14++ Money laundering risks faced by law firms info

Home » money laundering Info » 14++ Money laundering risks faced by law firms infoYour Money laundering risks faced by law firms images are available in this site. Money laundering risks faced by law firms are a topic that is being searched for and liked by netizens now. You can Download the Money laundering risks faced by law firms files here. Get all royalty-free photos and vectors.

If you’re looking for money laundering risks faced by law firms pictures information related to the money laundering risks faced by law firms interest, you have pay a visit to the right blog. Our site always provides you with hints for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Money Laundering Risks Faced By Law Firms. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 impose an obligation for a firm to undertake a written risk assessment of its AMLCFT exposure and for its policies controls and procedures to reflect the findings in that risk. Money laundering and terrorist financing risk has been a key area of focus for regulators across the globe for some years and this trend is only likely to continue. Examples of these risks and their consequences include the following factors. The Solicitor Regulation Authority SRA is planning to launch money laundering investigations into 7000 law firms after they discovered that too many were not complying with anti-money laundering regulations.

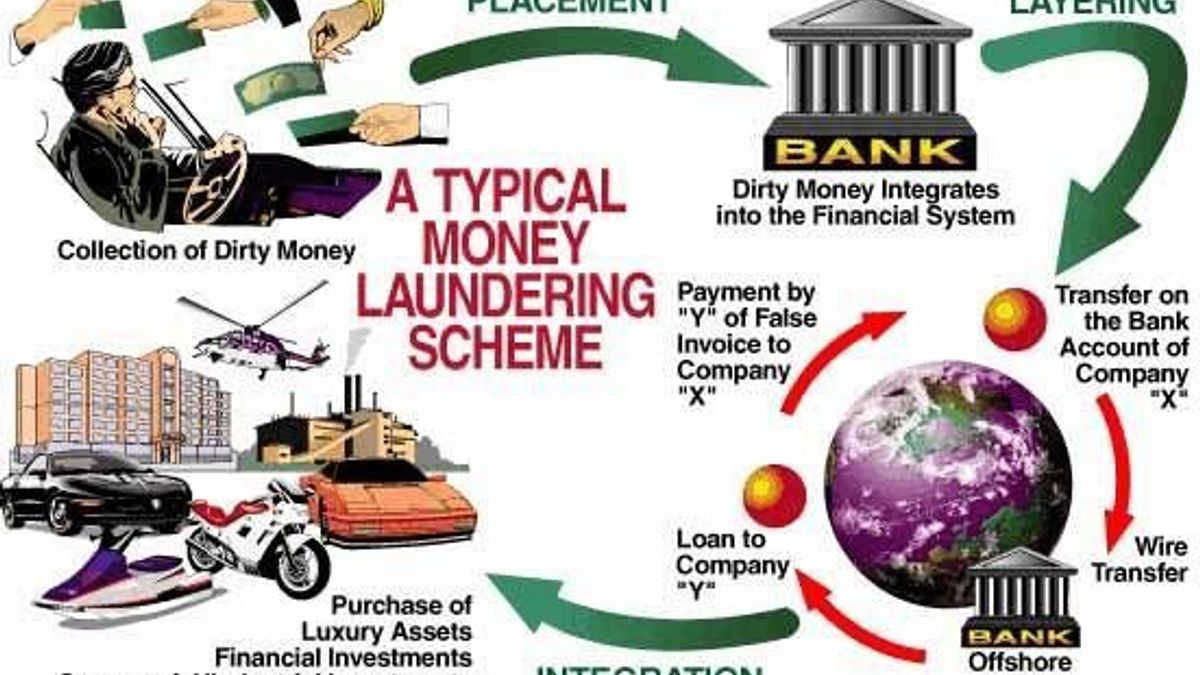

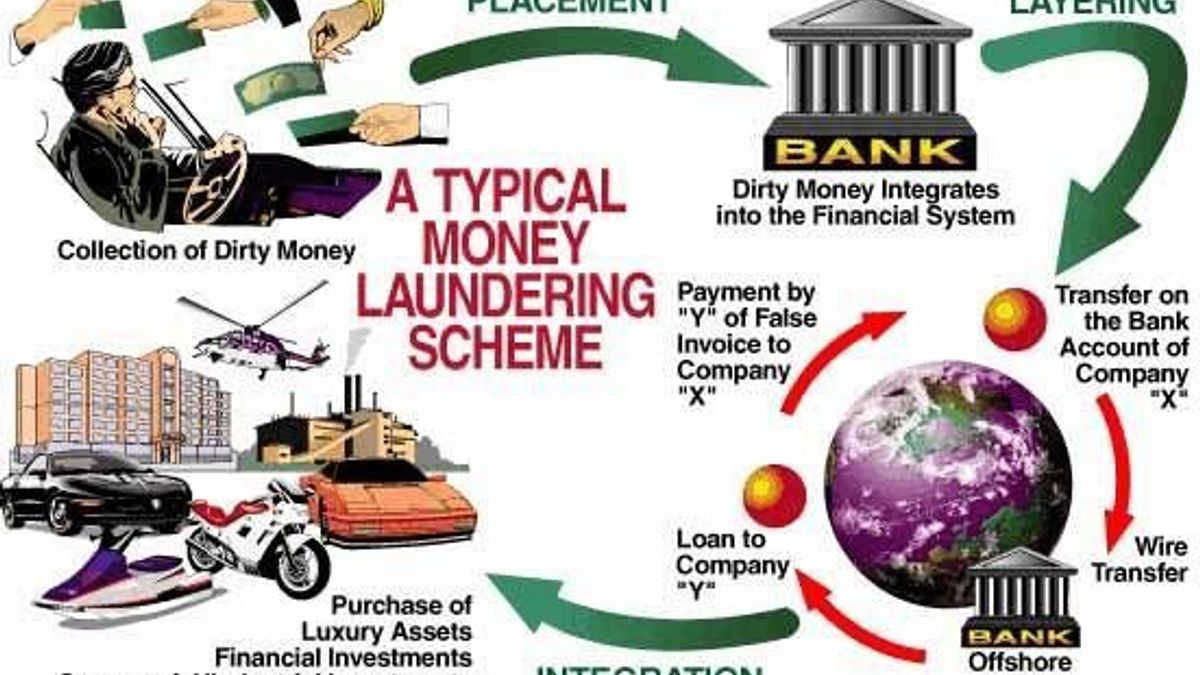

What Is Money Laundering And How Is It Done From jagranjosh.com

What Is Money Laundering And How Is It Done From jagranjosh.com

This will make his or her money indistinguishable from that of the law firm. Reporter Accountancy Daily 2019-2021 29 Oct 2019. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. The degree to which the main and subsidiary risks have changed since the risk outlook was first published last year show how rapidly the challenges facing. ML and to a lessor degree terrorist financing is a current risk to Australian law firms. Examples of these risks and their consequences include the following factors.

ML and to a lessor degree terrorist financing is a current risk to Australian law firms.

