16+ Offences under money laundering regulations 2017 ideas

Home » money laundering Info » 16+ Offences under money laundering regulations 2017 ideasYour Offences under money laundering regulations 2017 images are ready. Offences under money laundering regulations 2017 are a topic that is being searched for and liked by netizens today. You can Find and Download the Offences under money laundering regulations 2017 files here. Get all royalty-free images.

If you’re looking for offences under money laundering regulations 2017 images information related to the offences under money laundering regulations 2017 topic, you have pay a visit to the right site. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

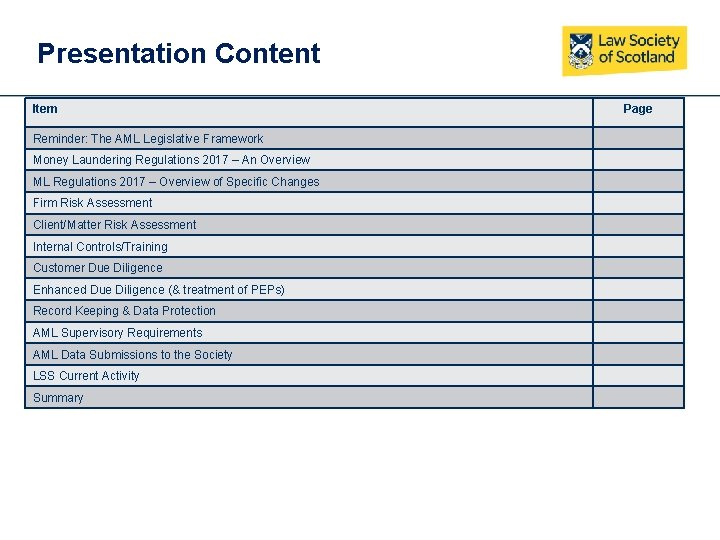

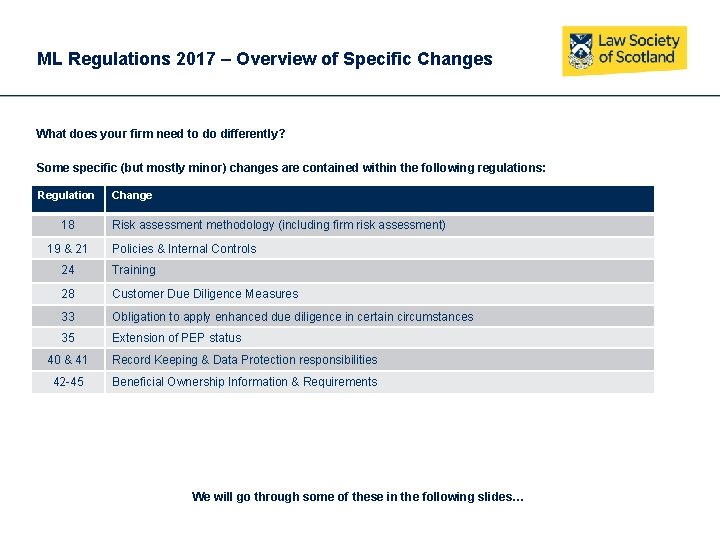

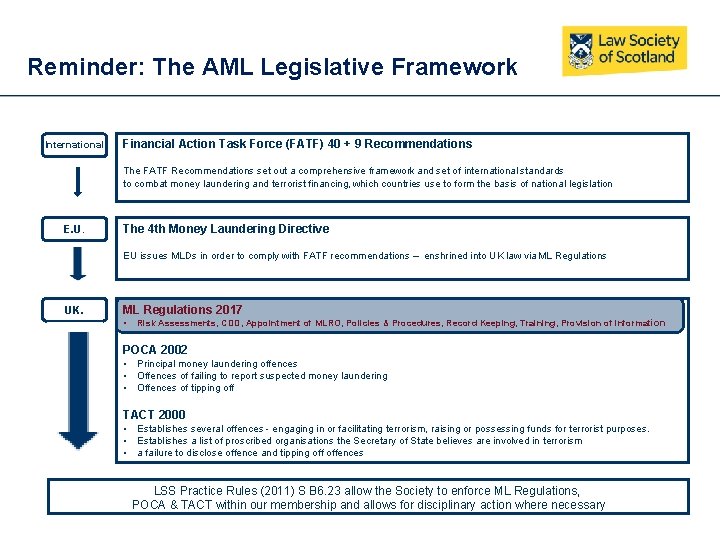

Offences Under Money Laundering Regulations 2017. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. An offence under the Perjury Act 1911179. Other disclosures and compliance. Under the UK Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017MLRs these are the relevant offences.

