15+ Prevention of money laundering act 2002 rbi info

Home » money laundering Info » 15+ Prevention of money laundering act 2002 rbi infoYour Prevention of money laundering act 2002 rbi images are ready. Prevention of money laundering act 2002 rbi are a topic that is being searched for and liked by netizens today. You can Find and Download the Prevention of money laundering act 2002 rbi files here. Find and Download all royalty-free photos and vectors.

If you’re looking for prevention of money laundering act 2002 rbi images information related to the prevention of money laundering act 2002 rbi keyword, you have visit the ideal site. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

Prevention Of Money Laundering Act 2002 Rbi. As a result black money is amassed through tax evasion. The Act extends to whole of India except JK. Accordingly rule 6 of the prevention of money-laundering rules 2005 provides that the records should be maintained for a period of ten years from the date of. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering.

Prevention Of Money Laundering Act 2002 Was Enacted To Prevent Money Laundering Bankerz From bankerz.in

Prevention Of Money Laundering Act 2002 Was Enacted To Prevent Money Laundering Bankerz From bankerz.in

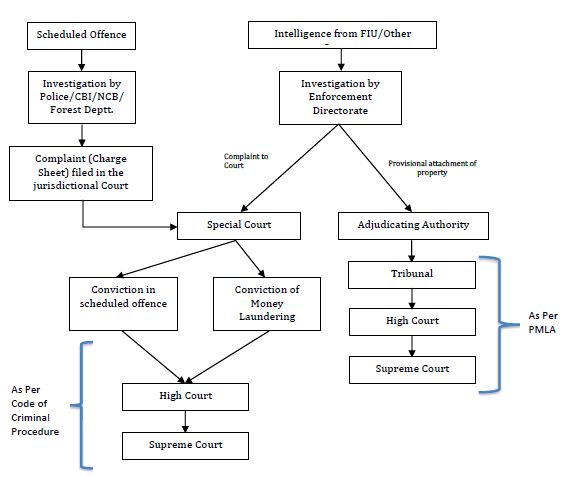

The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. The PMLA Act 2002 is empowered to confiscate property derived from Criminal Activity Involvement in money laundering and for matters connected thereto or incidental thereto acquired through proven criminal activity the violation by the said person results in both civil criminal consequences for the perpetrator violator of law. As per provision of act reporting entity is not only required to maintain records but also need retain them for a specified time. What is Money- Laundering. The Chief Executive Officers All Primary Urban Co-operative Banks. To prevent money- laundering seize the property with authority involved in money laundering.

To provide for confiscation and seizure of property obtained from laundered money.

No77 1401001 2006-07 April 13 2007. The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. The Act extends to whole of India except JK. Prevention of Money Laundering Act 2002 Obligation of banks in terms of Rules notified thereunder. No77 1401001 2006-07 April 13 2007. In this connection Government of India Ministry of Finance Department of Revenue issued a notification dated July 1 2005 in the Gazette of India notifying the Rules under the Prevention of Money Laundering Act PMLA 2002.

Source: slidetodoc.com

Source: slidetodoc.com

PMLA ACT 2002. Accordingly rule 6 of the prevention of money-laundering rules 2005 provides that the records should be maintained for a period of ten years from the date of. To prevent and control money laundering. To prevent money- laundering seize the property with authority involved in money laundering. The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA.

Source: mondaq.com

Source: mondaq.com

Reporting mechanism and formats were prescribed to banks to report cash and suspicious transactions to Financial Intelligence Unit- India FIU-IND. As per provision of act reporting entity is not only required to maintain records but also need retain them for a specified time. As a result black money is amassed through tax evasion. Reporting mechanism and formats were prescribed to banks to report cash and suspicious transactions to Financial Intelligence Unit- India FIU-IND. Disguise of illegal origin of money Smuggling Drug trafficking Illegal arms sales Computer frauds Embezzlement Regarded as DIRTY- MONEY Money Laundering by Activity Other Organized Crime 23 Smuggling 29 Terrorist groups 1 Drugs 26 Embezzlement White Collar Crime 21 Conversion of the dirty- money to a legitimate money.

Source: yumpu.com

Source: yumpu.com

The Chief Executive Officers All Primary Urban Co-operative Banks. Directorate of Enforcement of the Department of Revenue Ministry of Finance. The PMLA Act 2002 is empowered to confiscate property derived from Criminal Activity Involvement in money laundering and for matters connected thereto or incidental thereto acquired through proven criminal activity the violation by the said person results in both civil criminal consequences for the perpetrator violator of law. 6514010012012-13 December 10 2012 The Chairmen CEOs of all Scheduled Commercial Banks Excluding RRBsLocal Area Banks All India Financial Institutions Dear Sir Know Your Customer KYC norms Anti-Money Laundering AML StandardsCombating of Financing of Terrorism CFTObligation of banks under Prevention of Money Laundering Act PMLA 2002. Disguise of illegal origin of money Smuggling Drug trafficking Illegal arms sales Computer frauds Embezzlement Regarded as DIRTY- MONEY Money Laundering by Activity Other Organized Crime 23 Smuggling 29 Terrorist groups 1 Drugs 26 Embezzlement White Collar Crime 21 Conversion of the dirty- money to a legitimate money.

Source: crlreview.in

Source: crlreview.in

The offence of Money Laundering has been defined in Section 3 of the Prevention of Money Laundering Act 2002 PMLA as whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money laundering. Prevention of Money Laundering Act 2002 - Obligations of NBFCs in terms of Rules notified thereunder 1. Prevention of Money Laundering Act 2002 Obligation of banks in terms of Rules notified thereunder. The Prevention of Money Laundering Act 2002 PMLA The Prevention of Money Laundering Act 2002 PMLA forms the core of the legal framework put in place by India to combat money laundering. Under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of Money-Laundering Maintenance of Records Rules 2005Accordingly Regulated.

