17+ Money market placement classification information

Home » money laundering Info » 17+ Money market placement classification informationYour Money market placement classification images are available. Money market placement classification are a topic that is being searched for and liked by netizens today. You can Download the Money market placement classification files here. Find and Download all free vectors.

If you’re looking for money market placement classification images information related to the money market placement classification interest, you have pay a visit to the right blog. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Money Market Placement Classification. Classification of Exchange Rate Arrangements and Monetary Policy Frameworks 1 Data as of June 30 2004. Trading in money markets is done over the counter and is wholesale. IMMFA represents the institutional money market fund industry that sponsors and promotes funds based on providing a constant Net Asset Value per share to investors. The first stage in the process is placement.

Key Differences Between Mutual Funds Ulips Features Mfs Vs Ulips Mutuals Funds Investing Budgeting From pinterest.com

Key Differences Between Mutual Funds Ulips Features Mfs Vs Ulips Mutuals Funds Investing Budgeting From pinterest.com

Area time transactions regulation and volume of business nature of goods and nature of competition demand and supply conditions. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents. GAAP there may be circumstances such as instability in the financial markets and defaults on underlying securities where the money market fund may not be highly liquid and may not meet the criteria to be classified as a cash equivalent. The money market is a market for short-term financial assets that are close substitutes of money. Trading in money markets is done over the counter and is wholesale.

Trading in money markets is done over the counter and is wholesale.

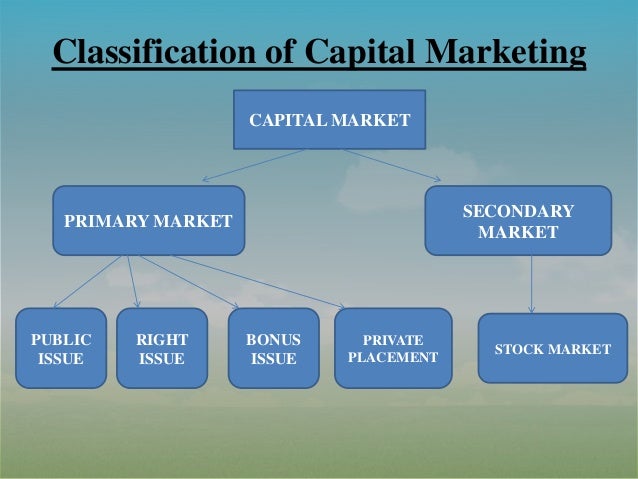

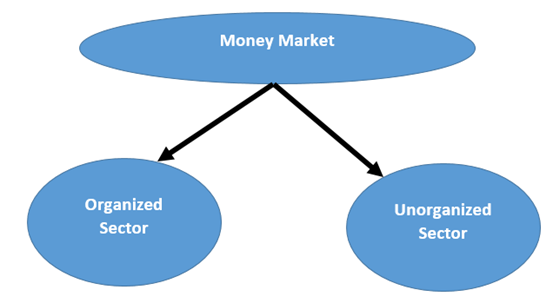

The money market is a component of the economy which provides short-term funds. There are several money market. Methods and Markets 25 Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers. Money market is a part of a larger financial market which consists of numerous smaller sub-markets like bill market acceptance market call money market etc.

Source: learncbse.in

Source: learncbse.in

Money market is a part of a larger financial market which consists of numerous smaller sub-markets like bill market acceptance market call money market etc. Area time transactions regulation and volume of business nature of goods and nature of competition demand and supply conditions. The money market is a market for short-term financial assets that are close substitutes of money. Access A money market account may be a good choice if you need access to your cash periodically but on a less frequent basis than a standard checking account. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers.

Source: pinterest.com

Source: pinterest.com

The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents. The most important feature of a money market instrument is that it is liquid and can be turned into money quickly at low cost and provides an avenue for equilibrating the short-term surplus funds of lenders and the requirements of borrowers. Area time transactions regulation and volume of business nature of goods and nature of competition demand and supply conditions. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. The money market deals in short-term loans generally for a period of a year or less.

