12+ Money market placement and borrowing info

Home » money laundering Info » 12+ Money market placement and borrowing infoYour Money market placement and borrowing images are available. Money market placement and borrowing are a topic that is being searched for and liked by netizens today. You can Download the Money market placement and borrowing files here. Get all royalty-free photos and vectors.

If you’re searching for money market placement and borrowing pictures information connected with to the money market placement and borrowing interest, you have pay a visit to the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

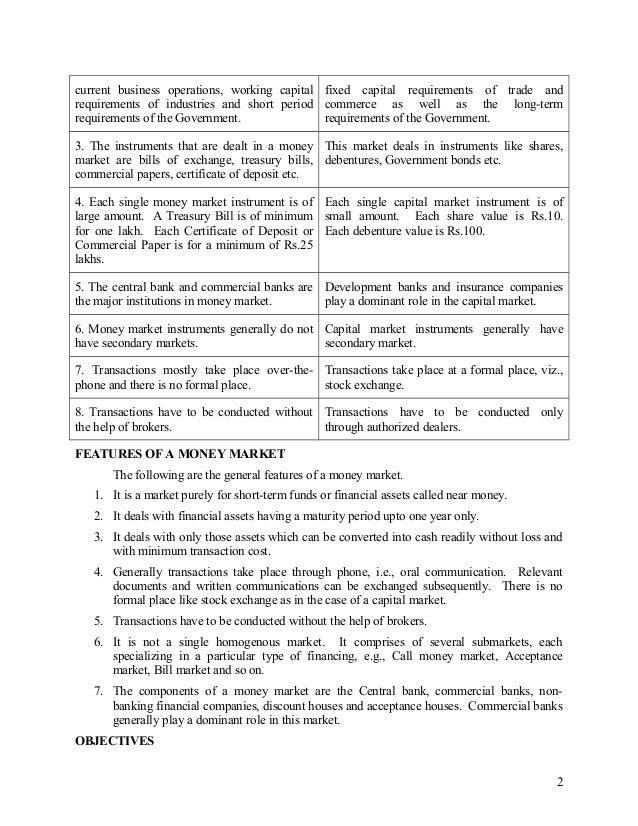

Money Market Placement And Borrowing. The main function of the market is to redistribute the pool of day-to-day surplus funds of banks among other banks in temporary deficit of cash. Money Market Borrowing means a Revolving Credit Borrowing if the advances under such borrowing bear or are to bear interest at a Money Market Rate. Money Market Account MMA MMA is a product of customer funds in rupiah or USD with a minimum term of one day overnight and a maximum of one year. Money market usually means lending and borrowing for a shorter period of time or we can say that for less than a year examples of money market are t bills commercial papers repurchase agreements etc What is a money market placement.

6 Money Markets Money Market Securities Individuals Businesses Govts May Have Excess Funds To Invest But Only For A Short Period Of Time Wwu Temporarily Ppt Download From slideplayer.com

6 Money Markets Money Market Securities Individuals Businesses Govts May Have Excess Funds To Invest But Only For A Short Period Of Time Wwu Temporarily Ppt Download From slideplayer.com

In addition to the exposure limits there is also a regulatory limit on the amount a Bank can lend and borrow in the callnotice money market. It enables governments banks and other large institutions to sell short-term securities Public Securities Public securities or marketable securities are investments that are openly or easily traded in a market. Basically the money market is the global financial market for short-term borrowing and lending and provides short term liquid funding for the global financial system. Money markets and complex financial instruments. The money market is used by ABC treasury as a means for borrowing and lending in the short term from several days to just under a year. Upon completion of this chapter you will be able to.

One consequence of the financial crisis has been to focus attention on the differences among various segments of money markets because some proved to be fragile whereas others exhibited a good deal of resilience.

In addition to the exposure limits there is also a regulatory limit on the amount a Bank can lend and borrow in the callnotice money market. Money market transactions are mainly happens in large amount which takes place between the companies and different financial institutions rather than the individuals. These institutions can borrow money by selling money market instruments and finance their short-term needs. Money Market Borrowing means a Revolving Credit Borrowing if the advances under such borrowing bear or are to bear interest at a Money Market Rate. On the other hand the capital market is also a component of the financial market that allows long term trading of equity and debt securities. This limit denotes the maximum amount the lender would lend to a specified borrower.

Source: slideplayer.com

Source: slideplayer.com

This limit denotes the maximum amount the lender would lend to a specified borrower. Money markets deal in short term lending borrowing buying and selling. The main function of the market is to redistribute the pool of day-to-day surplus funds of banks among other banks in temporary deficit of cash. These institutions can borrow money by selling money market instruments and finance their short-term needs. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos.

Source: slideplayer.com

Source: slideplayer.com

A money market fund is not the same as a money market account at a bank or credit union. Money market usually means lending and borrowing for a shorter period of time or we can say that for less than a year examples of money market are t bills commercial papers repurchase agreements etc What is a money market placement. One consequence of the financial crisis has been to focus attention on the differences among various segments of money markets because some proved to be fragile whereas others exhibited a good deal of resilience. The period is overnight or a few days weeks or even months but always less than a year. Money markets deal in short term lending borrowing buying and selling.

