18+ Primary offences of money laundering ideas in 2021

Home » money laundering idea » 18+ Primary offences of money laundering ideas in 2021Your Primary offences of money laundering images are ready in this website. Primary offences of money laundering are a topic that is being searched for and liked by netizens now. You can Find and Download the Primary offences of money laundering files here. Get all free vectors.

If you’re looking for primary offences of money laundering images information related to the primary offences of money laundering keyword, you have come to the ideal site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

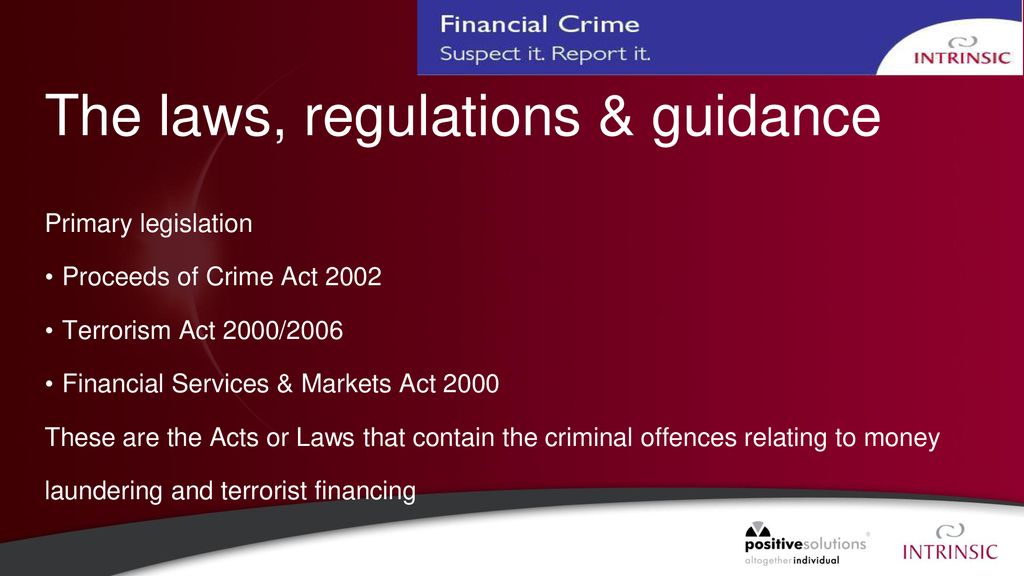

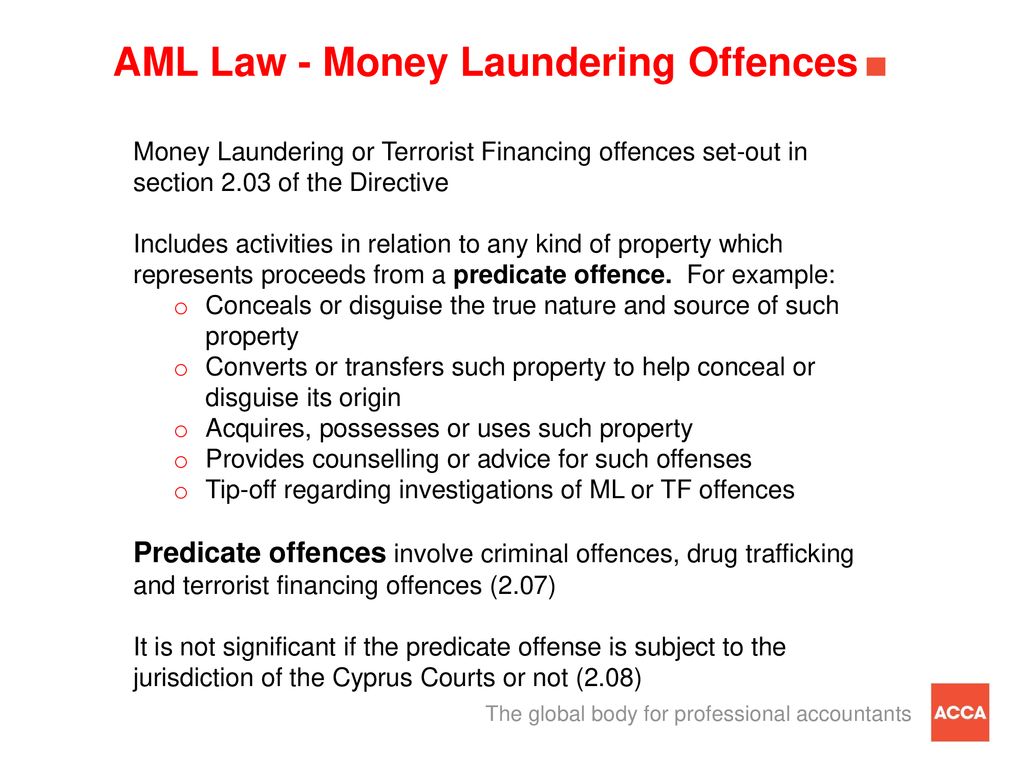

Primary Offences Of Money Laundering. Section 141 and 2 of the Criminal Justice International Co-operation Act 1990. 