14+ Money laundering risk trusts ideas in 2021

Home » money laundering idea » 14+ Money laundering risk trusts ideas in 2021Your Money laundering risk trusts images are available in this site. Money laundering risk trusts are a topic that is being searched for and liked by netizens today. You can Get the Money laundering risk trusts files here. Get all royalty-free photos.

If you’re searching for money laundering risk trusts images information related to the money laundering risk trusts topic, you have come to the right blog. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Money Laundering Risk Trusts. Money laundering is the process by which criminally obtained money or other assets criminal property are exchanged for clean money or other assets with no obvious link to their criminal origins. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations. As in any account relationship money laundering risk may arise from trust and asset management activities. When does this risk assessment apply.

Nz Police Anti Money Laundering Assessment Cites Trusts Among Attractive Money Laundering Vehicles As Government Plans To Exclude Them From Strengthened Beneficial Ownership Disclosure Regime Interest Co Nz From interest.co.nz

Nz Police Anti Money Laundering Assessment Cites Trusts Among Attractive Money Laundering Vehicles As Government Plans To Exclude Them From Strengthened Beneficial Ownership Disclosure Regime Interest Co Nz From interest.co.nz

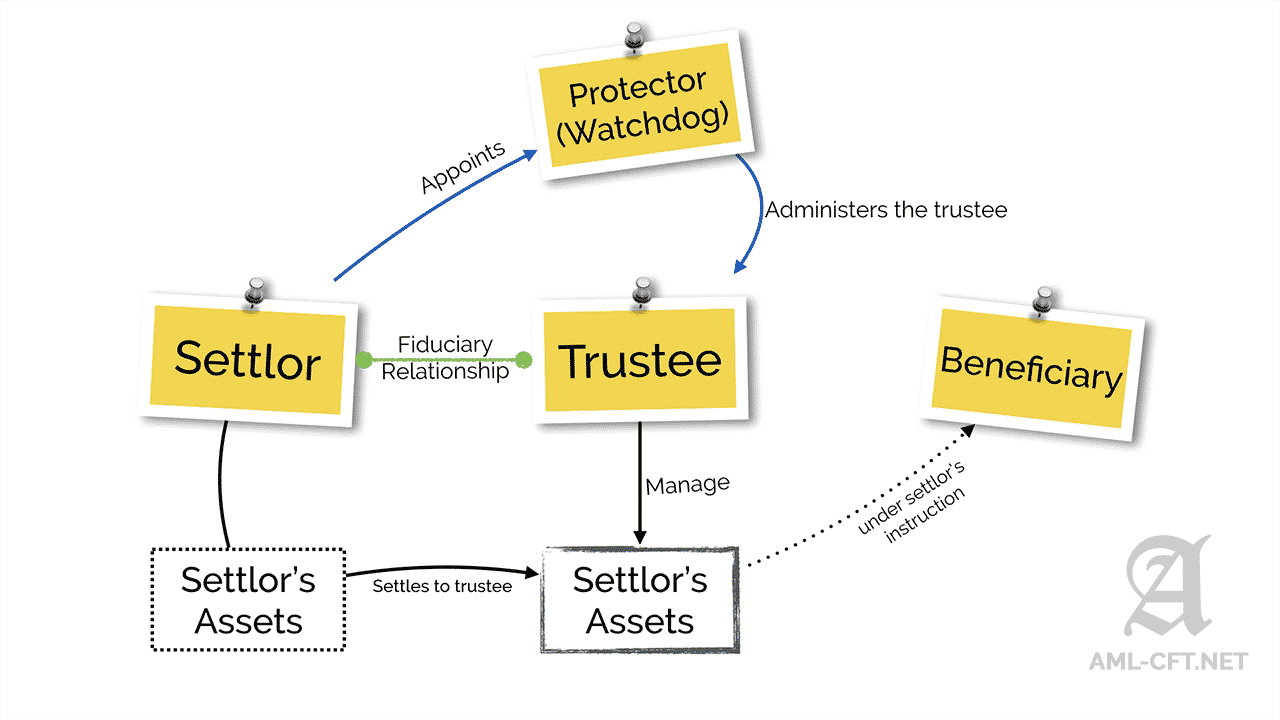

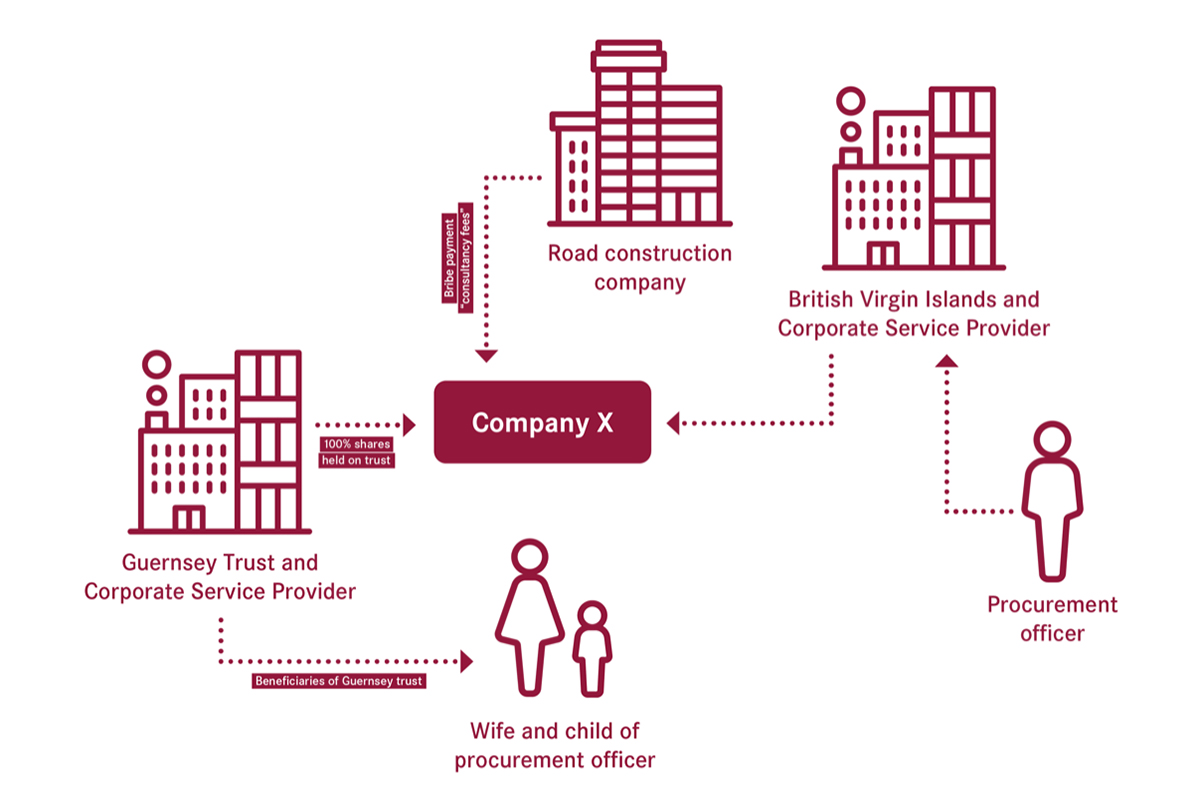

The risk of money laundering is also low so requiring them to be registered would be disproportionate to the risk. Commercial trusts 31 respondents proposed that trusts used to support commercial transactions should not be required to. When misused trust and asset management accounts can conceal the sources and uses of funds as well as the identity of beneficial and legal owners. On 15 July HMRC and HM Treasury published their summary of responses and confirmed that the government has taken respondents views into consideration when determining which trusts will be exempt from registration. The UKs second national risk assessment of money laundering and terrorist financing notes that there are no known cases of UK trusts being abused for terrorist financing. Trust and company service providers TCSPs are at a high risk of being used for money laundering or terrorist financing.

The risk of money laundering is also low so requiring them to be registered would be disproportionate to the risk.

The creation and management of trusts and companies might be readily used to disguise the ownership and control of assets that can help criminals to hide the proceeds of crime. Anti-Money Laundering Risk Advisory. In potentially important gaps in the global network to address the money laundering risks associated with this sector. Money Laundering and Trust or Company Service Providers 11 Money laundering includes how criminals change money and other assets into. 21 What is money laundering. Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to.

