14++ Money laundering risks of trusts ideas

Home » money laundering idea » 14++ Money laundering risks of trusts ideasYour Money laundering risks of trusts images are ready in this website. Money laundering risks of trusts are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering risks of trusts files here. Download all royalty-free images.

If you’re looking for money laundering risks of trusts images information linked to the money laundering risks of trusts interest, you have come to the right blog. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Money Laundering Risks Of Trusts. The risks exists because criminals may use accountants to help their illicit funds gain legitimacy and respectability by using the accountants professionally qualified status. It is widely acknowledged that law firms and solicitors are attractive to money launderers because of the services they provide and the position of trust they hold. Why are solicitors at risk of money laundering. Other common means of laundering proceeds are over-invoicing in commercial trade and fictitious loans.

We Compare The Trust And Costs Of The Accessible Tools On The Market To Gain Cost And Time Effective Trust Into You And Your Business As Seen From The From nl.pinterest.com

We Compare The Trust And Costs Of The Accessible Tools On The Market To Gain Cost And Time Effective Trust Into You And Your Business As Seen From The From nl.pinterest.com

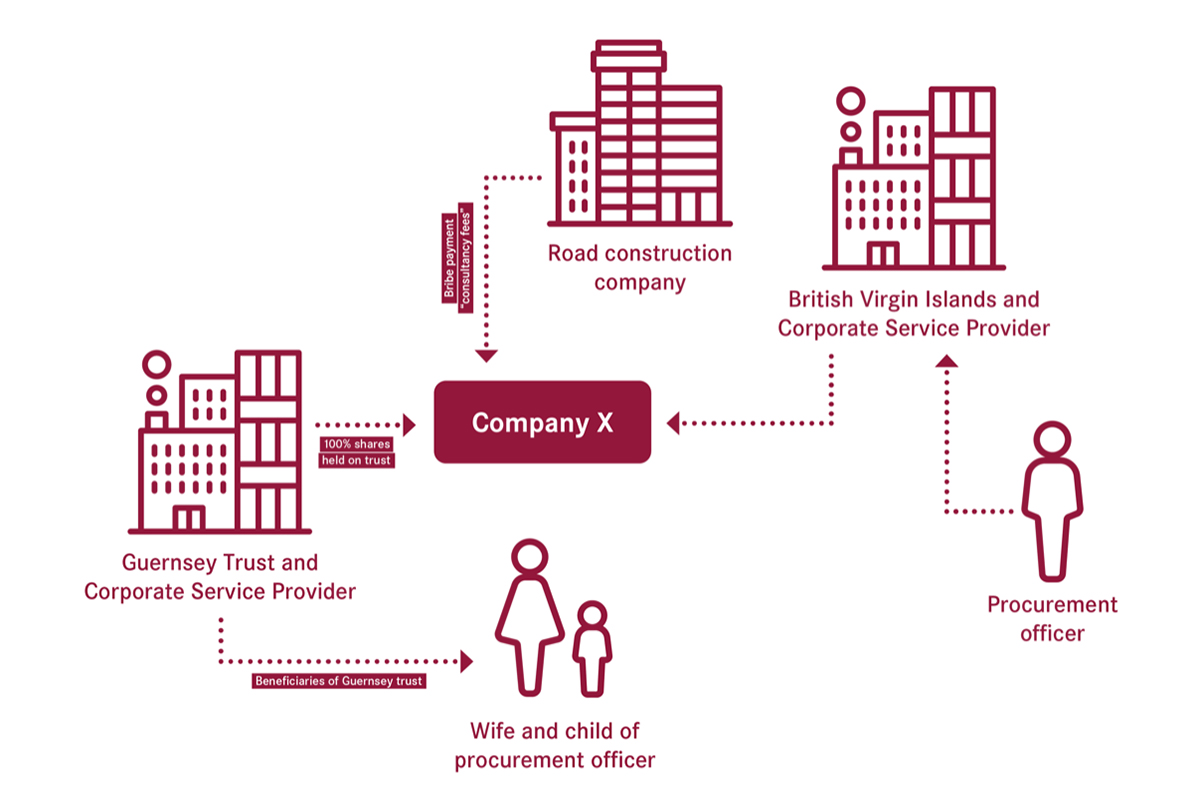

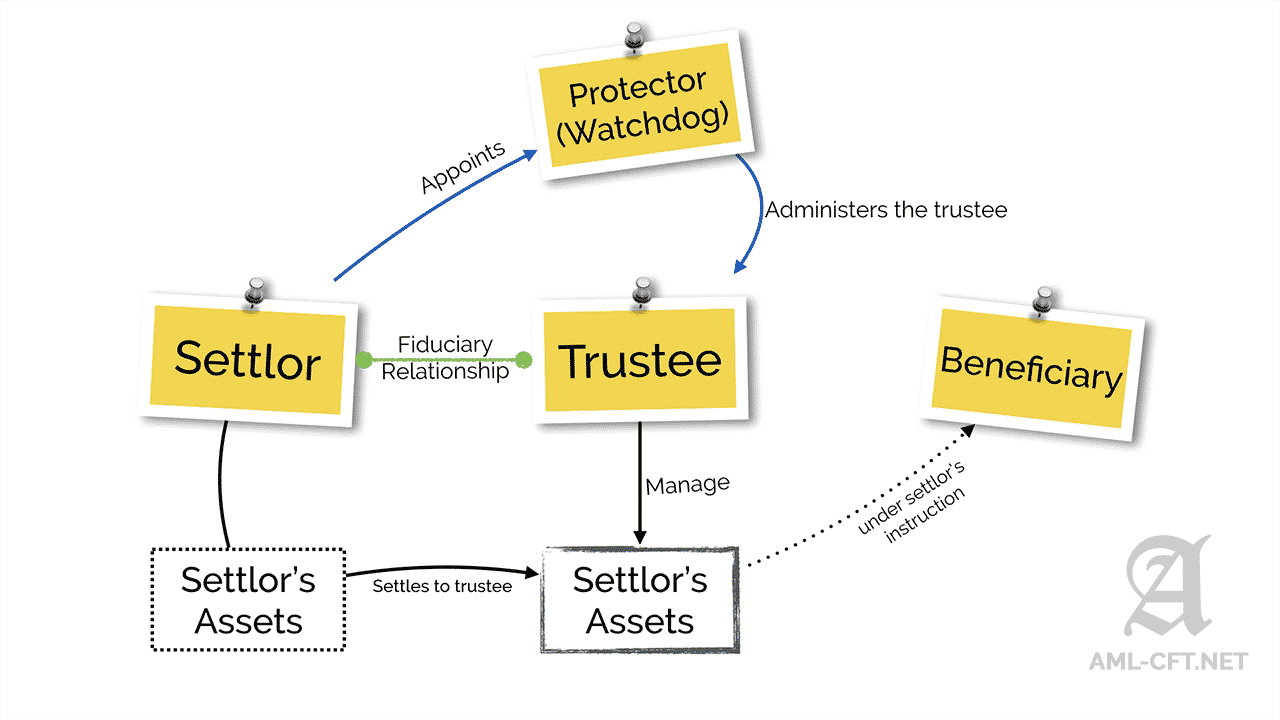

Why this risk matters. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to. Gambling sector Under the 4th Anti-Money Laundering Directive all providers of gambling services are. Additionally Banking secrecy the complexity of financial services and products and high value transactions also increases risk. The difficulty to identify beneficial owners and concealment through offshore trusts are high risk areas.

14 This Anti-Money Laundering and Counter Financing of Terrorism AMLCFT Trust Company Sector Guidelines is based on the.

The reasons could be. 14 This Anti-Money Laundering and Counter Financing of Terrorism AMLCFT Trust Company Sector Guidelines is based on the. As in any account relationship money laundering risk may arise from trust and asset management activities. However new regulations regarding money laundering which have been introduced in some places around the world consider that these situations are not too different and that tax evasion also suggests money laundering In addition what could also happen is that the trusts were not reported by the beneficiary. Law enforcement authorities consider such risks significant. The reasons could be.

Source: tr.pinterest.com

Source: tr.pinterest.com

It promotes the adoption of global solutions to respond to these threats at international levelThe European Union adopted robust legislation to fight against money laundering and terrorist financing which contributes to those international efforts. However new regulations regarding money laundering which have been introduced in some places around the world consider that these situations are not too different and that tax evasion also suggests money laundering In addition what could also happen is that the trusts were not reported by the beneficiary. The Legal Sector Affinity Group which represents the legal sector. In wealth management main areas of the money laundering risk lies in the culture of confidentiality. The risk that accountancy service providers could be abused by terrorists is considered low.

