11++ Penalty for failing to report money laundering ideas

Home » money laundering idea » 11++ Penalty for failing to report money laundering ideasYour Penalty for failing to report money laundering images are available in this site. Penalty for failing to report money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Penalty for failing to report money laundering files here. Get all free photos and vectors.

If you’re searching for penalty for failing to report money laundering pictures information linked to the penalty for failing to report money laundering keyword, you have come to the right site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Penalty For Failing To Report Money Laundering. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. The maximum penalties are fines of up to 500000 or double the amount of property involved whichever is greater for each violation and for individuals imprisonment of. For further information see Practice Note. In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies.

Stricter Anti Money Laundering Regulations For Financial Institutions With Non Eu Subsidiaries From branddocs.com

Stricter Anti Money Laundering Regulations For Financial Institutions With Non Eu Subsidiaries From branddocs.com

The civil monetary penalty inflation adjustment amount at 31 CFR 1010821 applies only to the 100000 amount. Failure to comply with the SMR regime can render the reporting entity liable to a civil penalty of up to 17000000. 52 Penalty determination for a violation related to foreign currency conversion. These serious crimes can involve the maximum prison sentence of 14 years. The penalty for a conversion rate violation that led to the failure to submit a prescribed report is the same as the penalty for failing to submit a report which is 1000. For example the penalty for willful FBAR failures is the greater of 100000 or 50 of the account balance at the time of the violation.

The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing.

No application for a civil penalty has ever been sought by AUSTRAC. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. It is also possible to receive a community order as a punishment for money laundering. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. No application for a civil penalty has ever been sought by AUSTRAC.

Source: researchgate.net

Source: researchgate.net

Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Your business is not registered for money laundering supervision you need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC. It is also possible to receive a community order as a punishment for money laundering. As a result FINTRACs AMP policy has been updated to reflect the change to mandatory publication at specific stages in the penalty process. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment.

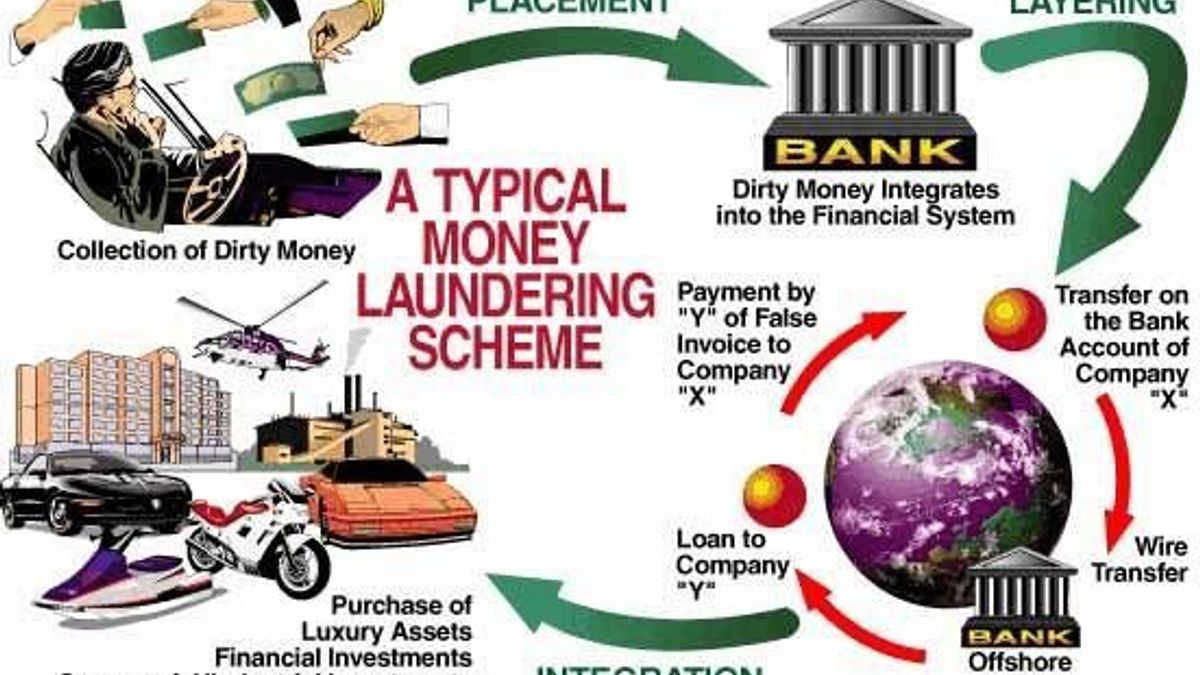

Source: pinterest.com

Source: pinterest.com

Money laundering regulations penalty for failure to report. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. On June 21 2019 the Proceeds of Crime Money Laundering and Terrorist Financing Act was amended requiring FINTRAC to make public all administrative monetary penalties AMPs imposed. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering.

