12+ Money laundering stages singapore info

Home » money laundering Info » 12+ Money laundering stages singapore infoYour Money laundering stages singapore images are ready in this website. Money laundering stages singapore are a topic that is being searched for and liked by netizens today. You can Get the Money laundering stages singapore files here. Get all royalty-free vectors.

If you’re searching for money laundering stages singapore images information related to the money laundering stages singapore interest, you have pay a visit to the ideal site. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

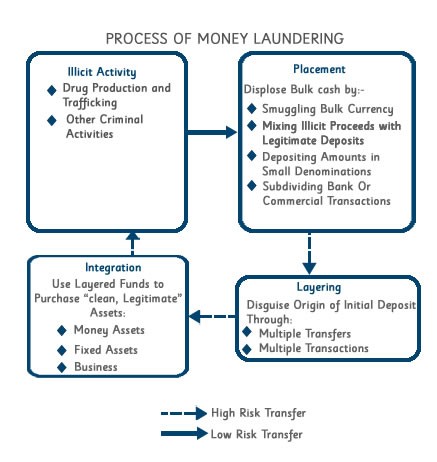

Money Laundering Stages Singapore. Other authorities impose AML requirements on non-financial businesses and professions such as. Placement is the first stage of money laundering. Singapore steps up scrutiny of shell firms to combat money laundering14 Aug 2019. And b it places the money into the legitimate financial system.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Global markets consider money laundering a significant white collar crime. Singapore adopts a firm stance against money laundering and terrorism financing with strict obligations for businesses to comply with. The stages of money laundering include the. Second phase involves mixing the funds. It is during the placement stage that money launderers. Anti Money Laundering Training Singapore pada tanggal Agustus 08 2021 laundering money Singapore Wallpaper.

The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system.

This article will provide business owners with a brief overview of Singapores Anti-Money Laundering AML. Authorities have a reasonable understanding of their MLTF risks and are taking steps to mitigate them. And b it places the money into the legitimate financial system. Generally this stage serves two purposes. There are four money laundering offences in Singapore law. Singapores central bank is raising its guard against money launderers increasingly using onshore shell companies to mask their transactions a senior official said.

Source: bi.go.id

Source: bi.go.id

Singapores central bank is raising its guard against money launderers increasingly using onshore shell companies to mask their transactions a senior official said. 51 A payment service provider shall identify and assess the money laundering and terrorism financing risks that may arise in relation to a the development of new products and new business practices including new delivery mechanisms. Other authorities impose AML requirements on non-financial businesses and professions such as. The relevant provisions are sections 46 2 and 47 2 of the CDSA. Singapore steps up scrutiny of shell firms to combat money laundering14 Aug 2019.

Source: bi.go.id

Singapores AMLCFT policy aims to prevent money laundering terrorist financing and predicate offences in order to maintain Singapores financial integrity from financial crime. It can be defined as the process of making dirty money the proceeds of criminal activity appear clean or legitimate. D converts or transfers that property or removes it from Singapore. Other authorities impose AML requirements on non-financial businesses and professions such as. At this stage the dirty money that has come from illegal activities is entered into a legitimate financial system.

Source: bi.go.id

Source: bi.go.id

There are four money laundering offences in Singapore law. Second phase involves mixing the funds. Each individual money laundering stage can be extremely complex due to the criminal activity involved. These are called methods of laundering. The AMLCFT efforts are focused on issuing guidelines acts of law and legislation for financial institutions.

Source: researchgate.net

Source: researchgate.net

The Committee comprises the Permanent Secretary of the Ministry of Home Affairs Permanent Secretary of the Ministry of Finance and Managing Director of the Monetary Authority of Singapore. Singapores AMLCFT coordination is highly sophisticated and inclusive of all relevant competent authorities. At this stage the dirty money that has come from illegal activities is entered into a legitimate financial system. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. Placement is the first stage of money laundering.

Source: shuftipro.com

Source: shuftipro.com

This article will provide business owners with a brief overview of Singapores Anti-Money Laundering AML. Singapores AMLCFT coordination is highly sophisticated and inclusive of all relevant competent authorities. The stages of money laundering include the. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Anti Money Laundering Training Singapore pada tanggal Agustus 08 2021 laundering money Singapore Wallpaper.

Source: bi.go.id

Source: bi.go.id

Singapore steps up scrutiny of shell firms to combat money laundering14 Aug 2019. It is important to mix the funds from illegal sources with legalIt is relatively very difficult to detect money laundering at this stage. There are four money laundering offences in Singapore law. The Monetary Authority of Singapore MAS imposes anti-money laundering AML requirements on FIs in Singapore. Other authorities impose AML requirements on non-financial businesses and professions such as.

Source: tookitaki.ai

Source: tookitaki.ai

The relevant provisions are sections 46 2 and 47 2 of the CDSA. And b the use of new or developing technologies for both new and pre-existing products. Authorities have a reasonable understanding of their MLTF risks and are taking steps to mitigate them. This is the first step showing one example of some frequently used money laundering methods. There are four money laundering offences in Singapore law.

Source: wikiwand.com

Source: wikiwand.com

It can be defined as the process of making dirty money the proceeds of criminal activity appear clean or legitimate. A governmental official in Brazil responsible for construction permits for real estate projects handed over his illicit corruption money in cash to his lawyer in Sao Paulo. SINGAPORE Reuters - Singapores central bank is raising its guard against money launderers increasingly using. Money laundering involves the use of processes to disguise an original source of funds or assets that are generated through criminal activities such as drug trafficking fraud smuggling corruption or extortion. Authorities have a reasonable understanding of their MLTF risks and are taking steps to mitigate them.

Source: bi.go.id

Source: bi.go.id

These are called methods of laundering. A it relieves the criminal of holding and guarding large amounts of bulky of cash. An example of placement can be placing the funds in a bank account to begin the cleaning process. The stages of money laundering include the. Placement is the first stage of money laundering.

Source: youtube.com

Source: youtube.com

And b the use of new or developing technologies for both new and pre-existing products. The 3 Stages of Money Laundering. Authorities have a reasonable understanding of their MLTF risks and are taking steps to mitigate them. The third money laundering offence is committed when a person who. The stages of money laundering include the.

Source: slidetodoc.com

Source: slidetodoc.com

The Committee comprises the Permanent Secretary of the Ministry of Home Affairs Permanent Secretary of the Ministry of Finance and Managing Director of the Monetary Authority of Singapore. Anti Money Laundering Training Singapore pada tanggal Agustus 08 2021 laundering money Singapore Wallpaper. Singapore adopts a firm stance against money laundering and terrorism financing with strict obligations for businesses to comply with. Valerie Tay who heads the anti-money laundering department at the Monetary Authority of. A governmental official in Brazil responsible for construction permits for real estate projects handed over his illicit corruption money in cash to his lawyer in Sao Paulo.

Source: sinexhk.com

Source: sinexhk.com

The stages of money laundering include the. It can be defined as the process of making dirty money the proceeds of criminal activity appear clean or legitimate. Singapore steps up scrutiny of shell firms to combat money laundering14 Aug 2019. With a profit margin ranging from 53. This is the act of moving the ill-gotten funds into a financial institution.

Source: pinterest.com

Source: pinterest.com

In 2015 Singapore discovered that funds linked to a scandal-ridden Malaysian state fund 1Malaysia Development Bhd had been laundered through its banking system. Singapore steps up scrutiny of shell firms to combat money laundering. Singapore adopts a firm stance against money laundering and terrorism financing with strict obligations for businesses to comply with. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system. The 3 Stages of Money Laundering.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering stages singapore by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.