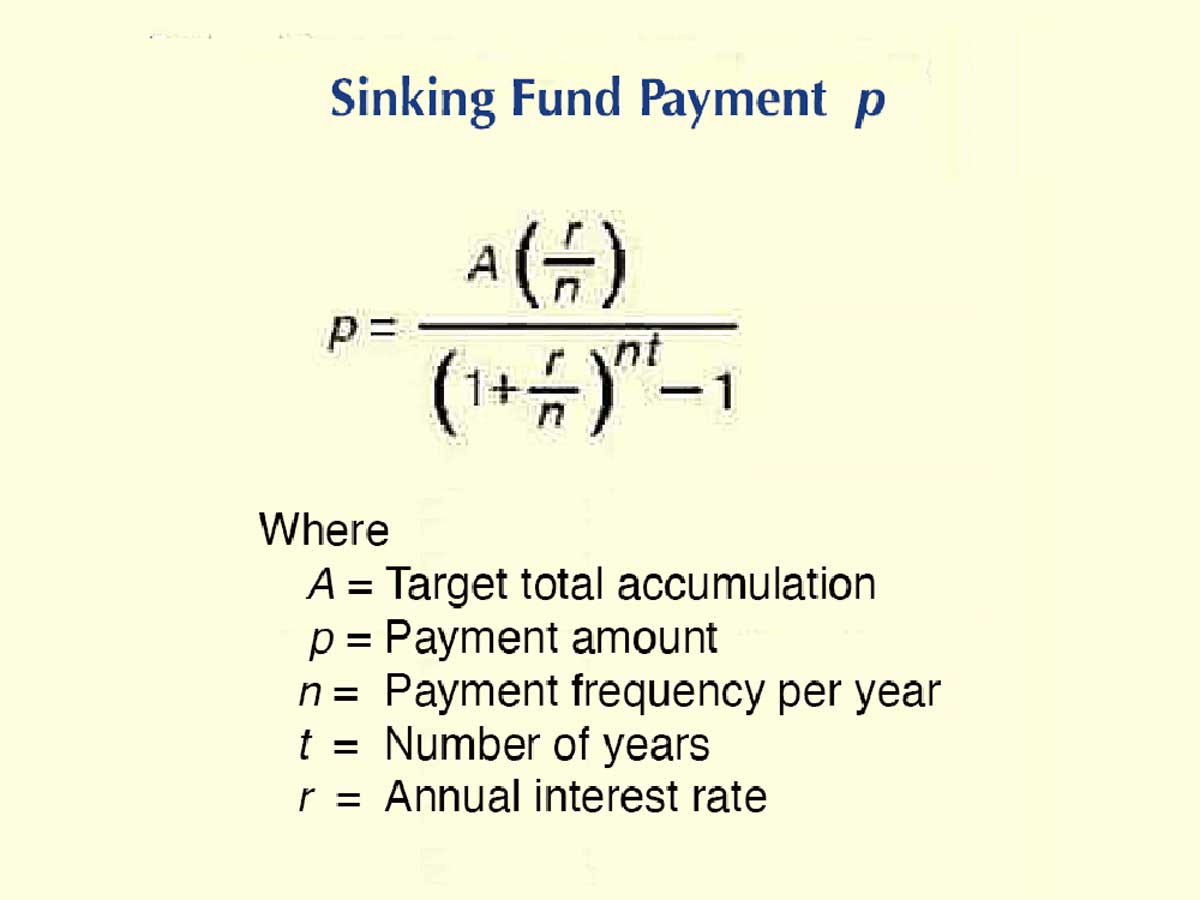

Source: business-case-analysis.com

Source: business-case-analysis.com

By Kam Dhillon Gowling WLG UK LLP. Formally called repurchase agreements and reverse repurchase agreements repos are forms of short-term lending and borrowing using bonds or securities as collateral. A practice in which a bank or other financial institution buys securities or another asset with the proviso that it will resell these same securities or asset to the same seller for an agreed-upon price on a certain day often the next day. In other words the Reverse Exchange allows an investor to. For example if you type something like longing for a time in the past then the engine will return nostalgia.

![]() Source: primerevenue.com

Source: primerevenue.com

Where the Delayed Exchange requires the Exchangor to relinquish property before he acquires property the Reverse Exchange allows the Exchangor to acquire property first and relinquish property second. Each of these reversals takes place at different stages of. The engine has indexed several million definitions so far and at. For example if you type something like longing for a time in the past then the engine will return nostalgia. Where the Delayed Exchange requires the Exchangor to relinquish property before he acquires property the Reverse Exchange allows the Exchangor to acquire property first and relinquish property second.

