14+ Psc register money laundering ideas in 2021

Home » money laundering Info » 14+ Psc register money laundering ideas in 2021Your Psc register money laundering images are available. Psc register money laundering are a topic that is being searched for and liked by netizens today. You can Download the Psc register money laundering files here. Get all royalty-free vectors.

If you’re looking for psc register money laundering pictures information related to the psc register money laundering interest, you have pay a visit to the ideal blog. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

Psc Register Money Laundering. What is a PSC register. The reason for the PSC register is to aid investors with analysing company structures and also to aid law enforcement. The purpose behind PSC discrepancy reporting is to ensure that the information on the PSC register is adequate accurate and current. Government plans to implement the EU Fourth Money Laundering Directive to prevent the use of the financial system for money laundering or terrorist financing will cost businesses up to 27m a year in additional compliance costs while the people with significant control register PSC.

Uk The Psc Register And Its Implications Ecovis International From ecovis.com

Uk The Psc Register And Its Implications Ecovis International From ecovis.com

The company will not be informed that a discrepancy report has been made about their PSC register information. Its a course of by which dirty money is converted into clear cash. The concept of cash laundering is essential to be understood for these working within the financial sector. Discrepancy is not defined in the 2017 Money Laundering Regulations but HM Governments interpretation of the intention is for material differences to be reported. Is your company aware of the new changes to PSC Registers implementing anti money laundering legislation. In particular to help with money laundering investigations and also to help identify and prevent other illegal activity that may be carried out through UK business structures.

Firms supervised under the money laundering regulations must report discrepancies between information firms have about their clients and the PSC Register in Companies House.

The introduction of the register is a move that aims to reduce money laundering and increase transparency of corporate ownership and effective control. The concept of cash laundering is essential to be understood for these working within the financial sector. Whilst the government maintains that it welcomes legitimate foreign investment in the UK it also highlights evidence that overseas investors in the UK property market have included criminals laundering the proceeds of crime. If the company traded on an EEA or Schedule 1 specified market it will remain exempt. Government plans to implement the EU Fourth Money Laundering Directive to prevent the use of the financial system for money laundering or terrorist financing will cost businesses up to 27m a year in additional compliance costs while the people with significant control register PSC. If you have any concerns or are unsure of what is required your professional legal or financial advisor will be able to clarify matters for you.

Source: branddocs.com

Source: branddocs.com

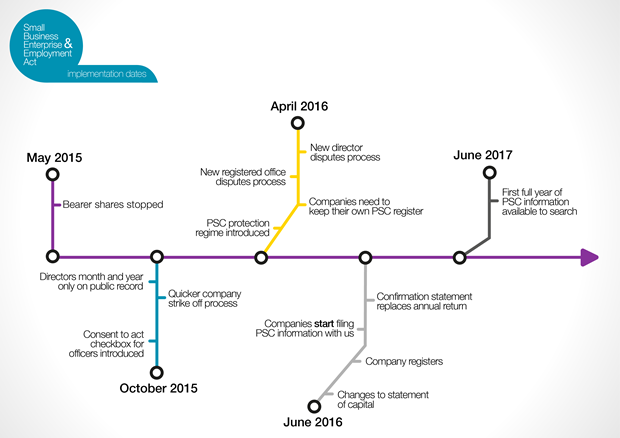

Under the Persons with Significant Control PSC Regime which came into effect on 6 April 2016 certain classes of entity were exempt from the need to maintain a PSC register as they already met the requirements primarily through what is known as being a DTR5 entity which means that they fall within the scope of Chapter 5 of the FCAs Disclosure and Transparency Rules which requires companies. The sources of the cash in actual are legal and the cash is invested in a manner that makes it appear like clean cash and hide the. Business owners and compliance officers should be aware of the requirements of the PSC register as well as the changes brought on by the Fourth Anti-Money Laundering Directive. Youll have to check the Persons with Significant Control PSC register for new clients Anyone taking on a new client will have to obtain evidence that the client has filed details of their Persons with Significant Control PSCs with Companies House and will also need to report discrepancies between the information they hold and whats on the PSC register. All EU Member States will be required to set up public registers of beneficial owners of companies as part of recent revisions to the EU Anti-Money Laundering Directive which take effect this summer.

