13+ Penalty for money laundering in india ideas

Home » money laundering idea » 13+ Penalty for money laundering in india ideasYour Penalty for money laundering in india images are available in this site. Penalty for money laundering in india are a topic that is being searched for and liked by netizens now. You can Download the Penalty for money laundering in india files here. Download all royalty-free vectors.

If you’re looking for penalty for money laundering in india images information related to the penalty for money laundering in india interest, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly search and find more enlightening video content and graphics that match your interests.

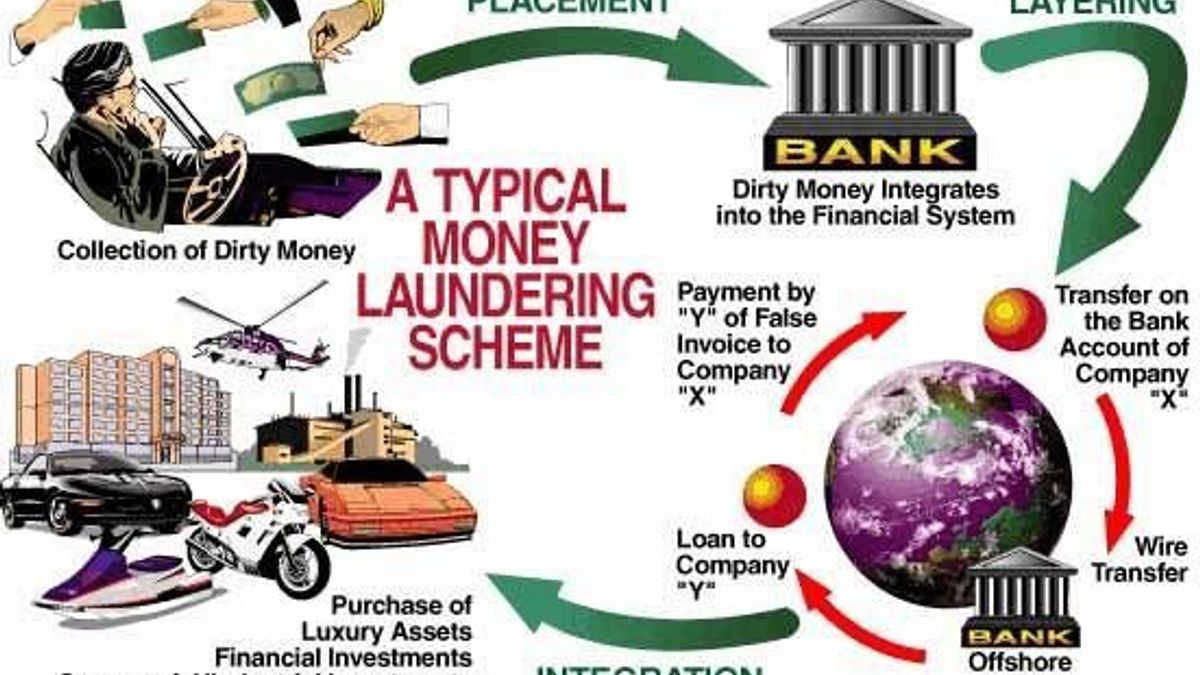

Penalty For Money Laundering In India. For transactions over 300 but less than 20000 it is a third-degree felony punishable by up to 5 years in prison. Essentially any movement of illegal proceeds from the illegal source to a legal source is money laundering. Money laundering is a felony and the level of the charge depends on the amount of money or value of the property involved. Money laundering happens in almost every country in the world and a single scheme typically involves transferring money through several countries in order to obscure its origins.

