16++ Money laundering risk rating info

Home » money laundering idea » 16++ Money laundering risk rating infoYour Money laundering risk rating images are ready in this website. Money laundering risk rating are a topic that is being searched for and liked by netizens today. You can Get the Money laundering risk rating files here. Get all royalty-free photos.

If you’re searching for money laundering risk rating pictures information related to the money laundering risk rating interest, you have pay a visit to the right site. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

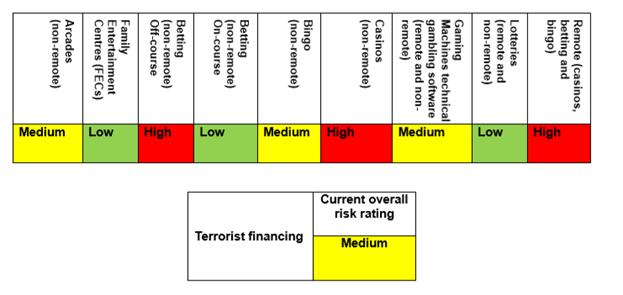

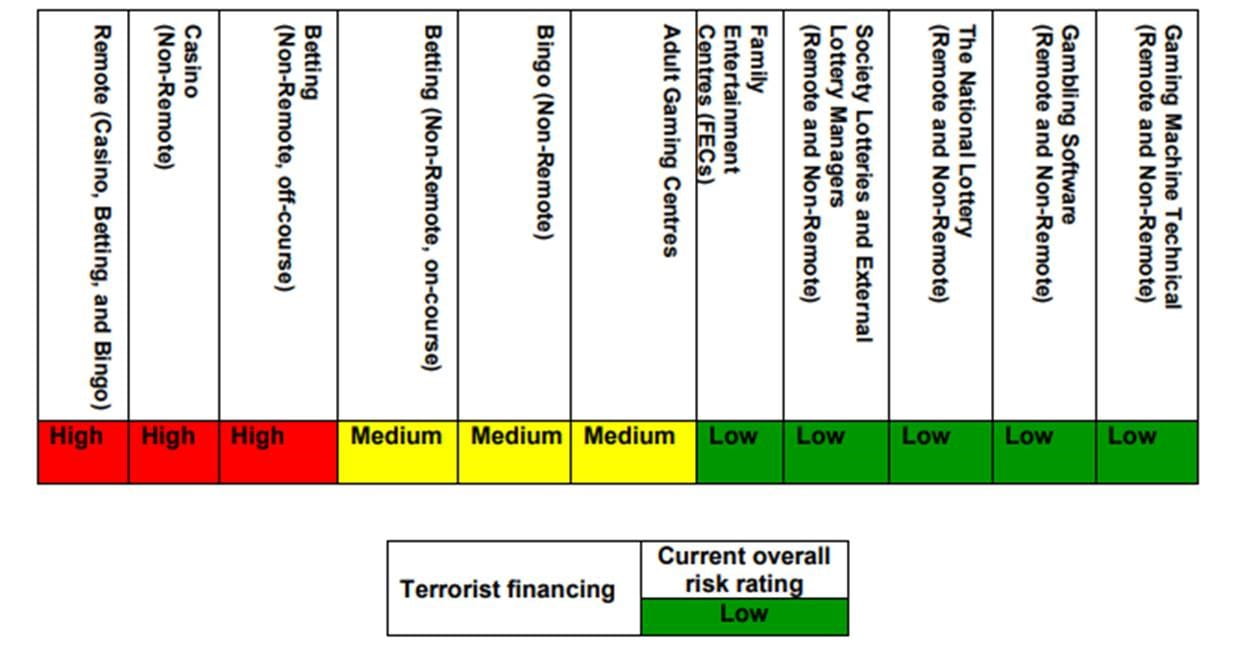

Money Laundering Risk Rating. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. To summarise the above points a money laundering risk assessment requires the identification of Key Risk Indicators the measurement of risk drivers and the allocation of the findings into a risk range. The system observes transaction activity and adjusts client perimeters in real-time.

Basel Anti Money Laundering Index 2017 Icfp From icfp.co.za

Basel Anti Money Laundering Index 2017 Icfp From icfp.co.za

Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. An effective supervisory tool and internal rating system to determine if risk management policies and practices and internal controls to prevent MLTF are in place well disseminated and effectively implemented. Assessors should consider the nature and extent of the money laundering and terrorist financing risk factors to the country at the outset of the assessment and throughout the. Risk ratings should be determined based on individual institutions policy and government regulations. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more.