Source: dmeurope.eu

Source: dmeurope.eu

Money Laundering Risk Scoring Model. Companies House will hold the personal data of the obliged entity and the personal data of the PSC in the discrepancy report on its PSC register for 10 years. The directives implementation sees separate forms introduced PSC01 to PSC09 to notify Companies House when PSC register information is altered and made within 14 days of the changes occurrence. From 26 June there will be changes and such companies may need to provide PSC information. The new regulations amend the UKs existing money laundering regulations MLRs to introduce a requirement for relevant persons subject to the MLRs to check the beneficial ownership registers ie.

Source: qualitycompanyformations.co.uk

Source: qualitycompanyformations.co.uk

Its a course of by which dirty money is converted into clear cash. Under the Persons with Significant Control PSC Regime which came into effect on 6 April 2016 certain classes of entity were exempt from the need to maintain a PSC register as they already met the requirements primarily through what is known as being a DTR5 entity which means that they fall within the scope of Chapter 5 of the FCAs Disclosure and Transparency Rules which requires companies. If the company traded on an EEA or Schedule 1 specified market it will remain exempt. The sources of the cash in actual are legal and the cash is invested in a manner that makes it appear like clean cash and hide the. PSC registers of companies and other legal entities that are within the scope of the UKs PSC regime before they establish a business relationship with those entities.

Source: ecovis.com

Source: ecovis.com

The new regulations amend the UKs existing money laundering regulations MLRs to introduce a requirement for relevant persons subject to the MLRs to check the beneficial ownership registers ie. Is your company aware of the new changes to PSC Registers implementing anti money laundering legislation. Anyone who is involved in the ownership or management of a limited company or limited liability partnership LLP should be aware of important changes that will come into force on the 26th June 2017 regarding their register of people with significant control the PSC. If it is valid they will contact the company to ask for their comments and request that they resolve the discrepancy to make sure the PSC register is up to date. If the company traded on an EEA or Schedule 1 specified market it will remain exempt.

Source: datagardener.com

Source: datagardener.com

PSC registers of companies and other legal entities that are within the scope of the UKs PSC regime before they establish a business relationship with those entities. From 26 June there will be changes and such companies may need to provide PSC information. As the first fully open register of its kind this assessment of the UKs PSC register also has wider global significance and can help inform other countries planning to set up similar registers. The introduction of the register is a move that aims to reduce money laundering and increase transparency of corporate ownership and effective control. Money Laundering Risk Scoring Model.

Source: branddocs.com

Source: branddocs.com

Government plans to implement the EU Fourth Money Laundering Directive to prevent the use of the financial system for money laundering or terrorist financing will cost businesses up to 27m a year in additional compliance costs while the people with significant control register PSC. The company will not be informed that a discrepancy report has been made about their PSC register information. Companies House will hold the personal data of the obliged entity and the personal data of the PSC in the discrepancy report on its PSC register for 10 years. Last year the register of people with significant control PSC was launched in the UK with filings made through Companies House. Companies will have 14 days to update their PSC register and another 14 days to file the required form.

Source: traverssmith.com

Source: traverssmith.com

Companies House will investigate reports of discrepancies received. DTR5 companies are currently exempt from the PSC requirements. Those companies are also required to provide and update this information publicly by filing it at Companies House within 14 days of any changes or additions to its PSC register. The purpose behind PSC discrepancy reporting is to ensure that the information on the PSC register is adequate accurate and current. The directives implementation sees separate forms introduced PSC01 to PSC09 to notify Companies House when PSC register information is altered and made within 14 days of the changes occurrence.