Pin On Banks Regulatory Compliance From pinterest.com

Pin On Banks Regulatory Compliance From pinterest.com

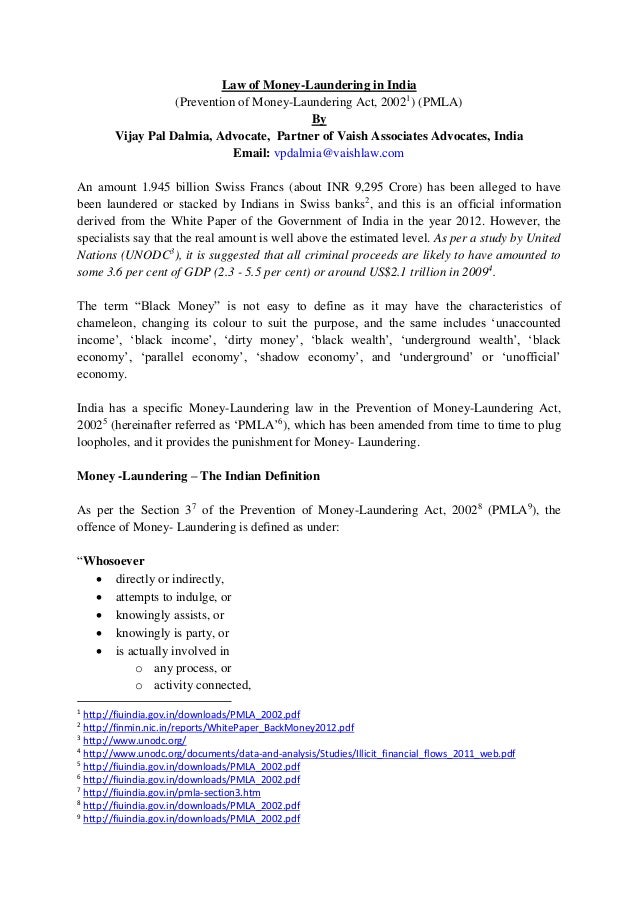

American online payment gateway giant PayPal has been imposed a Rs 96 lakh penalty by the FIU for alleged contravention of the anti-money laundering law and accused of concealing suspect financial transactions and abetting disintegration of Indias financial system. Given that the offence of money laundering is punishable with imprisonment from three to 10 years in accordance with the provisions of section 468 of the CrPC there is no limitation period for. MONEY LAUNDERING IN INDIA1-Paridhi Saxena NLU Raipur The aim of this paper is to study and evaluate the concept of money laundering in India and its law enforcement. In December 2012 HSBC Holdings Plc. Imprisonment is three to ten years. The court will also impose a penalty of up to Rs 5 Lakh in such a case.

Separately the Reserve Bank of India RBI has imposed penalties ranging from Rs 1-2 crore on eight public sector lenders for violations related to opening and operating current accounts discounting of bills cyber security framework and frauds classification and.

According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. The Act prescribes that any person found guilty of money-laundering shall be punishable with rigorous imprisonment from three years to seven years and where the proceeds of crime involved relate to any offence under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 the maximum punishment may extend to 10 years instead of 7. MONEY LAUNDERING IN INDIA1-Paridhi Saxena NLU Raipur The aim of this paper is to study and evaluate the concept of money laundering in India and its law enforcement. Laundering of money in its simplest term means hiding the origin of money obtained through illegal means such as gambling corruption drug trafficking etc. The money laundering crime in India has huge penalties. This law was introduced by the NDA Government Ruling Government of India in 2002.

Source: in.pinterest.com

Source: in.pinterest.com

According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. Given that the offence of money laundering is punishable with imprisonment from three to 10 years in accordance with the provisions of section 468 of the CrPC there is no limitation period for. According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. Prevention of Money Laundering Act 2002. This act ensures the taking over of the illegal land and money which could have been used in drug trafficking illegal arms.

Source: pinterest.com

Source: pinterest.com

Laws in India. Essentially any movement of illegal proceeds from the illegal source to a legal source is money laundering. This act ensures the taking over of the illegal land and money which could have been used in drug trafficking illegal arms. Section 4 of the Act prescribes the penalty for money laundering as defined in section 3. Given that the offence of money laundering is punishable with imprisonment from three to 10 years in accordance with the provisions of section 468 of the CrPC there is no limitation period for.

Source: acfcs.org

Source: acfcs.org

The minimum punishment in case of money laundering is 3 years and the maximum punishment is restricted to 7 years. Had to agree to pay a record USD 192 billion in fines to US authorities for getting itself involved in money-laundering issues4 As far as India is concerned in 2011-12 as many as 35 stock brokers were probed by the Securities and Exchange Board of India SEBI for possible lapses in controls related to money laundering and this led to actions. Money Laundering Penalties in India. Laundering of money in its simplest term means hiding the origin of money obtained through illegal means such as gambling corruption drug trafficking etc. Laws in India.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

Separately the Reserve Bank of India RBI has imposed penalties ranging from Rs 1-2 crore on eight public sector lenders for violations related to opening and operating current accounts discounting of bills cyber security framework and frauds classification and. According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. Money laundering happens in almost every country in the world and a single scheme typically involves transferring money through several countries in order to obscure its origins. Separately the Reserve Bank of India RBI has imposed penalties ranging from Rs 1-2 crore on eight public sector lenders for violations related to opening and operating current accounts discounting of bills cyber security framework and frauds classification and.

Source: in.pinterest.com

Source: in.pinterest.com

According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. Had to agree to pay a record USD 192 billion in fines to US authorities for getting itself involved in money-laundering issues4 As far as India is concerned in 2011-12 as many as 35 stock brokers were probed by the Securities and Exchange Board of India SEBI for possible lapses in controls related to money laundering and this led to actions. In December 2012 HSBC Holdings Plc. The case can be fined up to 5 Lakh Rupees.

