18+ Occ money laundering risk assessment information

Home » money laundering Info » 18+ Occ money laundering risk assessment informationYour Occ money laundering risk assessment images are available in this site. Occ money laundering risk assessment are a topic that is being searched for and liked by netizens today. You can Find and Download the Occ money laundering risk assessment files here. Download all royalty-free photos.

If you’re looking for occ money laundering risk assessment pictures information connected with to the occ money laundering risk assessment topic, you have come to the ideal site. Our website always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

Occ Money Laundering Risk Assessment. 1 For more information on the OCCs Office of Innovation visit occgov then go to Topics and select Responsible Innovation. This booklet applies to the OCCs supervision of national banks and federal savings associations. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. AVP at a bank 293MUSA Info regarding the MLR is usually sent in late Oct or 1st week of Nov.

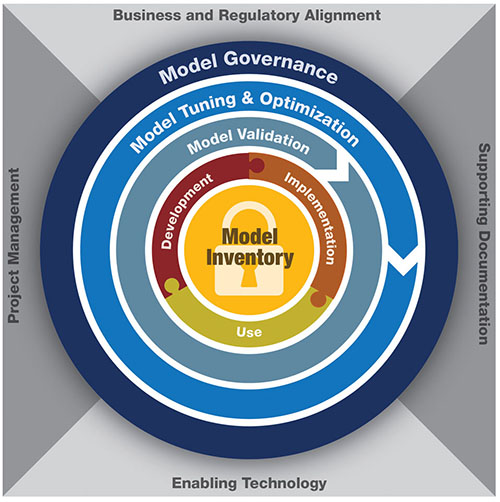

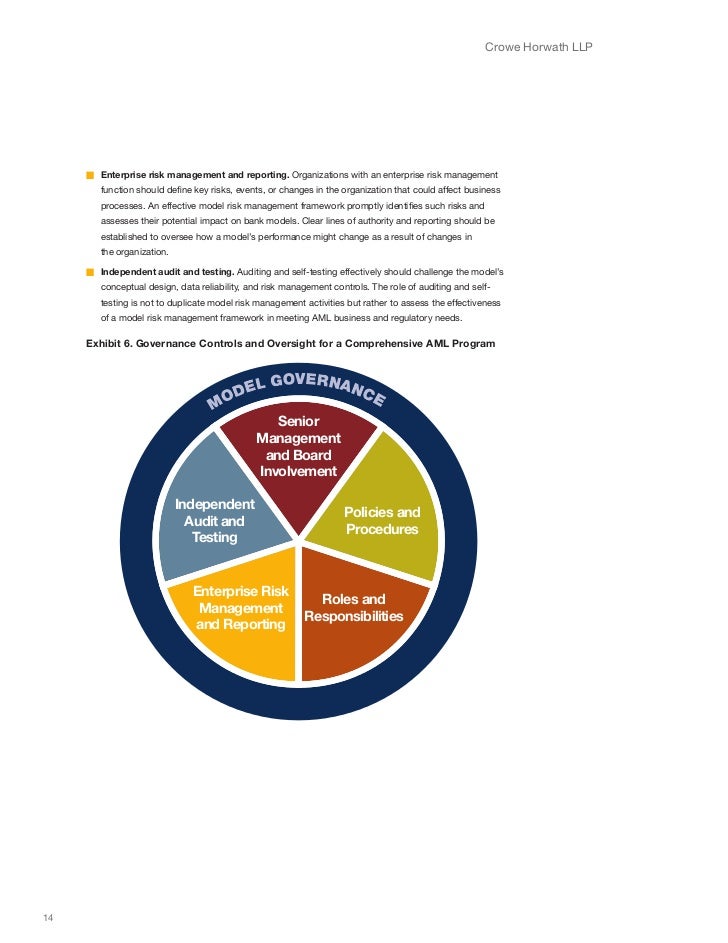

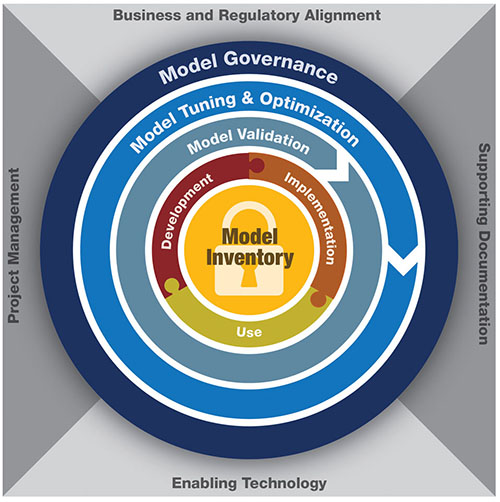

Effective Aml Model Risk Management For Financial Institutions The Six Critical Components Acams Today From acamstoday.org

