20+ Prevention of money laundering act 2002 india code ideas in 2021

Home » money laundering Info » 20+ Prevention of money laundering act 2002 india code ideas in 2021Your Prevention of money laundering act 2002 india code images are ready in this website. Prevention of money laundering act 2002 india code are a topic that is being searched for and liked by netizens now. You can Get the Prevention of money laundering act 2002 india code files here. Get all free images.

If you’re looking for prevention of money laundering act 2002 india code pictures information linked to the prevention of money laundering act 2002 india code interest, you have come to the ideal blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

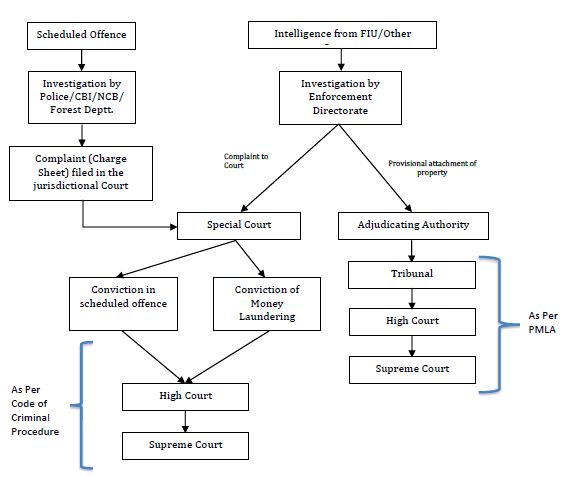

Prevention Of Money Laundering Act 2002 India Code. The nature of the statute and the utmost necessity that it be enforced in a manner that fulfils the legislative intent thereby creating economic security as well as the nations requirements have resulted in wide powers being granted to the Enforcement Directorate ED. 3 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the. Prevention of Money-laundering Act 2002. The scheduled offences are divided into three parts Part A Part B Part C.

