11++ Most common money laundering businesses ideas

Home » money laundering idea » 11++ Most common money laundering businesses ideasYour Most common money laundering businesses images are available in this site. Most common money laundering businesses are a topic that is being searched for and liked by netizens now. You can Get the Most common money laundering businesses files here. Download all royalty-free images.

If you’re searching for most common money laundering businesses pictures information linked to the most common money laundering businesses topic, you have come to the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

Most Common Money Laundering Businesses. These are among the most notorious money laundering operations of the past 100 years. What business is best for money. Today criminals have refined their tactics much further. A fraudster can attribute illegal income to an apparently legitimate business.

Common Money Laundering Schemes Houston Criminal Defense Attorneys From houstoncriminalfirm.com

Common Money Laundering Schemes Houston Criminal Defense Attorneys From houstoncriminalfirm.com

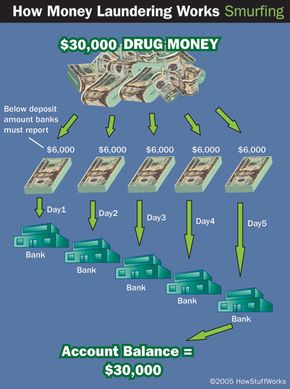

Similar to embezzlement trade-based laundering typically involves altering invoices or business documents in order to disguise dirty money as business profits. Organized crime often optimizes its tactics to transform the true source of its income. Most cases of laundering money take place via eCommerce platforms online games digital currencies and the like. Investing in real estate. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting. This type of business is usually set up so that it is difficult to monitor cash flow.

What business is best for money.

Most common Businesses used for Money Laundering The United Nations Office on Drugs and Crime found that 2 to 5 of global GDP is laundered every year. This type of business is usually set up so that it is difficult to monitor cash flow. Investing in other legitimate business interests. Today criminals have refined their tactics much further. Endgroup John Jun 8 17 at 2105. Most common Businesses used for Money Laundering The United Nations Office on Drugs and Crime found that 2 to 5 of global GDP is laundered every year.

Source: jagranjosh.com

Source: jagranjosh.com

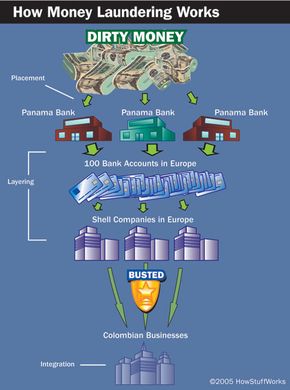

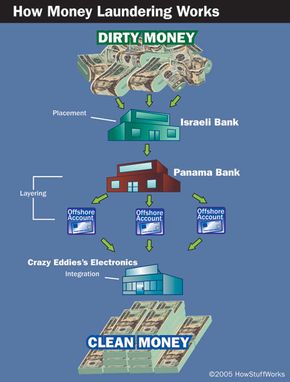

Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Similar to embezzlement trade-based laundering typically involves altering invoices or business documents in order to disguise dirty money as business profits. One of the most common ways to perform money laundering may be creating a shell company or business. The sources of the cash in precise are criminal and the money is invested in a means that makes it appear like. Endgroup John Jun 8 17 at 2105.

Source: bitquery.io

Source: bitquery.io

For example a barrestaurant receives about 50 of its sales payments in cash. The most common in terms of number of users would probably be pawn shops. Select an auditor who does not have the necessary level of independence and impartiality. Investing in real estate. While you might be aware of some of the more common money laundering techniques here is a detailed description of the methods of money laundering.

Source: iuricorn.com

Source: iuricorn.com

Cryptocurrencies like Bitcoin are looked upon by many with uncertainty as these assets arent centrally secured and are unregulated. Select an auditor who does not have the necessary level of independence and impartiality. The sources of the cash in precise are criminal and the money is invested in a means that makes it appear like. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting. Cash businesses such as bars and restaurants are favored.