6AMLD defines and standardizes 22 predicate offenses for money laundering in all EU member states. Charges and offences of money laundering Subject. The general offence of money laundering has no de minimis amount and applies no matter how small the transaction see 18 USC Section 1956.

Ghanaian Aml Cft Compliance Laws Ppt Download From slideplayer.com

Ghanaian Aml Cft Compliance Laws Ppt Download From slideplayer.com

The money laundering offences cover every type of offence and are all either way offences. The general offence of money laundering has no de minimis amount and applies no matter how small the transaction see 18 USC Section 1956. Under section 93C of the CJA88 as inserted by section 31 CJA93. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. 6AMLD also harmonizes the definition of other predicate offenses including. Section 541 and 2 of the NIEPA91.

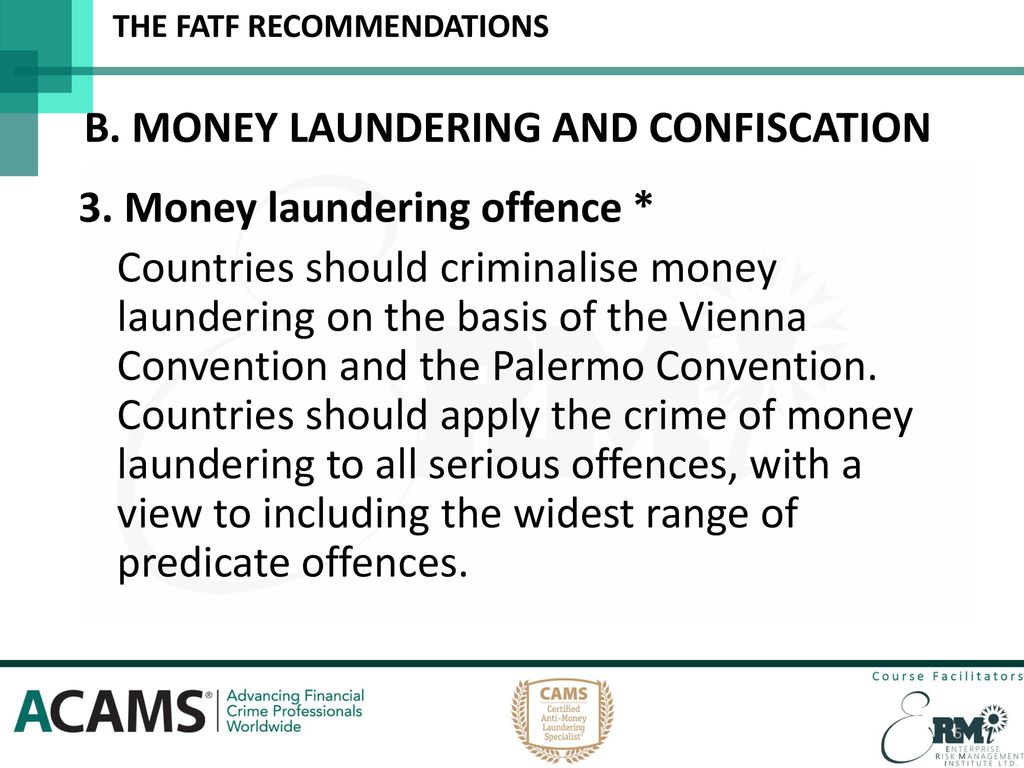

The 6th AML Directive aims to harmonise the definition of predicate offences against money laundering by all Member States.

