17+ Process flow of kyc ideas

Home » money laundering idea » 17+ Process flow of kyc ideasYour Process flow of kyc images are ready in this website. Process flow of kyc are a topic that is being searched for and liked by netizens today. You can Get the Process flow of kyc files here. Find and Download all royalty-free vectors.

If you’re looking for process flow of kyc images information connected with to the process flow of kyc interest, you have come to the right site. Our site always gives you hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Process Flow Of Kyc. The KYC process can follow the following steps although not always in the same order. The process for upload of KYC details is same as is being followed earlier and the same has been explained in detail in the User Manual for Employers. KYC is a process carried out by financial institutions like banks stockbroking firms fund houses etc to verify the identity and address of the customer. The digital KYC process is as follows.

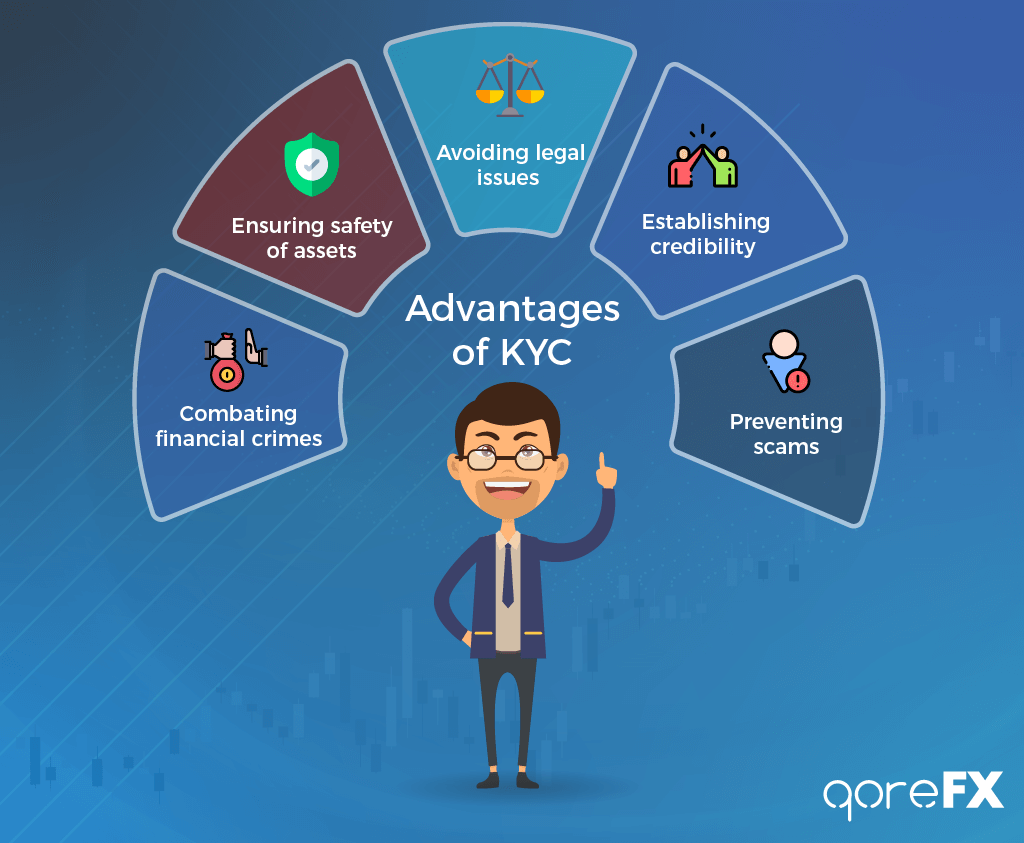

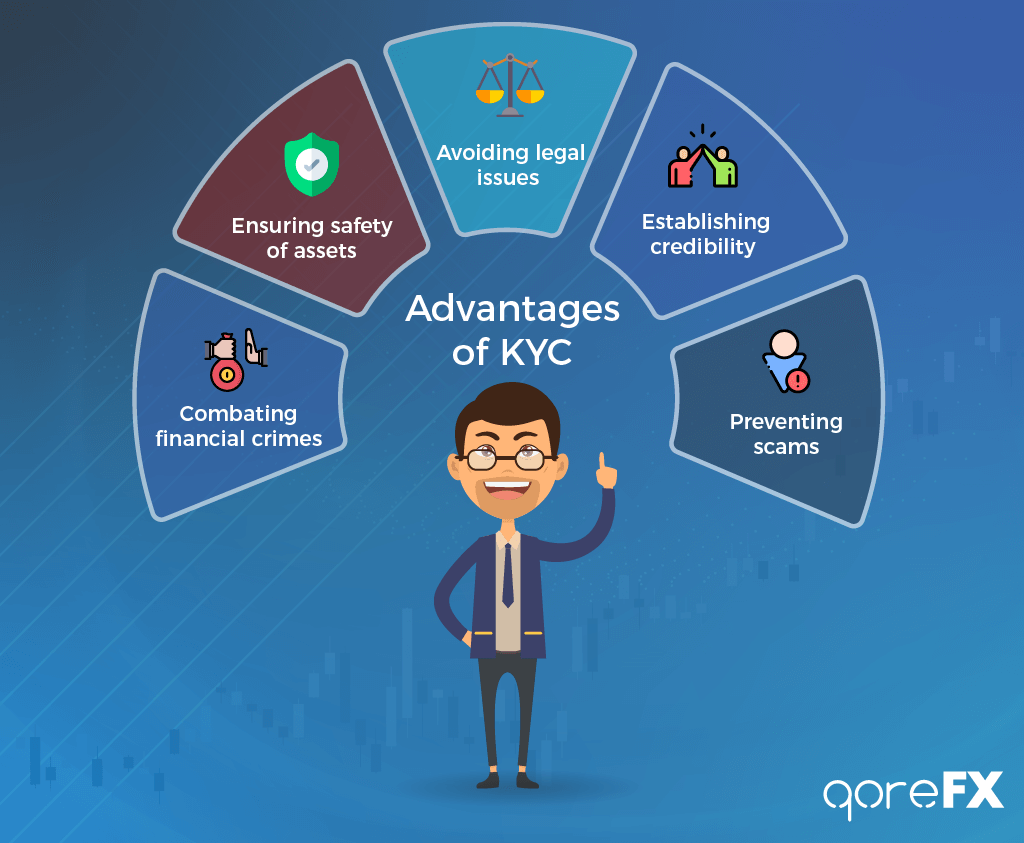

Everything You Need To Know About Kyc Qorefx From qorefx.com

Everything You Need To Know About Kyc Qorefx From qorefx.com

A critical step in the KYC process. EKYC is the expression used to describe the digitalization and electronic and online conception of KYC processes. This process helps to ensure that banks services are not misused. Submitting additional identity verification and documentation eIDV etc. EKYC Electronic Know Your Customer is the remote paperless process that minimizes the costs and traditional bureaucracy necessary in KYC processes. KYC is an acronym for Know Your Customer and is a term used for Customer Identification Process as a part of Account Opening process with any financial entityKYC establishes an investors identity address through relevant supporting documents such as prescribed photo id eg PAN card Aadhar card and address proof and In-Person Verification IPV.