Source: co.pinterest.com

Source: co.pinterest.com

700 333 - 11th Avenue SW Phone. When misused trust and asset management accounts can conceal the sources and uses of funds as well as the identity of beneficial and legal owners. 14032294700 Calgary Alberta T2R 1L9 Toll Free. TRUSTS PAGE 2. Why are solicitors at risk of money laundering.

Source: fatf-gafi.org

Source: fatf-gafi.org

Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. The reasons could be. In wealth management main areas of the money laundering risk lies in the culture of confidentiality. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill. Other common means of laundering proceeds are over-invoicing in commercial trade and fictitious loans.

Source: nl.pinterest.com

Source: nl.pinterest.com

Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill. 700 333 - 11th Avenue SW Phone. It is widely acknowledged that law firms and solicitors are attractive to money launderers because of the services they provide and the position of trust they hold. TRUSTS PAGE 2. Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to.

Source: ft.lk

Source: ft.lk

The 2021 Trust Regulations apply the definition of a relevant trust in the Criminal Justice Money Laundering and Terrorist Financing Act of 2010 as amended in 2021 the 2010 Act. 700 333 - 11th Avenue SW Phone. ANTI-MONEY LAUNDERING RISK ADVISORY. The majority of global research focuses on two major money-laundering sectors. The 2021 Trust Regulations apply the definition of a relevant trust in the Criminal Justice Money Laundering and Terrorist Financing Act of 2010 as amended in 2021 the 2010 Act.

Source: pinterest.com

Source: pinterest.com

700 333 - 11th Avenue SW Phone. Other common means of laundering proceeds are over-invoicing in commercial trade and fictitious loans. Law enforcement authorities consider such risks significant. Gambling sector Under the 4th Anti-Money Laundering Directive all providers of gambling services are. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

Source: dimensiongrc.com

Source: dimensiongrc.com

In wealth management main areas of the money laundering risk lies in the culture of confidentiality. TRUSTS PAGE 2. Additionally Banking secrecy the complexity of financial services and products and high value transactions also increases risk. Gambling sector Under the 4th Anti-Money Laundering Directive all providers of gambling services are. The risk that accountancy service providers could be abused by terrorists is considered low.

Source: pinterest.com

Source: pinterest.com

As in any account relationship money laundering risk may arise from trust and asset management activities. 14 This Anti-Money Laundering and Counter Financing of Terrorism AMLCFT Trust Company Sector Guidelines is based on the. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

Source: pinterest.com

Source: pinterest.com

700 333 - 11th Avenue SW Phone. The Legal Sector Affinity Group which represents the legal sector. Increasingly exposed to significant money laundering risks. The UK is seen as a high-risk jurisdiction for money laundering. Why this risk matters.

Source: pinterest.com

Source: pinterest.com

However new regulations regarding money laundering which have been introduced in some places around the world consider that these situations are not too different and that tax evasion also suggests money laundering In addition what could also happen is that the trusts were not reported by the beneficiary. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The difficulty to identify beneficial owners and concealment through offshore trusts are high risk areas. 14032294700 Calgary Alberta T2R 1L9 Toll Free. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy.

Source: pinterest.com

Source: pinterest.com

The Legal Sector Affinity Group which represents the legal sector. Other common means of laundering proceeds are over-invoicing in commercial trade and fictitious loans. The risk that accountancy service providers could be abused by terrorists is considered low. The 2021 Trust Regulations apply the definition of a relevant trust in the Criminal Justice Money Laundering and Terrorist Financing Act of 2010 as amended in 2021 the 2010 Act. 14032294700 Calgary Alberta T2R 1L9 Toll Free.

Source: baselgovernance.org

Source: baselgovernance.org

TRUSTS PAGE 2. The majority of global research focuses on two major money-laundering sectors. A relevant trust is an express trust established by deed or other declaration in writing and any other arrangement or class of arrangements as may be prescribed but not including an excluded. Guidelines on Anti-Money Laundering and Counter Financing of Terrorism AMLCFT Trust Company Sector Page 4 expectation on reporting institutions to assess and mitigate MLTF risks. The European Commission carries out risk assessments in order to identify and respond to risks affecting the EU internal market.

Source: aml-cft.net

Source: aml-cft.net

Increasingly exposed to significant money laundering risks. Drug trafficking and terrorist organizations. The risks exists because criminals may use accountants to help their illicit funds gain legitimacy and respectability by using the accountants professionally qualified status. It is widely acknowledged that law firms and solicitors are attractive to money launderers because of the services they provide and the position of trust they hold. Why this risk matters.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risks of trusts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.