Source: tookitaki.ai

Source: tookitaki.ai

Money can also be laundered through online auctions and sales gambling websites and even virtual gaming sites where ill-gotten money is converted into. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. The most common in terms of number of users would probably be pawn shops. Money can also be laundered through online auctions and sales gambling websites and even virtual gaming sites where ill-gotten money is converted into. But plenty get caught.

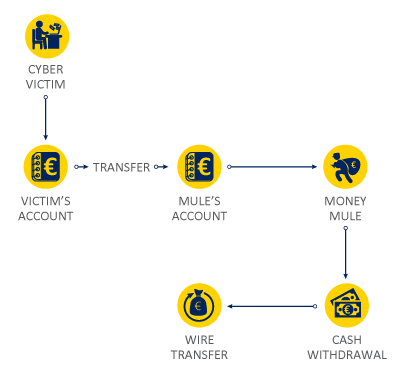

Source: europol.europa.eu

Source: europol.europa.eu

Cryptocurrencies like Bitcoin are looked upon by many with uncertainty as these assets arent centrally secured and are unregulated. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Because the money has a paper trail the bank does not suspect the profits as dirty However if your business documents show an unexplainable substantial profit increase the bank may see it as a red flag and investigate further. Cryptocurrencies like Bitcoin are looked upon by many with uncertainty as these assets arent centrally secured and are unregulated. Similar to embezzlement trade-based laundering typically involves altering invoices or business documents in order to disguise dirty money as business profits.

Some of the most common methods for this include. Four methods of money launderingcash smuggling casinos and other gambling venues insurance. Moving funds within the financial system generally only occurs with very large sums of money. Manipulated purchase and sale transactions Off shore financing Legitimate business front. Most Common Money Laundering Businesses.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Manipulated purchase and sale transactions Off shore financing Legitimate business front. Yes and banks are well aware. Most money laundering operations never make national headlines even when theyre detected by the authorities. Investing in real estate.

But plenty get caught. Most common money laundering. In the past the mafia bought automatic laundries to legalize the money they were making with their illegal activities. A fraudster can attribute illegal income to an apparently legitimate business. It is a global epidemic which starts with acquisition of illegal funds through criminal activities and conducted through banks and businesses.

Source: brittontime.com

Source: brittontime.com

The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. In the most common money laundering schemes the illegal funds are attributed to. Most common money laundering. Cash businesses such as bars and restaurants are favored. It is a process by which soiled money is transformed into clear cash.

Source: houstoncriminalfirm.com

Source: houstoncriminalfirm.com

HSBCs 19bn money-laundering settlement approved by US judge. It is a global epidemic which starts with acquisition of illegal funds through criminal activities and conducted through banks and businesses. The most common in terms of number of users would probably be pawn shops. But plenty get caught. Money can also be laundered through online auctions and sales gambling websites and even virtual gaming sites where ill-gotten money is converted into.

Cryptocurrencies like Bitcoin are looked upon by many with uncertainty as these assets arent centrally secured and are unregulated. In the most common money laundering schemes the illegal funds are attributed to. Today criminals have refined their tactics much further. For example a barrestaurant receives about 50 of its sales payments in cash. This is usually the result primarily of business or other relationships that may exist between the organization providing the audit service.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Many perpetrators successfully evade accountability. While you might be aware of some of the more common money laundering techniques here is a detailed description of the methods of money laundering. Cryptocurrencies like Bitcoin are looked upon by many with uncertainty as these assets arent centrally secured and are unregulated. In the most common money laundering schemes the illegal funds are attributed to. Many perpetrators successfully evade accountability.

Most Common Money Laundering Businesses. A fraudster can attribute illegal income to an apparently legitimate business. From Bonatti Compliance they highlight the four most common mistakes businesses typically make when selecting outside experts in money laundering prevention. Investing in real estate. Manipulated purchase and sale transactions Off shore financing Legitimate business front.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title most common money laundering businesses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.