14++ Onboarding kyc process flow ideas in 2021

Home » money laundering idea » 14++ Onboarding kyc process flow ideas in 2021Your Onboarding kyc process flow images are ready. Onboarding kyc process flow are a topic that is being searched for and liked by netizens now. You can Get the Onboarding kyc process flow files here. Download all royalty-free vectors.

If you’re searching for onboarding kyc process flow images information linked to the onboarding kyc process flow keyword, you have pay a visit to the right blog. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

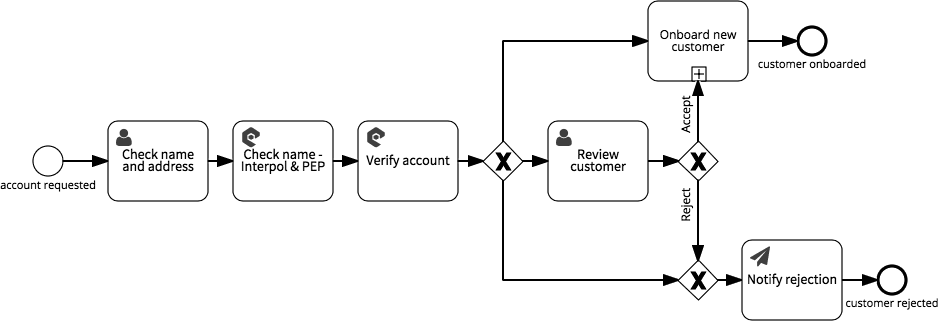

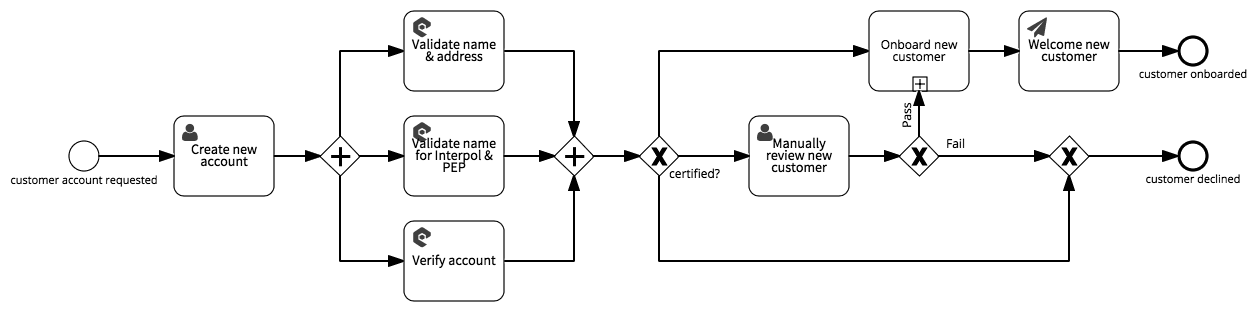

Onboarding Kyc Process Flow. Customer onboarding and KYC processes at traditional banks lag consumer expectations. When it comes to onboarding new customers a well-managed and executed KYC process flow can have wide ranging benefits. Digital customer onboarding process flow detects your customer information and protects you from any risk. There are five critical phases in the AML KYC onboarding process.

Know Your Customer Kyc Process Guide For Banking From processmaker.com

Know Your Customer Kyc Process Guide For Banking From processmaker.com

Regulators fine financial institutions. Once you have selected a KYC service provider its time to create an onboarding process. What are KYC and eKYC. Removed the Setting up KYC Onboarding section in Chapter 4 Maintenance Activities and Configuring Setup Parameters KYC Batch. A crucial part of onboarding is the KYC Know Your Customer procedure which in the financial industry is defined as the process a business such as a bank uses to verify the identity of its clients whether these are natural persons or legal entities. Added a chapter for KYC Onboarding.

Onboarding Process Flow Invoking the KYC Onboarding Service ConfiguringModifying the PMF Flow for the Onboarding Service Onboarding Process Flow Before you begin the Onboarding process ensure that Oracle Financial Services Analytical Applications OFSAA 80700 and Behavior Detection BD 80700 are installed and configured for KYC.

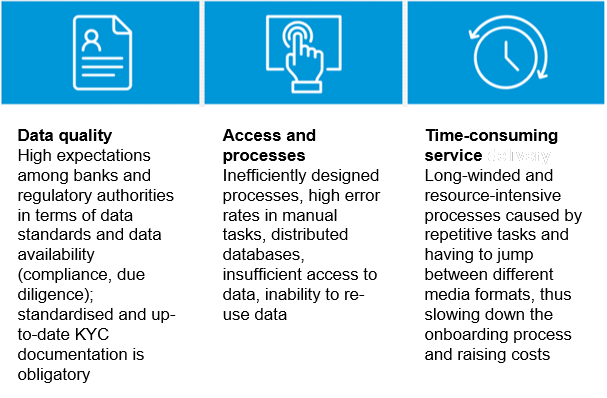

The flows frequently relied on easily-falsified proof of residence documents to confirm a customers. Updated the chapter for KYC Onboarding. Today we explore one of the most crucial procedures in the financial field in onboarding matters. EMAS eKYC electronic know-your-customer is a product suite comprises various integrated components to help businesses in next-generation customer journeys through realization of digital ID verification. Customer onboarding and KYC processes at traditional banks lag consumer expectations. Regulators fine financial institutions.

![]() Source: slideteam.net

Source: slideteam.net

Updated Appendix D BDF Datamaps. Removed the Setting up KYC Onboarding section in Chapter 4 Maintenance Activities and Configuring Setup Parameters KYC Batch. Regulators fine financial institutions. Flaws in digital onboarding and KYC flows - illustration. Customer Identification Program CIP Customer Due Diligence CDD Enhanced Due Diligence EDD Account Opening.