Assessors should consider the nature and extent of the money laundering and terrorist financing risk factors to the country at the outset of the assessment and throughout the.

Working Group members also get hands-on training on the Risk Assessment Tool. Assessors should consider the nature and extent of the money laundering and terrorist financing risk factors to the country at the outset of the assessment and throughout the. Money launderingterrorism financing risk assessment Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. How KYC Risk Rating Works. Working Group members also get hands-on training on the Risk Assessment Tool. Risk ratings should be determined based on individual institutions policy and government regulations.

Source: bi.go.id

Source: bi.go.id

Anti-Money Laundering Risk Rating System April 13 2012 1058 am This is to notify all members and partners of RBAP of the newly issued Anti-Money Laundering Risk Rating System adopted under MB Resolution 362 dated March 2 of this year. Recommendation 1 and the risk-based elements of other Recommendations and to assess effectiveness. Risk ratings should be determined based on individual institutions policy and government regulations. It enables assessment of all CPs in a comprehensive and uniform manner. To summarise the above points a money laundering risk assessment requires the identification of Key Risk Indicators the measurement of risk drivers and the allocation of the findings into a risk range.

Source: icfp.co.za

Source: icfp.co.za

Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. One of the applications is the monitoring of or restrictions on real-time transactions. It is the first thing you must do because it determines what measures you need to include in your program. Input into the overall money laundering risk assessment. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering.