Crimes or offences which generate the funds to be laundered are commonly referred to as money laundering primary offences or predicate offences. A person guilty of one of the above offence will be subject to a fine or up to fourteen years. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. And Section 49 Drug Trafficking. The principal defence to one of these money laundering offences is making an authorised disclosure under POCA 2002 s 338 and receiving appropriate consent to.

Source: slideplayer.com

Source: slideplayer.com

Money laundering presupposes that an original offence has been committed. A harmonisation of primary offences. The general offence of money laundering has no de minimis amount and applies no matter how small the transaction see 18 USC Section 1956. The 6th AML Directive aims to harmonise the definition of predicate offences against money laundering by all Member States. 6AMLD defines and standardizes 22 predicate offenses for money laundering in all EU member states.

Source: slideplayer.com

Source: slideplayer.com

Under section 93C of the CJA88 as inserted by section 31 CJA93. Section 141 and 2 of the Criminal Justice International Co-operation Act 1990. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. Money laundering presupposes that an original offence has been committed.

Source: researchgate.net

Source: researchgate.net

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Essentially then money laundering means making illegal money look like legitimate money by wiping any traces that could link it to its criminal origins. Money laundering presupposes that an original offence has been committed. These are the primary money laundering offences and thus prohibited acts under the legislation. Primary offences include illicit trafficking of narcotic drugs acts of terrorism or terrorist financing corruption weapons trafficking criminal organisation or criminal association certain tax offences trafficking in human beings sexual.

Source: wikiwand.com

Source: wikiwand.com

Money laundering relates to any economic benefit that is gained via this predicate offence. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting. The expanded list of 6AMLD predicate offenses now includes cybercrime and environmental crime. Money laundering relates to any economic benefit that is gained via this predicate offence. Charges and offences of money laundering Subject.

Source: delta-net.com

Source: delta-net.com

The money laundering offences cover every type of offence and are all either way offences. A harmonisation of primary offences. The 6th AML Directive aims to harmonise the definition of predicate offences against money laundering by all Member States. These are the primary money laundering offences and thus prohibited acts under the legislation. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec.

Source: slideplayer.com

Source: slideplayer.com

Section 141 and 2 of the Criminal Justice International Co-operation Act 1990. The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. Section 141 and 2 of the Criminal Justice International Co-operation Act 1990. The money laundering offence set out in 18 USC Section.

Source: researchgate.net

Source: researchgate.net

The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. 6AMLD defines and standardizes 22 predicate offenses for money laundering in all EU member states. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. A harmonisation of primary offences.

Source: slideplayer.com

Source: slideplayer.com

Dishonesty is not required to commit these offences. A person guilty of one of the above offence will be subject to a fine or up to fourteen years. Maximum penalty is a HK 5000000 fine and 14-year imprisonment. The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. Crimes or offences which generate the funds to be laundered are commonly referred to as money laundering primary offences or predicate offences.

Source: researchgate.net

Source: researchgate.net

The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Concealing or transferring proceeds to avoid prosecution or a confiscation order also called Own Funds money laundering. The general offence of money laundering has no de minimis amount and applies no matter how small the transaction see 18 USC Section 1956. These are the primary money laundering offences and thus prohibited acts under the legislation.

Source: slideplayer.com

Source: slideplayer.com

The expanded list of 6AMLD predicate offenses now includes cybercrime and environmental crime. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. Under section 93C of the CJA88 as inserted by section 31 CJA93. Money laundering presupposes that an original offence has been committed. And Section 49 Drug Trafficking.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

This note also considers the provisions of the Money Laundering Terrorist Financing and. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Crimes or offences which generate the funds to be laundered are commonly referred to as money laundering primary offences or predicate offences. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. And Section 49 Drug Trafficking.

Source: slideplayer.com

Source: slideplayer.com

These are the primary money laundering offences and thus prohibited acts under the legislation. Dishonesty is not required to commit these offences. Money laundering relates to any economic benefit that is gained via this predicate offence. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. The general offence of money laundering has no de minimis amount and applies no matter how small the transaction see 18 USC Section 1956.

Source: archive.comsuregroup.com

Source: archive.comsuregroup.com

Section 141 and 2 of the Criminal Justice International Co-operation Act 1990. Section 141 and 2 of the Criminal Justice International Co-operation Act 1990. Under section 93C of the CJA88 as inserted by section 31 CJA93. The 6th AML Directive aims to harmonise the definition of predicate offences against money laundering by all Member States. Charges and offences of money laundering Subject.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title primary offences of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.