Source: planetcompliance.com

Source: planetcompliance.com

Anti-Money Laundering Risk Advisory. Updated 18 March 2021. 21 What is money laundering. Money laundering is the process by which criminally obtained money or other assets criminal property are exchanged for clean money or other assets with no obvious link to their criminal origins. While there are many legitimate uses of trusts for matters such as estate planning and asset management members of the legal profession must be on guard against clients who wish to use such instruments for an improper or fraudulent purpose.

Source:

The Money Laundering Risk Posed by Lawyer Trust Accounts. Some criminals see. View that such trusts present a very low risk of money laundering. The Money Laundering Risk Posed by Lawyer Trust Accounts. The creation and management of trusts and companies might be readily used to disguise the ownership and control of assets that can help criminals to hide the proceeds of crime.

Source: interest.co.nz

Source: interest.co.nz

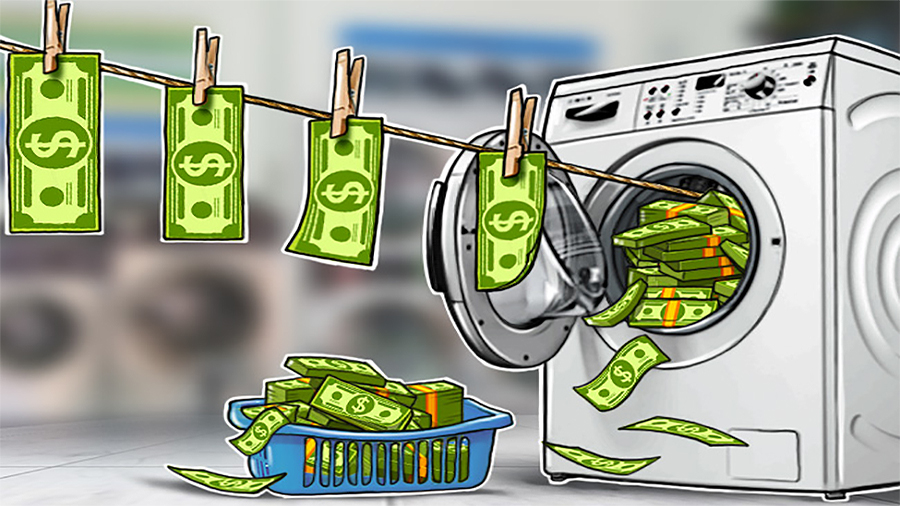

Trusts are a common typology for disguising ultimate beneficiaries andor hiding assets Trustees Settlors and Beneficiaries should be verifiedAMLCFT risks. Trusts provide a solution to those seeking to undertake money laundering and the financing of terrorism as they can facilitate the creation of false paper trails hide transactions and maintain secrecy of beneficial ownership. In potentially important gaps in the global network to address the money laundering risks associated with this sector. When misused trust and asset management accounts can conceal the sources and uses of funds as well as the identity of beneficial and legal owners. Anti-Money Laundering Risk Advisory.

Source: en.ppt-online.org

Source: en.ppt-online.org

On 15 July HMRC and HM Treasury published their summary of responses and confirmed that the government has taken respondents views into consideration when determining which trusts will be exempt from registration. Criminal property may take any form including money or moneys worth. The creation and management of trusts and companies might be readily used to disguise the ownership and control of assets that can help criminals to hide the proceeds of crime. While there are many legitimate uses of trusts for matters such as estate planning and asset management members of the legal profession must be on guard against clients who wish to use such instruments for an improper or fraudulent purpose. It means that supervisors financial institutions and trust and company service providers TCSPs identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed.

Source: aml-cft.net

Source: aml-cft.net

Trusts provide a solution to those seeking to undertake money laundering and the financing of terrorism as they can facilitate the creation of false paper trails hide transactions and maintain secrecy of beneficial ownership. Money laundering with trusts and trust company businesses 02 Mar 2016 Trusts are legal arrangements developed by common law jurisdictions in which the legal title and control of an asset are separated from the equitable interests to that asset. View that such trusts present a very low risk of money laundering. For the wills and probate sector the key here is the risk-based approach which sets out that there is a higher duty of care owed when there is a higher risk of money laundering. The UKs second national risk assessment of money laundering and terrorist financing notes that there are no known cases of UK trusts being abused for terrorist financing.

