19+ Outgoing wire travel rule ideas in 2021

Home » money laundering idea » 19+ Outgoing wire travel rule ideas in 2021Your Outgoing wire travel rule images are available in this site. Outgoing wire travel rule are a topic that is being searched for and liked by netizens today. You can Find and Download the Outgoing wire travel rule files here. Get all free images.

If you’re looking for outgoing wire travel rule images information connected with to the outgoing wire travel rule topic, you have pay a visit to the ideal blog. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Outgoing Wire Travel Rule. Meeting someone online never or rarely meeting in person is a red flag. Treasury issued a final rule that requires all financial institutions to include certain information in transmittal orders for funds transfers of 3000 or more 31 CFR 1010410. Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. The Office of Treasury Operations has provided resources to support accurate and timely transfers.

Https Www Becu Org Media Files Pdf 8058 Pdf La En From

So ensure travel rule compliance on outgoing wires then on incoming wire is the posting processes on both sides OFAC screening and any other sanctions screening that you would need to do. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. A Bank Secrecy Act BSA rule 31 CFR 10333goften called the Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution. The Office of Treasury Operations has provided resources to support accurate and timely transfers. If you do think something went wrong with your wire once you send it overseas youll want to tell the company within 180 days. Beneficiary Physical address for Wire Transfer Employee at a bank 334M USA There seems to be confusion regarding whether or not a physical address is required per regulation on the beneficiary recipient for wire transfers.

Person at a bank 360MUSA Just wondering it other FIs allow Outgoing wires when the beneficiary address is a PO.

Outgoing Wire Transfers A wire transfer is used to transfer money from one person or entity to another domestically or internationally. Industry commenters urged the Bureau to adopt a variety of additional exceptions to the rule in addition to exempting wire transfers and other open network transactions. Outgoing Wire Transfers A wire transfer is used to transfer money from one person or entity to another domestically or internationally. If you do think something went wrong with your wire once you send it overseas youll want to tell the company within 180 days. Because it is broader in scope the Travel Rule uses more expansive terms such as transmittal order instead of payment order and transmittors. Most industry commenters argued that the Bureau should exclude wire transfers and ACH transactions above a certain dollar amount generally ranging from 500 to 1000.

Source: id.pinterest.com

Source: id.pinterest.com

So ensure travel rule compliance on outgoing wires then on incoming wire is the posting processes on both sides OFAC screening and any other sanctions screening that you would need to do. The company will then need to investigate the matter. Most industry commenters argued that the Bureau should exclude wire transfers and ACH transactions above a certain dollar amount generally ranging from 500 to 1000. Why is it that most banks that originate outgoing wire transfers require a physical address no PO boxes for the beneficiary. Outgoing international wire transfers may cost 45 to 50 or more.

Source: pinterest.com

Source: pinterest.com

How to Waive or Reduce Wire Transfer Fees. Meeting someone online never or rarely meeting in person is a red flag. Does the Travel Rule apply to incoming wires. However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. Also in 1995 the US.

Source: id.pinterest.com

Source: id.pinterest.com

Under the rules administered by OFAC financial institutions are obligated to block or freeze property or payment of any funds transfers or transactions involving sanctioned. Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. How to Waive or Reduce Wire Transfer Fees. If an error was made you may be able to get a refund or have the transfer sent again⁵ Although its rare that youll get this opportunity for a do-over its worth giving it a try if something wasnt correct.

Source: tier1fin.com

Source: tier1fin.com

Industry commenters urged the Bureau to adopt a variety of additional exceptions to the rule in addition to exempting wire transfers and other open network transactions. So ensure travel rule compliance on outgoing wires then on incoming wire is the posting processes on both sides OFAC screening and any other sanctions screening that you would need to do. Some scammers may even coach you on how to respond to questions from the credit union. Meeting someone online never or rarely meeting in person is a red flag. Is this a compliance requirement and if so where is it established.