Reporter Accountancy Daily 2019-2021 29 Oct 2019. The main risk that firms should be aware of is that many of these types of claims are not genuine. The SRA have identified particular concerns relating to claims arising out of holiday sickness payment protection insurance and personal injury. Long term absences of key officers. ML and to a lessor degree terrorist financing is a current risk to Australian law firms. Exposés such as the Panama Papers and Paradise Papers have rightly or wrongly put offshore wealth in the cross-hairs of regulatory NGO and law enforcement scrutiny and the.

Source: researchgate.net

Source: researchgate.net

A fifth of law firms are failing to comply with anti-money laundering rules a watchdog has revealed as it vowed to clamp down on non-compliance. In money laundering a criminal is going to try to take his or her dirty money and clean it by using the accounts of law firms and legal professionals. Does not take into account other criteria that may influence the assessment of the level of money laundering and terrorist financing risk for a given client including. In more recent times the focus has switched to preventing money laundering identifying source of funds verifying that genuine business is being done and in general terms making sure there is clarity and clear understanding of what is going on in respect of a particular matterAccordingly in the UK there has been a big focus on the regulation of law firms a trend reflected in other sectors such as. So what are the reasons why law firms are targets for money laundering and have money laundering risks.

Source: pideeco.be

Source: pideeco.be

In money laundering a criminal is going to try to take his or her dirty money and clean it by using the accounts of law firms and legal professionals. The challenge is even greater for complex institutions that operate across several lines of business IT systems and business cultures. Long term absences of key officers. It is good risk and reputation management to consider these risks now not waiting for the Anti-Money Laundering Counter-Terrorism Financing Act 2006 to apply. So what are the reasons why law firms are targets for money laundering and have money laundering risks.

