19+ Penalty of money laundering in malaysia info

Home » money laundering Info » 19+ Penalty of money laundering in malaysia infoYour Penalty of money laundering in malaysia images are ready. Penalty of money laundering in malaysia are a topic that is being searched for and liked by netizens today. You can Download the Penalty of money laundering in malaysia files here. Find and Download all free images.

If you’re looking for penalty of money laundering in malaysia pictures information linked to the penalty of money laundering in malaysia keyword, you have visit the ideal blog. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

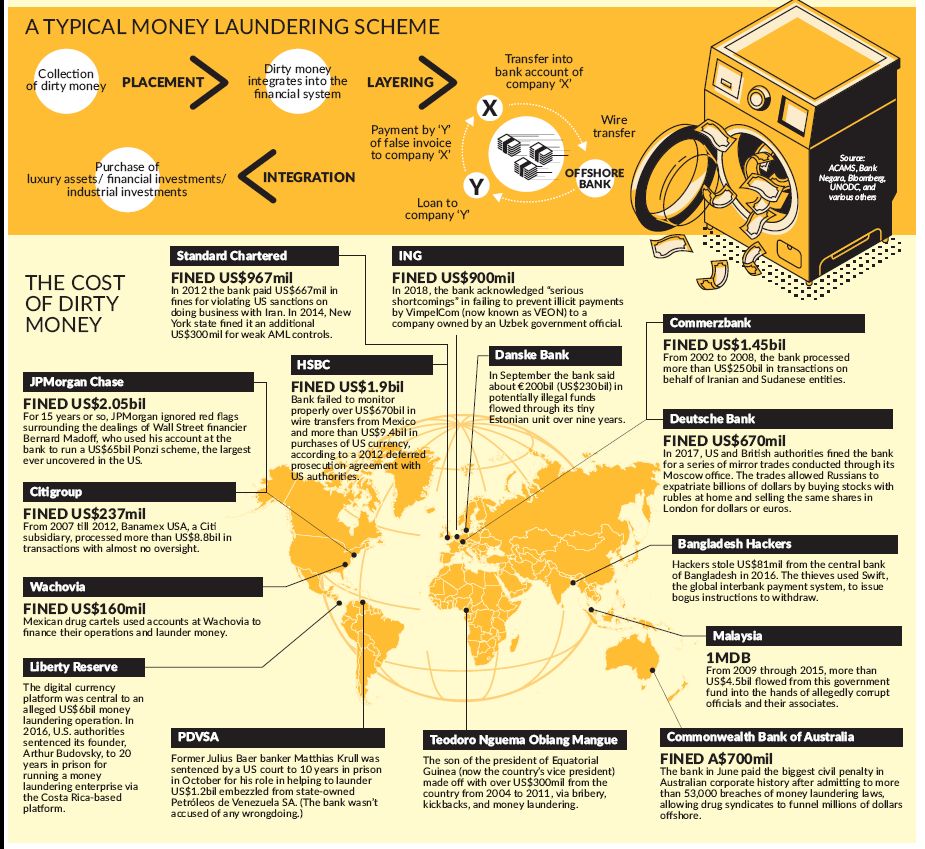

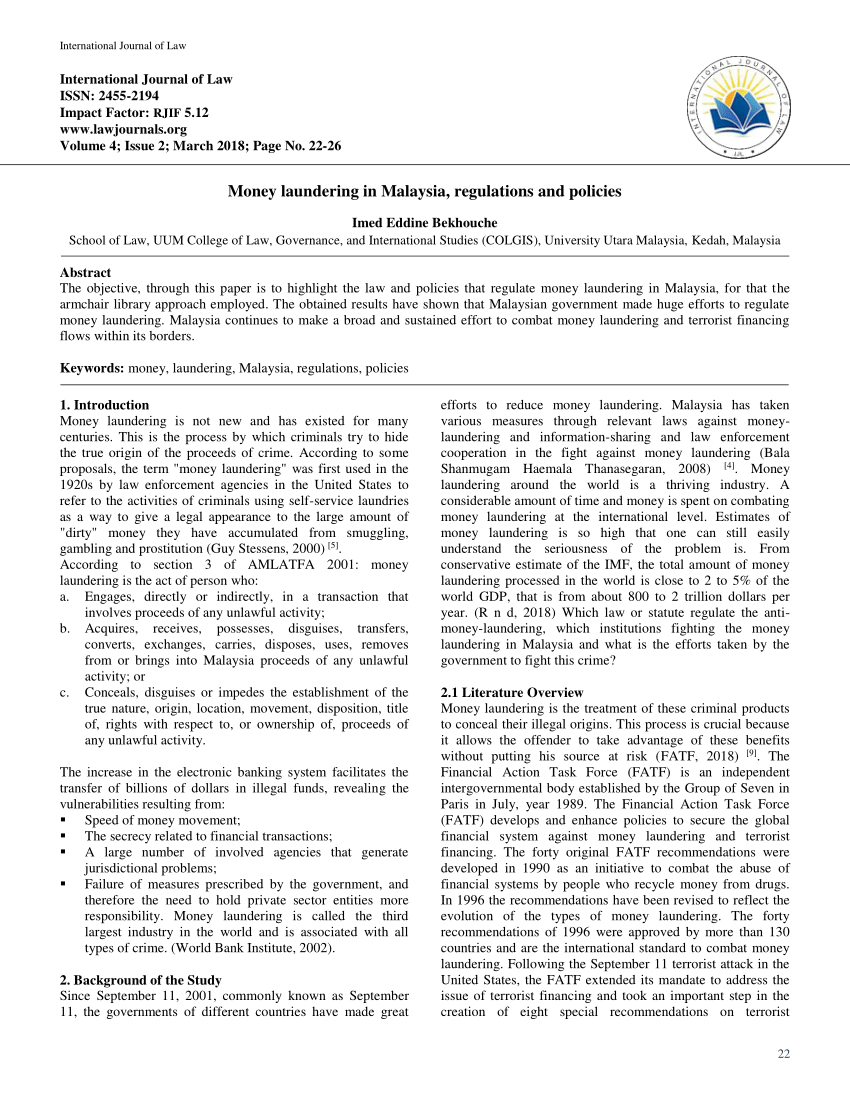

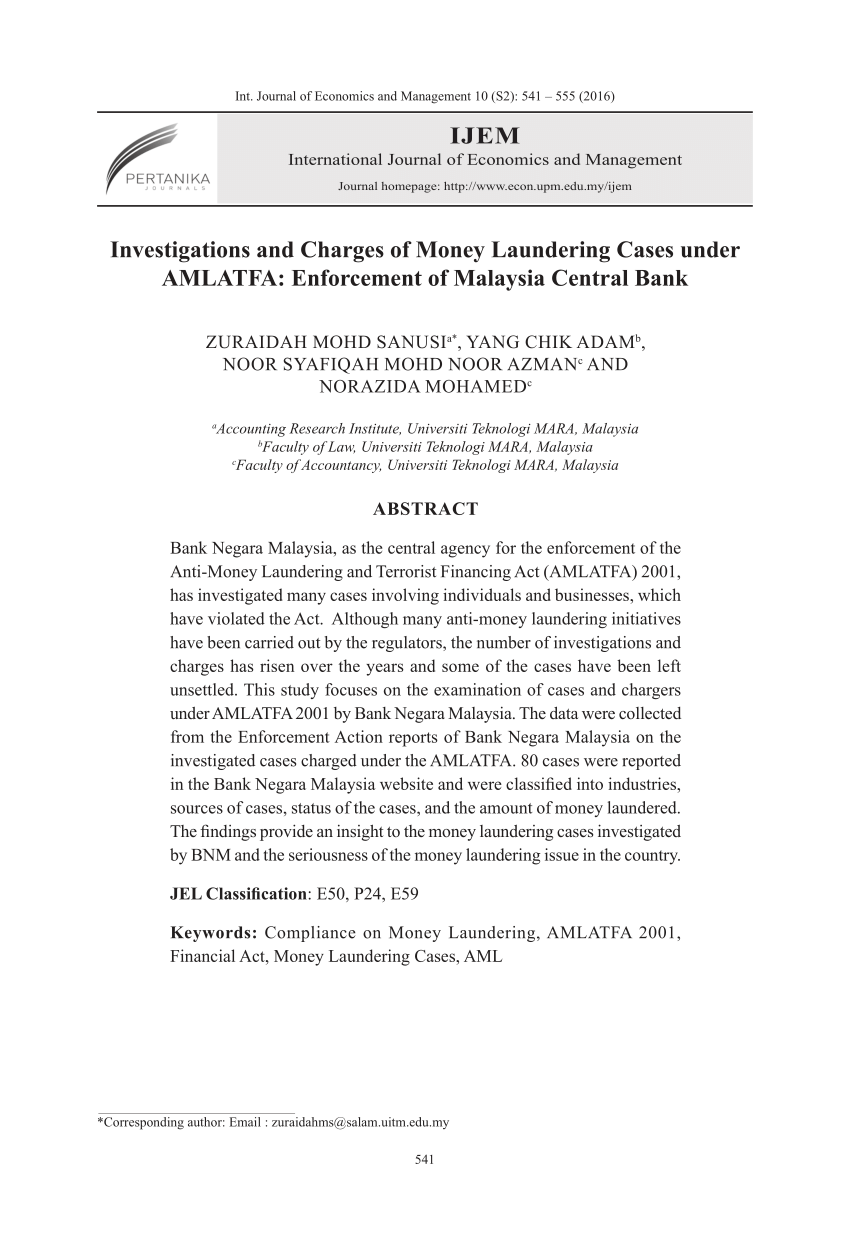

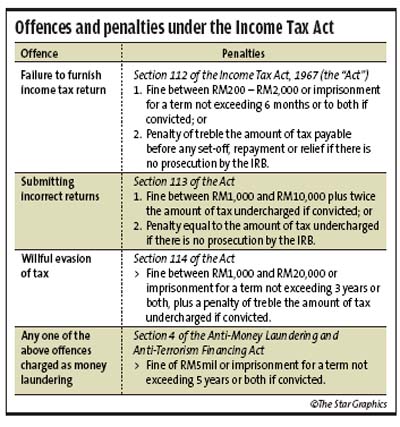

Penalty Of Money Laundering In Malaysia. Increase in the overall rate of crime that could threaten national security. Under Section 4 of the AMLA any person who commits a money laundering offence and shall on conviction be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than 5 times the sum or value of the proceeds of an unlawful activity or instrumentalities of an offence at the time the offence was committed or five million ringgit whichever is the higher. Bank Negara Malaysia as the central agency for the enforcement of the Anti-Money Laundering and Terrorist Financing Act AMLATFA 2001 has investigated many cases involving individuals and. Failure to do so constitutes an offence under Section 22 of the Act 15 to which the maximum penalty is a fine not exceeding Ringgit Malaysia One Million RM100000000 or an imprisonment for a term not exceeding three 3 years or both.

Malaysia What Is Money Laundering Conventus Law From conventuslaw.com

Malaysia What Is Money Laundering Conventus Law From conventuslaw.com