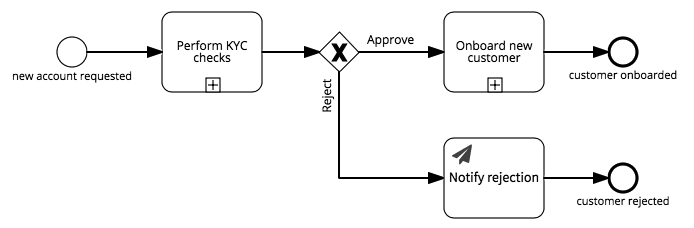

A simple KYC process flow is depicted below.

The process for upload of KYC details is same as is being followed earlier and the same has been explained in detail in the User Manual for Employers. A simple KYC process flow is depicted below. KYC is a process carried out by financial institutions like banks stockbroking firms fund houses etc to verify the identity and address of the customer. Before the 2000s KYC practices were directed at preventing money laundering but after 911 everything changed. The KYC procedure is to be completed by the banks while opening accounts and also periodically update the. Falsification of identity signatures and phishing is very common.

Source: researchgate.net

Source: researchgate.net

A critical step in the KYC process. Since the passing of the Patriot Act KYC processes. KYC is a process carried out by financial institutions like banks stockbroking firms fund houses etc to verify the identity and address of the customer. The KYC procedure is to be completed by the banks while opening accounts and also periodically update the. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed.

Source: slideteam.net

Source: slideteam.net

The digital KYC process is as follows. The KYC procedure is to be completed by the banks while opening accounts and also periodically update the. This process helps to ensure that banks services are not misused. Submitting additional identity verification and documentation eIDV etc. The KYC process is simple and differs only slightly from country to country.