Source: slideteam.net

Source: slideteam.net

When it comes to onboarding new customers a well-managed and executed KYC process flow can have wide ranging benefits. One of the most important reasons is that this method is preferred by customers because they can quickly manage procedures like application forms approvals signatures and Know Your Customer KYC verification via an online interface. The flows frequently relied on easily-falsified proof of residence documents to confirm a customers. Once you have selected a KYC service provider its time to create an onboarding process. Flaws in digital onboarding and KYC flows - illustration.

Source: signavio.com

Source: signavio.com

What are KYC and eKYC. However RegTechs are redesigning the whole experience. From cost and time savings through to improving the customer experience firms with a robust programme in place will have a strategic advantage. EMAS eKYC electronic know-your-customer is a product suite comprises various integrated components to help businesses in next-generation customer journeys through realization of digital ID verification. A crucial part of onboarding is the KYC Know Your Customer procedure which in the financial industry is defined as the process a business such as a bank uses to verify the identity of its clients whether these are natural persons or legal entities.

Source: advisoryhq.com

Source: advisoryhq.com

Design a customer journey and onboarding process. However exceptions may arise depending on the situation at hand. Regulators fine financial institutions. Dec 2018 First edition of 807 Removed all instances of negative news. KYC vendors such as BASIS ID usually offer several ways of integrating the KYC software solution into your customer onboarding flow.

Source: advisoryhq.com

Source: advisoryhq.com

EMAS eKYC has been successfully implemented in digital banking financial money services eg. Customer Identification Program CIP Customer Due Diligence CDD Enhanced Due Diligence EDD Account Opening. When it comes to onboarding new customers a well-managed and executed KYC process flow can have wide ranging benefits. Digital customer onboarding process flow detects your customer information and protects you from any risk. All features combined accelerate the customer onboarding without compromising any regulatory prerequisite.

Source: blog.gft.com

Source: blog.gft.com

However exceptions may arise depending on the situation at hand. Onboarding Process Flow Invoking the KYC Onboarding Service ConfiguringModifying the PMF Flow for the Onboarding Service Onboarding Process Flow Before you begin the Onboarding process ensure that Oracle Financial Services Analytical Applications OFSAA 80700 and Behavior Detection BD 80700 are installed and configured for KYC. EMAS eKYC electronic know-your-customer is a product suite comprises various integrated components to help businesses in next-generation customer journeys through realization of digital ID verification. The inability to offer an effective and compliant digital onboarding experience places traditional banks at a competitive disadvantage that has only been magnified by the ongoing pandemic. Once you have selected a KYC service provider its time to create an onboarding process.

Source: signavio.com

Source: signavio.com

When it comes to onboarding new customers a well-managed and executed KYC process flow can have wide ranging benefits. With the Covid-19-induced lockdown RegTech startups and financial institutions around the world are working on implementing new solutions for KYC procedures. The identity verification solution was developed for companies such as Telcos MNOs and Banks operating in Africa. Regulations require you first to KYC check your customers during the onboarding process and then follow their financial transactions. However exceptions may arise depending on the situation at hand.

Source: slideplayer.com

Source: slideplayer.com

Design a customer journey and onboarding process. What are KYC and eKYC. EMAS eKYC has been successfully implemented in digital banking financial money services eg. One of the most important reasons is that this method is preferred by customers because they can quickly manage procedures like application forms approvals signatures and Know Your Customer KYC verification via an online interface. Updated the chapter for KYC Onboarding.

Source: slideteam.net

Source: slideteam.net

The customer enrollment with KYC registration and AML rules guarantees a 100 compliant process. However exceptions may arise depending on the situation at hand. Regulations require you first to KYC check your customers during the onboarding process and then follow their financial transactions. All features combined accelerate the customer onboarding without compromising any regulatory prerequisite. Account opening is the final phase in the KYC onboarding lifecycle process flow.

All features combined accelerate the customer onboarding without compromising any regulatory prerequisite. EMAS eKYC has been successfully implemented in digital banking financial money services eg. When it comes to onboarding new customers a well-managed and executed KYC process flow can have wide ranging benefits. The most common flaws we found in what were supposedly digital onboarding processes. There are five critical phases in the AML KYC onboarding process.

Source: blog.cashfree.com

Source: blog.cashfree.com

Customer Identification Program CIP Customer Due Diligence CDD Enhanced Due Diligence EDD Account Opening. Updated Appendix D BDF Datamaps. The customer enrollment with KYC registration and AML rules guarantees a 100 compliant process. Regulations require you first to KYC check your customers during the onboarding process and then follow their financial transactions. Removed the Setting up KYC Onboarding section in Chapter 4 Maintenance Activities and Configuring Setup Parameters KYC Batch.

Source: basisid.com

Source: basisid.com

The customer enrollment with KYC registration and AML rules guarantees a 100 compliant process. If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead to rejecting the application. Find out why pros choose Lucidcharts to make process diagrams. Removed the Setting up KYC Onboarding section in Chapter 4 Maintenance Activities and Configuring Setup Parameters KYC Batch. The most common flaws we found in what were supposedly digital onboarding processes.

Source: processmaker.com

Source: processmaker.com

If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead to rejecting the application. Here are the steps involved in KYC AML onboarding. Mobile wallet remittance lending investment products insurance and telecommunications where customer identification forms a high priority function in customer sign-up process. KYC is a series of procedures made by a company to know as much as possible about. Onboarding Process Flow Invoking the KYC Onboarding Service ConfiguringModifying the PMF Flow for the Onboarding Service Onboarding Process Flow Before you begin the Onboarding process ensure that Oracle Financial Services Analytical Applications OFSAA 80700 and Behavior Detection BD 80700 are installed and configured for KYC.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title onboarding kyc process flow by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.