Taint the integrity and reputation of the business and financial sector. Failure to do so constitutes an offence under Section 22 of the Act 15 to which the maximum penalty is a fine not exceeding Ringgit Malaysia One Million RM100000000 or an imprisonment for a term not exceeding three 3 years or both. AMLCFT Regime in Malaysia In order to respond to the evolving money laundering and terrorism financing threats and the international standards Malaysia has established a comprehensive AMLCFT framework covering the legal and regulatory framework preventive measures for reporting institutions financial intelligence unit and law enforcement agencies. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. Malaysias Anti-Money Laundering Act 2001 AMLA was enacted in January 2002. Read More These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA.

The maximum fine for a person involved in money laundering activities is five million Ringgits or imprisonment for a term of five years or both.

Investigated for money laundering offences by Malaysian law enforcement authorities stood at RM131 billion Bernama 2014. Section 4 is defined as a serious offence under the Second Schedule of AMLATFA. Failure to do so constitutes an offence under Section 22 of the Act 15 to which the maximum penalty is a fine not exceeding Ringgit Malaysia One Million RM100000000 or an imprisonment for a term not exceeding three 3 years or both. Legal News Analysis - Asia Pacific - Malaysia - Regulatory Compliance 22 August 2017 A few months ago Malaysia was rocked with the news of Tan Sri Lee Kim Yew being threatened with a charge under the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 of Malaysia AMLATFA. Different crimes under AMLATFA have different maximum penalties. Of the RM41337 