Source: branddocs.com

Source: branddocs.com

Money laundering offencesacquisition use and possession. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. On June 21 2019 the Proceeds of Crime Money Laundering and Terrorist Financing Act was amended requiring FINTRAC to make public all administrative monetary penalties AMPs imposed. 52 Penalty determination for a violation related to foreign currency conversion.

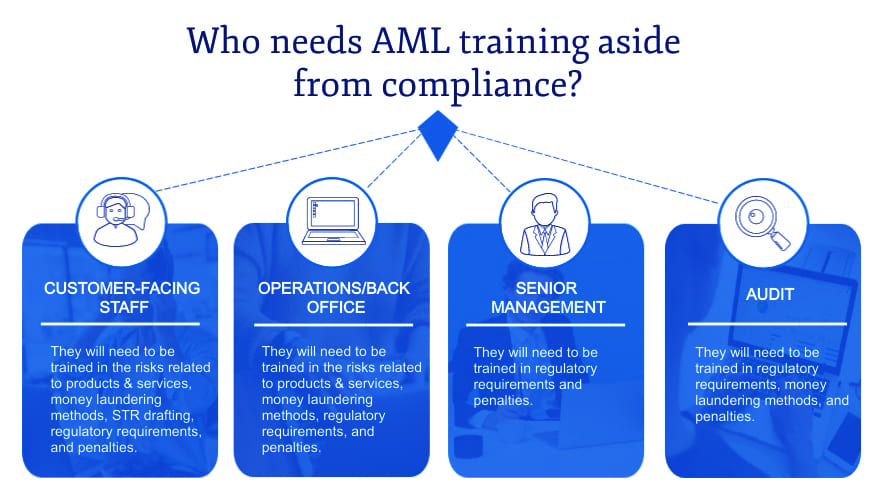

Source: shuftipro.com

Source: shuftipro.com

Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Failure to comply with the SMR regime can render the reporting entity liable to a civil penalty of up to 17000000. The maximum penalties are fines of up to 500000 or double the amount of property involved whichever is greater for each violation and for individuals imprisonment of. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. What Is The Penalty For Tipping Off A Money Launderer.

Source: pideeco.be

Source: pideeco.be

The maximum penalties are fines of up to 500000 or double the amount of property involved whichever is greater for each violation and for individuals imprisonment of. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. If the police are investigating potentially criminal monetary transactions they are highly likely to want the suspect to be unaware of the. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. The civil monetary penalty inflation adjustment amount at 31 CFR 1010821 applies only to the 100000 amount.

Source: acfcs.org

Source: acfcs.org

The civil monetary penalty inflation adjustment amount at 31 CFR 1010821 applies only to the 100000 amount. Failure to comply with the SMR regime can render the reporting entity liable to a civil penalty of up to 17000000. For further information see Practice Note. Your business is not registered for money laundering supervision you need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone.

Source: complyadvantage.com

Source: complyadvantage.com

Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. The civil monetary penalty inflation adjustment amount at 31 CFR 1010821 applies only to the 100000 amount. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. The maximum penalty for the three principal money laundering offences on conviction on indictment is fourteen years imprisonment.

Source: branddocs.com

Source: branddocs.com

For further information see Practice Note. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. No application for a civil penalty has ever been sought by AUSTRAC. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing.

Source: jagranjosh.com

Source: jagranjosh.com

The risk of such proceedings being brought by AUSTRAC is often viewed as remote. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. What Is The Penalty For Tipping Off A Money Launderer. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing.

Source: researchgate.net

Source: researchgate.net

The penalty for failing to report money laundering or a reasonable suspicion that money-laundering activity is taking place is imprisonment a fine or both. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. The maximum penalty for the three principal money laundering offences on conviction on indictment is fourteen years imprisonment. It is also possible to receive a community order as a punishment for money laundering. These serious crimes can involve the maximum prison sentence of 14 years.

Your business is not registered for money laundering supervision you need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC. In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The civil monetary penalty inflation adjustment amount at 31 CFR 1010821 applies only to the 100000 amount. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

An offence under s330 is punishable by a maximum penalty on conviction on indictment of five years imprisonment andor a fine. For further information see Practice Note. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Money laundering regulations penalty for failure to report.

Source: veriff.com

Source: veriff.com

Criminal prosecutions for money laundering. The maximum penalty for failing to file a Suspicious Transaction Report will also be raised from a maximum fine of S20000 to S250000 andor up to three years jail if the offender is an. Youll have to pay a 1500 penalty administration charge as well as the penalty for breaches of the Money Laundering Regulations such as failures for. The maximum penalties are fines of up to 500000 or double the amount of property involved whichever is greater for each violation and for individuals imprisonment of. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title penalty for failing to report money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.