12+ Red flag meaning in anti money laundering ideas

Home » money laundering Info » 12+ Red flag meaning in anti money laundering ideasYour Red flag meaning in anti money laundering images are ready. Red flag meaning in anti money laundering are a topic that is being searched for and liked by netizens today. You can Download the Red flag meaning in anti money laundering files here. Get all royalty-free photos and vectors.

If you’re searching for red flag meaning in anti money laundering images information related to the red flag meaning in anti money laundering topic, you have visit the right site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

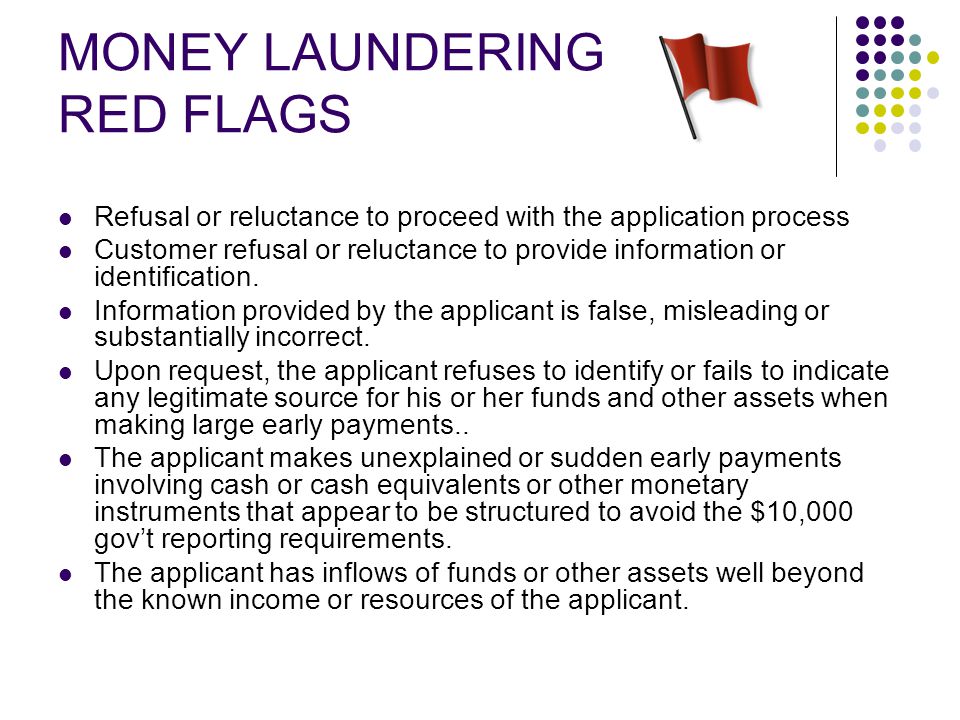

Red Flag Meaning In Anti Money Laundering. One of the following circumstances may provide a basis for making further enquiries of your client. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business. The report identifies 42 Red Flag Indicators or warning signs of money laundering and terrorist financing. The sources of the cash in actual are criminal and the.

Aml Red Flags For Broker From pt.slideshare.net

Aml Red Flags For Broker From pt.slideshare.net

Which red flag indicates the highest anti-money laundering risk. One of the following circumstances may provide a basis for making further enquiries of your client. Red Flags Money laundering and terrorist financing risks Clients who knowingly wish to sell at an artificially low or inflated price Clients who suggest unusually complicated structures for achieving a purchase or sale Sellers who request sale proceeds to be paid to a third party TRANSACTION RED FLAGS Clients who ask detailed questions. Anti Money Laundering Act Red Flags on August 08 2021 Get link. Multiple bank accounts opened with various banks for no apparent economic or business reason. Red Flag indicators If the client.

Money laundering is damaging in many ways.

Is secretive or evasive about who they are the beneficial owner the source of funds the reason for the transaction or what the big picture is. Businesses that incorporate it into their new or existing compliance regime can count on. Based on more than 100 case studies collected by members of the FATF Global Network it highlights the most important red flag. It is a process by which soiled cash is converted into clean money. Is secretive or evasive about who they are the beneficial owner the source of funds the reason for the transaction or what the big picture is. One of the following circumstances may provide a basis for making further enquiries of your client.

Source: telegraph.co.uk

Source: telegraph.co.uk

The sources of the cash in actual are criminal and the. It is important to be aware of and act properly upon red flag indicators that a transaction may be suspicious. The FATF claims that in case any of the following activities occur there may be a high likelihood of money. Projects with the highest monetary success threshold D. Based on more than 100 case studies collected by members of the FATF Global Network it highlights the most important red flag.