million given out by SFS the authorities managed to recover close to RM35 million hence the pecuniary penalty of RM635 million that was imposed for money laundering defined by Bank Negara Malaysia as a process of converting cash or property derived from criminal activities to give it a legitimate appearance.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. The AMLA has been renamed and revised as Anti-Money Laundering and Anti-Terrorism Financing Act 2001 Act 613 which came into force on March 6 2007 that incorporated relevant requirements in the area of terrorism financing. As a member of the United Nations Malaysia is obliged to comply with the UNSCs Resolutions. Malaysias Anti-Money Laundering Act 2001 AMLA was enacted in January 2002. E Malaysian Anti-Corruption Commission Act 2009.

Source: thestar.com.my

Source: thestar.com.my

As a member of the United Nations Malaysia is obliged to comply with the UNSCs Resolutions. Increase in the overall rate of crime that could threaten national security. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. AML Fines in Malaysia. Read More These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA.

Source: researchgate.net

Source: researchgate.net

Inhibit the growth and competitiveness of the economy. Failure to do so constitutes an offence under Section 22 of the Act 15 to which the maximum penalty is a fine not exceeding Ringgit Malaysia One Million RM100000000 or an imprisonment for a term not exceeding three 3 years or both. Inhibit the growth and competitiveness of the economy. Malaysias Anti-Money Laundering Act 2001 AMLA was enacted in January 2002. In addition in the event there is a continuing offence by the reporting institution the reporting institution shall be liable to a fine not exceeding Ringgit Malaysia.

