11++ Money laundering risks of prepaid stored value cards information

Home » money laundering idea » 11++ Money laundering risks of prepaid stored value cards informationYour Money laundering risks of prepaid stored value cards images are ready. Money laundering risks of prepaid stored value cards are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering risks of prepaid stored value cards files here. Download all royalty-free photos and vectors.

If you’re searching for money laundering risks of prepaid stored value cards pictures information linked to the money laundering risks of prepaid stored value cards interest, you have come to the ideal site. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Money Laundering Risks Of Prepaid Stored Value Cards. There are no money laundering risks if a bank does not offer load and re-load capability through third parties 10. The roles played by parties in the development operation distribution and use of the cards. You will be redirected to the full text document in the repository in a few seconds if not click hereclick here. In addition there is no physical account at a financial institution in the name of the stored value card holder.

Process To Be Used To Determine Virtual Money Laundering And Terrorism Download Scientific Diagram From researchgate.net

Process To Be Used To Determine Virtual Money Laundering And Terrorism Download Scientific Diagram From researchgate.net

Vulnerability refers to the characteristics of SVCs that make them susceptible to criminal exploitation. Money laundering risk is limited if a bank issues both the card and the stored value associated with the card 8. Cases of money laundering with prepaid cards rose over the past few years. A criminal used stolen credit card information to purchase 45000 gift cards. One identified risk is the misuse of prepaid stored value cards to keep the proceeds of crime and move them across borders without alerting law enforcement and financial intelligence units. ThispaperconsidersthemoneylaunderingrisksandmitigantsofphysicalPrepaidand StoredValueCardIssuing and MerchantAcquiringActivitiesandsupplementsthe WolfsbergGroupStatementonCreditChargeCardIssuingandMerchantAcquiring.

Prepaid stored value cards have several characteristics that contribute to the considerable utility efficiency and accessibility of this money laundering method.

The gift cards face value ranged from 2 to 2000 each and were sold for a total of 9 million on Raise. Unfortunately the difficulties in tracking ownership of some of these cards makes. The reasons for the increase in popularity of prepaid cards and how money laundering activities are achieved through prepaid cards are interesting. International students to purchase prepaid cards and the mailing or shipping of prepaid cards out of the country without. Money laundering risk is limited if a bank issues both the card and the stored value associated with the card 8. By Julian Dixon CEO of Napier Last month it emerged that prepaid payment card provider PFS a subsidiary of EML Payments is being investigated by the Central Bank of Ireland after it raised concerns over PFS anti-money laundering and anti-financial crime governance.

Source: complyadvantage.com

Source: complyadvantage.com

2008 Money laundering risks of prepaid stored value cards Australian Institute of Criminology ISBN - 978 1 921185 92 2. Unfortunately the difficulties in tracking ownership of some of these cards makes. The gift cards face value ranged from 2 to 2000 each and were sold for a total of 9 million on Raise. A criminal used stolen credit card information to purchase 45000 gift cards. Prepaid stored value cards cannot be seized for failure to file a CMIR and may therefore be openly carried or shipped across US.

Source: acfcs.org

Source: acfcs.org

Those have a significantly lower risk to be used by criminals to store and launder money but still can be. A criminal used stolen credit card information to purchase 45000 gift cards. Last 2017 an infamous gift card scam occurred in Florida. There are some instances in which they used prepaid cards to buy legally available materials for drug manufacturing in drug cartels. In order to reduce the money laundering risk posed by prepaid stored value cards SVCs SVC providers must be made aware of and comply with local regulatory requirements.

Source: thetimes.co.uk

Source: thetimes.co.uk

The reasons for the increase in popularity of prepaid cards and how money laundering activities are achieved through prepaid cards are interesting. Had the 911 terrorists used prepaid stored-value cards to cover their expenses. The reasons for the increase in popularity of prepaid cards and how money laundering activities are achieved through prepaid cards are interesting. Those have a significantly lower risk to be used by criminals to store and launder money but still can be. Borders without fear of seizure.

Source: acfcs.org

Source: acfcs.org

Risks identified in this article include recruiting card mules eg. Cases of money laundering with prepaid cards rose over the past few years. Prepaid cards can be purchased without the same customer due diligence CDD identification and verification measures associated with other payment cards. International students to purchase prepaid cards and the mailing or shipping of prepaid cards out of the country without. An explanation as to why the characteristics of the cards can increase money laundering risk and details about assessing potential risks.

