18+ Record keeping under money laundering regulations 2017 info

Home » money laundering idea » 18+ Record keeping under money laundering regulations 2017 infoYour Record keeping under money laundering regulations 2017 images are available in this site. Record keeping under money laundering regulations 2017 are a topic that is being searched for and liked by netizens today. You can Get the Record keeping under money laundering regulations 2017 files here. Find and Download all royalty-free photos and vectors.

If you’re looking for record keeping under money laundering regulations 2017 images information linked to the record keeping under money laundering regulations 2017 topic, you have come to the ideal blog. Our website always gives you hints for downloading the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

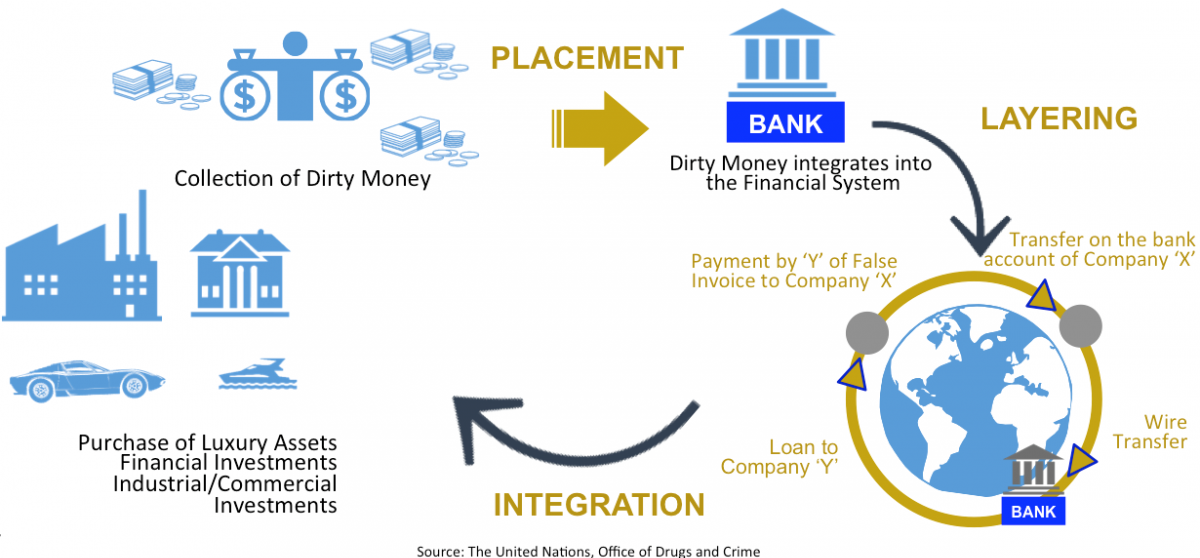

Record Keeping Under Money Laundering Regulations 2017. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. The following are areas that it is recommended that formal records are in place and this should be considered to be included as either a stand-alone policy on record-keeping andor included in relevant internal policies and procedures. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of ten years. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

