12+ Qatar money laundering risk ideas

Home » money laundering idea » 12+ Qatar money laundering risk ideasYour Qatar money laundering risk images are available in this site. Qatar money laundering risk are a topic that is being searched for and liked by netizens today. You can Download the Qatar money laundering risk files here. Find and Download all royalty-free images.

If you’re looking for qatar money laundering risk images information connected with to the qatar money laundering risk keyword, you have come to the ideal site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Qatar Money Laundering Risk. 3 This is completed as soon as practicable after contact is first established with the customer. Some of the most significant changes have been brought about by Law No 27 of 2019. Our professionals have assisted and continue to assist a variety of clients with developing and implementing comprehensive AMLCFT Compliance Programs that address the latest regulatory and industry expectations and the companys own unique money laundering risk. Those found guilty of money laundering can expect to face serious penalties including up to seven years imprisonment and hefty fines.

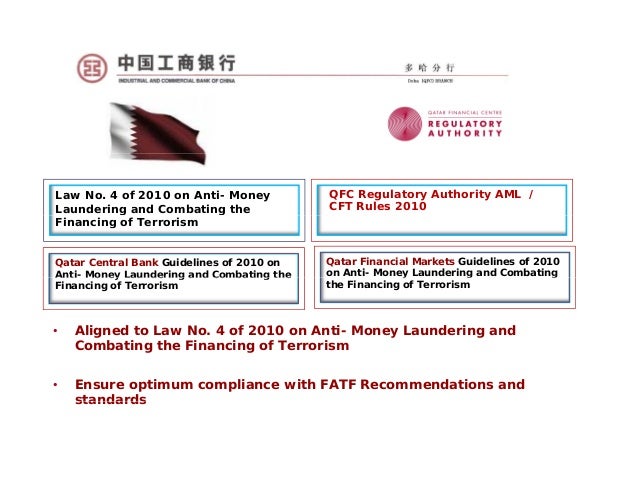

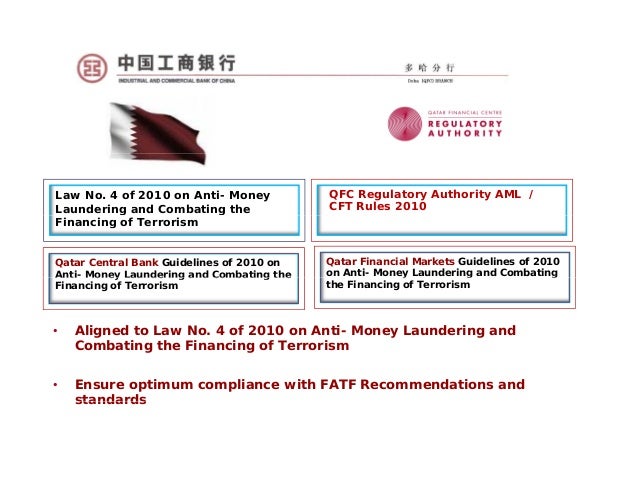

International Aml Standards Qatar Case Compatibility Mode From slideshare.net

International Aml Standards Qatar Case Compatibility Mode From slideshare.net

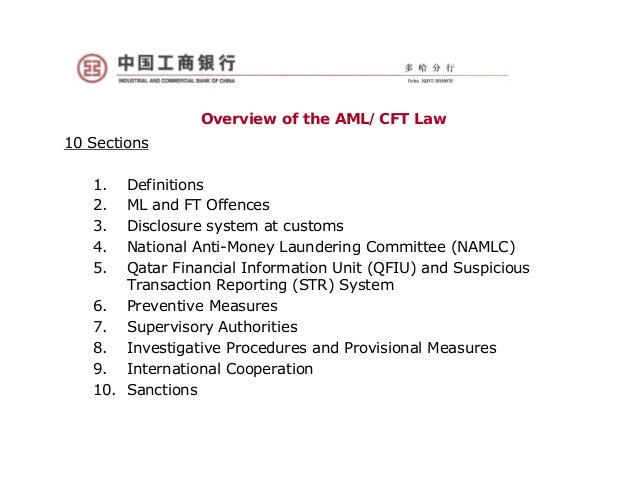

The QFC AMLCFT Rules 2019 are stated to come into force on 1. 2 There is little risk of money laundering or terrorism financing and these risks are effectively managed. 4 of 2010 for combating money laundering and terrorism financing. Qatar has issued a number of laws to criminalize activities related to money laundering and terrorist financing as follows. The expansion of the financial and trade sectors the large number of expatriate laborers who send remittances to their home countries the liberalization and growth in the real estate sector uneven corporate oversight and Irans efforts to bypass sanctions through Gulf economies make Qatar increasingly vulnerable to the threat of money laundering. Counter-Terrorism Financing and Sanctions.

