15++ Offences under the money laundering regulations ideas in 2021

Home » money laundering idea » 15++ Offences under the money laundering regulations ideas in 2021Your Offences under the money laundering regulations images are available. Offences under the money laundering regulations are a topic that is being searched for and liked by netizens today. You can Get the Offences under the money laundering regulations files here. Get all free images.

If you’re searching for offences under the money laundering regulations images information connected with to the offences under the money laundering regulations topic, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Offences Under The Money Laundering Regulations. The MLR 2017 replace the Money Laundering Regulations 2007 SI 20072157 and give effect to Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing sometimes known as the Fourth Money Laundering Directive or MLD4 which took effect from 26 June 2017. The power to create sanctions regulations and anti-money laundering regulations the power to create offences for sanctions breaches Magnitsky provisions for the creation of sanctions. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Offences under the Money Laundering Regulations 2017 MLR 2017 Private Client.

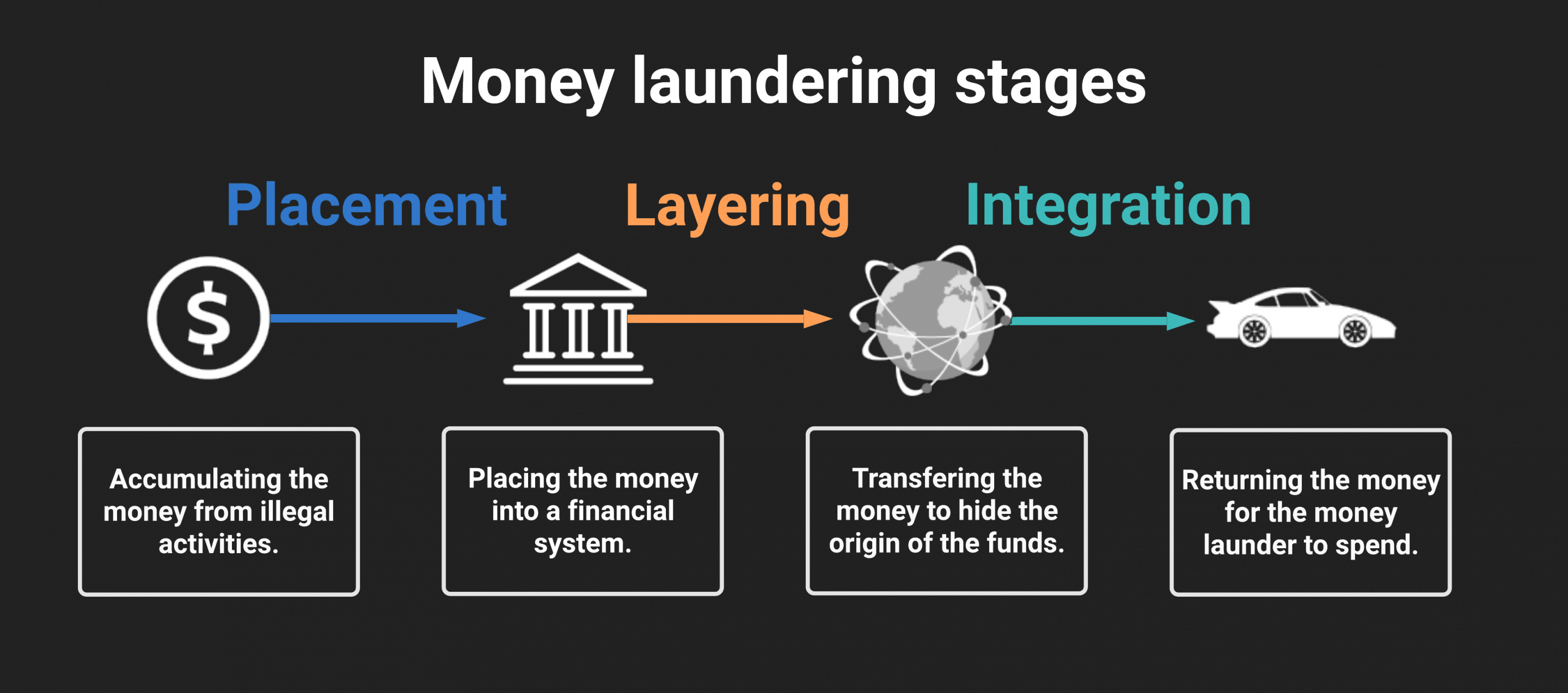

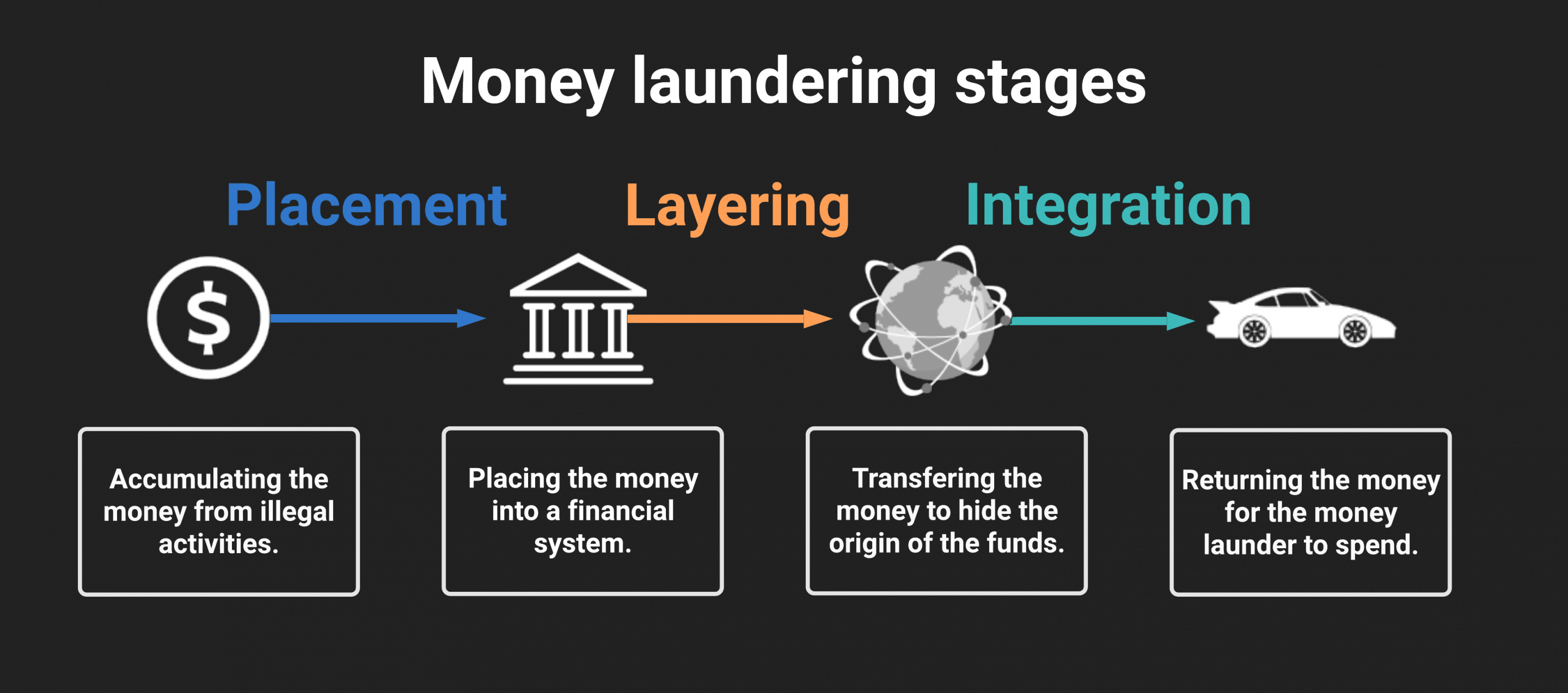

What Are The Three Stages Of Money Laundering From brittontime.com

What Are The Three Stages Of Money Laundering From brittontime.com

A person commits a money laundering offence under the Criminal Code if they deal with money or property and the money or property is and the person believes that it is the proceeds of crime or the person intends that the money or property will become an instrument of crime. The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329 The money laundering offences cover every type of offence and are all either way offences. Breach of confidentiality offence. Offences under the Money Laundering Regulations 2017 MLR 2017. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business. The MLR 2017 replace the Money Laundering Regulations 2007 SI 20072157 and give effect to Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing sometimes known as the Fourth Money Laundering Directive or MLD4 which took effect from 26 June 2017.

