18++ Money market placement definition info

Home » money laundering idea » 18++ Money market placement definition infoYour Money market placement definition images are available in this site. Money market placement definition are a topic that is being searched for and liked by netizens today. You can Get the Money market placement definition files here. Find and Download all royalty-free vectors.

If you’re searching for money market placement definition images information connected with to the money market placement definition topic, you have come to the right blog. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

Money Market Placement Definition. They get and give loan or purchase and sell short terms bill in this market. Qualifying Money Market Funds were first defined in MiFID although money market funds as such have been available for decades. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. Securities and other short term loans.

Nice And Simple Graph Depicting The 4 P S Of Marketing Marketing Product Price Promotion Placement What Is Marketing Marketing Definition Marketing From pinterest.com

Nice And Simple Graph Depicting The 4 P S Of Marketing Marketing Product Price Promotion Placement What Is Marketing Marketing Definition Marketing From pinterest.com

The advantage of a placing is that it is a cheap and simple method of raising money. Money market mainly used by the people who wants to do borrowing and lending normally for the short term maturities. They get and give loan or purchase and sell short terms bill in this market. Money market instruments are securities that provide businesses banks and the government with large amounts of low-cost capital for a short time. The financial markets meet longer-term cash needs. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos.

Unlike a rights issue a placing of shares is not an offer to existing shareholders.

The money market is an organized exchange market where participants can lend and borrow short-term high-quality debt securities with average maturities of one year or less. It enables governments banks and other large institutions to sell short-term securities to fund their short-term cash flow. MM means a marketplace where highly liquid short-term securities and debt instruments are traded by bank and financial institutions. The money market is used for one to invest money to make more money. Unlike a rights issue a placing of shares is not an offer to existing shareholders. A placement is the sale of securities to a small number of private investors that is exempt from registration with the Securities and Exchange Commission under Regulation.

Source: pinterest.com

Source: pinterest.com

MM means a marketplace where highly liquid short-term securities and debt instruments are traded by bank and financial institutions. Qualifying Money Market Funds were first defined in MiFID although money market funds as such have been available for decades. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. Unlike a rights issue a placing of shares is not an offer to existing shareholders. The money market is an organized exchange market where participants can lend and borrow short-term high-quality debt securities with average maturities of one year or less.

Source: ar.pinterest.com

Source: ar.pinterest.com

Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers. The advantage of a placing is that it is a cheap and simple method of raising money. Money market usually means lending and borrowing for a shorter period of time or we can say that for less than a year examples of money market are t bills commercial papers repurchase agreements etc What is a money market placement. Securities and other short term loans. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers.

Source: forbes.com

Source: forbes.com

Unlike a rights issue a placing of shares is not an offer to existing shareholders. Money market basically refers to a section of the financial market where financial instruments with high liquidity and short-term maturities are traded. They get and give loan or purchase and sell short terms bill in this market. The money market is used for one to invest money to make more money. The advantage of a placing is that it is a cheap and simple method of raising money.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The financial markets meet longer-term cash needs. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos. The period is overnight or a few days weeks or even months but always less than a year. The money market is used by ABC treasury as a means for borrowing and lending in the short term from several days to just under a year. The advantage of a placing is that it is a cheap and simple method of raising money.

Source: youtube.com

Source: youtube.com

Money Market Placement of Deposits. The financial markets meet longer-term cash needs. A money market account is a type of account that tends to offer a higher interest rate than traditional savings accounts. A placing called a placement in the US is the issue of new securities which are sold directly to holders usually institutions. The money market is what helps the economy to grow and prosper by one being interested to.