Effective Aml Model Risk Management For Financial Institutions The Six Critical Components Acams Today From acamstoday.org

Although the OCC did not impose a monetary. Assessing the BSAAML Compliance Program. Safra Bank arising from the banks decision to accept a variety of high-risk Digital Asset Customers DACs allegedly without implementing the necessary Bank Secrecy Act BSA and Anti-Money Laundering AML controls. Cybersecurity and Money Laundering Threats are the Key Risks Facing Banks. DAntuono also referenced the National Money Laundering Risk Assessment authored by the Department of Treasury which observed that the use of legal entities constitute a significant money laundering risk especially when ownership trails lead overseas and involve numerous layers. Cover 100 of flood risk in Asia Pacific with RMS models and maps.

With conference calls regarding that years report being held later in Nov.

The OCC is issuing the Statement on Risk Management Associated With Money Services Businesses to provide clarification to national banks federal savings associations and federal branches and agencies of foreign banks on the agencys supervisory expectations with regard to offering banking services to money services businesses. AVP at a bank 293MUSA Info regarding the MLR is usually sent in late Oct or 1st week of Nov. National Money Laundering and Terrorist Financing Risk Assessments - The National Money Laundering Risk Assessment PDF identifies the money laundering risks that are of priority concern to the United States. Although the OCC did not impose a monetary. Cover 100 of flood risk in Asia Pacific with RMS models and maps. The Report focuses on issues that pose threats to those financial institutions regulated by the OCC and is intended to be used as a resource to by those financial institutions to address the key concerns identified by the OCC.

![]() Source: adiconsulting.com

Source: adiconsulting.com

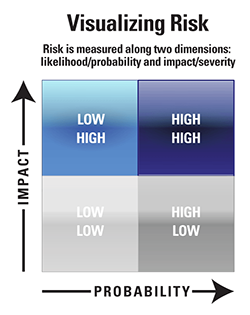

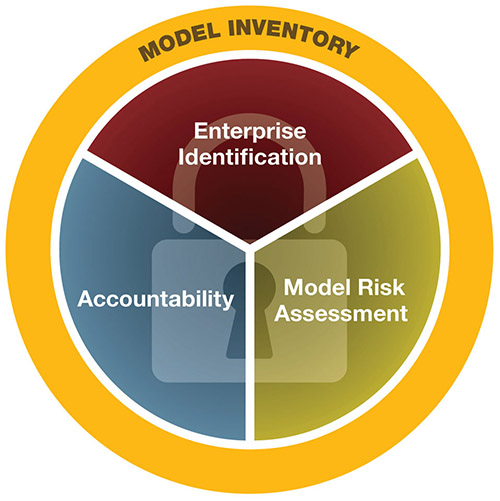

Cover 100 of flood risk in Asia Pacific with RMS models and maps. As BSA officers continue to enhance the rigor behind their risk assessment process regulators and practitioners are beginning to ask if risk assessments should be classified as models and thus held to the standards found in OCCs 2011-12 Model Risk Bulletin OCC. Moreover the assessment noted that US. This speaks to a comprehensive fraud risk assessment that includes data analysis demonstrating to management institutional leadership auditors and regulators a comprehensive view of the institutions fraud risk including losses and recoveries and how the institution mitigates that risk. Assessing the BSAAML Compliance Program.

Source: risk.net

Source: risk.net

Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. The Report focuses on issues that pose threats to those financial institutions regulated by the OCC and is intended to be used as a resource to by those financial institutions to address the key concerns identified by the OCC. With the advent of terrorists who employ money-laundering techniques to fund their operations the risk.

Source: slideshare.net

Source: slideshare.net

AVP at a bank 293MUSA Info regarding the MLR is usually sent in late Oct or 1st week of Nov. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. OCC Money Laundering Risk Assessment. Criminals have long used money laundering schemes to conceal or clean the source of fraudulently obtained or stolen funds. Last week the Office of the Comptroller of the Currency OCC published the Spring 2018 Semiannual Risk Perspective the Report which uses up-to-date data to identify risks to US.

Source: acamstoday.org

Source: acamstoday.org

In accordance with the OCCs risk-based supervision approach examiners use the core assessment in the Community Bank Supervision Federal Branches and Agencies Supervision or Large Bank Supervision booklets of the Comptrollers Handbook when evaluating the governance of community. Starting with last years reporting all data needed used to complete the PSCs needed to be verified. National Money Laundering and Terrorist Financing Risk Assessments - The National Money Laundering Risk Assessment PDF identifies the money laundering risks that are of priority concern to the United States. Money laundering poses significant risks to the safety and soundness of the US. Monday January 22 2018.