Financial Institutions and DNFBPs both as defined below are required to identify consider understand assess document monitor and update on a regular basis their money laundering and terrorist financing risks and are required to submit reports to.

The Anti Money Laundering Law also calls for all financial institutions to report any suspicious transactions to the Qatar Central Bank QCB and to maintain records of these transactions for up to 15 years. The QFC AMLCFT Rules 2019 are stated to come into force on 1. Whilst the skeleton of the laws may be somewhat genericised however requirements such as those that refer to the National Risk Assessment simultaneously maintain a broad awareness and better management of Qatars specific money laundering and terrorism financing risks amongst key stakeholders. The expansion of the financial and trade sectors the large number of expatriate laborers who send remittances to their home countries the liberalization and growth in the real estate sector uneven corporate oversight and Irans efforts to bypass sanctions through Gulf economies make Qatar increasingly vulnerable to the threat of money laundering. Conducting an ongoing off-site surveillance and on-site inspection of all financial institutions regulated and controlled by the Qatar Central Bank to-. The Qatar Financial Centre Regulatory Authority QFCRA which regulates financial institutions and DNFBPs operating in the Qatar Financial Centre has implemented Law 20 through the recently issued new Anti-Money Laundering and Combating the Financing of Terrorism Rules 2019 the QFC AMLCFT Rules 2019.

Source: thepeninsulaqatar.com

Source: thepeninsulaqatar.com

The Qatar Financial Centre Regulatory Authority QFCRA which regulates financial institutions and DNFBPs operating in the Qatar Financial Centre has implemented Law 20 through the recently issued new Anti-Money Laundering and Combating the Financing of Terrorism Rules 2019 the QFC AMLCFT Rules 2019. Our professionals have assisted and continue to assist a variety of clients with developing and implementing comprehensive AMLCFT Compliance Programs that address the latest regulatory and industry expectations and the companys own unique money laundering risk. Counter-Terrorism Financing and Sanctions. The Anti Money Laundering Law also calls for all financial institutions to report any suspicious transactions to the Qatar Central Bank QCB and to maintain records of these transactions for up to 15 years. Those found guilty of money laundering can expect to face serious penalties including up to seven years imprisonment and hefty fines.

Source: slideshare.net

Source: slideshare.net

41 of 2019 on Combating Money Laundering and. The Anti Money Laundering Law also calls for all financial institutions to report any suspicious transactions to the Qatar Central Bank QCB and to maintain records of these transactions for up to 15 years. Destabilization of security and stability. Coordinating all official correspondence and communication between the Central Bank and the National Anti-Money Laundering and Combating the Financing of Terrorism Committee. Upon reviewing Law No 13 of 2012 on Qatar Central Bank and the Regulation of Financial Institutions Law No 20 of 2019 on Combating Money Laundering and Terrorism Financing and the Implementing Regulations issued as per Prime Minister decree no.

Source: slideshare.net

Source: slideshare.net

The QFC AMLCFT Rules 2019 are stated to come into force on 1. ML security risks and damages consist of the following. Upon reviewing Law No 13 of 2012 on Qatar Central Bank and the Regulation of Financial Institutions Law No 20 of 2019 on Combating Money Laundering and Terrorism Financing and the Implementing Regulations issued as per Prime Minister decree no. On the Issuance of the Counter-Terrorism. Some of the most significant changes have been brought about by Law No 27 of 2019.

Source: amlhelpdesk.com

Source: amlhelpdesk.com

Those found guilty of money laundering can expect to face serious penalties including up to seven years imprisonment and hefty fines. Financial penalties of up to QAR100000000 on any entity in breach of anti-money laundering or terrorism financing regulations or a penalty of. Conducting an ongoing off-site surveillance and on-site inspection of all financial institutions regulated and controlled by the Qatar Central Bank to-. Our professionals have assisted and continue to assist a variety of clients with developing and implementing comprehensive AMLCFT Compliance Programs that address the latest regulatory and industry expectations and the companys own unique money laundering risk. 20 of 2019 issuing the Anti-Money Laundering and.

Source: tamimi.com

Source: tamimi.com

2 With respect to the QFC Rules. Law No 3 of 2004 on Combating Terrorism amended by Decree Law. AMLCFT risk management requires companies to identify measure control and monitor money laundering risk effectively. Whilst the skeleton of the laws may be somewhat genericised however requirements such as those that refer to the National Risk Assessment simultaneously maintain a broad awareness and better management of Qatars specific money laundering and terrorism financing risks amongst key stakeholders. 2 There is little risk of money laundering or terrorism financing and these risks are effectively managed.