Source: pinterest.com

Source: pinterest.com

The placement stage involves the phys-. Access A money market account may be a good choice if you need access to your cash periodically but on a less frequent basis than a standard checking account. The first stage in the process is placement. GAAP there may be circumstances such as instability in the financial markets and defaults on underlying securities where the money market fund may not be highly liquid and may not meet the criteria to be classified as a cash equivalent. The money market is a component of the economy which provides short-term funds.

Source: superheuristics.com

Source: superheuristics.com

The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents. IMMFA represents the institutional money market fund industry that sponsors and promotes funds based on providing a constant Net Asset Value per share to investors. There are several money market. The money market is a market for short-term financial assets that are close substitutes of money. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents.

Source:

In practical terms this means offering an investment product that without guaranteeing a result expects to return 1 plus yield calculated daily for each 1 invested. Money market basically refers to a section of the financial market where financial instruments with high liquidity and short-term maturities are traded. Markets can be classified on different bases of which most common bases are. Methods and Markets 25 Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. The money market deals in short-term loans generally for a period of a year or less.

Source: learncbse.in

Source: learncbse.in

Typically time deposit accounts especially those held for longer terms pay a higher rate of interest than money market accounts. This classification system is based on members actual de facto arrangements as identified by IMF staff which may differ from their officially announced arrangements. Requirements for the classification of investments in money market funds under US. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. You can make withdrawals by writing a check withdrawing from an ATM or transferring money online.

Source: slideshare.net

Source: slideshare.net

Requirements for the classification of investments in money market funds under US. The most important feature of a money market instrument is that it is liquid and can be turned into money quickly at low cost and provides an avenue for equilibrating the short-term surplus funds of lenders and the requirements of borrowers. IMMFA represents the institutional money market fund industry that sponsors and promotes funds based on providing a constant Net Asset Value per share to investors. The money market deals in short-term loans generally for a period of a year or less. A money market fund is a kind of mutual fund that invests in highly liquid near-term instruments.

Source: superheuristics.com

Source: superheuristics.com

Besides the money market deals are not out in money cash but other instruments like trade bills government papers promissory notes etc. Besides the money market deals are not out in money cash but other instruments like trade bills government papers promissory notes etc. GAAP there may be circumstances such as instability in the financial markets and defaults on underlying securities where the money market fund may not be highly liquid and may not meet the criteria to be classified as a cash equivalent. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. The money market is a market for short-term financial assets that are close substitutes of money.

Source: civilserviceindia.com

Source: civilserviceindia.com

A money market account is a current asset unless it is restricted for a long-term purpose. The money market deals in short-term loans generally for a period of a year or less. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers. Methods and Markets 25 Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. Classification of Exchange Rate Arrangements and Monetary Policy Frameworks 1 Data as of June 30 2004.

Source: elibrary.imf.org

Source: elibrary.imf.org

Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers. There are several money market. Besides the money market deals are not out in money cash but other instruments like trade bills government papers promissory notes etc. Trading in money markets is done over the counter and is wholesale. The money market deals in short-term loans generally for a period of a year or less.

Source: pinterest.com

Source: pinterest.com

A money market account is a current asset unless it is restricted for a long-term purpose. The placement stage involves the phys-. This classification system is based on members actual de facto arrangements as identified by IMF staff which may differ from their officially announced arrangements. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. These instruments include cash cash equivalent securities and high-credit-rating debt-based.

Source: pinterest.com

Source: pinterest.com

A money market account is a current asset unless it is restricted for a long-term purpose. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less such as treasury bills and commercial papers. Requirements for the classification of investments in money market funds under US. As short-term securities became a commodity the money market became a component of the financial market for assets involved in short-term borrowing lending buying and selling with original maturities of one year or less. The money market is a market for short-term financial assets that are close substitutes of money.

Source: pinterest.com

Source: pinterest.com

There are several money market. Markets can be classified on different bases of which most common bases are. You can make withdrawals by writing a check withdrawing from an ATM or transferring money online. A money market account is a current asset unless it is restricted for a long-term purpose. The placement stage involves the phys-.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money market placement classification by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.