11+ Money laundering risk profile information

Home » money laundering idea » 11+ Money laundering risk profile informationYour Money laundering risk profile images are available in this site. Money laundering risk profile are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering risk profile files here. Download all royalty-free photos.

If you’re looking for money laundering risk profile pictures information linked to the money laundering risk profile topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

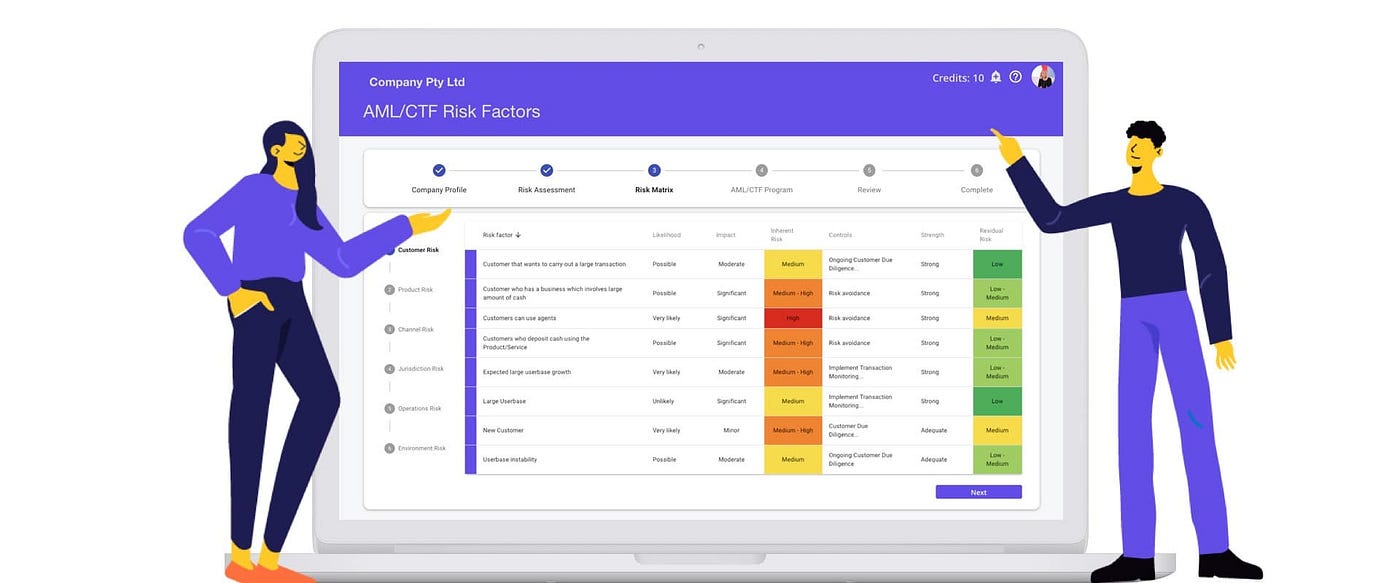

Money Laundering Risk Profile. The professional subscription is for those businesses that manage AMLCFT compliance obligations across multiple branches and want a simple solution for managing money laundering risks. Model Risk Assessment Model Risks Model Controls 1 Model is not aligned to identify typologies of money laundering consistent with the unique. B Implementation of technology based solutions. Simonovski I Nikoloska S 2016 Profiling of High Risk Profiles of Clients in Order to Prevent Money Laundering and Terrorism.