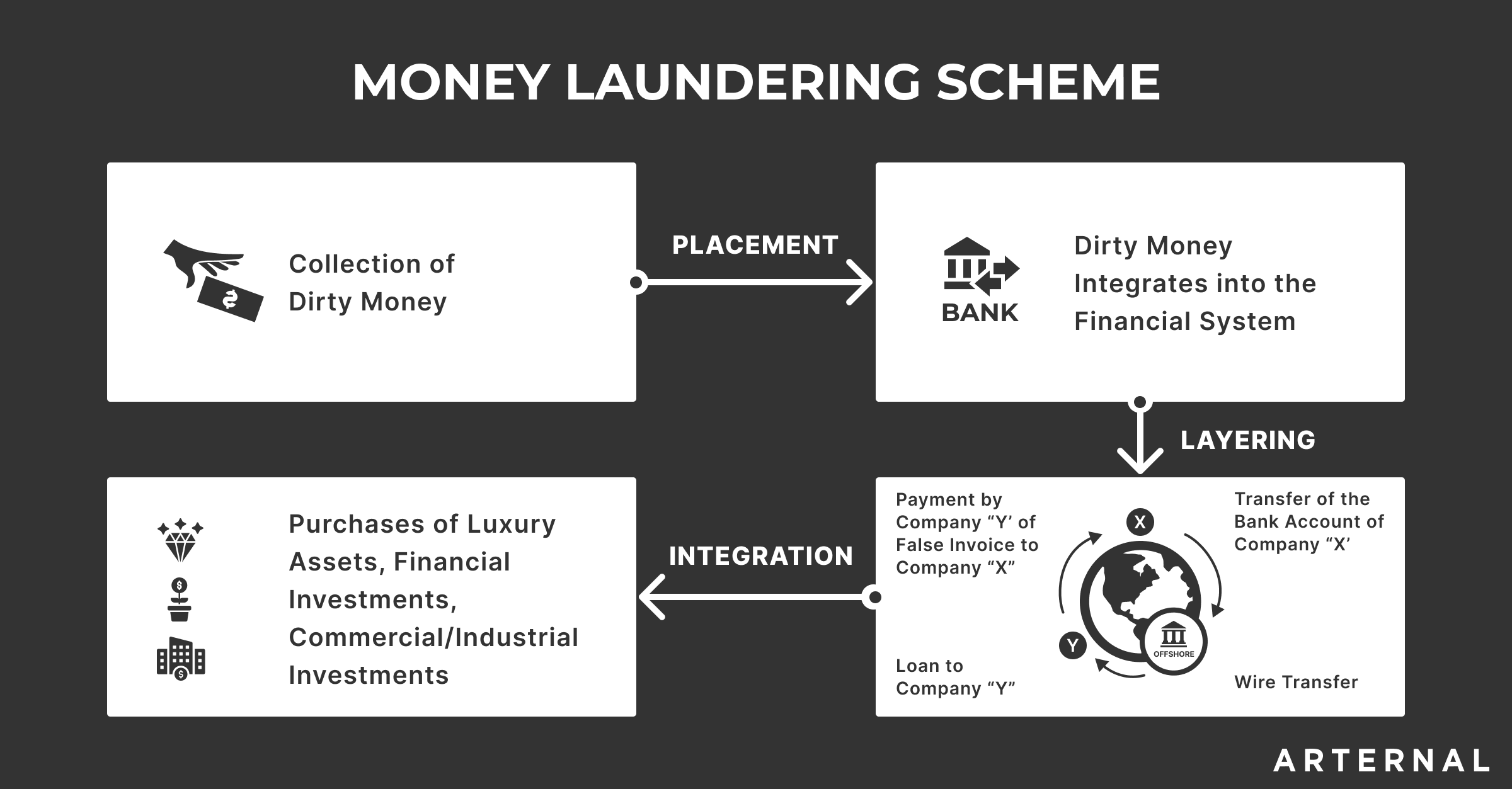

Source: blog.arternal.com

Source: blog.arternal.com

Red Flag indicators If the client. The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks. In response the FATF Report Virtual Assets - Red Flag Indiciators of Money Laundering and Terrorist Financing will help national authorities detect whether virtual assets are being used for criminal activity. Projects that start and close and are fully funded within a very short period. Money Laundering Red Flags.

Source: pt.slideshare.net

Source: pt.slideshare.net

Red Flag indicators If the client. Addresses of the Filing Agent FA or Post Office PO box addresses are used by the companies as their registeredmailing addresses. It is a process by which soiled cash is converted into clean money. A full range of risk level checking Unbeatable match rates. Projects that start and close and are fully funded within a very short period.

Source: smartvault.com

Source: smartvault.com

SRBs and law enforcement officers find these red-flag indicators useful when monitoring or researching the professional behavior of professionals or customers. A problem arises here because the average red-flag training programs for anti money laundering and terrorist financing are still bank-focused. Money laundering is damaging in many ways. The FATF claims that in case any of the following activities occur there may be a high likelihood of money. The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks.