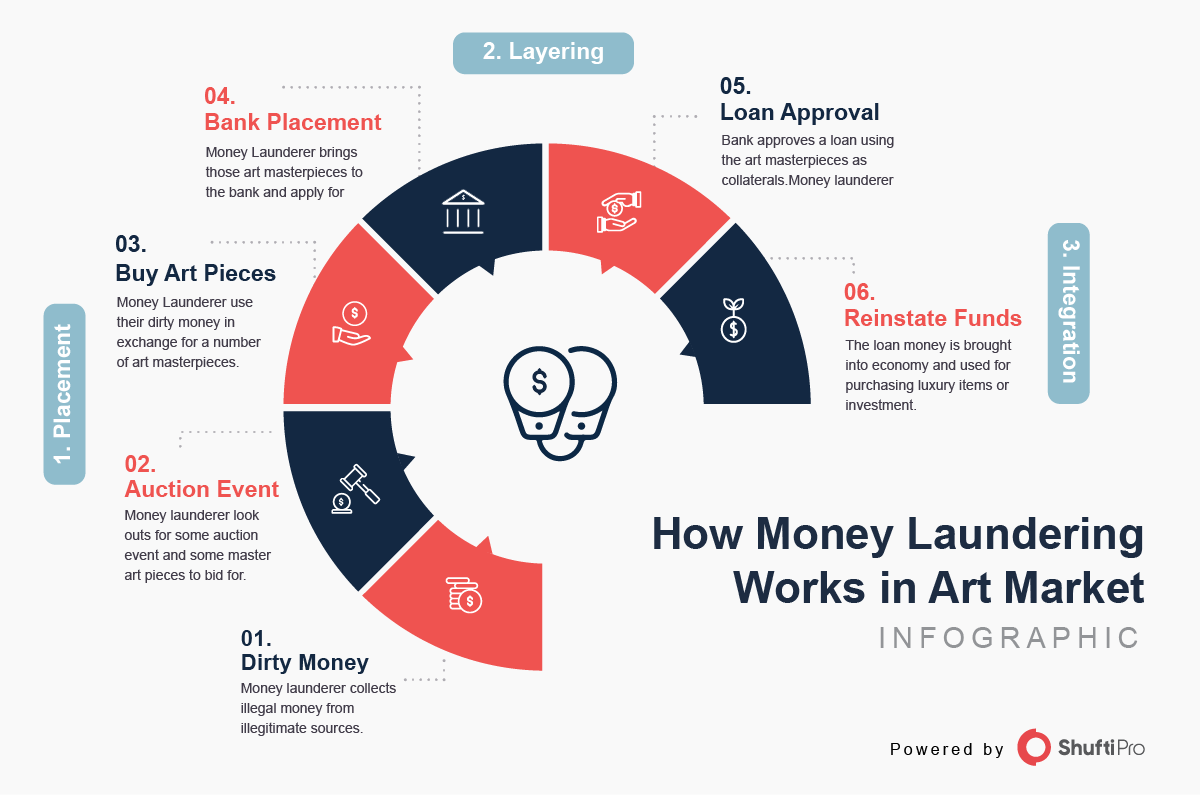

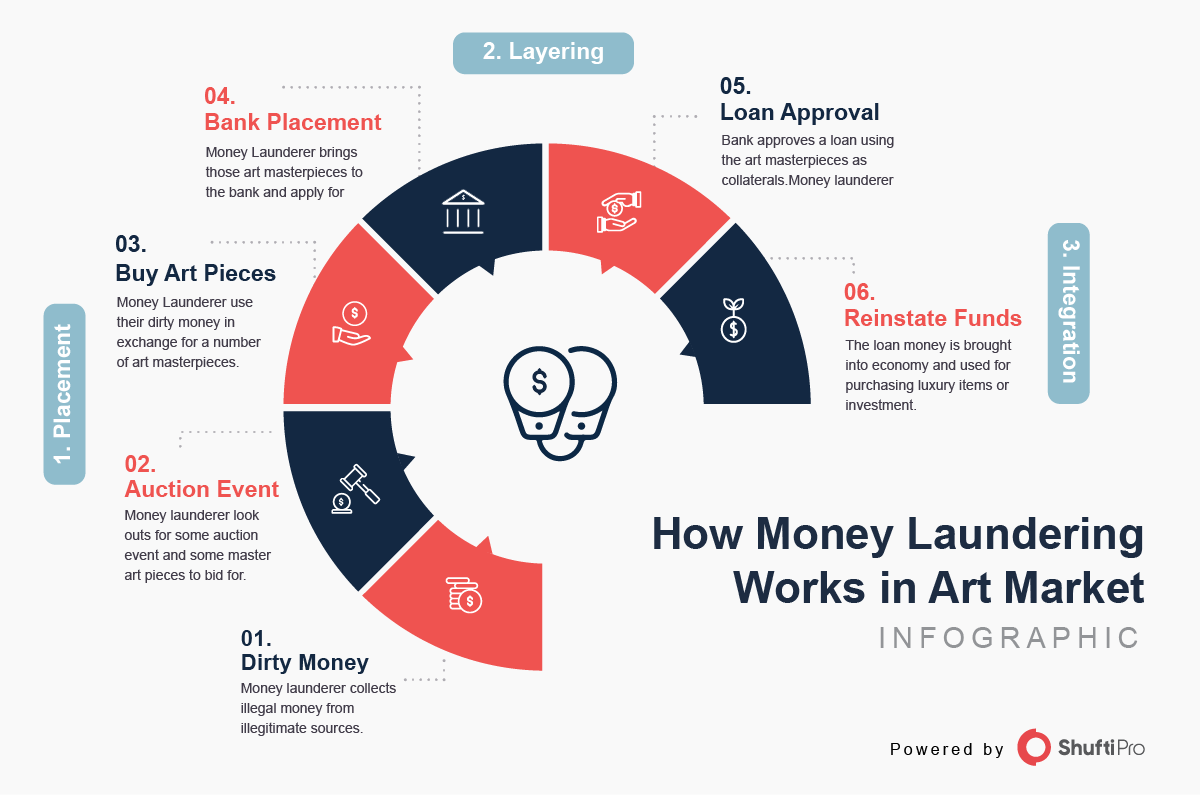

Art Market In The Frame Of Money Laundering From shuftipro.com

Art Market In The Frame Of Money Laundering From shuftipro.com

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. This Practice Note explains the regulatory requirements relating to anti-money laundering and counter-terrorist financing record keeping as set out in the Money Laundering Regulations 2017 MLR 2017 as amended. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the customer or its beneficial owner and agrees to keep records for the periods the MLR. Auditors insolvency practitioners external accountants and tax advisers. The following are areas that it is recommended that formal records are in place and this should be considered to be included as either a stand-alone policy on record-keeping andor included in relevant internal policies and procedures.

It also contains recommended actions.

The AML Regulations provide a statutory basis for certain requirements previously contained only in the Guidance Notes on the Prevention and. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of ten years. The Anti-Money Laundering Regulations 2017 AML Regulations which replace the Money Laundering Regulations 2015 Revision MLRs were gazetted on 20 September 2017 and came into force on 2 October 2017. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. Money Laundering Regulations 2017record keeping Practice notes.

Source: shuftipro.com

Source: shuftipro.com

The 2017 MLRs have been informed by the responses submitted and. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. Data retention policies need to. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. Your record retention period should be outlined in the programme including the process of how your business will undertake destruction of records.

Source: ec.europa.eu

Source: ec.europa.eu

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law. However you should be aware that the presence of one or. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law. It also contains recommended actions. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