The power to create sanctions regulations and anti-money laundering regulations the power to create offences for sanctions breaches Magnitsky provisions for the creation of sanctions.

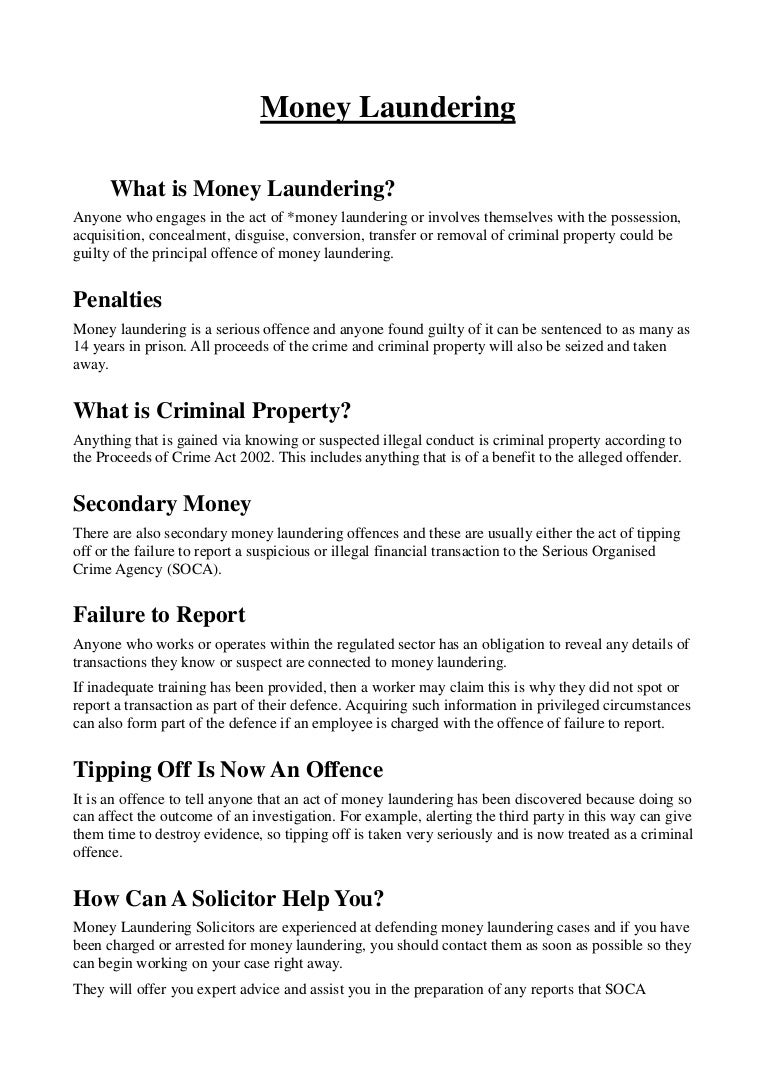

Company disclosures records and registers. Offences under the Money Laundering Regulations 2017. Non-compliance with the Money Laundering Regulations 2007 It is a criminal offence for a business not to comply with the 2007 Regulations if it is within their scope. Breach of confidentiality offence. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017.

Source: pinterest.com

Source: pinterest.com

Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The MLR 2017 replace the Money Laundering Regulations 2007 SI 20072157 and give effect to Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing sometimes known as the Fourth Money Laundering Directive or MLD4 which took effect from 26 June 2017. Tax avoidance evasion and non-compliance. Simple money laundering Article 420 bis 1 and 420 quater 1 DPC acquisition or possession of an object that originates directly from an own crime both the intentional and culpable form are criminalised. While you must take these factors into account you should consider the situation as a whole and bear in mind that the presence of one or more of the.

Source: brittontime.com

Source: brittontime.com

Regulation 336 sets out a list of factors that must be taken into account in assessing whether there is a higher risk of money laundering and terrorist financing present in a given situation and the extent of EDD measures that should be applied. Offences under the Money Laundering Regulationsoverview. Offences under the Money Laundering Regulations 2017 MLR 2017 Private Client. The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329 The money laundering offences cover every type of offence and are all either way offences. Tax avoidance evasion and non-compliance.