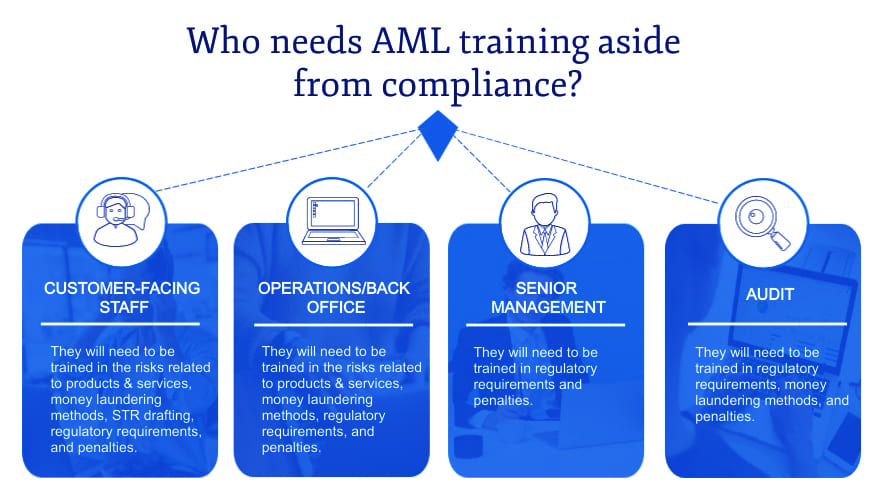

Source: complyadvantage.com

Source: complyadvantage.com

It is critical to prevent this from happening. Ad Hadromi Partners is one of the prominent law firms in Indonesia. Does not take into account other criteria that may influence the assessment of the level of money laundering and terrorist financing risk for a given client including. In more recent times the focus has switched to preventing money laundering identifying source of funds verifying that genuine business is being done and in general terms making sure there is clarity and clear understanding of what is going on in respect of a particular matterAccordingly in the UK there has been a big focus on the regulation of law firms a trend reflected in other sectors such as. The SRA have identified particular concerns relating to claims arising out of holiday sickness payment protection insurance and personal injury.

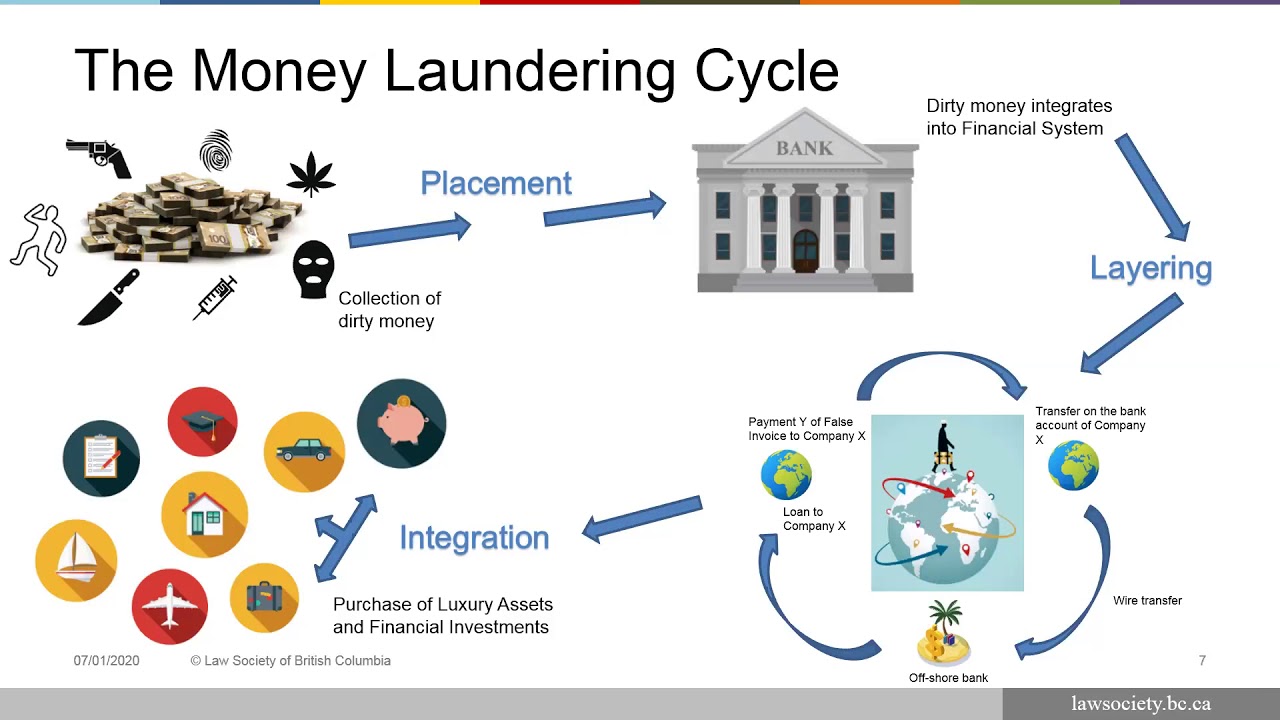

Source: youtube.com

Source: youtube.com

Examples of red flag indicators of money laundering could include. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. Regulatory risks are the negative consequences that financial services institutions are likely to face if they dont comply with regulatorylegislative norms meant to counter money laundering activities. There is a risk that the regulatory authority will impose a sanction either upon the financial organisation or one of its officers for failing to comply with the regulatory standards applicable in the financial services. Reporter Accountancy Daily 2019-2021 29 Oct 2019.