Source: infopro.com.my

Source: infopro.com.my

The AMLA has been renamed and revised as Anti-Money Laundering and Anti-Terrorism Financing Act 2001 Act 613 which came into force on March 6 2007 that incorporated relevant requirements in the area of terrorism financing. AML Fines in Malaysia. Increase in the overall rate of crime that could threaten national security. AMLCFT Regime in Malaysia In order to respond to the evolving money laundering and terrorism financing threats and the international standards Malaysia has established a comprehensive AMLCFT framework covering the legal and regulatory framework preventive measures for reporting institutions financial intelligence unit and law enforcement agencies. Act managed to put AMLATF A 2001 through the houses of the Parliament.

Source: researchgate.net

Source: researchgate.net

For different levels of money laundering offences the levels of sentences are specified in the act. Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 Act 613 - Bank Negara Malaysia. Different crimes under AMLATFA have different maximum penalties. Increase cost of doing business and operations of various sectors of the economy. As a member of the United Nations Malaysia is obliged to comply with the UNSCs Resolutions.

E Malaysian Anti-Corruption Commission Act 2009. The Act defines the offenses of money laundering and the financing of terrorism and sets out the measures that financial institutions must take to detect and prevent those criminal activities. Impact of Money Laundering and Terrorism Financing on Country. The AMLATFA criminalizes money laundering and. Inhibit the growth and competitiveness of the economy.

Source: amazon.com

Source: amazon.com

Increase cost of doing business and operations of various sectors of the economy. E Malaysian Anti-Corruption Commission Act 2009. Impact of Money Laundering and Terrorism Financing on Country. Section 4 is defined as a serious offence under the Second Schedule of AMLATFA. Under Section 4 of the AMLA any person who commits a money laundering offence and shall on conviction be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than 5 times the sum or value of the proceeds of an unlawful activity or instrumentalities of an offence at the time the offence was committed or five million ringgit whichever is the higher.

Source: researchgate.net

Source: researchgate.net

The AMLATFA criminalizes money laundering and. In addition in the event there is a continuing offence by the reporting institution the reporting institution shall be liable to a fine not exceeding Ringgit Malaysia. AMLCFT Regime in Malaysia In order to respond to the evolving money laundering and terrorism financing threats and the international standards Malaysia has established a comprehensive AMLCFT framework covering the legal and regulatory framework preventive measures for reporting institutions financial intelligence unit and law enforcement agencies. The maximum penalty for a money laundering offense under section 4 of the AMLATFA is 15 years imprisonment and a fine of not less than five times the offenses value. Act managed to put AMLATF A 2001 through the houses of the Parliament.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

Increase cost of doing business and operations of various sectors of the economy. For different levels of money laundering offences the levels of sentences are specified in the act. The Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA is the primary piece of AMLCFT legislation in Malaysia. ICLG - Anti-Money Laundering Laws and Regulations - covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. Act managed to put AMLATF A 2001 through the houses of the Parliament.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

In June 2014 Bank Negara Malaysia as the primary keeper of the Anti-Money Laundering. Taint the integrity and reputation of the business and financial sector. In the e ort to. Failure to do so constitutes an offence under Section 22 of the Act 15 to which the maximum penalty is a fine not exceeding Ringgit Malaysia One Million RM100000000 or an imprisonment for a term not exceeding three 3 years or both. Different crimes under AMLATFA have different maximum penalties.

Malaysias Anti-Money Laundering Act 2001 AMLA was enacted in January 2002. For different levels of money laundering offences the levels of sentences are specified in the act. In the e ort to. Under Section 4 of the AMLA any person who commits a money laundering offence and shall on conviction be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than 5 times the sum or value of the proceeds of an unlawful activity or instrumentalities of an offence at the time the offence was committed or five million ringgit whichever is the higher. Failure to do so constitutes an offence under Section 22 of the Act 15 to which the maximum penalty is a fine not exceeding Ringgit Malaysia One Million RM100000000 or an imprisonment for a term not exceeding three 3 years or both.

Source: researchgate.net

Source: researchgate.net

Malaysia too has joined other countries in embarking in serious efforts in opposition to money laundering activities by establishing a comprehensive AML framework covering. As a member of the United Nations Malaysia is obliged to comply with the UNSCs Resolutions. Anti-Money Laundering Laws and Regulations 2021. And domestic and international cooperation. Read More These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA.

Source: conventuslaw.com

Source: conventuslaw.com

E Malaysian Anti-Corruption Commission Act 2009. Impact of Money Laundering and Terrorism Financing on Country. And domestic and international cooperation. Increase in the overall rate of crime that could threaten national security. E Malaysian Anti-Corruption Commission Act 2009.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title penalty of money laundering in malaysia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.