16++ Money market placement accounting treatment info

Home » money laundering idea » 16++ Money market placement accounting treatment infoYour Money market placement accounting treatment images are ready in this website. Money market placement accounting treatment are a topic that is being searched for and liked by netizens today. You can Download the Money market placement accounting treatment files here. Find and Download all royalty-free vectors.

If you’re searching for money market placement accounting treatment pictures information connected with to the money market placement accounting treatment topic, you have come to the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

Money Market Placement Accounting Treatment. Money Market Funds. Determine the current market value of the commodity. A Imprest fund system b Fluctuating fund system Summary of journal entries. The Securities and Exchange Commission issued a statement clarifying the accounting treatment for money market mutual funds amid the growing turmoil in the financial markets.

5 Stocks Flows And Accounting Rules In Monetary And Financial Statistics Manual And Compilation Guide From elibrary.imf.org

5 Stocks Flows And Accounting Rules In Monetary And Financial Statistics Manual And Compilation Guide From elibrary.imf.org

This Financial Reporting Alert addresses the investors accounting for money market funds that were appropriately classified as cash equivalents and that have subsequently imposed restrictions on redemptions or have been frozen. Money market funds allow individual investors to. If this is applied to money market instruments any discount surplus initially paid over par face value is gradually added to taken off the value of the instrument over time. Enter the value of the money market fund and add to the value of the other current assets. Determine the current market value of the commodity. Yes your money is safe in a money market account.

Yes your money is safe in a money market account.

Accounts through banks are FDIC-insured up to 250000 per depositor per account ownership category like other bank accounts. The Securities and Exchange Commission issued a statement clarifying the accounting treatment for money market mutual funds amid the growing turmoil in the financial markets. Amortisation is an accounting technique which diminishes the value of an asset in a gradual manner over time. They are not suitable as long-term investments. This is its value on the date of the physical exchange between the buyer and seller. They are widely used by corporate treasurers and therefore their treatment under IAS 7 is important to many treasurers.

Source: elibrary.imf.org

Source: elibrary.imf.org

The use of amortised cost accounting by money market funds amortised cost then the fair value per share will deteriorate as a consequence of the redemption at the expense of remaining investors and potentially to the point where a CNAV fund will no longer be. Money market funds allow individual investors to. If using paper and pencil add a line for money market fund under the last item in the current assets list. Enter the value of the money market fund and add to the value of the other current assets. The Commission also asked whether an investment in a money market fund that combines a floating NAV with liquidity fees and gates would continue to be treated as a cash equivalent under US.

Source: learncbse.in

Source: learncbse.in

Money market funds allow individual investors to. They are not suitable as long-term investments. This is its value on the date of the physical exchange between the buyer and seller. Money market funds allow individual investors to. A money market account is a current asset unless it is restricted for a long-term purpose.

Source: elibrary.imf.org

Source: elibrary.imf.org

Participants in this market use it to borrow and invest for short periods of time. Then credit or decrease your Asset account by the current market value of the commodity. Yes your money is safe in a money market account. Treasury regulations issued Thursday finalize proposed rules for a simplified method of accounting for gains and losses on shares in money market funds MMFs and provide rules for information reporting of these amounts. Participants in this market use it to borrow and invest for short periods of time.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

The use of amortised cost accounting by money market funds amortised cost then the fair value per share will deteriorate as a consequence of the redemption at the expense of remaining investors and potentially to the point where a CNAV fund will no longer be. Next debit or increase your cash account by the forward rate. The Commission also asked whether an investment in a money market fund that combines a floating NAV with liquidity fees and gates would continue to be treated as a cash equivalent under US. Gain or Loss on Available-for-Sale Securities. Accounting for Petty Cash Fund.

Source: elibrary.imf.org

Source: elibrary.imf.org

Money market funds allow individual investors to. Money market funds allow individual investors to. If you stash some of your savings in money market funds you probably take for granted that the share price is always 1. MMFs are equity investments that generally seek to give investors short-term stable low-risk returns while maintaining a stable net asset value NAV. Money Market Funds.