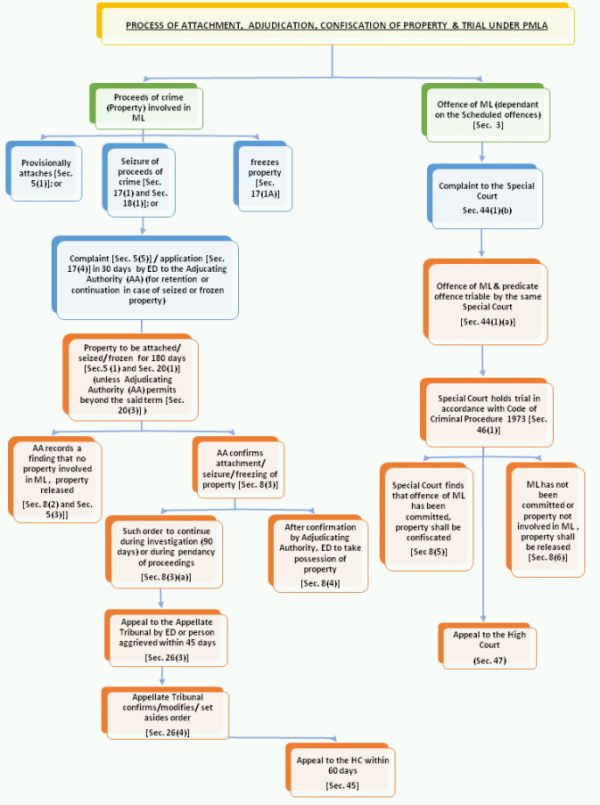

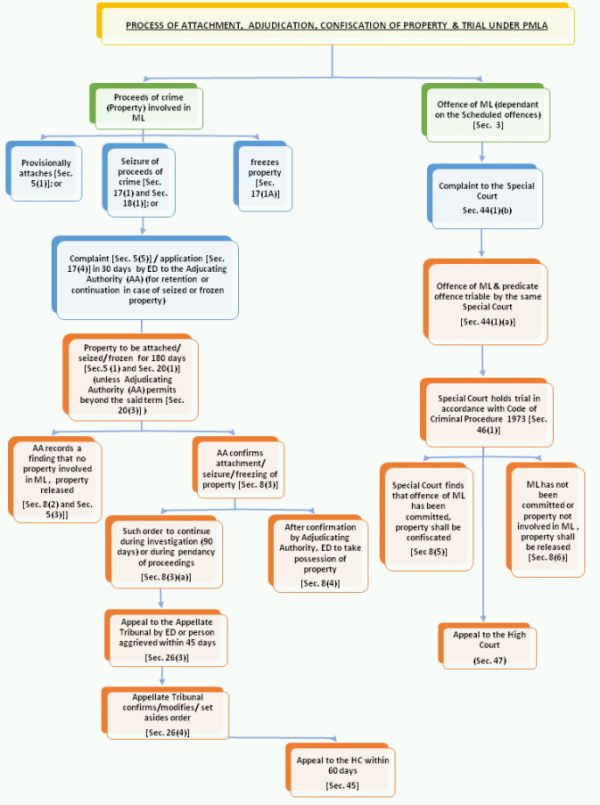

Process Of Attachment Adjudication Confiscation Of Property Trial Under Pmla Government Public Sector India From mondaq.com

Process Of Attachment Adjudication Confiscation Of Property Trial Under Pmla Government Public Sector India From mondaq.com

The Prevention of Money-Laundering Act 2002 Long Title. Some of the primary rules and guidelines regulating money laundering activities in India. Income Tax Department Tax Laws Rules Acts Prevention of Money Laundering Act 2002 Income Tax Department All Acts Prevention of Money Laundering Act 2002. Punishment for money-laundering– Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to fine which may extend to five lakh rupees. THE PREVENTION OF MONEY-LAUNDERING ACT 2002 15 of 2003 17th January 2003 An Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and for matters connected therewith or incidental thereto. However the PMLA 2002 and the rules notified thereunder came into force with effect from 1 st July 2005.

By now yourselves will agree that the Act is a special Law and a self-contained code intended to address the increasing scourge of money laundering and provides for attachment of property derived from or involved in money laundering and prosecution of those involved directly or indirectly in the process or activities of money laundering.

An Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and for matters connected therewith or incidental thereto. The NDA government enacted the Prevention of Money Laundering Act 2002 hereinafter as PMLA to prevent money laundering and provide for the confiscation of. However the PMLA 2002 and the rules notified thereunder came into force with effect from 1 st July 2005. With the amendment of the Act in 2009 a large number of offences have been included in the Schedule of the Act. Provided that where the proceeds of crime involved in money-laundering relates to any offence. The scheduled offences are divided into two parts Part A Part C.

Source: taxdose.com

Source: taxdose.com

The Prevention of Money-Laundering Act 2002 Long Title. Income Tax Department Tax Laws Rules Acts Prevention of Money Laundering Act 2002 Income Tax Department All Acts Prevention of Money Laundering Act 2002. The nature of the statute and the utmost necessity that it be enforced in a manner that fulfils the legislative intent thereby creating economic security as well as the nations requirements have resulted in wide powers being granted to the Enforcement Directorate ED. 3 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the. Any conduct by a person at a place outside India which constitutes an offence at that place and which would have constituted an offence specified in Part A Part B or Part C of the Schedule had it been committed in India and if such person transfers in any manner the proceeds of such conduct or part thereof to India.

Source: taxguru.in

Source: taxguru.in

The nature of the statute and the utmost necessity that it be enforced in a manner that fulfils the legislative intent thereby creating economic security as well as the nations requirements have resulted in wide powers being granted to the Enforcement Directorate ED. WHEREAS the Political Declaration and Global Programme of Action annexed. The scheduled offences are divided into three parts Part A Part B Part C. Prevention of Money-laundering Act 2002. Prevention of Money-laundering Act2002.

Source: issuu.com

Source: issuu.com

The nature of the statute and the utmost necessity that it be enforced in a manner that fulfils the legislative intent thereby creating economic security as well as the nations requirements have resulted in wide powers being granted to the Enforcement Directorate ED. Income Tax Department Tax Laws Rules Acts Prevention of Money Laundering Act 2002 Income Tax Department All Acts Prevention of Money Laundering Act 2002. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act. The Prevention of Money-Laundering Act 2002 Long Title.