Source: researchgate.net

Source: researchgate.net

Banks and measure their compliance with applicable laws and regulations. Assessing the BSAAML Compliance Program. This booklet applies to the OCCs supervision of national banks and federal savings associations. National Money Laundering and Terrorist Financing Risk Assessments - The National Money Laundering Risk Assessment PDF identifies the money laundering risks that are of priority concern to the United States. And Developing Conclusions and Finalizing the Exam These revisions reflect the OCCs.

Source: acamstoday.org

Source: acamstoday.org

This booklet applies to the OCCs supervision of national banks and federal savings associations. The OCC also is giving Start Printed Page 44353 notice that it has submitted the collection to OMB. With the advent of terrorists who employ money-laundering techniques to fund their operations the risk. National Money Laundering and Terrorist Financing Risk Assessments - The National Money Laundering Risk Assessment PDF identifies the money laundering risks that are of priority concern to the United States. The purpose of the NMLRA is to explain the money laundering methods used in the United States the safeguards in place to address the threats and vulnerabilities that create money laundering opportunities and the residual risk.

Source: slideshare.net

Source: slideshare.net

The OCC is soliciting comment concerning its information collection entitled Bank Secrecy ActMoney Laundering Risk Assessment also known as the Money Laundering Risk MLR System. Assessing the BSAAML Compliance Program. Country risk is the risk that economic social and political conditions and events in a foreign country will affect the current or projected financial condition or resilience of a bank. Money laundering poses significant risks to the safety and soundness of the US. OCC Money Laundering Risk Assessment.

Source: acamstoday.org

Source: acamstoday.org

The Department of the Treasurys Office of the Comptroller of the Currency OCC recently issued a Consent Order against MY. The OCC also called for banks to address the compliance risks related to managing money laundering risks in an increasingly complex risk environment. The Report concluded that some of the OCCs primary concerns are with banks abilities to comply with the antimoney laundering AML laws and regulations as well as to manage risks. OCC Money Laundering Risk Assessment. The OCC is requiring the bank to conduct a comprehensive risk assessment of the groups customer relationships including the risk-rating methodology and the weighting of risk indicators such as account type volume of transactions and geographic region.

Source: acamstoday.org

Source: acamstoday.org

The Department of the Treasurys Office of the Comptroller of the Currency OCC recently issued a Consent Order against MY. The Federal Financial Institutions Examination Council FFIEC revised the following sections of the FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual. Country risk is the risk that economic social and political conditions and events in a foreign country will affect the current or projected financial condition or resilience of a bank. With the advent of terrorists who employ money-laundering techniques to fund their operations the risk. Cover 100 of flood risk in Asia Pacific with RMS models and maps.

Source: osr.2160pusiulize.pw

Source: osr.2160pusiulize.pw

September 23 2016. In accordance with the OCCs risk-based supervision approach examiners use the core assessment in the Community Bank Supervision Federal Branches and Agencies Supervision or Large Bank Supervision booklets of the Comptrollers Handbook when evaluating the governance of community. OCC Money Laundering Risk Assessment. The Department of the Treasurys Office of the Comptroller of the Currency OCC recently issued a Consent Order against MY. Starting with last years reporting all data needed used to complete the PSCs needed to be verified.

Source: pinterest.com

Source: pinterest.com

Cover 100 of flood risk in Asia Pacific with RMS models and maps. Safra Bank arising from the banks decision to accept a variety of high-risk Digital Asset Customers DACs allegedly without implementing the necessary Bank Secrecy Act BSA and Anti-Money Laundering AML controls. Assessing the BSAAML Compliance Program. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. As BSA officers continue to enhance the rigor behind their risk assessment process regulators and practitioners are beginning to ask if risk assessments should be classified as models and thus held to the standards found in OCCs 2011-12 Model Risk Bulletin OCC.

Source: youtube.com

Source: youtube.com

The OCC stated that. The OCC stated that. OCC Money Laundering Risk Assessment. Law enforcement agencies have no systematic way to obtain. 1 For more information on the OCCs Office of Innovation visit occgov then go to Topics and select Responsible Innovation.

Source: acamstoday.org

Source: acamstoday.org

A risk assessment is an important process that many consider critical to ensuring the health of a Bank Secrecy Act BSA program. Criminals have long used money laundering schemes to conceal or clean the source of fraudulently obtained or stolen funds. The Federal Financial Institutions Examination Council FFIEC revised the following sections of the FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual. The Report focuses on issues that pose threats to those financial institutions regulated by the OCC and is intended to be used as a resource to by those financial institutions to address the key concerns identified by the OCC. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title occ money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.