16+ Quick guide to money laundering regulations 2017 ideas in 2021

Home » money laundering Info » 16+ Quick guide to money laundering regulations 2017 ideas in 2021Your Quick guide to money laundering regulations 2017 images are ready. Quick guide to money laundering regulations 2017 are a topic that is being searched for and liked by netizens today. You can Get the Quick guide to money laundering regulations 2017 files here. Download all free images.

If you’re looking for quick guide to money laundering regulations 2017 pictures information connected with to the quick guide to money laundering regulations 2017 keyword, you have come to the ideal site. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Quick Guide To Money Laundering Regulations 2017. This Practice Note is intended to be a guide to help you to comply with the client due diligence CDD requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended in. The Money Laundering Regulations 2017 require relevant businesses to. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive.

Https Www Econstor Eu Bitstream 10419 162698 1 891246215 Pdf From

Below we set out some key aspects of MLR 2017. This Practice Note is intended to be a guide to help you to comply with the client due diligence CDD requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended in. The 2017 MLRs have been informed by the responses submitted and. Money Laundering Regulations 2017 August 10 2021 The concept of cash laundering is essential to be understood for these working within the monetary sector. Time is now running short and the legislation must be in force by 26 June. Regularly provide training on how to recognise and deal with transactions and other.

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law.

The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear. Identify the money laundering risks that are relevant to their business. Client due diligence CDD is a central pillar of the anti-money laundering AMLcounter-terrorist financing CTF regime. The details completed below will provide an overview of your firm which you should then utilise to assist with completion of your risk assessment. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source:

The details completed below will provide an overview of your firm which you should then utilise to assist with completion of your risk assessment. HMRC recommends that organisations. The Law Societys Quick guide to the Money Laundering Regulations 2017 This quick guide provides a brief overview of the key issues firms will need to be aware of and the changes they will have to implement in order to comply with the regulations. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692.