Source: easethebiz.com

Source: easethebiz.com

PMLA 2002 is an Act of the Parliament of India enacted by the Government of India for the sake of prevention of money laundering in India and to provide for confiscation of property made out of the money laundering. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The NDA government enacted the Prevention of Money Laundering Act 2002 hereinafter as PMLA to prevent money laundering and provide for the confiscation of. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act. Prevention of Money-laundering Act2002.

Source: taxguru.in

Source: taxguru.in

2 It extends to the whole of India. WHEREAS the Political Declaration and Global Programme of Action annexed. The Prevention of Money-Laundering Act 2002 Long Title. The scheduled offences are divided into two parts Part A Part C. 2 It extends to the whole of India.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

3 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the. The Prevention of Money Laundering Act 2002 PMLA has proven to be a revolutionary legislation and is certainly one of its kind. The scheduled offences are divided into three parts Part A Part B Part C. The NDA government enacted the Prevention of Money Laundering Act 2002 hereinafter as PMLA to prevent money laundering and provide for the confiscation of. The Prevention of Money-Laundering Act 2002 Long Title.

Source: livelaw.in

Source: livelaw.in

The NDA government enacted the Prevention of Money Laundering Act 2002 hereinafter as PMLA to prevent money laundering and provide for the confiscation of. Provided that where the proceeds of crime involved in money-laundering relates to any offence. The Prevention of Money-Laundering Act 2002 Long Title. Prevention of Money-laundering Act 2002. The Prevention of Money Laundering Act 2002 PMLA has proven to be a revolutionary legislation and is certainly one of its kind.

Source: mondaq.com

Source: mondaq.com

2 It extends to the whole of India. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act. The Prevention of Money Laundering Act 2002 together with the rules issued thereunder and the rules and regulations prescribed by regulators such as the Reserve Bank of India and the Securities and Exchange Board of India set out the broad framework for the anti-money laundering laws in India. 3 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the. The Prevention of Money-Laundering Act 2002 Long Title.

Source: studylib.net

Source: studylib.net

However the PMLA 2002 and the rules notified thereunder came into force with effect from 1 st July 2005. The Prevention of Money-Laundering Act 2002 Long Title. 2 It extends to the whole of India. Prevention of Money-laundering Act 2002. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering.

Source: issuu.com

Source: issuu.com

An Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and for matters connected therewith or incidental thereto. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act. However the PMLA 2002 and the rules notified thereunder came into force with effect from 1 st July 2005. Prevention of Money-laundering Act 2002. 3 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the.

Source: livelaw.in

Source: livelaw.in

The Prevention of Money Laundering Act 2002 together with the rules issued thereunder and the rules and regulations prescribed by regulators such as the Reserve Bank of India and the Securities and Exchange Board of India set out the broad framework for the anti-money laundering laws in India. Prevention of Money-laundering Act 2002. Punishment for money-laundering– Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to fine which may extend to five lakh rupees. With the amendment of the Act in 2009 a large number of offences have been included in the Schedule of the Act. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act.

Source: civils360.com

Source: civils360.com

3 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The scheduled offences are divided into two parts Part A Part C. The Prevention of Money-Laundering Act 2002 Long Title. By now yourselves will agree that the Act is a special Law and a self-contained code intended to address the increasing scourge of money laundering and provides for attachment of property derived from or involved in money laundering and prosecution of those involved directly or indirectly in the process or activities of money laundering.

Source: mondaq.com

Source: mondaq.com

PMLA defines money laundering offense and provides for the freezing seizure and confiscation of the proceeds of crime. With the amendment of the Act in 2009 a large number of offences have been included in the Schedule of the Act. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act. Some of the primary rules and guidelines regulating money laundering activities in India. The nature of the statute and the utmost necessity that it be enforced in a manner that fulfils the legislative intent thereby creating economic security as well as the nations requirements have resulted in wide powers being granted to the Enforcement Directorate ED.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title prevention of money laundering act 2002 india code by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.