14+ Placement aml definition ideas in 2021

Home » money laundering idea » 14+ Placement aml definition ideas in 2021Your Placement aml definition images are ready. Placement aml definition are a topic that is being searched for and liked by netizens now. You can Download the Placement aml definition files here. Find and Download all royalty-free images.

If you’re looking for placement aml definition pictures information related to the placement aml definition topic, you have come to the right blog. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Placement Aml Definition. Placement This is the movement of cash from its source. Some of the common methods include. Latest news reports from the medical literature videos from the experts and more. On occasion the source can be easily disguised or misrepresented.

What Is Anti Money Laundering Quora From quora.com

What Is Anti Money Laundering Quora From quora.com

And b it places the money into the legitimate financial system. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. History of Anti-Money Laundering Laws. Aml placement layering integration. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income.

The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier.

Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Some of the common methods include. Placement is one of the ways where illicit funds are separated from their illegal source and are placed into the financial system. Ad AML coverage from every angle. Placement layering and integration. First the illegitimate funds are furtively introduced into.

Source: thekeepitsimple.com

Source: thekeepitsimple.com

Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Generally this stage serves two purposes. The Placement Stage Filtering. B Layering - separating illicit proceeds from their source by. A simpler definition of money laundering would be a series of financial transactions that intend to transform ill-gotten gains into legitimate money or other assets.

Source: slideshare.net

Source: slideshare.net

Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Complex layering schemes involve sending the money around the globe using a series of transactions. At this stage cash derived from criminal activity is infused into the financial system. First the illegitimate funds are furtively introduced into. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Source: pinterest.com

Source: pinterest.com

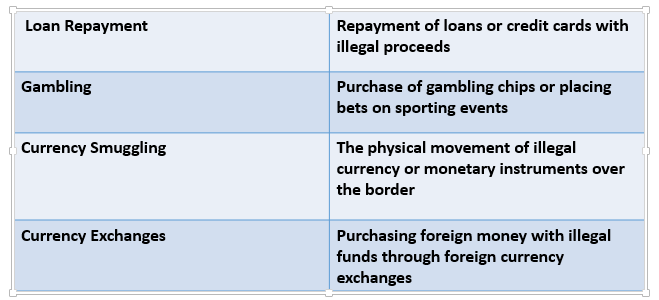

The process of placing through deposits or other means unlawful cash proceeds into traditional financial institutions. Generally this stage serves two purposes. Criminals may use several methodologies to place illegal money in the legitimate financial system including. Aml placement layering integration. The Placement Stage Filtering.

Source: letstalkaml.com

Source: letstalkaml.com

A simpler definition of money laundering would be a series of financial transactions that intend to transform ill-gotten gains into legitimate money or other assets. A Placement - the physical disposal of cash proceeds d erived from illegal activities. And b it places the money into the legitimate financial system. On occasion the source can be easily disguised or misrepresented. The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier.

Source: vskills.in

Source: vskills.in

First the illegitimate funds are furtively introduced into. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Breaking down large sums of money into smaller amounts that can be deposited in banks without triggering AML reporting threshold alerts. Ad AML coverage from every angle. Ad AML coverage from every angle.

Source: youtube.com

Source: youtube.com

Ad AML coverage from every angle. Depositing the ill gotten gains into financial institutions. Ad AML coverage from every angle. Money Laundering Placement Layering Integration three stages. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. At this stage cash derived from criminal activity is infused into the financial system. The Placement Stage Filtering. Placement is one of the ways where illicit funds are separated from their illegal source and are placed into the financial system. Depositing the ill gotten gains into financial institutions.

Source: calert.info

Source: calert.info

Depositing the ill gotten gains into financial institutions. Placement layering and integration. Breaking down large sums of money into smaller amounts that can be deposited in banks without triggering AML reporting threshold alerts. A simpler definition of money laundering would be a series of financial transactions that intend to transform ill-gotten gains into legitimate money or other assets. Complex layering schemes involve sending the money around the globe using a series of transactions.

Source: calert.info

Source: calert.info

Money laundering is the process of making illegally-gained proceeds ie. The process of placing through deposits or other means unlawful cash proceeds into traditional financial institutions. The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Source: quora.com

Source: quora.com

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. History of Anti-Money Laundering Laws. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. Latest news reports from the medical literature videos from the experts and more.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

In the initial - or placement - stage of money laundering the launderer introduces his illegal profits into the financial system. Dirty money appear legal ie. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier. Placement layering and integration.

Source: amlcompliance.ie

Source: amlcompliance.ie

History of Anti-Money Laundering Laws. Latest news reports from the medical literature videos from the experts and more. The Placement Stage Filtering. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. Typically it involves three steps.

Source: bitquery.io

Source: bitquery.io

Generally this stage serves two purposes. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. First the illegitimate funds are furtively introduced into. History of Anti-Money Laundering Laws. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title placement aml definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.