Source: fatf-gafi.org

Source: fatf-gafi.org

20 of 2019 issuing the Anti-Money Laundering and. Some of the most significant changes have been brought about by Law No 27 of 2019. 20 of 2019 on Combating Money Laundering and Terrorism Financing and its Implementing Regulations issued by Council of Ministers decision No. On the Issuance of the Counter-Terrorism. Law No 3 of 2004 on Combating Terrorism amended by Decree Law.

Source: researchgate.net

Source: researchgate.net

4 of 2010 for combating money laundering and terrorism financing. 20 of 2019 issuing the Anti-Money Laundering and. This Detailed Assessment Report on Anti-Money Laundering and Combating the Financing of Terrorism for Qatar was prepared by a staff team of the International Monetary Fund using the assessment methodology adopted by the Financial Action Task Force in February 2004 and endorsed. Qatar has issued a number of laws to criminalize activities related to money laundering and terrorist financing as follows. ML security risks and damages consist of the following.

Source: slideshare.net

Source: slideshare.net

Those found guilty of money laundering can expect to face serious penalties including up to seven years imprisonment and hefty fines. Upon reviewing Law No 13 of 2012 on Qatar Central Bank and the Regulation of Financial Institutions Law No 20 of 2019 on Combating Money Laundering and Terrorism Financing and the Implementing Regulations issued as per Prime Minister decree no. AMLCFT risk management requires companies to identify measure control and monitor money laundering risk effectively. Qatar ranks second among GCC states with the lowest risk of money laundering and terrorism financing crimes Central Bank Deputy Governor Sheikh Fahad bin Faisal al. 41 of 2019 on Combating Money Laundering and.

Source: iccqatar.org

Source: iccqatar.org

AMLCFT risk management requires companies to identify measure control and monitor money laundering risk effectively. Upon reviewing Law No 13 of 2012 on Qatar Central Bank and the Regulation of Financial Institutions Law No 20 of 2019 on Combating Money Laundering and Terrorism Financing and the Implementing Regulations issued as per Prime Minister decree no. Counter-Terrorism Financing and Sanctions. Destabilization of security and stability. National Risk Assessment simultaneously maintain a broad awareness and better management of Qatars specific money laundering and terrorism financing risks amongst key stakeholders.

Source: slideshare.net

Source: slideshare.net

41 of 2019 on Combating Money Laundering and. The Anti Money Laundering Law also calls for all financial institutions to report any suspicious transactions to the Qatar Central Bank QCB and to maintain records of these transactions for up to 15 years. Counter-Terrorism Financing and Sanctions. Our professionals have assisted and continue to assist a variety of clients with developing and implementing comprehensive AMLCFT Compliance Programs that address the latest regulatory and industry expectations and the companys own unique money laundering risk. 20 of 2019 on Combating Money Laundering and Terrorism Financing and its Implementing Regulations issued by Council of Ministers decision No.

Source: elibrary.imf.org

Source: elibrary.imf.org

The legislation reflects Qatars continued commitment to combating money laundering and terrorism financing in all its forms in accordance with the latest international standards adopted by major international organisations including Financial Action Task. The Anti Money Laundering Law also calls for all financial institutions to report any suspicious transactions to the Qatar Central Bank QCB and to maintain records of these transactions for up to 15 years. Qatar has issued a number of laws to criminalize activities related to money laundering and terrorist financing as follows. Qatar ranks second among GCC states with the lowest risk of money laundering and terrorism financing crimes Central Bank Deputy Governor Sheikh Fahad bin Faisal al. Counter-Terrorism Financing and Sanctions.

Source: pinterest.com

Source: pinterest.com

On the Issuance of the Counter-Terrorism. Money laundering temptations will lead some vulnerable and paid categories of persons to conduct ML operations regardless of their legitimacy and damages. 4 of 2010 for combating money laundering and terrorism financing. Destabilization of security and stability. Qatar has issued a number of laws to criminalize activities related to money laundering and terrorist financing as follows.

Source: slideshare.net

Source: slideshare.net

On the Issuance of the Counter-Terrorism. The QFC AMLCFT Rules 2019 are stated to come into force on 1. Qatar Central Bank QCB said the new law will replace Law No. Qatar has issued a number of laws to criminalize activities related to money laundering and terrorist financing as follows. 2 With respect to the QFC Rules.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title qatar money laundering risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.