11++ Money laundering violations penalties ideas in 2021

Home » money laundering idea » 11++ Money laundering violations penalties ideas in 2021Your Money laundering violations penalties images are ready in this website. Money laundering violations penalties are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering violations penalties files here. Find and Download all free vectors.

If you’re searching for money laundering violations penalties pictures information related to the money laundering violations penalties keyword, you have pay a visit to the right site. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

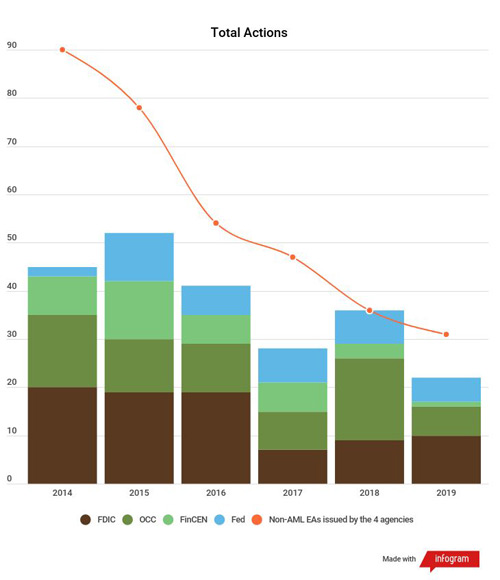

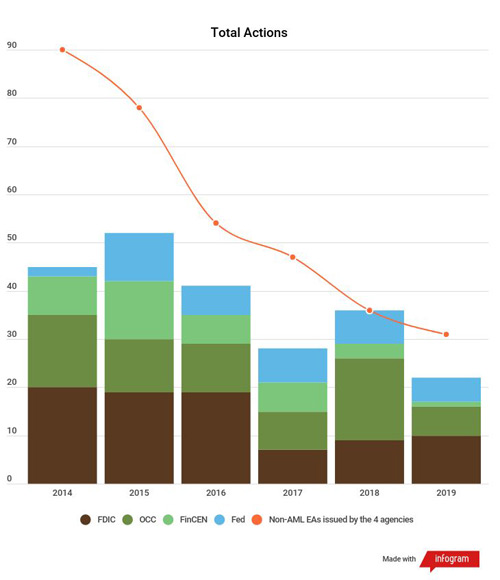

Money Laundering Violations Penalties. Dollars regarding numerous alleged Anti-Money Laundering AML and Counter Terrorism Financing CTF violations. While the AML penalties given in 2018 were approximately 4 billion the AML penalties given in 2019 increased by approximately 2 times to approximately 8 billion. There is also a civil penalty provision in 1956b which may be pursued as a civil cause of. And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both.

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training From moneylaundering.com

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training From moneylaundering.com

The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. - Agencies can impose civil and criminal penalties for violations of the BSA. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. Dollars regarding numerous alleged Anti-Money Laundering AML and Counter Terrorism Financing CTF violations. Money laundering offenses can also give rise to a civil action under Section 1956. Commonwealth Bank of Australia CBA the largest bank in Australia has agreed to a proposed civil settlement subject to court approval of historic proportions involving a fine of approximately 700 million Australian dollars roughly equivalent to 530 million US.

The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both.

Federal Money Laundering Penalties In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. The representation may also be made by another at the direction of or approval of a Federal officer. Money laundering regulations penalty for failure to report. Department of Treasury or the US. The money laundering penalties for this type of offence can be a fine or up to two years in prison. State banking agencies can impose similar penalties.

Money laundering offenses can also give rise to a civil action under Section 1956. Section 1957 carries a maximum penalty of ten years in prison and maximum fine of 250000 or. There is also a civil penalty provision in 1956b which may be pursued as a civil cause of. Dollars regarding numerous alleged Anti-Money Laundering AML and Counter Terrorism Financing CTF violations. Failures in the compliance processes of financial institutions cause them to face heavy fines.

Source: caixinglobal.com

Source: caixinglobal.com

- Agencies can impose civil and criminal penalties for violations of the BSA. Are you aware of anti-money laundering violations and want to report them to the authorities and receive a whistleblower reward. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering.