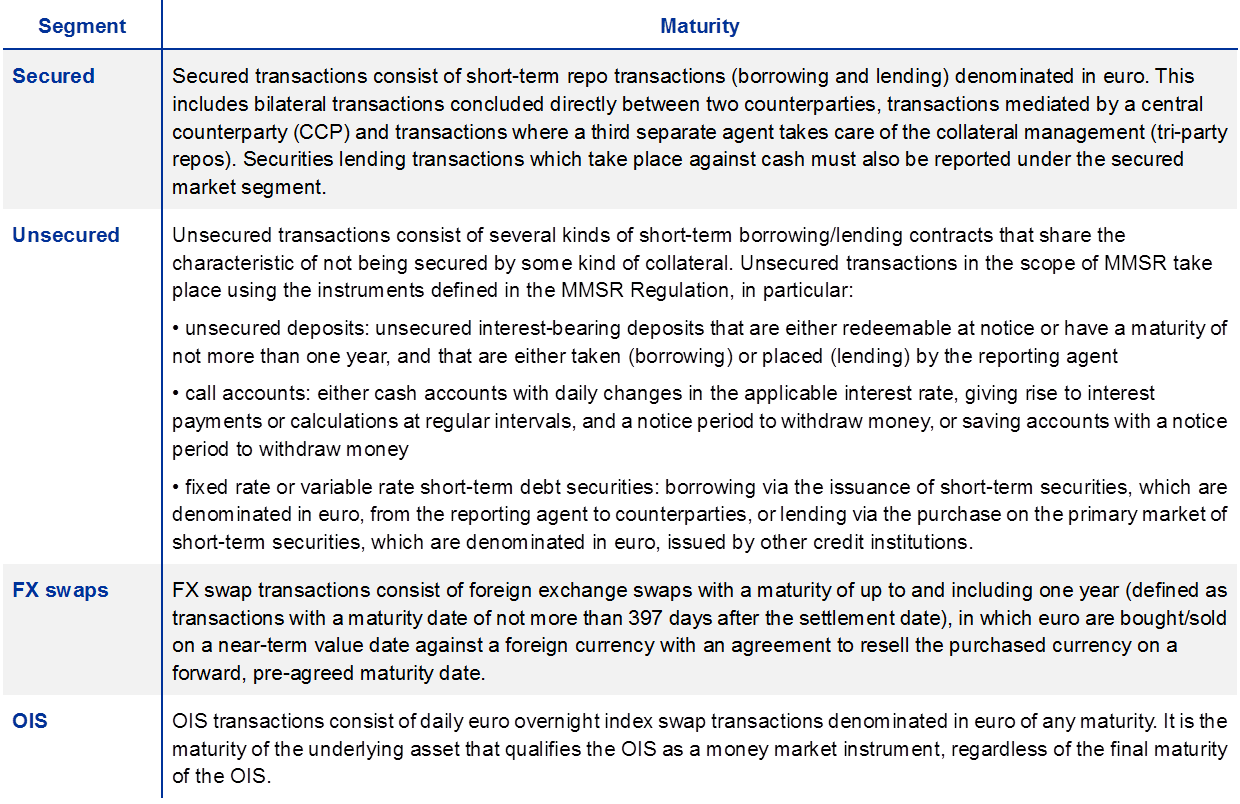

Source: ecb.europa.eu

Source: ecb.europa.eu

A money market account is a type of account that tends to offer a higher interest rate than traditional savings accounts. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos. It enables governments banks and other large institutions to sell short-term securities to fund their short-term cash flow. The main dealers of money markets are the banks and financial institutions. The advantage of a placing is that it is a cheap and simple method of raising money.

Source: pinterest.com

Source: pinterest.com

They get and give loan or purchase and sell short terms bill in this market. The money market is what helps the economy to grow and prosper by one being interested to. The money market is used for one to invest money to make more money. A money market account is a high-interest savings account that also shares some features with checking accounts. MM means a marketplace where highly liquid short-term securities and debt instruments are traded by bank and financial institutions.

Source: pinterest.com

Source: pinterest.com

Money market mainly used by the people who wants to do borrowing and lending normally for the short term maturities. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. Unlike a rights issue a placing of shares is not an offer to existing shareholders. The money market is what helps the economy to grow and prosper by one being interested to. It enables governments banks and other large institutions to sell short-term securities to fund their short-term cash flow.

Source: in.pinterest.com

Source: in.pinterest.com

The period is overnight or a few days weeks or even months but always less than a year. Money market placements shall include investments in debt instruments including purchase of receivables with recourse to the lending institution except purchase of. Money Market Placement of Deposits. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. What is the Money Market.

It enables governments banks and other large institutions to sell short-term securities to fund their short-term cash flow. Simply to any suitable buyers who can be found. Money Market Placement of Deposits. If you have enough cash on hand to open one it can be a useful savings tool that allows limited access to your funds while earning more interest than a traditional savings account. The money market is an organized exchange market where participants can lend and borrow short-term high-quality debt securities with average maturities of one year or less.

Source: pinterest.com

Source: pinterest.com

Definition of Money market What is it. Money market is a market where financial instruments with high liquidity and very short maturities are traded. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers. Money market placements shall include investments in debt instruments including purchase of receivables with recourse to the lending institution except purchase of. The main dealers of money markets are the banks and financial institutions.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

A money market account is a type of account that tends to offer a higher interest rate than traditional savings accounts. Money market usually means lending and borrowing for a shorter period of time or we can say that for less than a year examples of money market are t bills commercial papers repurchase agreements etc What is a money market placement. Place client money in MMDs as an alternative to depositing client money in a bank account and must obtain an acknowledgement letter from the counterparty bank with whom the MMD has been placed in line with the provisions of CASS 781R when placing client money in an MMD. The money market is what helps the economy to grow and prosper by one being interested to. The period is overnight or a few days weeks or even months but always less than a year.

Source: investopedia.com

Source: investopedia.com

Definition of money market Money market is the centre of dealing in short term monetary assets like bill of exchange short term govt. They get and give loan or purchase and sell short terms bill in this market. Unlike a rights issue a placing of shares is not an offer to existing shareholders. The main dealers of money markets are the banks and financial institutions. Money Market Placement of Deposits.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money market placement definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.