Source: bi.go.id

Source: bi.go.id

It is critical to prevent this from happening. In money laundering a criminal is going to try to take his or her dirty money and clean it by using the accounts of law firms and legal professionals. The damage caused by money laundering to the public. The main risk that firms should be aware of is that many of these types of claims are not genuine. Financial institutions face the challenge of addressing the threat of money laundering on multiple fronts.

Source: bi.go.id

Financial institutions face the challenge of addressing the threat of money laundering on multiple fronts. The SRAs latest guidance looks at some concerns that law firms may have about money laundering risks in the current climate. Criminals will seek to take advantage of the pandemic and may try to exploit any vulnerabilities in anti-money laundering systems because businesses and individuals focus is elsewhere. A fifth of law firms are failing to comply with anti-money laundering rules a watchdog has revealed as it vowed to clamp down on non-compliance. Regulatory risks are the negative consequences that financial services institutions are likely to face if they dont comply with regulatorylegislative norms meant to counter money laundering activities.

Source: redalyc.org

Source: redalyc.org

ML and to a lessor degree terrorist financing is a current risk to Australian law firms. The degree to which the main and subsidiary risks have changed since the risk outlook was first published last year show how rapidly the challenges facing. The main risk that firms should be aware of is that many of these types of claims are not genuine. Does not take into account other criteria that may influence the assessment of the level of money laundering and terrorist financing risk for a given client including. A fifth of law firms are failing to comply with anti-money laundering rules a watchdog has revealed as it vowed to clamp down on non-compliance.

Source: researchgate.net

Source: researchgate.net

It is critical to prevent this from happening. Large amounts of money handled confidentially by law firms. Regulatory risks are the negative consequences that financial services institutions are likely to face if they dont comply with regulatorylegislative norms meant to counter money laundering activities. In more recent times the focus has switched to preventing money laundering identifying source of funds verifying that genuine business is being done and in general terms making sure there is clarity and clear understanding of what is going on in respect of a particular matterAccordingly in the UK there has been a big focus on the regulation of law firms a trend reflected in other sectors such as. So what are the reasons why law firms are targets for money laundering and have money laundering risks.

Source: branddocs.com

Source: branddocs.com

It is critical to prevent this from happening. ML and to a lessor degree terrorist financing is a current risk to Australian law firms. The main risk that firms should be aware of is that many of these types of claims are not genuine. The damage caused by money laundering to the public. There is a risk that the regulatory authority will impose a sanction either upon the financial organisation or one of its officers for failing to comply with the regulatory standards applicable in the financial services.

Source: branddocs.com

Source: branddocs.com

In more recent times the focus has switched to preventing money laundering identifying source of funds verifying that genuine business is being done and in general terms making sure there is clarity and clear understanding of what is going on in respect of a particular matterAccordingly in the UK there has been a big focus on the regulation of law firms a trend reflected in other sectors such as. The Solicitor Regulation Authority SRA is planning to launch money laundering investigations into 7000 law firms after they discovered that too many were not complying with anti-money laundering regulations. It is good risk and reputation management to consider these risks now not waiting for the Anti-Money Laundering Counter-Terrorism Financing Act 2006 to apply. Exposés such as the Panama Papers and Paradise Papers have rightly or wrongly put offshore wealth in the cross-hairs of regulatory NGO and law enforcement scrutiny and the. Examples of red flag indicators of money laundering could include.

There is a risk that the regulatory authority will impose a sanction either upon the financial organisation or one of its officers for failing to comply with the regulatory standards applicable in the financial services. Bogus law firms and money laundering have become two of the biggest current risks to law firms the Solicitors Regulation Authority SRA said yesterday in publishing its 2014 risk outlook. Anti-Money Laundering Counter Terrorist Financing and wider Financial Crime issues remain near the top of the risk and compliance agenda for law firms and property professionals. Large amounts of money handled confidentially by law firms. It is critical to prevent this from happening.

Source: pinterest.com

Source: pinterest.com

It is good risk and reputation management to consider these risks now not waiting for the Anti-Money Laundering Counter-Terrorism Financing Act 2006 to apply. Examples of these risks and their consequences include the following factors. It is good risk and reputation management to consider these risks now not waiting for the Anti-Money Laundering Counter-Terrorism Financing Act 2006 to apply. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. Bogus law firms and money laundering have become two of the biggest current risks to law firms the Solicitors Regulation Authority SRA said yesterday in publishing its 2014 risk outlook.

Source: jagranjosh.com

Source: jagranjosh.com

There is a risk that the regulatory authority will impose a sanction either upon the financial organisation or one of its officers for failing to comply with the regulatory standards applicable in the financial services. Regulatory risks are the negative consequences that financial services institutions are likely to face if they dont comply with regulatorylegislative norms meant to counter money laundering activities. Money laundering and terrorist financing risk has been a key area of focus for regulators across the globe for some years and this trend is only likely to continue. There are strong penalties planned for those who fail to comply. Long term absences of key officers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risks faced by law firms by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.