Source: slidetodoc.com

Source: slidetodoc.com

The Chief Executive Officers All Primary Urban Co-operative Banks. The Prevention of Money Laundering Act 2002 PMLA The Prevention of Money Laundering Act 2002 PMLA forms the core of the legal framework put in place by India to combat money laundering. The law was enacted to combat money laundering in India and has three main objectives. Prevention of Money Laundering Act 2002 Obligation of banks in terms of Rules notified thereunder. The PMLA Act 2002 is empowered to confiscate property derived from Criminal Activity Involvement in money laundering and for matters connected thereto or incidental thereto acquired through proven criminal activity the violation by the said person results in both civil criminal consequences for the perpetrator violator of law.

Source: slidetodoc.com

Source: slidetodoc.com

PREVENTION OF MONEY LAUNDERING ACT 2002 2. Accordingly rule 6 of the prevention of money-laundering rules 2005 provides that the records should be maintained for a period of ten years from the date of. NBFCs were advised to appoint a Principal Officer and put in place a system of internal reporting of suspicious transactions and cash transactions of Rs10 lakh and above. Under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of Money-Laundering Maintenance of Records Rules 2005Accordingly Regulated. PMLA defines money laundering offense and provides for the freezing seizure and confiscation of the proceeds of crime.

Source: bankexamstoday.com

Source: bankexamstoday.com

Reporting mechanism and formats were prescribed to banks to report cash and suspicious transactions to Financial Intelligence Unit- India FIU-IND. The PMLA Act 2002 is empowered to confiscate property derived from Criminal Activity Involvement in money laundering and for matters connected thereto or incidental thereto acquired through proven criminal activity the violation by the said person results in both civil criminal consequences for the perpetrator violator of law. The offence of Money Laundering has been defined in Section 3 of the Prevention of Money Laundering Act 2002 PMLA as whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money laundering. Reporting mechanism and formats were prescribed to banks to report cash and suspicious transactions to Financial Intelligence Unit- India FIU-IND. Under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of Money-Laundering Maintenance of Records Rules 2005Accordingly Regulated.

Source: slideshare.net

Source: slideshare.net

THE PREVENTION OF MONEY-LAUNDERING ACT 2002 15 of 2003 17th January 2003 An Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and for matters connected therewith or incidental thereto. What is Money- Laundering. Under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of Money-Laundering Maintenance of Records Rules 2005Accordingly Regulated. To prevent money- laundering seize the property with authority involved in money laundering. NBFCs were advised to appoint a Principal Officer and put in place a system of internal reporting of suspicious transactions and cash transactions of Rs10 lakh and above.

Source: taxguru.in

Source: taxguru.in

Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. 6514010012012-13 December 10 2012 The Chairmen CEOs of all Scheduled Commercial Banks Excluding RRBsLocal Area Banks All India Financial Institutions Dear Sir Know Your Customer KYC norms Anti-Money Laundering AML StandardsCombating of Financing of Terrorism CFTObligation of banks under Prevention of Money Laundering Act PMLA 2002. As per provision of act reporting entity is not only required to maintain records but also need retain them for a specified time. NBFCs were advised to appoint a Principal Officer and put in place a system of internal reporting of suspicious transactions and cash transactions of Rs10 lakh and above.

Source: rna-cs.com

Source: rna-cs.com

Prevention of Money Laundering Act 2002 Obligation of banks in terms of Rules notified thereunder. Prevention of Money Laundering Act 2002 - Obligations of NBFCs in terms of Rules notified thereunder 1. To provide for confiscation and seizure of property obtained from laundered money. PMLA ACT 2002. Reporting mechanism and formats were prescribed to banks to report cash and suspicious transactions to Financial Intelligence Unit- India FIU-IND.

Source: taxguru.in

Source: taxguru.in

The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. Prevention of Money Laundering Act 2002 The NDA government enacted the Prevention of Money Laundering Act 2002 hereinafter as PMLA to prevent money laundering and provide for the confiscation of. The Chief Executive Officers All Primary Urban Co-operative Banks. Under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of Money-Laundering Maintenance of Records Rules 2005Accordingly Regulated. 6514010012012-13 December 10 2012 The Chairmen CEOs of all Scheduled Commercial Banks Excluding RRBsLocal Area Banks All India Financial Institutions Dear Sir Know Your Customer KYC norms Anti-Money Laundering AML StandardsCombating of Financing of Terrorism CFTObligation of banks under Prevention of Money Laundering Act PMLA 2002.

Source: easethebiz.com

Source: easethebiz.com

In this connection Government of India Ministry of Finance Department of Revenue issued a notification dated July 1 2005 in the Gazette of India notifying the Rules under the Prevention of Money Laundering Act PMLA 2002. PMLA defines money laundering offence and provides for the freezing seizure and confiscation of the proceeds of crime. The Prevention of Money Laundering Act 2002 PMLA The Prevention of Money Laundering Act 2002 PMLA forms the core of the legal framework put in place by India to combat money laundering. In terms of the Rules the provisions of PMLA 2002 came into effect from July 1 2005. As per provision of act reporting entity is not only required to maintain records but also need retain them for a specified time.

Source: bankerz.in

Source: bankerz.in

In this connection Government of India Ministry of Finance Department of Revenue issued a notification dated July 1 2005 in the Gazette of India notifying the Rules under the Prevention of Money Laundering Act PMLA 2002. To prevent and control money laundering. The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. What is Money- Laundering. In this connection Government of India Ministry of Finance Department of Revenue issued a notification dated July 1 2005 in the Gazette of India notifying the Rules under the Prevention of Money Laundering Act PMLA 2002.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title prevention of money laundering act 2002 rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.