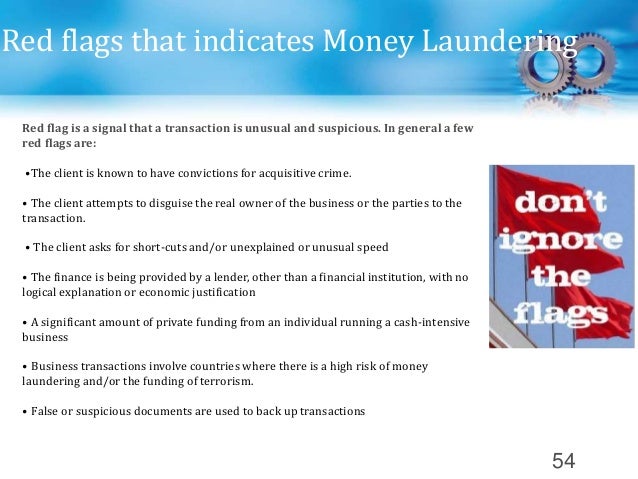

Source: ppt-online.org

Source: ppt-online.org

Allowing money laundering to take place through your business can leave you prone to challenges in. The concept of money laundering is very important to be understood for those working in the financial sector. Money laundering is damaging in many ways. The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business.

Source: blueazurite.com

Source: blueazurite.com

The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks. Red Flag indicators If the client. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business. One of the following circumstances may provide a basis for making further enquiries of your client. If there is a red flag indicator regulators may suspect that money laundering ML or terrorist financing TF has occurred.

Source: shuftipro.com

Source: shuftipro.com

Projects that get funding within days of their start C. Which red flag indicates the highest anti-money laundering risk. Money laundering is damaging in many ways. The six indicators and red flags have been summarized below. Is secretive or evasive about who they are the beneficial owner the source of funds the reason for the transaction or what the big picture is.

Source: shuftipro.com

Source: shuftipro.com

If there is a red flag indicator regulators may suspect that money laundering ML or terrorist financing TF has occurred. Red flags By admin in Market commentary 26th July 2019 0 Stephen Ward director of strategy at the Council for Licensed Conveyancers delves into what firms must do to make sure they are following anti-money laundering rules. A problem arises here because the average red-flag training programs for anti money laundering and terrorist financing are still bank-focused. Authorised bank signatories are usually foreign directors and shareholders are located overseas. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business.

Source: slideshare.net

Source: slideshare.net

Based on more than 100 case studies collected by members of the FATF Global Network it highlights the most important red flag. Red flags By admin in Market commentary 26th July 2019 0 Stephen Ward director of strategy at the Council for Licensed Conveyancers delves into what firms must do to make sure they are following anti-money laundering rules. Which red flag indicates the highest anti-money laundering risk. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business. Allowing money laundering to take place through your business can leave you prone to challenges in.

Source: clc-uk.org

Source: clc-uk.org

Projects with the highest monetary success threshold D. Projects with the highest monetary success threshold D. Multiple bank accounts opened with various banks for no apparent economic or business reason. Allowing money laundering to take place through your business can leave you prone to challenges in. The FATF claims that in case any of the following activities occur there may be a high likelihood of money.

Source: slideplayer.com

Source: slideplayer.com

Anti Money Laundering Act Red Flags on August 08 2021 Get link. Several red flag indicators together without reasonable explanation are. Which red flag indicates the highest anti-money laundering risk. Businesses that incorporate it into their new or existing compliance regime can count on. The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks.

Source: regtechconsulting.net

Source: regtechconsulting.net

The sources of the cash in actual are criminal and the. Ideally you should retain an experienced money-laundering expert to assess your organizations unique vulnerabilities and tailor the list of red flags to your specific operation. The FATF claims that in case any of the following activities occur there may be a high likelihood of money. Addresses of the Filing Agent FA or Post Office PO box addresses are used by the companies as their registeredmailing addresses. Red Flag Alerts AML service is the simple answer to this complex issue and can help firms to monitor for suspicious activity without disrupting their everyday commercial activities.

Source: slideplayer.com

Source: slideplayer.com

SRBs and law enforcement officers find these red-flag indicators useful when monitoring or researching the professional behavior of professionals or customers. The FATF claims that in case any of the following activities occur there may be a high likelihood of money. Red flags By admin in Market commentary 26th July 2019 0 Stephen Ward director of strategy at the Council for Licensed Conveyancers delves into what firms must do to make sure they are following anti-money laundering rules. The six indicators and red flags have been summarized below. Projects with the highest monetary success threshold D.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title red flag meaning in anti money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.