17+ Offence of money laundering under pmla 2002 section ideas

Home » money laundering idea » 17+ Offence of money laundering under pmla 2002 section ideasYour Offence of money laundering under pmla 2002 section images are ready in this website. Offence of money laundering under pmla 2002 section are a topic that is being searched for and liked by netizens now. You can Download the Offence of money laundering under pmla 2002 section files here. Get all royalty-free photos and vectors.

If you’re searching for offence of money laundering under pmla 2002 section images information connected with to the offence of money laundering under pmla 2002 section interest, you have come to the right site. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

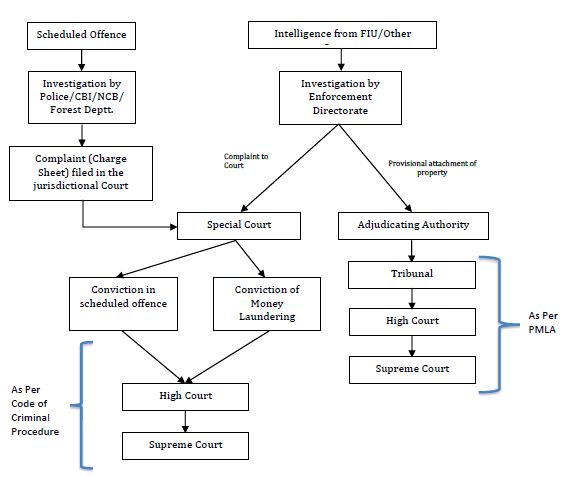

Offence Of Money Laundering Under Pmla 2002 Section. Measures to enhance effectiveness of investigations. Section 43 of Prevention of Money Laundering Act 2002 PMLA says that the Central Government in consultation with the Chief Justice of the High Court shall for trial of offence punishable under Section 4 by notification designate one or more Courts of Session as Special Court or Special Courts for such area or areas or for such case or. An offence under PMLA 2002 or any of the scheduled offences. B Persons found guilty of an offence of Money Laundering are punishable with imprisonment for a term which shall not be less than three years but may extend up to seven years and shall also be liable to fine Section 4.

The Prevention Of Money Laundering Act 2002 Enforcement From slidetodoc.com

The Prevention Of Money Laundering Act 2002 Enforcement From slidetodoc.com

The Prevention of Money Laundering Act 2002 PMLA was passed by Parliament in the year 2002 and it was notified on 1-7-2005. Section 3 of PMLA act mentions the act of money laundering it doesnt talk about intention majorly. In relation to money laundering the PMLA does not specifically provide for a limitation period. Of Prevention of Money Laundering Act PMLA 2002. Adjudicating Authority exercises jurisdiction powers and authority conferred by or under the PMLA. The Government of India has enacted PML Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering.

1 In this Act unless the context otherwise requires a Adjudicating Authority means an Adjudicating Authority appointed under sub-section 1 of section 6.

In addition to the Provision of this section IPC section can also be applied to the offender. Limitation period under PMLA. Section 43 of Prevention of Money Laundering Act 2002 PMLA says that the Central Government in consultation with the Chief Justice of the High Court shall for trial of offence punishable under Section 4 by notification designate one or more Courts of Session as Special Court or Special Courts for such area or areas or for such case or. B Persons found guilty of an offence of Money Laundering are punishable with imprisonment for a term which shall not be less than three years but may extend up to seven years and shall also be liable to fine Section 4. C When the scheduled offence committed is under. The Prevention of Money Laundering Act 2002 PMLA was passed by Parliament in the year 2002 and it was notified on 1-7-2005.

