12+ Pep meaning money laundering info

Home » money laundering idea » 12+ Pep meaning money laundering infoYour Pep meaning money laundering images are ready. Pep meaning money laundering are a topic that is being searched for and liked by netizens now. You can Download the Pep meaning money laundering files here. Find and Download all free photos.

If you’re looking for pep meaning money laundering pictures information related to the pep meaning money laundering keyword, you have visit the ideal site. Our website always provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

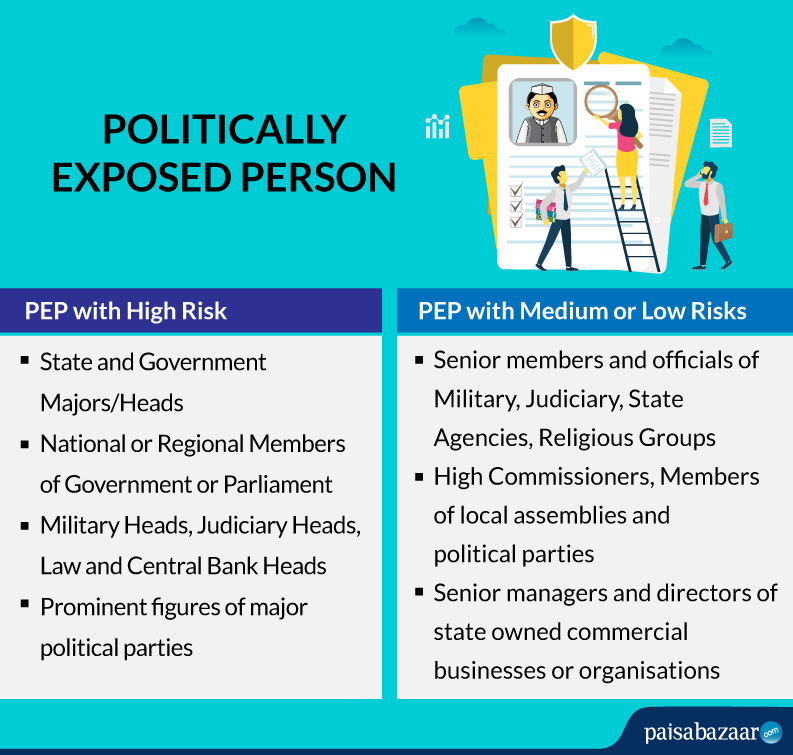

Pep Meaning Money Laundering. A politically exposed person or PEP means an individual who is entrusted with prominent public functions other than as a middle-ranking or more junior official. Politically Exposed Persons PEP meaning are high-risk clients with more opportunities than ordinary nationals to gain assets through illegal means like bribe-taking and money laundering. PEPs often have power over government spending and budgets. This definition also extends to their immediate family members and close associates.

Beneficial Ownership And Politically Exposed Persons Peps Definitions From slidetodoc.com

Beneficial Ownership And Politically Exposed Persons Peps Definitions From slidetodoc.com

Politically Exposed Persons PEP meaning are high-risk clients with more opportunities than ordinary nationals to gain assets through illegal means like bribe-taking and money laundering. Assess the adequacy of the banks systems to manage the risks associated with senior foreign political figures often referred to as politically exposed persons PEP and managements ability to implement effective risk-based due. What am I required to do. This definition also extends to their immediate family members and close associates. A Politically Exposed Person is somebody with public power and the ability to affect various situations using this power. Identify the accountholders and beneficial owners countries of residence and the level of risk for corruption and money laundering associated with these jurisdictions.

They present a higher risk for involvement in money laundering andor terrorist financing because of the position they hold.

A PEP also known and a politically exposed person is an individual that holds a public politically influential role in society. Regulation 35 9 a and b states that a PEP should continue to be treated as one for at least 12 months after they leave their public function or longer if there appears to be a risk of money laundering or terrorist financing relating to that person. The Money Laundering Terrorists Financing and Transfer of Funds Information on the Payer Regulations 2017 In accordance with regulation 35 the relevant persons must have in place appropriate risk-management systems and procedures to determine whether a customer or the beneficial owner of a customer is a political exposed person PEP. This definition also extends to their immediate family members and close associates. They present a higher risk for involvement in money laundering andor terrorist financing because of the position they hold. Immediate family members andor close associates of these individuals are also considered PEPs.

Source: complyadvantage.com

Source: complyadvantage.com

Thecurrent regime as per theMoney Laundering Regulations 2007 requiresfirms to apply extra measures calledenhanced due diligence when dealing with those who are PEPs in a state other than the UK as well as family members or close associates of those. But who exactly is a pep. Politically Exposed People PEPs are a risk when it comes to money laundering because of their social status. Immediate family members andor close associates of these individuals are also considered PEPs. Irish anti-money laundering legislation defines a PEP as a person who holds or has held at any time in the last year a prominent public function including-A specified official including any of the following.

Source: paisabazaar.com

Source: paisabazaar.com

This status means that companies see them as a higher risk customer because of their opportunities to gain assets through unlawful means being greater than usual. Obtain information regarding employment including industry and sector and the level of. Risks Associated with Money Laundering and Terrorist Financing. But who exactly is a pep. Regulation 35 9 a and b states that a PEP should continue to be treated as one for at least 12 months after they leave their public function or longer if there appears to be a risk of money laundering or terrorist financing relating to that person.

Source: complyadvantage.com

Source: complyadvantage.com

Immediate family members andor close associates of these individuals are also considered PEPs. PEPs often have power over government spending and budgets. Under Australias Anti-Money Laundering AML and Counter-Terrorism Financing CTF Rules Politically exposed persons PEPs are individuals who occupy a prominent public position or functions in a government body or international organisation both within and outside Australia. Thecurrent regime as per theMoney Laundering Regulations 2007 requiresfirms to apply extra measures calledenhanced due diligence when dealing with those who are PEPs in a state other than the UK as well as family members or close associates of those. A head of state head of Government Government minister deputy or assistant Government minister.