Source: encompasscorporation.com

Source: encompasscorporation.com

Business owners and compliance officers should be aware of the requirements of the PSC register as well as the changes brought on by the Fourth Anti-Money Laundering Directive. Youll have to check the Persons with Significant Control PSC register for new clients Anyone taking on a new client will have to obtain evidence that the client has filed details of their Persons with Significant Control PSCs with Companies House and will also need to report discrepancies between the information they hold and whats on the PSC register. The sources of the cash in actual are legal and the cash is invested in a manner that makes it appear like clean cash and hide the. Those companies are also required to provide and update this information publicly by filing it at Companies House within 14 days of any changes or additions to its PSC register. The introduction of the register is a move that aims to reduce money laundering and increase transparency of corporate ownership and effective control.

Source: nl.pinterest.com

Source: nl.pinterest.com

Last year the register of people with significant control PSC was launched in the UK with filings made through Companies House. Is your company aware of the new changes to PSC Registers implementing anti money laundering legislation. Discrepancy is not defined in the 2017 Money Laundering Regulations but HM Governments interpretation of the intention is for material differences to be reported. All EU Member States will be required to set up public registers of beneficial owners of companies as part of recent revisions to the EU Anti-Money Laundering Directive which take effect this summer. Youll have to check the Persons with Significant Control PSC register for new clients Anyone taking on a new client will have to obtain evidence that the client has filed details of their Persons with Significant Control PSCs with Companies House and will also need to report discrepancies between the information they hold and whats on the PSC register.

Source: smallfirmsservices.com

Source: smallfirmsservices.com

The concept of cash laundering is essential to be understood for these working within the financial sector. Youll have to check the Persons with Significant Control PSC register for new clients Anyone taking on a new client will have to obtain evidence that the client has filed details of their Persons with Significant Control PSCs with Companies House and will also need to report discrepancies between the information they hold and whats on the PSC register. Companies House will investigate reports of discrepancies received. If it is valid they will contact the company to ask for their comments and request that they resolve the discrepancy to make sure the PSC register is up to date. The new regulations amend the UKs existing money laundering regulations MLRs to introduce a requirement for relevant persons subject to the MLRs to check the beneficial ownership registers ie.

As the first fully open register of its kind this assessment of the UKs PSC register also has wider global significance and can help inform other countries planning to set up similar registers. A companys PSC register will be available for public inspection including online from 30 June 2016. Companies House will hold the personal data of the obliged entity and the personal data of the PSC in the discrepancy report on its PSC register for 10 years. Youll have to check the Persons with Significant Control PSC register for new clients Anyone taking on a new client will have to obtain evidence that the client has filed details of their Persons with Significant Control PSCs with Companies House and will also need to report discrepancies between the information they hold and whats on the PSC register. The sources of the cash in actual are legal and the cash is invested in a manner that makes it appear like clean cash and hide the.

Source: branddocs.com

Source: branddocs.com

This new register aims to increase transparency and also reduce the impact of money laundering on the UK economy. The purpose behind PSC discrepancy reporting is to ensure that the information on the PSC register is adequate accurate and current. All EU Member States will be required to set up public registers of beneficial owners of companies as part of recent revisions to the EU Anti-Money Laundering Directive which take effect this summer. DTR5 companies are currently exempt from the PSC requirements. This new register aims to increase transparency and also reduce the impact of money laundering on the UK economy.

Source: schmidt-export.com

Source: schmidt-export.com

The introduction of the register is a move that aims to reduce money laundering and increase transparency of corporate ownership and effective control. The sources of the cash in actual are legal and the cash is invested in a manner that makes it appear like clean cash and hide the. Companies House will investigate reports of discrepancies received. The introduction of the register is a move that aims to reduce money laundering and increase transparency of corporate ownership and effective control. The concept of cash laundering is essential to be understood for these working within the financial sector.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title psc register money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.