Money Laundering Regulations 2017 The Key Changes From claytonandbrewill.com

Money Laundering Regulations 2017 The Key Changes From claytonandbrewill.com

Other disclosures and compliance. Company disclosures records and registers. An offence under Part 7 money laundering or Part 8 investigations of or listed in Schedule 2 lifestyle offences. An offence under the Money Laundering Regulations 2001 the Money Laundering Regulations 2003 the Money Laundering Regulations 2007 or under these Regulations. Offences carried out by individuals corporate bodies partnerships and unincorporated associations. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments.

Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business.

England and Wales 4 lifestyle offences. This note explains the criminal offences under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 the defences available and the sentences that may be imposed on conviction. Offences under the Money Laundering Regulations 2017 MLR 2017. Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the Luxembourg Criminal Code. Other disclosures and compliance.

An offence under the Perjury Act 1911179. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. An offence under the Money Laundering Regulations 2001 the Money Laundering Regulations 2003 the Money Laundering Regulations 2007 or under these Regulations. This note also considers the provisions of the Money Laundering. Offences under the Money Laundering Regulations 2017.

Source: pinterest.com

Source: pinterest.com

An offence under section 89 of the Criminal Justice Act 1967. However you should be aware that the presence of one or. Under the UK Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017MLRs these are the relevant offences. This note explains the criminal offences under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 the defences available and the sentences that may be imposed on conviction. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied.

Source: slidetodoc.com

Source: slidetodoc.com

Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business. Offences under the Money Laundering Regulations 2017 MLR 2017. England and Wales 4 lifestyle offences. An offence under Part 7 money laundering or Part 8 investigations of or listed in Schedule 2 lifestyle offences. Under the UK Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017MLRs these are the relevant offences.

This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. This note explains the criminal offences under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 the defences available and the sentences that may be imposed on conviction. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied.

Source: slidetodoc.com

Source: slidetodoc.com

Offences under the Money Laundering Regulations 2017. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. Offences under the Money Laundering Regulations 2017 MLR 2017 Private Client. Breach of confidentiality offence. Company disclosures records and registers.

Source: bi.go.id

Source: bi.go.id

Offences under the Money Laundering Regulations 2017 MLR 2017 Corporate. Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017. A person who makes an authorised disclosure can avail themselves of a defence against committing a money laundering offence if they seek the consent of the NCA under section 335 of POCA to. An offence under section 89 of the Criminal Justice Act 1967. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business.

Offences under the Money Laundering Regulations 2017 MLR 2017 Private Client. England and Wales 4 lifestyle offences. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. An offence under section 89 of the Criminal Justice Act 1967. Tax avoidance evasion and non-compliance.

Source: claytonandbrewill.com

Source: claytonandbrewill.com

Scotland or 5 lifestyle offences. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. Offences under the Money Laundering Regulations 2017 MLR 2017 Corporate. A person who makes an authorised disclosure can avail themselves of a defence against committing a money laundering offence if they seek the consent of the NCA under section 335 of POCA to. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business.

Source: bi.go.id

Source: bi.go.id

Offences carried out by individuals corporate bodies partnerships and unincorporated associations. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the Luxembourg Criminal Code. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. Scotland or 5 lifestyle offences. Regulated sector offences Regardless of any involvement in a suspicious activity as for general offences for those carrying out a regulated business there is a separate offence of failing to disclose suspicions of money laundering discovered in the conduct of their business.

Source: slidetodoc.com

Source: slidetodoc.com

Offences under the Money Laundering Regulations 2017 MLR 2017. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the Luxembourg Criminal Code. England and Wales 4 lifestyle offences. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. A person who makes an authorised disclosure can avail themselves of a defence against committing a money laundering offence if they seek the consent of the NCA under section 335 of POCA to.

Source: bi.go.id

Source: bi.go.id

Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. An offence under section 89 of the Criminal Justice Act 1967. Scotland or 5 lifestyle offences. An offence under Part 7 money laundering or Part 8 investigations of or listed in Schedule 2 lifestyle offences.

Source: bi.go.id

Source: bi.go.id

Offences carried out by individuals corporate bodies partnerships and unincorporated associations. Offences under the Money Laundering Regulations 2017. A person who makes an authorised disclosure can avail themselves of a defence against committing a money laundering offence if they seek the consent of the NCA under section 335 of POCA to. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017. This note explains the criminal offences under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 the defences available and the sentences that may be imposed on conviction.

Source: slidetodoc.com

Source: slidetodoc.com

This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. An offence under the Money Laundering Regulations 2001 the Money Laundering Regulations 2003 the Money Laundering Regulations 2007 or under these Regulations. Offences under the Money Laundering Regulations 2017 MLR 2017 Introduction to the Money Laundering Regulations 2017. An offence under Part 7 money laundering or Part 8 investigations of or listed in Schedule 2 lifestyle offences. Offences under the Money Laundering Regulations 2017.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title offences under money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.