19+ Money laundering risks from stablecoins and other emerging assets info

Home » money laundering idea » 19+ Money laundering risks from stablecoins and other emerging assets infoYour Money laundering risks from stablecoins and other emerging assets images are available in this site. Money laundering risks from stablecoins and other emerging assets are a topic that is being searched for and liked by netizens now. You can Download the Money laundering risks from stablecoins and other emerging assets files here. Find and Download all free images.

If you’re looking for money laundering risks from stablecoins and other emerging assets images information connected with to the money laundering risks from stablecoins and other emerging assets topic, you have come to the right site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Money Laundering Risks From Stablecoins And Other Emerging Assets. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist. However their growing use has regulators concerned over the risks they pose. At present emerging stablecoins have many of the features of more traditional cryptoassets but seek to stabilise the price of the coin by linking its value to that of an asset or pool of assets. Money laundering risk from stablecoins and other emerging assets After strengthening its standards to address the money laundering and terrorist financing risks of virtual assets the FATF has now agreed on how to assess whether countries have taken the necessary steps to implement the new requirements.

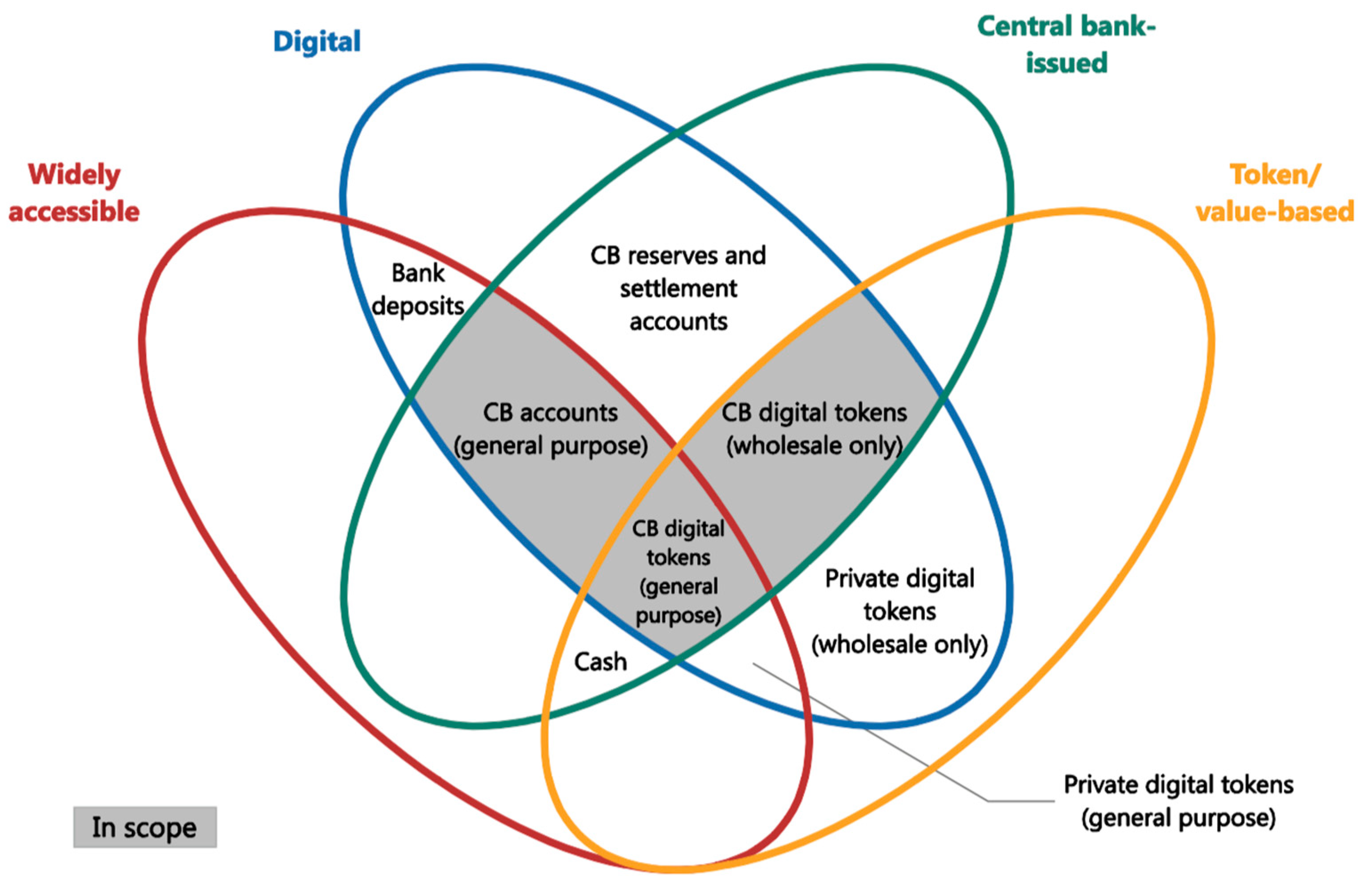

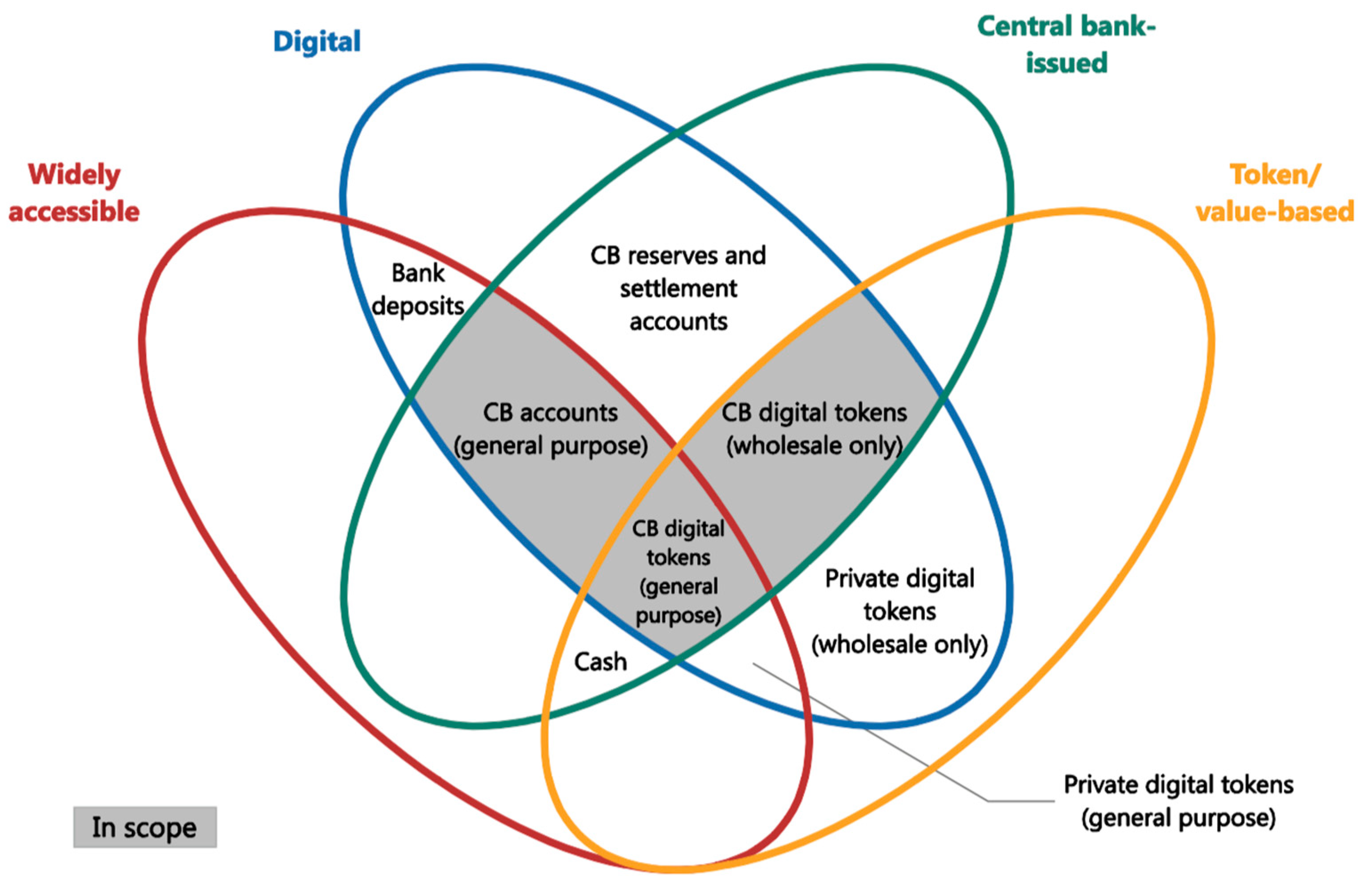

Future Internet Free Full Text From Bitcoin To Central Bank Digital Currencies Making Sense Of The Digital Money Revolution Html From mdpi.com