Source: slideshare.net

Source: slideshare.net

Money markets and complex financial instruments. These institutions can borrow money by selling money market instruments and finance their short-term needs. This limit denotes the maximum amount the lender would lend to a specified borrower. The call money market operates through brokers who keen in constant touch with banks in the city and bring the borrowing and lending banks together. Money markets deal in short term lending borrowing buying and selling.

Source: slideplayer.com

Source: slideplayer.com

The call money market operates through brokers who keen in constant touch with banks in the city and bring the borrowing and lending banks together. Money market instruments are securities that provide businesses banks and the government with large amounts of low-cost capital for a short time. Customers can take advantage of idle funds in a very short period of time starting from one day overnight. The money market is an organized exchange market where participants can lend and borrow short-term high-quality debt securities with average maturities of one year or less. Upon completion of this chapter you will be able to.

Source: slideshare.net

Source: slideshare.net

On the other hand the capital market is also a component of the financial market that allows long term trading of equity and debt securities. The money market is used by ABC treasury as a means for borrowing and lending in the short term from several days to just under a year. Money Market Borrowing means a Borrowing comprised of Money Market Loans. One consequence of the financial crisis has been to focus attention on the differences among various segments of money markets because some proved to be fragile whereas others exhibited a good deal of resilience. These institutions can borrow money by selling money market instruments and finance their short-term needs.

Source: slideplayer.com

Source: slideplayer.com

The money markets are a collection of markets each trading a distinctly different financial instrument in a central exchange market. The term money market is an umbrella that covers several market types which vary according to the needs of the lenders and borrowers. Money Market Account MMA MMA is a product of customer funds in rupiah or USD with a minimum term of one day overnight and a maximum of one year. Explain the role of the money markets in providing short-term trade finance. The interbank call money market is a short-term money market which allows for large financial institutions such as banks mutual funds and corporations to borrow and lend money at interbank.

Source: slideplayer.com

Source: slideplayer.com

Money market mainly used by the people who wants to do borrowing and lending normally for the short term maturities. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos. One consequence of the financial crisis has been to focus attention on the differences among various segments of money markets because some proved to be fragile whereas others exhibited a good deal of resilience. Money market transactions are mainly happens in large amount which takes place between the companies and different financial institutions rather than the individuals. Money market usually means lending and borrowing for a shorter period of time or we can say that for less than a year examples of money market are t bills commercial papers repurchase agreements etc What is a money market placement.

Source: slideplayer.com

Source: slideplayer.com

The placement of moneylending in the callnotice money market is unsecured. Money Market Account MMA MMA is a product of customer funds in rupiah or USD with a minimum term of one day overnight and a maximum of one year. Money Market Borrowing means a Revolving Credit Borrowing if the advances under such borrowing bear or are to bear interest at a Money Market Rate. On the other hand the capital market is also a component of the financial market that allows long term trading of equity and debt securities. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos.

Source: elibrary.imf.org

Source: elibrary.imf.org

Customers can take advantage of idle funds in a very short period of time starting from one day overnight. Money market transactions are mainly happens in large amount which takes place between the companies and different financial institutions rather than the individuals. On the other hand the capital market is also a component of the financial market that allows long term trading of equity and debt securities. The money market is the component of a financial market that deals with short term borrowings. This limit denotes the maximum amount the lender would lend to a specified borrower.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Money Market Borrowing means a Revolving Credit Borrowing if the advances under such borrowing bear or are to bear interest at a Money Market Rate. It enables governments banks and other large institutions to sell short-term securities Public Securities Public securities or marketable securities are investments that are openly or easily traded in a market. Money markets and complex financial instruments. Money market transactions are mainly happens in large amount which takes place between the companies and different financial institutions rather than the individuals. Money Market Placement of Deposits.

Source: youtube.com

Source: youtube.com

Basically the money market is the global financial market for short-term borrowing and lending and provides short term liquid funding for the global financial system. The money market is an organized exchange market where participants can lend and borrow short-term high-quality debt securities with average maturities of one year or less. Explain the role of the money markets in providing short-term liquidity to industry and the public sector. The term money market is an umbrella that covers several market types which vary according to the needs of the lenders and borrowers. The call money market operates through brokers who keen in constant touch with banks in the city and bring the borrowing and lending banks together.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

As a prudential measure therefore each lender fixes a placementcounterparty exposure for each borrower. The call money market operates through brokers who keen in constant touch with banks in the city and bring the borrowing and lending banks together. The money markets are a collection of markets each trading a distinctly different financial instrument in a central exchange market. Money markets deal in short term lending borrowing buying and selling. This limit denotes the maximum amount the lender would lend to a specified borrower.

Source: slideplayer.com

Source: slideplayer.com

Upon completion of this chapter you will be able to. One consequence of the financial crisis has been to focus attention on the differences among various segments of money markets because some proved to be fragile whereas others exhibited a good deal of resilience. As a prudential measure therefore each lender fixes a placementcounterparty exposure for each borrower. The money markets are a collection of markets each trading a distinctly different financial instrument in a central exchange market. Explain the role of the money markets in providing short-term trade finance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money market placement and borrowing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.