Source: bi.go.id

Source: bi.go.id

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Offences under the Money Laundering Regulationsoverview. While you must take these factors into account you should consider the situation as a whole and bear in mind that the presence of one or more of the. Non-compliance with the Money Laundering Regulations 2007 It is a criminal offence for a business not to comply with the 2007 Regulations if it is within their scope. Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017.

Source: slideshare.net

Source: slideshare.net

Other disclosures and compliance. Simple money laundering Article 420 bis 1 and 420 quater 1 DPC acquisition or possession of an object that originates directly from an own crime both the intentional and culpable form are criminalised. The MLR 2017 replace the Money Laundering Regulations 2007 SI 20072157 and give effect to Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing sometimes known as the Fourth Money Laundering Directive or MLD4 which took effect from 26 June 2017. While you must take these factors into account you should consider the situation as a whole and bear in mind that the presence of one or more of the. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

Source: bi.go.id

While you must take these factors into account you should consider the situation as a whole and bear in mind that the presence of one or more of the. The power to create sanctions regulations and anti-money laundering regulations the power to create offences for sanctions breaches Magnitsky provisions for the creation of sanctions. Offences under the Money Laundering Regulations 2017 MLR 2017 Private Client. 11pm GMT on 31 December 2020 marks the end of the Brexit transitionimplementation period entered into following the UKs withdrawal from the EU. Regulation 336 sets out a list of factors that must be taken into account in assessing whether there is a higher risk of money laundering and terrorist financing present in a given situation and the extent of EDD measures that should be applied.

Source: bi.go.id

Source: bi.go.id

The principal money laundering offences created by the Proceeds of Crime Act 2002 are. Tax avoidance evasion and non-compliance. Offences under the Money Laundering Regulations 2017. A person commits a money laundering offence under the Criminal Code if they deal with money or property and the money or property is and the person believes that it is the proceeds of crime or the person intends that the money or property will become an instrument of crime. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business.

Source: pinterest.com

Source: pinterest.com

Sentencing fraud offences committed by individualsThe Sentencing Council SC has produced sentencing guidelines for fraud offences under the Fraud Act 2006 fraud by false representation fraud by failing to disclose information and fraud by abuse of position false accounting under section 17 of. Offences carried out by individuals corporate bodies partnerships and unincorporated associations. Non-compliance with the Money Laundering Regulations 2007 It is a criminal offence for a business not to comply with the 2007 Regulations if it is within their scope. Offences under the Money Laundering Regulations 2017 MLR 2017 Corporate. Offences under the Money Laundering Regulations 2017 MLR 2017.

Source: bi.go.id

Source: bi.go.id

Offences under the Money Laundering Regulations 2017. Non-compliance with the Money Laundering Regulations 2007 It is a criminal offence for a business not to comply with the 2007 Regulations if it is within their scope. Offences under the Money Laundering Regulations 2017. 11pm GMT on 31 December 2020 marks the end of the Brexit transitionimplementation period entered into following the UKs withdrawal from the EU. Other disclosures and compliance.

Source: researchgate.net

Source: researchgate.net

Offences under the Money Laundering Regulations 2017 MLR 2017 Private Client. 11pm GMT on 31 December 2020 marks the end of the Brexit transitionimplementation period entered into following the UKs withdrawal from the EU. At this point in time referred to in UK law as IP completion day key transitional arrangements come to an end and significant changes begin to take effect across the UKs. Tax avoidance evasion and non-compliance. Offences carried out by individuals corporate bodies partnerships and unincorporated associations.