Source: slideshare.net

Source: slideshare.net

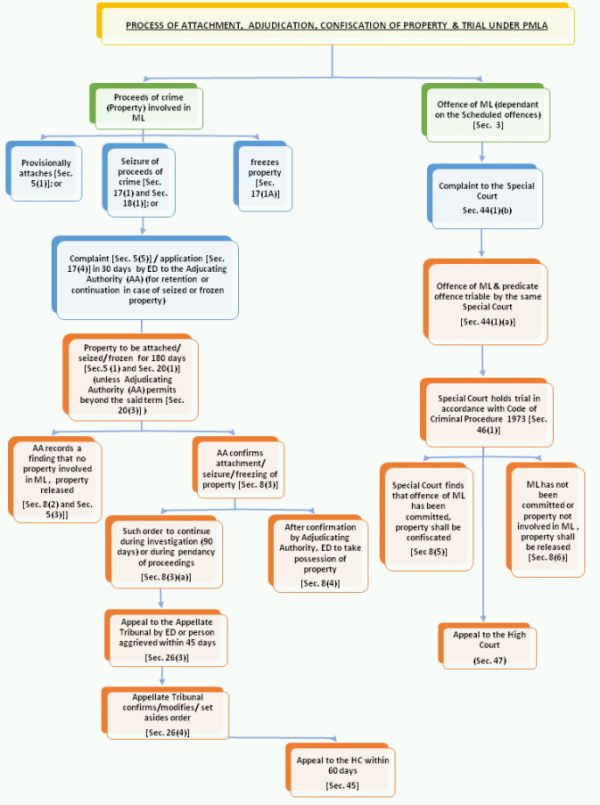

The Government of India has enacted PML Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering. 1 On receipt of a complaint under sub-section 5 of section 5 or applications made under sub-section 4 of section 17 or under sub-section 10 of section 18 if the Adjudicating Authority has reason to believe that any person has committed an 13 offence under. Limitation period under PMLA. Section 43 of Prevention of Money Laundering Act 2002 PMLA says that the Central Government in consultation with the Chief Justice of the High Court shall for trial of offence punishable under Section 4 by notification designate one or more Courts of Session as Special Court or Special Courts for such area or areas or for such case or. Section 8 in The Prevention of Money-Laundering Act 2002.

Source: civils360.com

Source: civils360.com

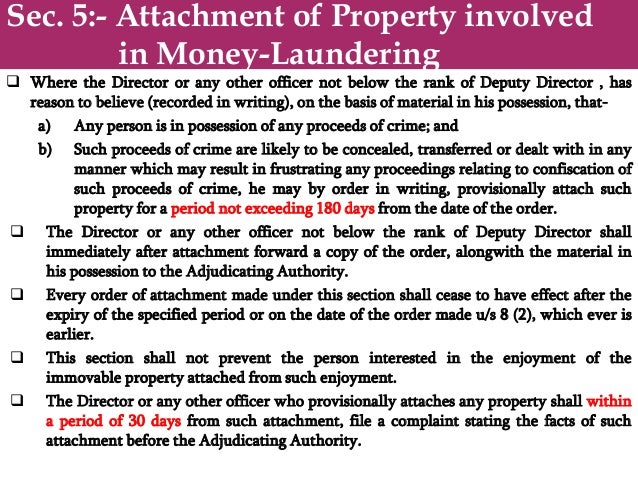

The section is proposed to be amended to include the period of stay in this time limit of 180 days and also further period of not more. 1 On receipt of a complaint under sub-section 5 of section 5 or applications made under sub-section 4 of section 17 or under sub-section 10 of section 18 if the Adjudicating Authority has reason to believe that any person has committed an 13 offence under. Limitation period under PMLA. B Appellate Tribunal means. Offence of money-laundering– Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.

Source: livelaw.in

Source: livelaw.in

In terms of sub-section 1 of section 6 of Preventions of Money Laundering Act 2002 an Adjudicating Authority under PMLA has been constituted to exercise jurisdiction powers and authority conferred by or under the said Act. An offence under PMLA 2002 or any of the scheduled offences. Offence of money laundering is defined us 3 of PMLA as follows. Prevention of Money-laundering Act 2002 PMLA. 5 Where on conclusion of a trial of an offence under this Act the Special Court finds that the offence of money-laundering has been committed it shall order that such property involved in the money-laundering or which has been used for commission of the offence of money-laundering shall stand confiscated to the Central Government.

Source: slidetodoc.com

Source: slidetodoc.com

The Government of India has enacted PML Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering. Section 43 of Prevention of Money Laundering Act 2002 PMLA says that the Central Government in consultation with the Chief Justice of the High Court shall for trial of offence punishable under Section 4 by notification designate one or more Courts of Session as Special Court or Special Courts for such area or areas or for such case or. Limitation period under PMLA. The section is proposed to be amended to include the period of stay in this time limit of 180 days and also further period of not more. B Persons found guilty of an offence of Money Laundering are punishable with imprisonment for a term which shall not be less than three years but may extend up to seven years and shall also be liable to fine Section 4.