Source: en.ppt-online.org

Source: en.ppt-online.org

Classifying a potential client as a PEP doesnt mean that a corporation cant work with them. The Money Laundering Regulations 2017 require firms to establish the source of wealth and funds used in a business relationship or transaction as well as beneficial ownership. 11 The term politically exposed persons PEPs refers to people who hold high public office. Assess the adequacy of the banks systems to manage the risks associated with senior foreign political figures often referred to as politically exposed persons PEP and managements ability to implement effective risk-based due. Immediate family members andor close associates of these individuals are also considered PEPs.

Source: en.ppt-online.org

Source: en.ppt-online.org

The Money Laundering Regulations 2017 require firms to establish the source of wealth and funds used in a business relationship or transaction as well as beneficial ownership. This status means that companies see them as a higher risk customer because of their opportunities to gain assets through unlawful means being greater than usual. PEP in money laundering Lets start with definitions. Risks Associated with Money Laundering and Terrorist Financing. Under Australias Anti-Money Laundering AML and Counter-Terrorism Financing CTF Rules Politically exposed persons PEPs are individuals who occupy a prominent public position or functions in a government body or international organisation both within and outside Australia.

Source: en.ppt-online.org

Source: en.ppt-online.org

A PEP also known and a politically exposed person is an individual that holds a public politically influential role in society. Identify the accountholders and beneficial owners countries of residence and the level of risk for corruption and money laundering associated with these jurisdictions. Politically exposed persons PEPs A PEP is an individual who holds a prominent public position or role in a government body or international organisation either in Australia or overseas. A head of state head of Government Government minister deputy or assistant Government minister. Due to their position and.

Source: indiaforensic.com

Source: indiaforensic.com

Classifying a potential client as a PEP doesnt mean that a corporation cant work with them. Under Australias Anti-Money Laundering AML and Counter-Terrorism Financing CTF Rules Politically exposed persons PEPs are individuals who occupy a prominent public position or functions in a government body or international organisation both within and outside Australia. The Money Laundering Terrorists Financing and Transfer of Funds Information on the Payer Regulations 2017 In accordance with regulation 35 the relevant persons must have in place appropriate risk-management systems and procedures to determine whether a customer or the beneficial owner of a customer is a political exposed person PEP. They present a higher risk for involvement in money laundering andor terrorist financing because of the position they hold. Immediate family members andor close associates of these individuals are also considered PEPs.

Source: slidetodoc.com

Source: slidetodoc.com

The Money Laundering Regulations 2017 require firms to establish the source of wealth and funds used in a business relationship or transaction as well as beneficial ownership. Such a decision is based on a risk assessment of that individual. PEP in money laundering Lets start with definitions. Politically Exposed Persons PEPs need to be subjected to a higher level of scrutiny along with their immediate family close associates and linked entities companies close corporations trusts etc and State Owned Entities SOEs need also to be fully identified and understood. Classifying a potential client as a PEP doesnt mean that a corporation cant work with them.

Source: slidetodoc.com

Source: slidetodoc.com

Obtain information regarding employment including industry and sector and the level of. Risks Associated with Money Laundering and Terrorist Financing. A head of state head of Government Government minister deputy or assistant Government minister. This status means that companies see them as a higher risk customer because of their opportunities to gain assets through unlawful means being greater than usual. B family member of a.

Source: slidetodoc.com

Source: slidetodoc.com

B family member of a. A PEP also known and a politically exposed person is an individual that holds a public politically influential role in society. PEPs often have power over government spending and budgets. Politically Exposed People PEPs are a risk when it comes to money laundering because of their social status. This status means that companies see them as a higher risk customer because of their opportunities to gain assets through unlawful means being greater than usual.

Source: researchgate.net

Source: researchgate.net

Politically Exposed Persons PEP meaning are high-risk clients with more opportunities than ordinary nationals to gain assets through illegal means like bribe-taking and money laundering. PEPs may use their position to get involved with corrupt practices. Politically Exposed Persons PEP meaning are high-risk clients with more opportunities than ordinary nationals to gain assets through illegal means like bribe-taking and money laundering. Politically Exposed People PEPs are a risk when it comes to money laundering because of their social status. Politically Exposed Persons PEPs need to be subjected to a higher level of scrutiny along with their immediate family close associates and linked entities companies close corporations trusts etc and State Owned Entities SOEs need also to be fully identified and understood.

Source: en.ppt-online.org

Source: en.ppt-online.org

This definition also extends to their immediate family members and close associates. The Money Laundering Regulations 2017 require firms to establish the source of wealth and funds used in a business relationship or transaction as well as beneficial ownership. This definition also extends to their immediate family members and close associates. Risks Associated with Money Laundering and Terrorist Financing. What am I required to do.

Source: en.ppt-online.org

Source: en.ppt-online.org

Under Australias Anti-Money Laundering AML and Counter-Terrorism Financing CTF Rules Politically exposed persons PEPs are individuals who occupy a prominent public position or functions in a government body or international organisation both within and outside Australia. As a result of this position the individual may be more susceptible to bribery corruption and other money laundering acts. Politically Exposed Persons PEPs need to be subjected to a higher level of scrutiny along with their immediate family close associates and linked entities companies close corporations trusts etc and State Owned Entities SOEs need also to be fully identified and understood. This definition also extends to their immediate family members and close associates. Risks Associated with Money Laundering and Terrorist Financing.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pep meaning money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.