Source: slideplayer.com

Source: slideplayer.com

Person at a bank 360MUSA Just wondering it other FIs allow Outgoing wires when the beneficiary address is a PO. Beneficiary Physical address for Wire Transfer Employee at a bank 334M USA There seems to be confusion regarding whether or not a physical address is required per regulation on the beneficiary recipient for wire transfers. 1000 Corporate Drive PO Box 9003 Westbury New York 11590-9003 Outgoing Wire Transfer Authorization Questionnaire Due to the global increase in wire fraud Jovia wants you to be aware of common indicators of scams. A Bank Secrecy Act BSA rule 31 CFR 10333goften called the Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution. Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule.

Source: pinterest.com

Source: pinterest.com

Also in 1995 the US. If a person receiving an incoming wire transfer of 50 US Dollars USD is assessed 10 USD as a fee then 20 percent of the funds would go directly to the fee. Person at a bank 360MUSA Just wondering it other FIs allow Outgoing wires when the beneficiary address is a PO. Is this a compliance requirement and if so where is it established. If the wire transfer was for 1000 USD however the fee would only consume 1 percent of.

Source: tier1fin.com

Source: tier1fin.com

However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. Outgoing Wires to PO Boxes. Treasury issued a final rule that requires all financial institutions to include certain information in transmittal orders for funds transfers of 3000 or more 31 CFR 1010410. The Office of Treasury Operations has provided resources to support accurate and timely transfers. If the wire transfer was for 1000 USD however the fee would only consume 1 percent of.

Source: earncheese.com

Source: earncheese.com

Meeting someone online never or rarely meeting in person is a red flag. This requirement is commonly referred to as the Travel Rule 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. Treasury issued a final rule that requires all financial institutions to include certain information in transmittal orders for funds transfers of 3000 or more 31 CFR 1010410. Is this rule limited to wire transfers. Because it is broader in scope the Travel Rule uses more expansive terms such as transmittal order instead of payment order and transmittors.

Source: pinterest.com

Source: pinterest.com

How to Waive or Reduce Wire Transfer Fees. This requirement is commonly referred to as the Travel Rule 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. Most industry commenters argued that the Bureau should exclude wire transfers and ACH transactions above a certain dollar amount generally ranging from 500 to 1000. However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. The Office of Treasury Operations has provided resources to support accurate and timely transfers.

Source: veem.com

Source: veem.com

So ensure travel rule compliance on outgoing wires then on incoming wire is the posting processes on both sides OFAC screening and any other sanctions screening that you would need to do. Whether you could even get into the verification processes that are taking place. Beneficiary Physical address for Wire Transfer Employee at a bank 334M USA There seems to be confusion regarding whether or not a physical address is required per regulation on the beneficiary recipient for wire transfers. How to Waive or Reduce Wire Transfer Fees. Travel Rule Incoming Wires.

Source: tier1fin.com

Source: tier1fin.com

The company will then need to investigate the matter. The company will then need to investigate the matter. Many banks in the spirit of the BSA regulations require anyone sending a wire through their bank to provide a physical address for a beneficiary. Whether you could even get into the verification processes that are taking place. Meeting someone online never or rarely meeting in person is a red flag.

Source:

However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. Outgoing Wires to PO Boxes. Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. Why is it that most banks that originate outgoing wire transfers require a physical address no PO boxes for the beneficiary. 1000 Corporate Drive PO Box 9003 Westbury New York 11590-9003 Outgoing Wire Transfer Authorization Questionnaire Due to the global increase in wire fraud Jovia wants you to be aware of common indicators of scams.