Source: en.ppt-online.org

Source: en.ppt-online.org

The Money Laundering Risk Posed by Lawyer Trust Accounts. In potentially important gaps in the global network to address the money laundering risks associated with this sector. In December 2016 the Financial Action Task Force FATF an intergovernmental organization established during the 1989 G7 summit released a report on the United States efforts to combat money laundering and terrorist financing. In addition there are other bodies that have done significant work in. The UKs second national risk assessment of money laundering and terrorist financing notes that there are no known cases of UK trusts being abused for terrorist financing.

Source: ftadviser.com

Source: ftadviser.com

Commercial trusts 31 respondents proposed that trusts used to support commercial transactions should not be required to. The UKs second national risk assessment of money laundering and terrorist financing notes that there are no known cases of UK trusts being abused for terrorist financing. While there are many legitimate uses of trusts for matters such as estate planning and asset management members of the legal profession must be on guard against clients who wish to use such instruments for an improper or fraudulent purpose. The Money Laundering Risk Posed by Lawyer Trust Accounts. Money laundering is the process by which criminally obtained money or other assets criminal property are exchanged for clean money or other assets with no obvious link to their criminal origins.

Source:

The UKs second national risk assessment of money laundering and terrorist financing notes that there are no known cases of UK trusts being abused for terrorist financing. Some criminals see. The creation and management of trusts and companies might be readily used to disguise the ownership and control of assets that can help criminals to hide the proceeds of crime. The report from HM Treasury prepares the way for a review by the international Financial Action Task Force FATF later this year with publication expected in 2018. It means that supervisors financial institutions and trust and company service providers TCSPs identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed.

Source:

21 What is money laundering. Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to. Money laundering with trusts and trust company businesses 02 Mar 2016 Trusts are legal arrangements developed by common law jurisdictions in which the legal title and control of an asset are separated from the equitable interests to that asset. Trusts are a common typology for disguising ultimate beneficiaries andor hiding assets Trustees Settlors and Beneficiaries should be verifiedAMLCFT risks. Trust and company service providers TCSPs are at a high risk of being used for money laundering or terrorist financing.

Source: fatf-gafi.org

Source: fatf-gafi.org

For the wills and probate sector the key here is the risk-based approach which sets out that there is a higher duty of care owed when there is a higher risk of money laundering. Commercial trusts 31 respondents proposed that trusts used to support commercial transactions should not be required to. Criminal property may take any form including money or moneys worth. While there are many legitimate uses of trusts for matters such as estate planning and asset management members of the legal profession must be on guard against clients who wish to use such instruments for an improper or fraudulent purpose. In December 2016 the Financial Action Task Force FATF an intergovernmental organization established during the 1989 G7 summit released a report on the United States efforts to combat money laundering and terrorist financing.

Source: ft.lk

Source: ft.lk

View that such trusts present a very low risk of money laundering. Money laundering with trusts and trust company businesses 02 Mar 2016 Trusts are legal arrangements developed by common law jurisdictions in which the legal title and control of an asset are separated from the equitable interests to that asset. Anti-Money Laundering Risk Advisory. The creation and management of trusts and companies might be readily used to disguise the ownership and control of assets that can help criminals to hide the proceeds of crime. View that such trusts present a very low risk of money laundering.

Source: baselgovernance.org

Source: baselgovernance.org

The Money Laundering Risk Posed by Lawyer Trust Accounts. In December 2016 the Financial Action Task Force FATF an intergovernmental organization established during the 1989 G7 summit released a report on the United States efforts to combat money laundering and terrorist financing. Money laundering with trusts and trust company businesses 02 Mar 2016 Trusts are legal arrangements developed by common law jurisdictions in which the legal title and control of an asset are separated from the equitable interests to that asset. The UKs second national risk assessment of money laundering and terrorist financing notes that there are no known cases of UK trusts being abused for terrorist financing. Money laundering is the process by which criminally obtained money or other assets criminal property are exchanged for clean money or other assets with no obvious link to their criminal origins.

Source: en.ppt-online.org

Source: en.ppt-online.org

Some criminals see. View that such trusts present a very low risk of money laundering. Trust and company service providers TCSPs are at a high risk of being used for money laundering or terrorist financing. When does this risk assessment apply. Some criminals see.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk trusts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.