Source: taxguru.in

Source: taxguru.in

The scheduled offences are divided into three parts Part A Part B Part C. The Directorate of Enforcement in the Department of Revenue Ministry of Finance is responsible for. Provided that a person who is under the age of sixteen years or is a woman or is sick and infirm or is accused either on his own or along with other co-accused of money-laundering a sum of less than one crore rupees may be released on bail if the Special Court so directs. In terms of sub-section 1 of section 6 of Preventions of Money Laundering Act 2002 an Adjudicating Authority under PMLA has been constituted to exercise jurisdiction powers and authority conferred by or under the said Act. An offence under PMLA 2002 or any of the scheduled offences.

Source: slidetodoc.com

Source: slidetodoc.com

Offence of money-laundering– Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering. Prevention of Money Laundering Act 2002 came into force with effect from July 1. The scheduled offences are divided into three parts Part A Part B Part C. 5 Where on conclusion of a trial of an offence under this Act the Special Court finds that the offence of money-laundering has been committed it shall order that such property involved in the money-laundering or which has been used for commission of the offence of money-laundering shall stand confiscated to the Central Government. B Persons found guilty of an offence of Money Laundering are punishable with imprisonment for a term which shall not be less than three years but may extend up to seven years and shall also be liable to fine Section 4.

Source: livelaw.in

Source: livelaw.in

Corporate frauds included as Scheduled offence. In terms of sub-section 1 of section 6 of Preventions of Money Laundering Act 2002 an Adjudicating Authority under PMLA has been constituted to exercise jurisdiction powers and authority conferred by or under the said Act. As a result the general criminal procedure law will apply. Offence of money-laundering– Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering. Adjudicating Authority exercises jurisdiction powers and authority conferred by or under the PMLA.

Source: mondaq.com

Source: mondaq.com

Prevention of Money-laundering Act 2002 PMLA. Offence of money laundering construed as an independent offence. 1 In this Act unless the context otherwise requires a Adjudicating Authority means an Adjudicating Authority appointed under sub-section 1 of section 6. The Directorate of Enforcement in the Department of Revenue Ministry of Finance is responsible for. In relation to money laundering the PMLA does not specifically provide for a limitation period.

Source: slidetodoc.com

Source: slidetodoc.com

Money laundering is a process where proceeds of crime generated out of scheduled offence. To strengthen the PMLA with respect to Corporate frauds. In addition to the Provision of this section IPC section can also be applied to the offender. Corporate frauds included as Scheduled offence. OFFENCE OF MONEY-LAUNDERING 3.

Source: legal.xpertxone.com

Source: legal.xpertxone.com

Adjudicating Authority exercises jurisdiction powers and authority conferred by or under the PMLA. Offence of money-laundering– Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering. Of Prevention of Money Laundering Act PMLA 2002. Measures to enhance effectiveness of investigations. In terms of sub-section 1 of section 6 of Preventions of Money Laundering Act 2002 an Adjudicating Authority under PMLA has been constituted to exercise jurisdiction powers and authority conferred by or under the said Act.

Source: mondaq.com

Source: mondaq.com

Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected proceeds of crime including its concealment possession acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of money-laundering. Prevention of Money Laundering Act 2002 came into force with effect from July 1. Section 3 of PMLA act mentions the act of money laundering it doesnt talk about intention majorly. The primary object of the Act is to make money laundering an offence and to attach the property involved in the money laundering. Section 8 in The Prevention of Money-Laundering Act 2002.

Source: slidetodoc.com

Source: slidetodoc.com

Money laundering is a process where proceeds of crime generated out of scheduled offence. The offences listed in the Schedule to the Prevention of Money Laundering Act 2002 are scheduled offences in terms of Section 2 1 y of the Act. 1 On receipt of a complaint under sub-section 5 of section 5 or applications made under sub-section 4 of section 17 or under sub-section 10 of section 18 if the Adjudicating Authority has reason to believe that any person has committed an 13 offence under. B Persons found guilty of an offence of Money Laundering are punishable with imprisonment for a term which shall not be less than three years but may extend up to seven years and shall also be liable to fine Section 4. In terms of sub-section 1 of section 6 of Preventions of Money Laundering Act 2002 an Adjudicating Authority under PMLA has been constituted to exercise jurisdiction powers and authority conferred by or under the said Act.

Source: slidetodoc.com

Source: slidetodoc.com

Section 3 of PMLA act mentions the act of money laundering it doesnt talk about intention majorly. Section 8 in The Prevention of Money-Laundering Act 2002. Offence of money laundering construed as an independent offence. Prevention of Money Laundering Act 2002 came into force with effect from July 1. Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected proceeds of crime including its concealment possession acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of money-laundering.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title offence of money laundering under pmla 2002 section by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.