Source:

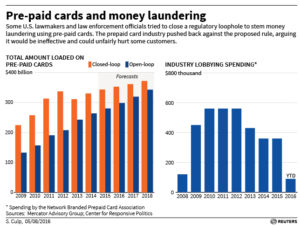

In the prepaid or stored value space there are also closed-loop cards such as a non-reloadable card that can only be used at a specific restaurant or retailer. The roles played by parties in the development operation distribution and use of the cards. Those have a significantly lower risk to be used by criminals to store and launder money but still can be. Cases of money laundering with prepaid cards rose over the past few years. By Julian Dixon CEO of Napier Last month it emerged that prepaid payment card provider PFS a subsidiary of EML Payments is being investigated by the Central Bank of Ireland after it raised concerns over PFS anti-money laundering and anti-financial crime governance.

Source: pinterest.com

Source: pinterest.com

There are no money laundering risks if a bank does not offer load and re-load capability through third parties 10. Risks identified in this article include recruiting card mules eg. STORED VALUE CARDS 14. The reasons for the increase in popularity of prepaid cards and how money laundering activities are achieved through prepaid cards are interesting. Borders without fear of seizure.

Source: researchgate.net

Source: researchgate.net

The roles played by parties in the development operation distribution and use of the cards. Prepaid cards which provide access to accounts worth tens of thousands of dollars transfer this money quickly causing money laundering activities. Had the 911 terrorists used prepaid stored-value cards to cover their expenses. However unlike traditional debit cards stored value cards are prepaid providing consumers with immediate fund availability and little risk of overdraft. Borders without fear of seizure.

Source: pinterest.com

Source: pinterest.com

Typical uses of prepaid and stored value cards. An explanation as to why the characteristics of the cards can increase money laundering risk and details about assessing potential risks. In order to reduce the money laundering risk posed by prepaid stored value cards SVCs SVC providers must be made aware of and comply with local regulatory requirements. There are no money laundering risks if a bank does not offer load and re-load capability through third parties 10. Unfortunately the difficulties in tracking ownership of some of these cards makes.

Source: feedzai.com

Source: feedzai.com

The specific AMLCFT risks associated with prepaid cards and that make them such a popular tool for money launderers include. We are not allowed to display external PDFs yet. Types of prepaid and stored value card arrangements and features. International students to purchase prepaid cards and the mailing or shipping of prepaid cards out of the country without. However unlike traditional debit cards stored value cards are prepaid providing consumers with immediate fund availability and little risk of overdraft.

Source: slideshare.net

Source: slideshare.net

You will be redirected to the full text document in the repository in a few seconds if not click hereclick here. STORED VALUE CARDS 14. There are no money laundering risks if a bank does not offer load and re-load capability through third parties 10. International students to purchase prepaid cards and the mailing or shipping of prepaid cards out of the country without. An explanation as to why the characteristics of the cards can increase money laundering risk and details about assessing potential risks.

Source: medium.com

Source: medium.com

By Julian Dixon CEO of Napier Last month it emerged that prepaid payment card provider PFS a subsidiary of EML Payments is being investigated by the Central Bank of Ireland after it raised concerns over PFS anti-money laundering and anti-financial crime governance. Cases of money laundering with prepaid cards rose over the past few years. The reasons for the increase in popularity of prepaid cards and how money laundering activities are achieved through prepaid cards are interesting. Prepaid stored value cards cannot be seized for failure to file a CMIR and may therefore be openly carried or shipped across US. The card processor is managing the money laundering risks.

Source: researchgate.net

Source: researchgate.net

Borders without fear of seizure. Money laundering risk does not exist if a bank does not use a third party to market the cards 9. By Julian Dixon CEO of Napier Last month it emerged that prepaid payment card provider PFS a subsidiary of EML Payments is being investigated by the Central Bank of Ireland after it raised concerns over PFS anti-money laundering and anti-financial crime governance. Compliance with these measures however can be challenging and expensive for SVC providers. In order to reduce the money laundering risk posed by prepaid stored value cards SVCs SVC providers must be made aware of and comply with local regulatory requirements.

Source: transparint.com

Source: transparint.com

Last 2017 an infamous gift card scam occurred in Florida. Money laundering risk is limited if a bank issues both the card and the stored value associated with the card 8. International students to purchase prepaid cards and the mailing or shipping of prepaid cards out of the country without. Borders without fear of seizure. Prepaid cards which provide access to accounts worth tens of thousands of dollars transfer this money quickly causing money laundering activities.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risks of prepaid stored value cards by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.