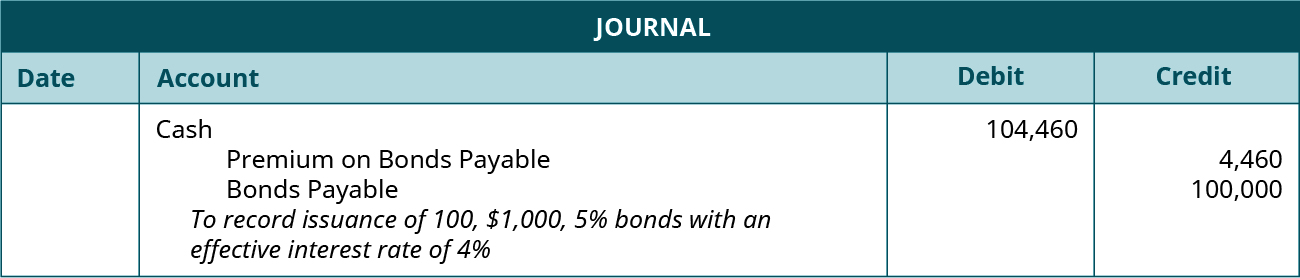

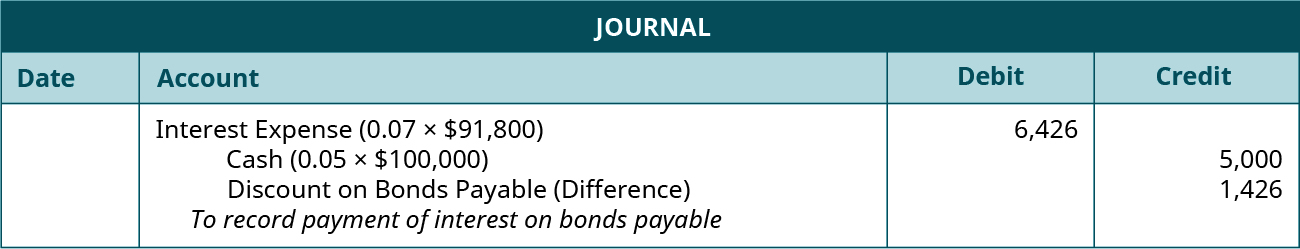

Source: opentextbc.ca

Source: opentextbc.ca

Money Market Funds. Money market funds allow individual investors to. Statutory accounting framework currently exist. A Imprest fund system b Fluctuating fund system Summary of journal entries. Accounts through banks are FDIC-insured up to 250000 per depositor per account ownership category like other bank accounts.

Source: opentextbc.ca

Source: opentextbc.ca

Place client money in MMDs as an alternative to depositing client money in a bank account and must obtain an acknowledgement letter from the counterparty bank with whom the MMD has been placed in line with the provisions of CASS 781R when placing client money in an MMD. They are not suitable as long-term investments. Amortisation is an accounting technique which diminishes the value of an asset in a gradual manner over time. They are widely used by corporate treasurers and therefore their treatment under IAS 7 is important to many treasurers. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents.

MMFs are equity investments that generally seek to give investors short-term stable low-risk returns while maintaining a stable net asset value NAV. Generally accepted accounting principles US. Statutory accounting framework currently exist. They are not suitable as long-term investments. The money market is the marketplace for debt instruments with short maturities and high liquidity levels.

Source: researchgate.net

Source: researchgate.net

This is its value on the date of the physical exchange between the buyer and seller. This is its value on the date of the physical exchange between the buyer and seller. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents. A money market account is a current asset unless it is restricted for a long-term purpose. Each period available-for-sale securities are revalued to their current market value.

Source: cpajournal.com

Source: cpajournal.com

Mark to market aims to provide a realistic appraisal of an. To record the change debit Unrealized Loss credit Value of Available-For-Sale Security if. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents. Next debit or increase your cash account by the forward rate. Gain or Loss on Available-for-Sale Securities.

Source: elibrary.imf.org

Source: elibrary.imf.org

A money market account is a current asset unless it is restricted for a long-term purpose. This is its value on the date of the physical exchange between the buyer and seller. Those participating directly in the market do so in large denominations exceeding 5 million per transaction. Mark to market aims to provide a realistic appraisal of an. The Securities and Exchange Commission issued a statement clarifying the accounting treatment for money market mutual funds amid the growing turmoil in the financial markets.

Source: elibrary.imf.org

Source: elibrary.imf.org

Money market funds provide a viable treasury management solution combining the provision of capital security with liquidity. Then credit or decrease your Asset account by the current market value of the commodity. If using paper and pencil add a line for money market fund under the last item in the current assets list. Keeping the value stable even though the price of the funds underlying investments varies makes these accounts feel like a regular bank account. Participants in this market use it to borrow and invest for short periods of time.

Source: elibrary.imf.org

Source: elibrary.imf.org

Those participating directly in the market do so in large denominations exceeding 5 million per transaction. If using paper and pencil add a line for money market fund under the last item in the current assets list. Money Market Funds. Generally accepted accounting principles US. The amount of an unrestricted money market account will likely be reported on the balance sheet as part of a companys cash or its cash and cash equivalents.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money market placement accounting treatment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.