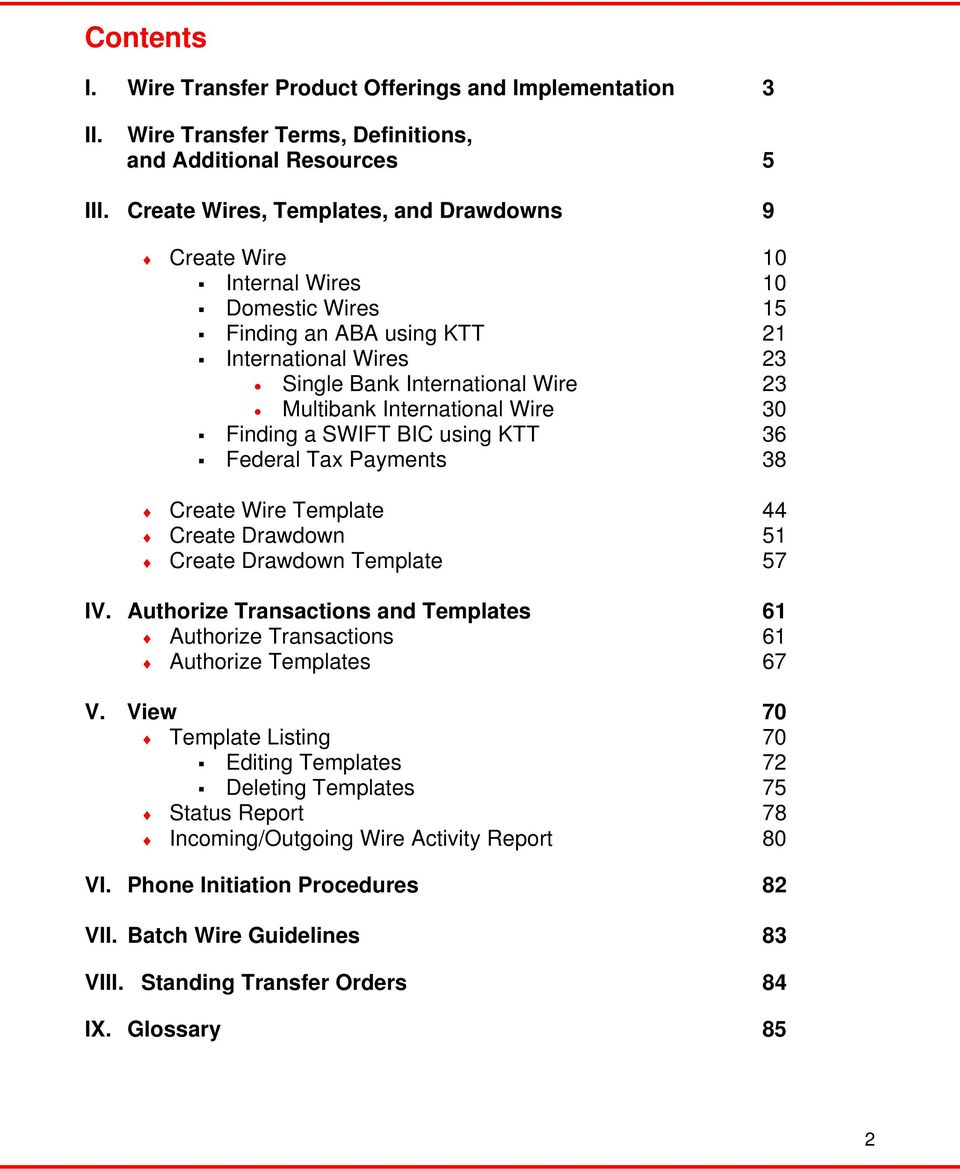

Source: docplayer.net

Source: docplayer.net

Most industry commenters argued that the Bureau should exclude wire transfers and ACH transactions above a certain dollar amount generally ranging from 500 to 1000. The new rule authorized by the Dodd-Frank Wall Street Reform and Consumer Protection Act applies to international wire transfers of 15 or more handled by a. Many banks in the spirit of the BSA regulations require anyone sending a wire through their bank to provide a physical address for a beneficiary. So ensure travel rule compliance on outgoing wires then on incoming wire is the posting processes on both sides OFAC screening and any other sanctions screening that you would need to do. HSBC does not list rates for outgoing domestic and foreign wire transfers until the time of transaction.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title outgoing wire travel rule by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.