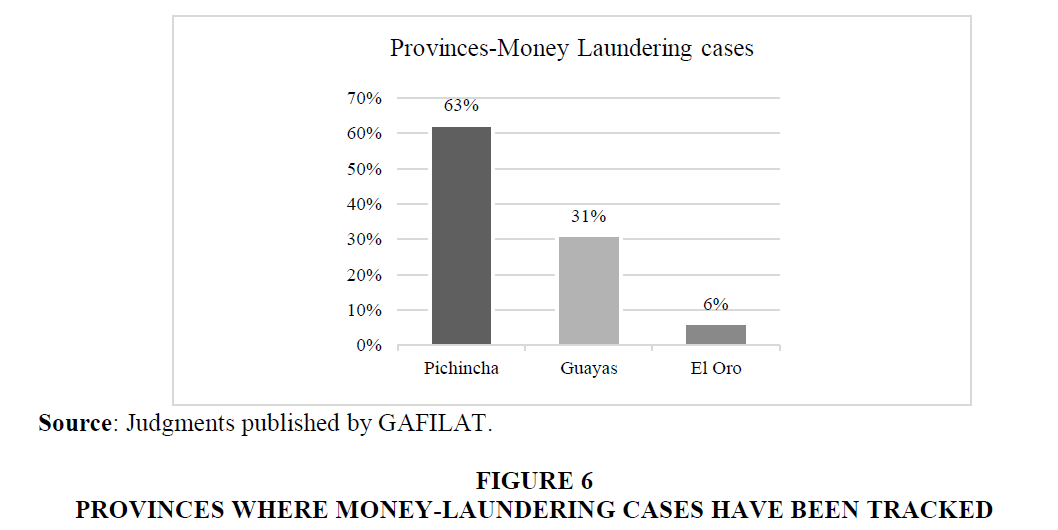

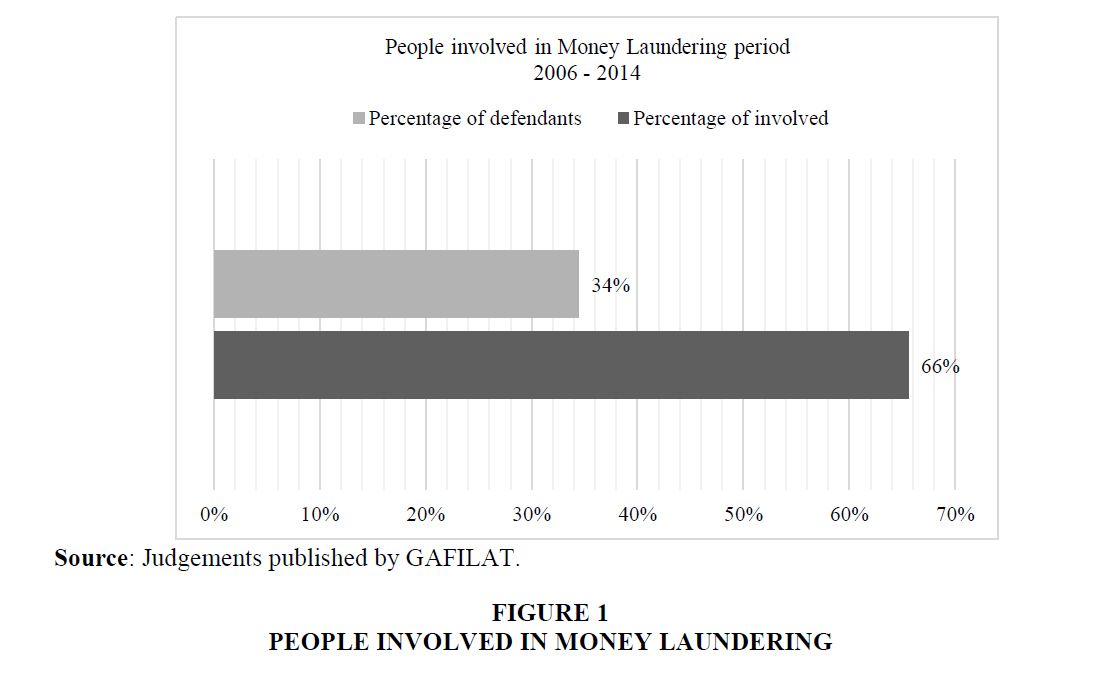

Source: abacademies.org

Source: abacademies.org

Regularly provide training on how to recognise and deal with transactions and other. Identify the money laundering risks that are relevant to their business. The Money Laundering Regulations 2017 require relevant businesses to. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Guide to anti-money laundering training requirements under the Fourth Directive.

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. Money Laundering Regulations 2017CDD quick reference guidePartnerships LLPs and companies. The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. The 2017 MLRs have been informed by the responses submitted and.

Source: abacademies.org

Source: abacademies.org

The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. Following Treasurys initial consultation on how to implement MLD4 in September 2016 it has now published the feedback to that consultation and the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017. The 2017 MLRs have been informed by the responses submitted and. The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive.

Source: bi.go.id

Source: bi.go.id

The Money Laundering Regulations 2017 Require Risk Assessments To Be Carried Out. Regularly provide training on how to recognise and deal with transactions and other. Money Laundering Regulations 2017 August 10 2021 The concept of cash laundering is essential to be understood for these working within the monetary sector. These new regulations need to be carefully considered along with the accompanying guidance. The details completed below will provide an overview of your firm which you should then utilise to assist with completion of your risk assessment.

Source: bi.go.id

Source: bi.go.id

The Law Societys Quick guide to the Money Laundering Regulations 2017 This quick guide provides a brief overview of the key issues firms will need to be aware of and the changes they will have to implement in order to comply with the regulations. These new regulations need to be carefully considered along with the accompanying guidance. The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear. What Are the New Duties.

Source: bi.go.id

Eisneramper Ireland Anti Money Laundering Aml Preparation For Cbi Reviews Under Amld4. The Law Societys Quick guide to the Money Laundering Regulations 2017 This quick guide provides a brief overview of the key issues firms will need to be aware of and the changes they will have to implement in order to comply with the regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into.

Source: in.pinterest.com

Source: in.pinterest.com

Money Laundering Regulations 2017 August 10 2021 The concept of cash laundering is essential to be understood for these working within the monetary sector. Identify the money laundering risks that are relevant to their business. Make employees aware of the laws relating to money laundering and terrorist financing. Customer Due Diligence CDD Introduction. This Practice Note is intended to be a guide to help you to comply with the client due diligence CDD requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 as amended in.

Source: bi.go.id

Source: bi.go.id

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Time is now running short and the legislation must be in force by 26 June. The Money Laundering Regulations 2017 require relevant businesses to. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692.

Source: bi.go.id

Following Treasurys initial consultation on how to implement MLD4 in September 2016 it has now published the feedback to that consultation and the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017. Guide to anti-money laundering training requirements under the Fourth Directive. Carry out a detailed risk assessment focusing on customer behaviour delivery channels and so on. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: shuftipro.com

Source: shuftipro.com

HMRC recommends that organisations. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Customer Due Diligence CDD Introduction. The 2017 MLRs have been informed by the responses submitted and. These new regulations need to be carefully considered along with the accompanying guidance.

Source: shuftipro.com

Source: shuftipro.com

It is a process by which soiled money is converted into clean money. What Are the New Duties. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. Client care and complaints handling. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear.

Source: bi.go.id

Source: bi.go.id

The Law Societys Quick guide to the Money Laundering Regulations 2017 This quick guide provides a brief overview of the key issues firms will need to be aware of and the changes they will have to implement in order to comply with the regulations. What Are the New Duties. Client due diligence CDD is a central pillar of the anti-money laundering AMLcounter-terrorist financing CTF regime. Below we set out some key aspects of MLR 2017. These new regulations need to be carefully considered along with the accompanying guidance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title quick guide to money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.