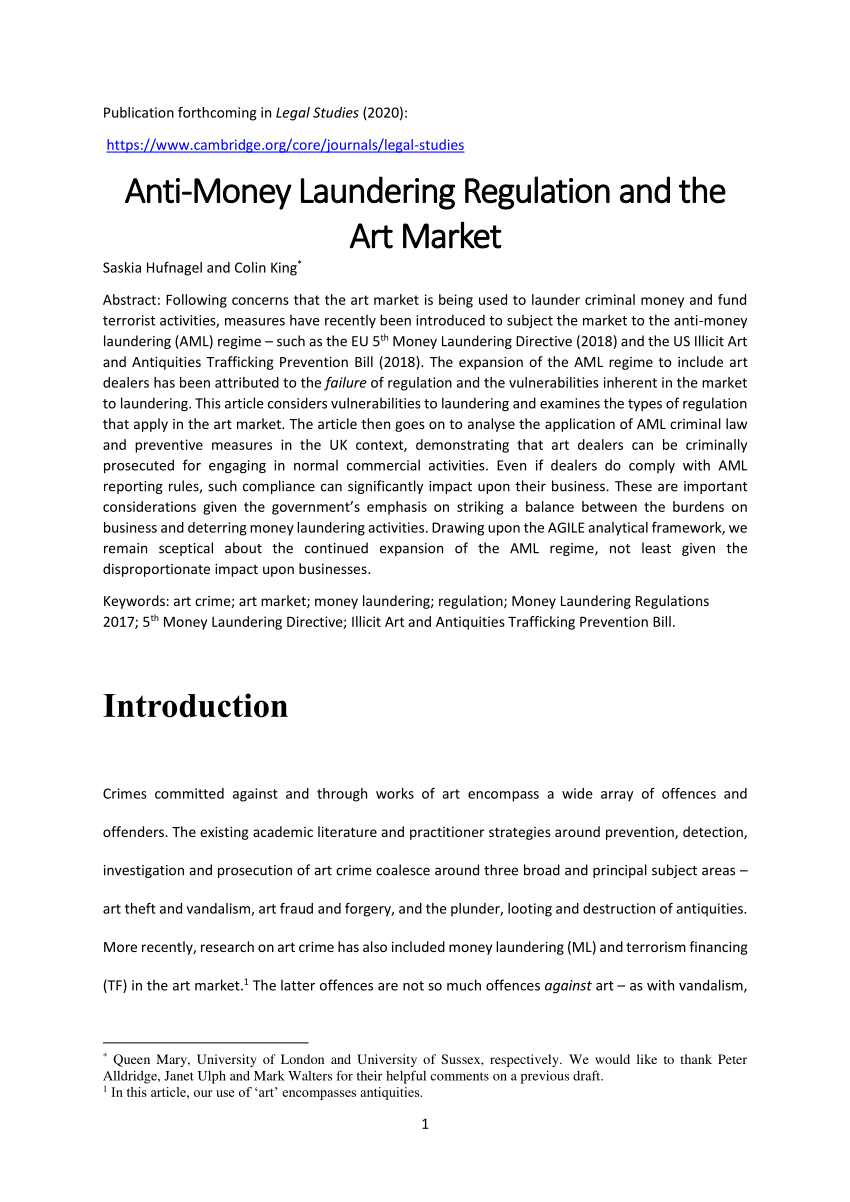

Source: researchgate.net

Source: researchgate.net

This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of ten years. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The following are areas that it is recommended that formal records are in place and this should be considered to be included as either a stand-alone policy on record-keeping andor included in relevant internal policies and procedures. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

The AML Regulations provide a statutory basis for certain requirements previously contained only in the Guidance Notes on the Prevention and. The AML Regulations provide a statutory basis for certain requirements previously contained only in the Guidance Notes on the Prevention and. 1 Subject to paragraph a relevant person must keep the records specified in paragraph for at least the period specified in paragraph. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. This Practice Note explains the regulatory requirements relating to anti-money laundering and counter-terrorist financing record keeping as set out in the Money Laundering Regulations 2017 MLR 2017 as amended.

Source: researchgate.net

Source: researchgate.net

Data retention policies need to. Auditors insolvency practitioners external accountants and tax advisers. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of ten years.

Source: gov.si

Source: gov.si

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 commenced on 26 June 2017 and replace the Money Laundering Regulations 2007. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Records are required to be maintained for a period of 5 years unless there is a legislative reason to maintain those records for a longer period. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of ten years. This Practice Note explains the regulatory requirements relating to anti-money laundering and counter-terrorist financing record keeping as set out in the Money Laundering Regulations 2017 MLR 2017 as amended.

Source: slidetodoc.com

Source: slidetodoc.com

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law. It also contains recommended actions. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated.

Source: researchgate.net

Source: researchgate.net

A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the customer or its beneficial owner and agrees to keep records for the periods the MLR. It also contains recommended actions. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. 2 The records are a a copy of any documents and. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended.

Source: landlordsguild.com

Source: landlordsguild.com

The following are areas that it is recommended that formal records are in place and this should be considered to be included as either a stand-alone policy on record-keeping andor included in relevant internal policies and procedures. This Money Laundering Regulations 2017 MLR 2017record keeping checklist pulls together requirements in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. The AML Regulations provide a statutory basis for certain requirements previously contained only in the Guidance Notes on the Prevention and. The following are areas that it is recommended that formal records are in place and this should be considered to be included as either a stand-alone policy on record-keeping andor included in relevant internal policies and procedures.

Source: researchgate.net

Source: researchgate.net

Your record retention period should be outlined in the programme including the process of how your business will undertake destruction of records. 1 Subject to paragraph a relevant person must keep the records specified in paragraph for at least the period specified in paragraph. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the customer or its beneficial owner and agrees to keep records for the periods the MLR. The following are areas that it is recommended that formal records are in place and this should be considered to be included as either a stand-alone policy on record-keeping andor included in relevant internal policies and procedures.

MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. The Anti-Money Laundering Regulations 2017 AML Regulations which replace the Money Laundering Regulations 2015 Revision MLRs were gazetted on 20 September 2017 and came into force on 2 October 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The regulations apply to.

Source: wikiwand.com

Source: wikiwand.com

The regulations apply to. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the customer or its beneficial owner and agrees to keep records for the periods the MLR. The regulations apply to. Money Laundering Regulations 2017record keeping This Practice Note explains the regulatory requirements relating to anti-money laundering AML and counter-terrorist financing CTF record keeping as set out in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended. The Anti-Money Laundering Regulations 2017 AML Regulations which replace the Money Laundering Regulations 2015 Revision MLRs were gazetted on 20 September 2017 and came into force on 2 October 2017.

Source: semanticscholar.org

Source: semanticscholar.org

The regulations apply to. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. 1 Subject to paragraph a relevant person must keep the records specified in paragraph for at least the period specified in paragraph. The AML Regulations provide a statutory basis for certain requirements previously contained only in the Guidance Notes on the Prevention and. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title record keeping under money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.