Future Internet Free Full Text From Bitcoin To Central Bank Digital Currencies Making Sense Of The Digital Money Revolution Html From mdpi.com

A second document titled Money laundering risks from stablecoins and other emerging assets said the FATF will continue to examine the characteristics and perceived risks of. Stablecoins have been defined as a type of crypto-asset that attempts to address volatility by tying its value to conventional assets. Money laundering risk from stablecoins and other emerging assets After strengthening its standards to address the money laundering and terrorist financing risks of virtual assets the FATF has now agreed on how to assess whether countries have taken the necessary steps to implement the new requirements. The Financial Action Task Force FATF has taken action to respond to the very real risk that legitimate services offered by virtual asset service providers will be abused by criminals and terrorists to launder money and finance terrorist acts. In a statement the Financial Action Task Force FATF which includes the US. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks.

In a statement the Financial Action Task Force FATF which includes the US.

Today the FATF agreed how to assess countries implementation of these new requirements. The FATF also singled out stablecoins listing the money laundering risk attached to them and other emerging assets as one its major strategic initiatives. Stablecoins are generally seen as being much more secure than typical cryptocurrencies. The FATF also singled out stablecoins listing the money laundering risk attached to them and other emerging assets as one its major strategic initiatives. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks. Stablecoins pose a risk of money laundering and financing of terrorism in the world the Financial Action Task Force FATF said on Friday.

Source: pinterest.com

Source: pinterest.com

Emerging assets such as so-called stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for money laundering and terrorist financing risks. The FATF also singled out stablecoins listing the money laundering risk attached to them and other emerging assets as one its major strategic initiatives. At present emerging stablecoins have many of the features of more traditional cryptoassets but seek to stabilise the price of the coin by linking its value to that of an asset or pool of assets. Stablecoins are generally seen as being much more secure than typical cryptocurrencies. This is because they usually have a fixed price due to being backed by physical assets.

Source: slideshare.net

Source: slideshare.net

In June the FATF introduced the first global standards to address the money laundering and terrorist financing risks of virtual assets. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF claimed that it would continue examining the characteristics of stablecoins and. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF stated that it will continue to analyze various risks associated with the. Stablecoins have been defined as a type of crypto-asset that attempts to address volatility by tying its value to conventional assets. A second document titled Money laundering risks from stablecoins and other emerging assets said the FATF will continue to examine the characteristics and perceived risks of stablecoins and may even clarify or update its virtual currency guidance to better address this class of.

Source: mdpi.com

Source: mdpi.com

Today the FATF agreed how to assess countries implementation of these new requirements. The FATF also singled out stablecoins listing the money laundering risk attached to them and other emerging assets as one its major strategic initiatives. This is because they usually have a fixed price due to being backed by physical assets. And its federal financial regulators as members said stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for money laundering and terrorist financing risks. The Financial Action Task Force FATF has taken action to respond to the very real risk that legitimate services offered by virtual asset service providers will be abused by criminals and terrorists to launder money and finance terrorist acts.

Source: variances.eu

Source: variances.eu

In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF stated that it will continue to analyze various risks associated with the. At present emerging stablecoins have many of the features of more traditional cryptoassets but seek to stabilise the price of the coin by linking its value to that of an asset or pool of assets. Stablecoins are generally seen as being much more secure than typical cryptocurrencies. In June the FATF introduced the first global standards to address the money laundering and terrorist financing risks of virtual assets. A second document titled Money laundering risks from stablecoins and other emerging assets said the FATF will continue to examine the characteristics and perceived risks of stablecoins and may even clarify or update its virtual currency guidance to better address this class of.

Source: uk.pinterest.com

Source: uk.pinterest.com

In June the FATF introduced the first global standards to address the money laundering and terrorist financing risks of virtual assets. The term stablecoin has no established international classification and such coins may not actually be. The FATF also singled out stablecoins listing the money laundering risk attached to them and other emerging assets as one its major strategic initiatives. In documents issued after its last meeting the intergovernmental organization referred cryptocurrencies as an important strategic initiative and said Cryptos whose values are linked to fiat currencies could have a particularly large impact. A second document titled Money laundering risks from stablecoins and other emerging assets said the FATF will continue to examine the characteristics and perceived risks of stablecoins and may even clarify or update its virtual currency guidance to better address this class of.