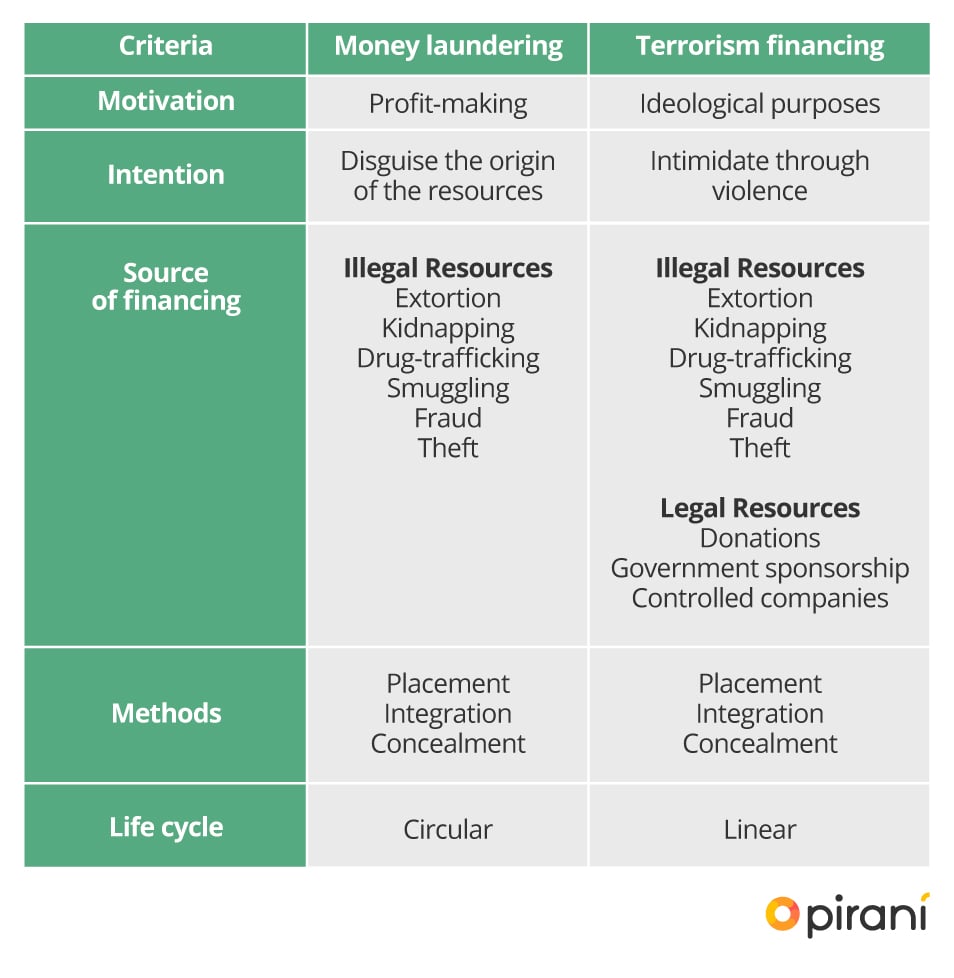

Source: piranirisk.com

Source: piranirisk.com

Offences under the Money Laundering Regulationsoverview. Non-compliance with the Money Laundering Regulations 2007 It is a criminal offence for a business not to comply with the 2007 Regulations if it is within their scope. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Offences carried out by individuals corporate bodies partnerships and unincorporated associations. The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329 The money laundering offences cover every type of offence and are all either way offences.

Source: researchgate.net

Source: researchgate.net

Tax avoidance evasion and non-compliance. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business. Regulation 336 sets out a list of factors that must be taken into account in assessing whether there is a higher risk of money laundering and terrorist financing present in a given situation and the extent of EDD measures that should be applied. Culpable money laundering Article 420 quater DPC lower limit culpa regarding the origin of the object suffices. Offences carried out by individuals corporate bodies partnerships and unincorporated associations.

Source: wikiwand.com

Source: wikiwand.com

The power to create sanctions regulations and anti-money laundering regulations the power to create offences for sanctions breaches Magnitsky provisions for the creation of sanctions. The power to create sanctions regulations and anti-money laundering regulations the power to create offences for sanctions breaches Magnitsky provisions for the creation of sanctions. Breach of confidentiality offence. Act on penalties for money laundering offences 2014307 Updated 15 October 2018 Lag 2014307 om straff för penningtvättsbrott. It describes why a UK domestic sanctions regime was needed explains the progress taken by the Sanctions and Anti-Money Laundering Bill through Parliament and its subsequent passing as SAMLA 2018 and provides an outline of some of the key provisions of the SAMLA 2018 including.

Source: dimensiongrc.com

Source: dimensiongrc.com

Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business. Offences carried out by individuals corporate bodies partnerships and unincorporated associations. The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329 The money laundering offences cover every type of offence and are all either way offences. Offences under the Money Laundering Regulations 2017 MLR 2017.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title offences under the money laundering regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.