Source: investopedia.com

Source: investopedia.com

Because legitimate funds are used for reverse money laundering it can mean its much more difficult to monitor detect and prevent than straightforward money laundering. Your reverse mortgage loan is customizable meaning you choose how to receive your funds either as a lump sum line of credit monthly advances or any combination of these. The engine has indexed several million definitions so far and at. A payment reversal is when a customer receives back the funds from a transaction. The Cross-border Distribution Directive EU20191160 CBDD and Cross-border Distribution Regulation EU20191156 CBDR amend the Alternative Investment Fund Managers Directive AIFMD and introduce new rules for the pre-marketing of alternative investment funds.

Source: investopedia.com

Source: investopedia.com

The way Reverse Dictionary works is pretty simple. What is reverse consolidation. Reverse Linkage is defined as a technical cooperation mechanism enabled by the IsDB whereby member countries and Muslim communities in non-member countries exchange their knowledge expertise technology and resources to develop their capacities. A payment reversal is when a customer receives back the funds from a transaction. The Reverse Exchange is the opposite of the Delayed Exchange.

Source: investopedia.com

Source: investopedia.com

Your reverse mortgage loan is customizable meaning you choose how to receive your funds either as a lump sum line of credit monthly advances or any combination of these. These financial instruments are also called collateralized loans buysell back loans and sellbuy back loans. What is reverse consolidation. The Reverse Exchange is the opposite of the Delayed Exchange. The way Reverse Dictionary works is pretty simple.

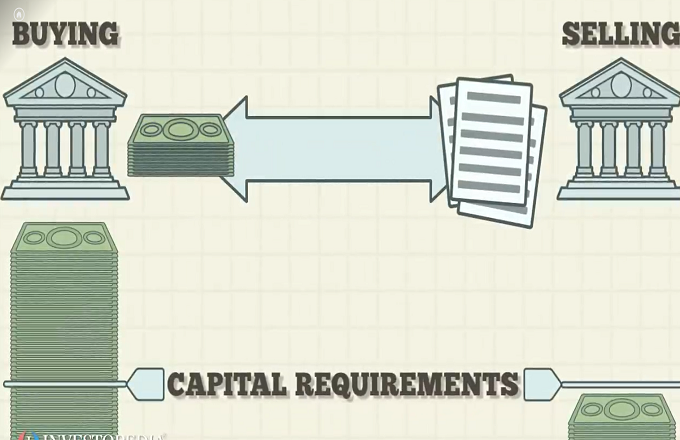

Source: business-case-analysis.com

Source: business-case-analysis.com

Reverse solicitation consists of providing information regarding an AIF and making units or shares of that AIF available for purchase by a potential investor. The own exclusive initiative test or reverse enquiry as it is also known means that as long as the initial initiative to receive services or information on fundsproducts was taken by the investor rather than the firm the firm can accept the request for services or information from the investor. In other words the Reverse Exchange allows an investor to. Formally called repurchase agreements and reverse repurchase agreements repos are forms of short-term lending and borrowing using bonds or securities as collateral. It simply looks through tonnes of dictionary definitions and grabs the ones that most closely match your search query.

Source: investopedia.com

Source: investopedia.com

It simply looks through tonnes of dictionary definitions and grabs the ones that most closely match your search query. Each of these reversals takes place at different stages of. Reverse solicitation consists of providing information regarding an AIF and making units or shares of that AIF available for purchase by a potential investor. This term is often used to describe a form of reverse money laundering because. Formally called repurchase agreements and reverse repurchase agreements repos are forms of short-term lending and borrowing using bonds or securities as collateral.

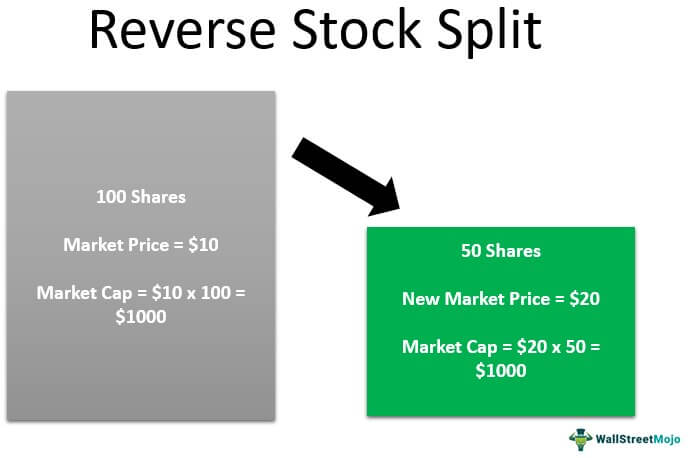

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In a word a reverse mortgage is a loan. Each of these reversals takes place at different stages of. Because legitimate funds are used for reverse money laundering it can mean its much more difficult to monitor detect and prevent than straightforward money laundering. This term is often used to describe a form of reverse money laundering because. Reverse repurchase agreements RRPs are the buyer end of a repurchase agreement.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reverse funding definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.