Source: taxguru.in

Source: taxguru.in

Chapter III of the Act sets out the rules relating to attachment adjudication and seizure. Prevention of Money Laundering Act 2002. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. Imprisonment is three to ten years. MONEY LAUNDERING IN INDIA1-Paridhi Saxena NLU Raipur The aim of this paper is to study and evaluate the concept of money laundering in India and its law enforcement.

Source: slideshare.net

Source: slideshare.net

Financial institutions in India have to meet AML obligations. This act ensures the taking over of the illegal land and money which could have been used in drug trafficking illegal arms. To quote Jeffrey Robinson from The laundrymen after foreign exchange and the oil industry the laundering of money is the worlds third largest business. Money laundering is a felony and the level of the charge depends on the amount of money or value of the property involved. Separately the Reserve Bank of India RBI has imposed penalties ranging from Rs 1-2 crore on eight public sector lenders for violations related to opening and operating current accounts discounting of bills cyber security framework and frauds classification and.

Source: jagranjosh.com

Source: jagranjosh.com

For transactions over 300 but less than 20000 it is a third-degree felony punishable by up to 5 years in prison. The case can be fined up to 5 Lakh Rupees. Furthermore because the maximum penalty for money laundering is seven years in prison except in the case of proceeds of crime arising from an offence under. Money Laundering Penalties in India. Comparative analysis of penal provision of money laundering in India and the United States of America - India Prevention of Money Laundering Act 2002.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

In addition to this the Black Money Act provided for a three-month window from 1 July 2015 to 30 September 2015 within which a person could make a declaration in respect of his or her undisclosed assets located outside India and pay the prescribed rate of tax and penalty on such foreign assets on or before 31 December 2015 failing which. Laundering of money in its simplest term means hiding the origin of money obtained through illegal means such as gambling corruption drug trafficking etc. The court will also impose a penalty of up to Rs 5 Lakh in such a case. Laws in India. Essentially any movement of illegal proceeds from the illegal source to a legal source is money laundering.

Source: pinterest.com

Source: pinterest.com

Money laundering happens in almost every country in the world and a single scheme typically involves transferring money through several countries in order to obscure its origins. Given that the offence of money laundering is punishable with imprisonment from three to 10 years in accordance with the provisions of section 468 of the CrPC there is no limitation period for. American online payment gateway giant PayPal has been imposed a Rs 96 lakh penalty by the FIU for alleged contravention of the anti-money laundering law and accused of concealing suspect financial transactions and abetting disintegration of Indias financial system. Comparative analysis of penal provision of money laundering in India and the United States of America - India Prevention of Money Laundering Act 2002. Had to agree to pay a record USD 192 billion in fines to US authorities for getting itself involved in money-laundering issues4 As far as India is concerned in 2011-12 as many as 35 stock brokers were probed by the Securities and Exchange Board of India SEBI for possible lapses in controls related to money laundering and this led to actions.

Source: primelegal.in

Source: primelegal.in

Section 4 of the Act says that any person who commits the offence of money laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and also liable to fine. Financial institutions in India have to meet AML obligations. The money laundering crime in India has huge penalties. Furthermore because the maximum penalty for money laundering is seven years in prison except in the case of proceeds of crime arising from an offence under. Section 4 of the Act prescribes the penalty for money laundering as defined in section 3.

Source: in.pinterest.com

Source: in.pinterest.com

In addition to this the Black Money Act provided for a three-month window from 1 July 2015 to 30 September 2015 within which a person could make a declaration in respect of his or her undisclosed assets located outside India and pay the prescribed rate of tax and penalty on such foreign assets on or before 31 December 2015 failing which. The money laundering crime in India has huge penalties. Section 4 of the Act says that any person who commits the offence of money laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and also liable to fine. According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. In addition to this the Black Money Act provided for a three-month window from 1 July 2015 to 30 September 2015 within which a person could make a declaration in respect of his or her undisclosed assets located outside India and pay the prescribed rate of tax and penalty on such foreign assets on or before 31 December 2015 failing which.

Source: livelaw.in

Source: livelaw.in

Laundering of money in its simplest term means hiding the origin of money obtained through illegal means such as gambling corruption drug trafficking etc. Comparative analysis of penal provision of money laundering in India and the United States of America - India Prevention of Money Laundering Act 2002. Given that the offence of money laundering is punishable with imprisonment from three to 10 years in accordance with the provisions of section 468 of the CrPC there is no limitation period for. Section 4 of the Act prescribes the penalty for money laundering as defined in section 3. This law was introduced by the NDA Government Ruling Government of India in 2002.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title penalty for money laundering in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.