Source: jcauaeaudit.com

Source: jcauaeaudit.com

However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. Failures in the compliance processes of financial institutions cause them to face heavy fines. Commonwealth Bank of Australia CBA the largest bank in Australia has agreed to a proposed civil settlement subject to court approval of historic proportions involving a fine of approximately 700 million Australian dollars roughly equivalent to 530 million US. Attorney General as a result of your. - Agencies can impose civil and criminal penalties for violations of the BSA.

Source: moneylaundering.com

Source: moneylaundering.com

The relevant responsible people at the five institutions were also fined a total 520000 yuan. While the AML penalties given in 2018 were approximately 4 billion the AML penalties given in 2019 increased by approximately 2 times to approximately 8 billion. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The offender might have to pay the greater of 500000 or twice the value of.

Source: 24newshd.tv

Source: 24newshd.tv

Commonwealth Bank of Australia CBA the largest bank in Australia has agreed to a proposed civil settlement subject to court approval of historic proportions involving a fine of approximately 700 million Australian dollars roughly equivalent to 530 million US. Are you aware of anti-money laundering violations and want to report them to the authorities and receive a whistleblower reward. The representation must be made by or authorized by a Federal officer with authority to investigate or prosecute money laundering violations. The offender might have to pay the greater of 500000 or twice the value of. - Agencies can impose civil and criminal penalties for violations of the BSA.

Source: iclg.com

Source: iclg.com

State banking agencies can impose similar penalties. Commonwealth Bank of Australia CBA the largest bank in Australia has agreed to a proposed civil settlement subject to court approval of historic proportions involving a fine of approximately 700 million Australian dollars roughly equivalent to 530 million US. If so you may be entitled to receive as much as 30 of any penalties recovered by the US. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. - The BSA requires financial institutions to have an anti -money laundering compliance program and comply with a number of reporting and recordkeeping requirements.

Source: asiatimes.com

Source: asiatimes.com

State banking agencies can impose similar penalties. The relevant responsible people at the five institutions were also fined a total 520000 yuan. Fines for money laundering can reach as high as half a million dollars depending on the kind of things involved in the laundering transaction. - Agencies can impose civil and criminal penalties for violations of the BSA. There is also a civil penalty provision in 1956b which may be pursued as a civil cause of.

Source: gulfbusiness.com

Source: gulfbusiness.com

Fines for money laundering can reach as high as half a million dollars depending on the kind of things involved in the laundering transaction. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. Department of Treasury or the US. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. Commonwealth Bank of Australia CBA the largest bank in Australia has agreed to a proposed civil settlement subject to court approval of historic proportions involving a fine of approximately 700 million Australian dollars roughly equivalent to 530 million US.

Source: arachnys.com

Source: arachnys.com

Commonwealth Bank of Australia CBA the largest bank in Australia has agreed to a proposed civil settlement subject to court approval of historic proportions involving a fine of approximately 700 million Australian dollars roughly equivalent to 530 million US. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. - Agencies can impose civil and criminal penalties for violations of the BSA. The representation must be made by or authorized by a Federal officer with authority to investigate or prosecute money laundering violations. Attorney General as a result of your.

Source: philstar.com

Source: philstar.com

Department of Treasury or the US. If so you may be entitled to receive as much as 30 of any penalties recovered by the US. Failures in the compliance processes of financial institutions cause them to face heavy fines. Money laundering offenses can also give rise to a civil action under Section 1956. Attorney General as a result of your.

Source: damianakoslaw.com

Source: damianakoslaw.com

There is also a civil penalty provision in 1956b which may be pursued as a civil cause of. BNP Paribas China Unit Receives Fines for Negligence in Anti-Money Laundering May 2020 The Chinese branch of BNP Paribas the European banking giant was fined 27 million yuan or 378200 for failing to correctly verify customer identity and also not report suspicious transactions to the Chinese central bank. The offender might have to pay the greater of 500000 or twice the value of. Federal Money Laundering Penalties In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. The money laundering penalties for this type of offence can be a fine or up to two years in prison.

Source: wsj.com

Source: wsj.com

- Agencies can impose civil and criminal penalties for violations of the BSA. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. Department of Treasury or the US. The offender might have to pay the greater of 500000 or twice the value of. The representation may also be made by another at the direction of or approval of a Federal officer.

Source: shuftipro.com

Source: shuftipro.com

And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. - The BSA requires financial institutions to have an anti -money laundering compliance program and comply with a number of reporting and recordkeeping requirements. If so you may be entitled to receive as much as 30 of any penalties recovered by the US. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering violations penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.