Source: lexology.com

Source: lexology.com

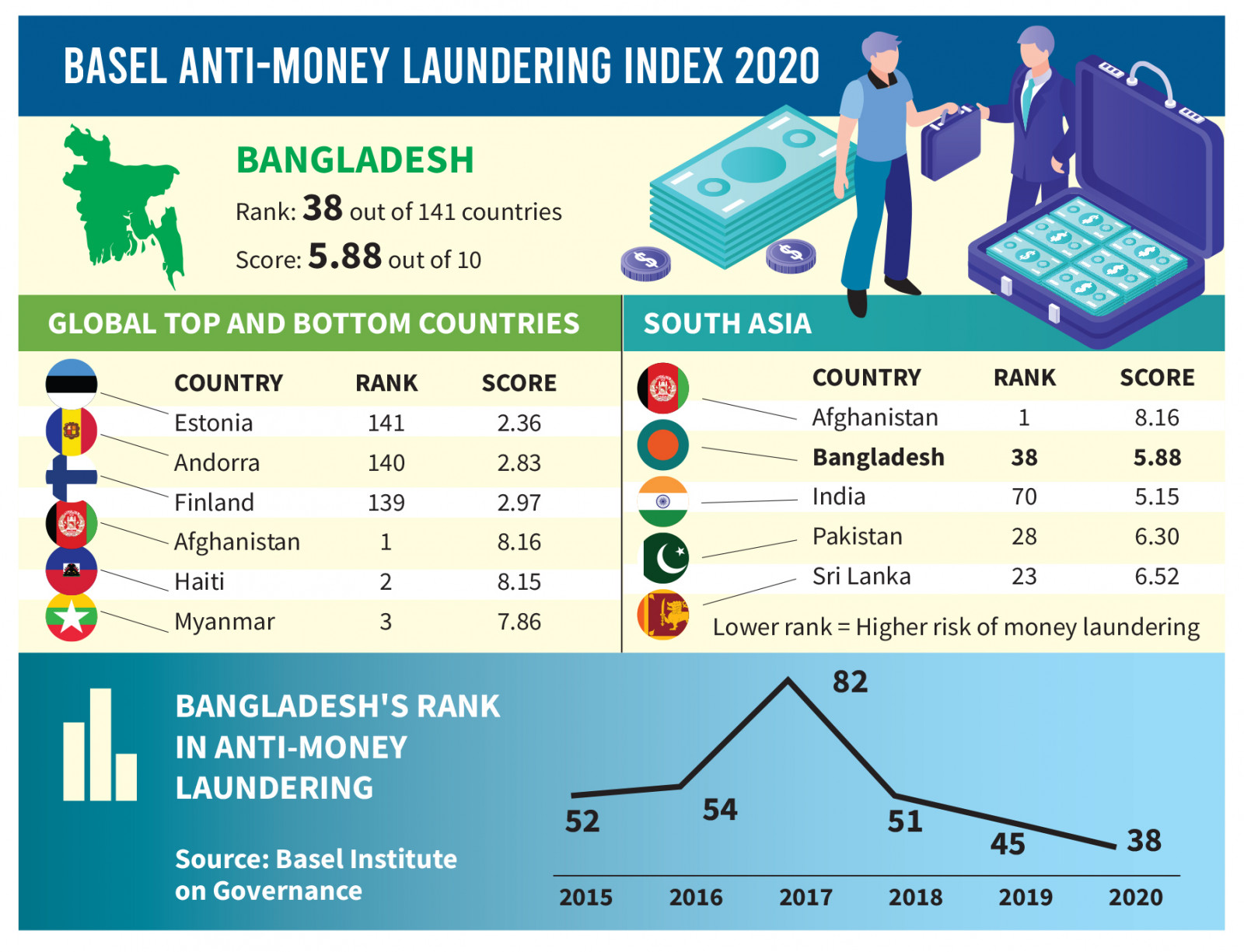

Working Group members also get hands-on training on the Risk Assessment Tool. How KYC Risk Rating Works. The Basel AML Index measures the risk of MLTF in countries around the world. AML Risk Rating System ARRS What is the ARRS. It is the first thing you must do because it determines what measures you need to include in your program.

Source: tbsnews.net

Source: tbsnews.net

To summarise the above points a money laundering risk assessment requires the identification of Key Risk Indicators the measurement of risk drivers and the allocation of the findings into a risk range. Jurisdiction of citizenship The money laundering risk rating of every country needs to be included in the risk rating methodology used to assess the customers overall risk rating. Anti Money Laundering And Counter Terrorism Financing. It is the first thing you must do because it determines what measures you need to include in your program. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing.

Source: pinterest.com

Source: pinterest.com

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Risk ratings should be determined based on individual institutions policy and government regulations. Flexible rules up 1500 different components. It is the first thing you must do because it determines what measures you need to include in your program. Recalculate your entire client portfolio in minutes.

Source:

Anti Money Laundering And Counter Terrorism Financing. One of the applications is the monitoring of or restrictions on real-time transactions. Global Anti-Money Laundering Research Tool Used by Financial Institutions Regulators Government Agencies and Educational Establishments throughout the world Country Reports. Assessors should consider the nature and extent of the money laundering and terrorist financing risk factors to the country at the outset of the assessment and throughout the. Working Group members also get hands-on training on the Risk Assessment Tool.

Source: bi.go.id

Source: bi.go.id

With regard to specific types of customers or high-risk customers banks should combine their risk characterization to increase monitoring or restriction measures in their business operation systems. The assessment process starts during the workshop. Anti Money Laundering And Counter Terrorism Financing. Assessors should consider the nature and extent of the money laundering and terrorist financing risk factors to the country at the outset of the assessment and throughout the. According to their risk of money laundering and terrorist financing MLTF.

Source: lexology.com

Source: lexology.com

Jurisdiction of citizenship The money laundering risk rating of every country needs to be included in the risk rating methodology used to assess the customers overall risk rating. Risk is defined broadly as a countrys vulnerability to MLTF and its capacities to counter it. It does not measure the actual amount of MLTF activity in a country. A domicile may have one of three country money laundering risks. High-risk and other monitored jurisdictions.

Source: tbsnews.net

Source: tbsnews.net

Recalculate your entire client portfolio in minutes. Anti-Money Laundering Risk Rating System April 13 2012 1058 am This is to notify all members and partners of RBAP of the newly issued Anti-Money Laundering Risk Rating System adopted under MB Resolution 362 dated March 2 of this year. A domicile may have one of three country money laundering risks. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. Global Anti-Money Laundering Research Tool Used by Financial Institutions Regulators Government Agencies and Educational Establishments throughout the world Country Reports.

Source: bi.go.id

Source: bi.go.id

The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more. The risk rating can lead to a proactive response to the potential threat and a wider choice of reactive action to track money laundering. Input into the overall money laundering risk assessment. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. The assessment process starts during the workshop.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

How KYC Risk Rating Works. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. A domicile may have one of three country money laundering risks. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. With regard to specific types of customers or high-risk customers banks should combine their risk characterization to increase monitoring or restriction measures in their business operation systems.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

A risk range can be a simple rating of Low Medium and High. The system observes transaction activity and adjusts client perimeters in real-time. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. How KYC Risk Rating Works.

Source: bi.go.id

Source: bi.go.id

Assessors should consider the nature and extent of the money laundering and terrorist financing risk factors to the country at the outset of the assessment and throughout the. Global Anti-Money Laundering Research Tool Used by Financial Institutions Regulators Government Agencies and Educational Establishments throughout the world Country Reports. AML Risk Rating System ARRS What is the ARRS. Anti Money Laundering And Counter Terrorism Financing. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.