Source: signavio.com

Source: signavio.com

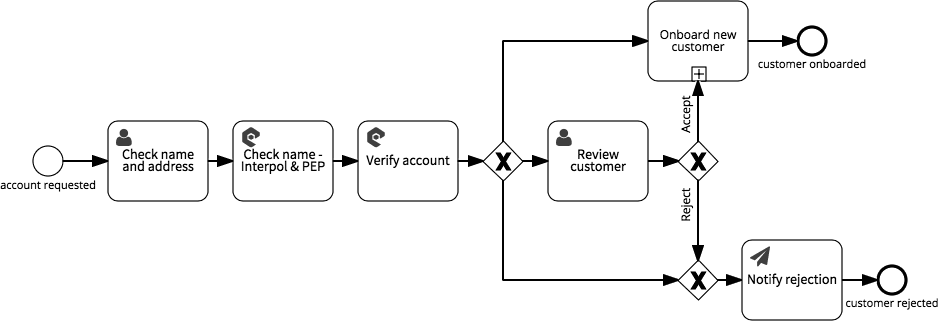

Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. EKYC Electronic Know Your Customer is the remote paperless process that minimizes the costs and traditional bureaucracy necessary in KYC processes. Organizations need to perform a detailed politically exposed person PEP and sanction check when. It is a process by which banks obtain information about the identity and address of the customers. This process helps to ensure that banks services are not misused.

Source: signavio.com

Source: signavio.com

Before the 2000s KYC practices were directed at preventing money laundering but after 911 everything changed. Sanctions and PEP screening. KYC means Know Your Customer. What is Know Your Customer KYC for Cryptocurrency. The process is mandatory for banks lenders insurance providers and other financial and monetary companies of all sizes.

Source: basisid.com

Source: basisid.com

Organizations need to perform a detailed politically exposed person PEP and sanction check when. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. KYC is a process carried out by financial institutions like banks stockbroking firms fund houses etc to verify the identity and address of the customer. The process is mandatory for banks lenders insurance providers and other financial and monetary companies of all sizes. Know Your Customer KYC or sometimes referred to as Know Your Client is a process by which a business or agency verifies the identity of its clients.

Source: processmaker.com

Source: processmaker.com

The first step in KYC verification involves the collection of personal information from an online user. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed. Before the 2000s KYC practices were directed at preventing money laundering but after 911 everything changed. It automates once manual email and telephone communications and gives your customers self-service access to more quickly and easily review and respond to case queries eg.

Source: eis.c13h28lensed.pw

Source: eis.c13h28lensed.pw

This process helps to ensure that banks services are not misused. The process is mandatory for banks lenders insurance providers and other financial and monetary companies of all sizes. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Furthermore everyday companies are exposed to operational legal and. Organizations need to perform a detailed politically exposed person PEP and sanction check when.

Source: advisoryhq.com

Source: advisoryhq.com

EKYC Electronic Know Your Customer is the remote paperless process that minimizes the costs and traditional bureaucracy necessary in KYC processes. The KYC procedure is to be completed by the banks while opening accounts and also periodically update the. It is a process by which banks obtain information about the identity and address of the customers. This process helps to ensure that banks services are not misused. Organizations need to perform a detailed politically exposed person PEP and sanction check when.

Source: papersoft-dms.com

Source: papersoft-dms.com

KYC Flows web portal improves customer experience by transforming your KYC customer outreach processes. The digital KYC process is as follows. What is Know Your Customer KYC for Cryptocurrency. This process would be done periodically depending on the risk of the customer. KYC Flows web portal improves customer experience by transforming your KYC customer outreach processes.

A critical step in the KYC process. So how frequently will it be done. KYC process flow KYC and Customer Due Diligence measures. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. A critical step in the KYC process.

Source: slideteam.net

Source: slideteam.net

The digital KYC process is as follows. The process for upload of KYC details is same as is being followed earlier and the same has been explained in detail in the User Manual for Employers. The digital KYC process is as follows. What is Know Your Customer KYC for Cryptocurrency. Completing KYC outside of the transaction flow MuchBetter has now developed an extension within the API that allows operators to complete KYC outside of the transaction flow.

Source: blog.enkripa.id

Source: blog.enkripa.id

AML KYC Process Flow After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. Its origin stems from the 2001 Title III of the Patriot Act to provide various tools to prevent terrorist activities. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. We will answer this in the latter part of the article. Introduction to KYC or Know your customer.

Source: qorefx.com

Source: qorefx.com

What is Know Your Customer KYC for Cryptocurrency. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. KYC Flows web portal improves customer experience by transforming your KYC customer outreach processes. Since the passing of the Patriot Act KYC processes. It is a process by which banks obtain information about the identity and address of the customers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title process flow of kyc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.