Source: medium.com

Source: medium.com

In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF stated that it will continue to analyze various risks associated with the. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF stated that it will continue to analyze various risks associated with the. Stablecoins pose a risk of money laundering and financing of terrorism in the world the Financial Action Task Force FATF said on Friday. Money laundering risk from stablecoins and other emerging assets After strengthening its standards to address the money laundering and terrorist financing risks of virtual assets the FATF has now agreed on how to assess whether countries have taken the necessary steps to implement the new requirements. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks.

Source: fatf-gafi.org

Source: fatf-gafi.org

Stablecoins have been defined as a type of crypto-asset that attempts to address volatility by tying its value to conventional assets. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF stated that it will continue to analyze various risks associated with the. And its federal financial regulators as members said stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for money laundering and terrorist financing risks. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist. The term stablecoin has no established international classification and such coins may not actually be.

Source: pinterest.com

Source: pinterest.com

The Financial Action Task Force FATF has issued a statement on money laundering risks from stablecoins and other emerging assets. Stablecoins are generally seen as being much more secure than typical cryptocurrencies. Stablecoins pose a risk of money laundering and financing of terrorism in the world the Financial Action Task Force FATF said on Friday. However their growing use has regulators concerned over the risks they pose. However as pointed out by a recent G7 report and ongoing FSB work stablecoins pose a wide range of risks related to among others legal certainty financial integrity sound governance the smooth functioning of payments consumer protection data privacy tax compliance and potentially monetary policy and financial stability G7 Working Group on Stablecoins 2019.

Source: sarsonfunds.com

Source: sarsonfunds.com

This is because they usually have a fixed price due to being backed by physical assets. Stablecoins are generally seen as being much more secure than typical cryptocurrencies. A second document titled Money laundering risks from stablecoins and other emerging assets said the FATF will continue to examine the characteristics and perceived risks of stablecoins and may even clarify or update its virtual currency guidance to better address this class of. Today the FATF agreed how to assess countries implementation of these new requirements. Stablecoins pose a risk of money laundering and financing of terrorism in the world the Financial Action Task Force FATF said on Friday.

Source: medium.com

Source: medium.com

The FATF argues that emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks. Money laundering risk from stablecoins and other emerging assets After strengthening its standards to address the money laundering and terrorist financing risks of virtual assets the FATF has now agreed on how to assess whether countries have taken the necessary steps to implement the new requirements. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF claimed that it would continue examining the characteristics of stablecoins and. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks. Stablecoins have been defined as a type of crypto-asset that attempts to address volatility by tying its value to conventional assets.

Source: slideshare.net

Source: slideshare.net

Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks. Stablecoins pose a risk of money laundering and financing of terrorism in the world the Financial Action Task Force FATF said on Friday. Another document titled Money laundering risks from stablecoins and other emerging assets said that the FATF will continue to examine the characteristics and risks of stablecoins and may even clarify the update of virtual currency guidance to better address this class of digital assets. Emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks. The term stablecoin has no established international classification and such coins may not actually be.

Stablecoins have been defined as a type of crypto-asset that attempts to address volatility by tying its value to conventional assets. In a statement the Financial Action Task Force FATF which includes the US. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF claimed that it would continue examining the characteristics of stablecoins and. Money laundering risk from stablecoins and other emerging assets After strengthening its standards to address the money laundering and terrorist financing risks of virtual assets the FATF has now agreed on how to assess whether countries have taken the necessary steps to implement the new requirements. In a second document titled Money laundering risks from stablecoins and other emerging assets the FATF stated that it will continue to analyze various risks associated with the.

Source: slideshare.net

Source: slideshare.net

The FATF argues that emerging assets such as so-called global stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for the money laundering and terrorist financing risks. Money laundering and terrorist financing risks. Emerging assets such as so-called stablecoins and their proposed global networks and platforms could potentially cause a shift in the virtual asset ecosystem and have implications for money laundering and terrorist financing risks. Stablecoins pose a risk of money laundering and financing of terrorism in the world the Financial Action Task Force FATF said on Friday. Another document titled Money laundering risks from stablecoins and other emerging assets said that the FATF will continue to examine the characteristics and risks of stablecoins and may even clarify the update of virtual currency guidance to better address this class of digital assets.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risks from stablecoins and other emerging assets by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.