Create And Update The Ml Tf Risk Profiles Of Your Customers By Mitchell Travers Bronid Medium From medium.com

Create And Update The Ml Tf Risk Profiles Of Your Customers By Mitchell Travers Bronid Medium From medium.com

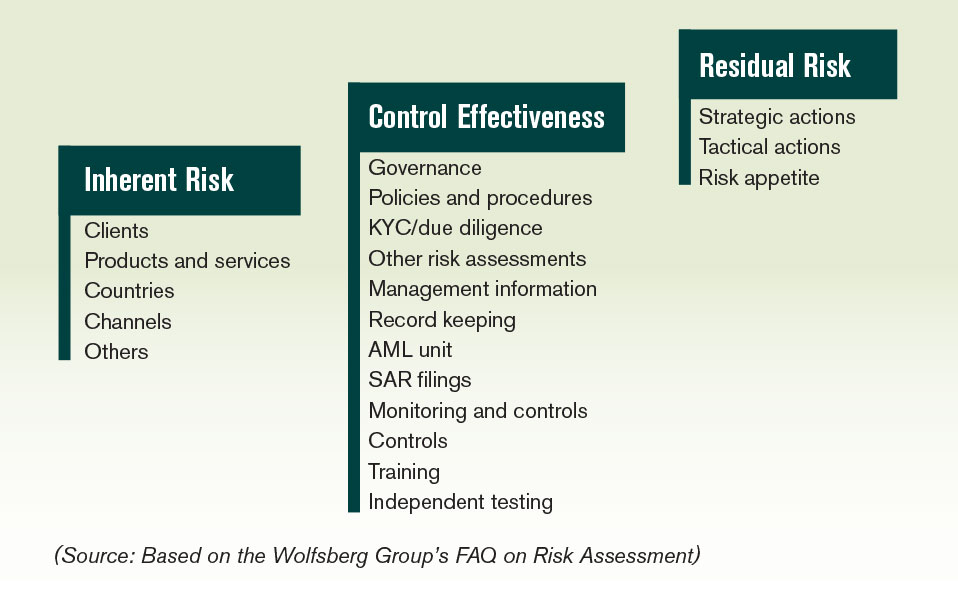

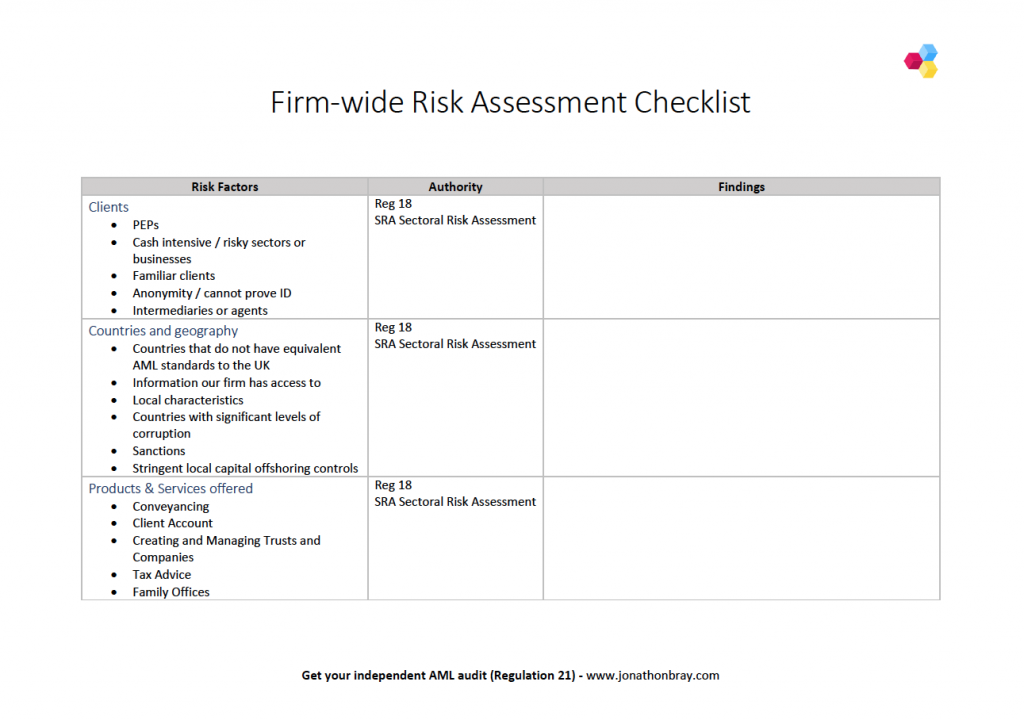

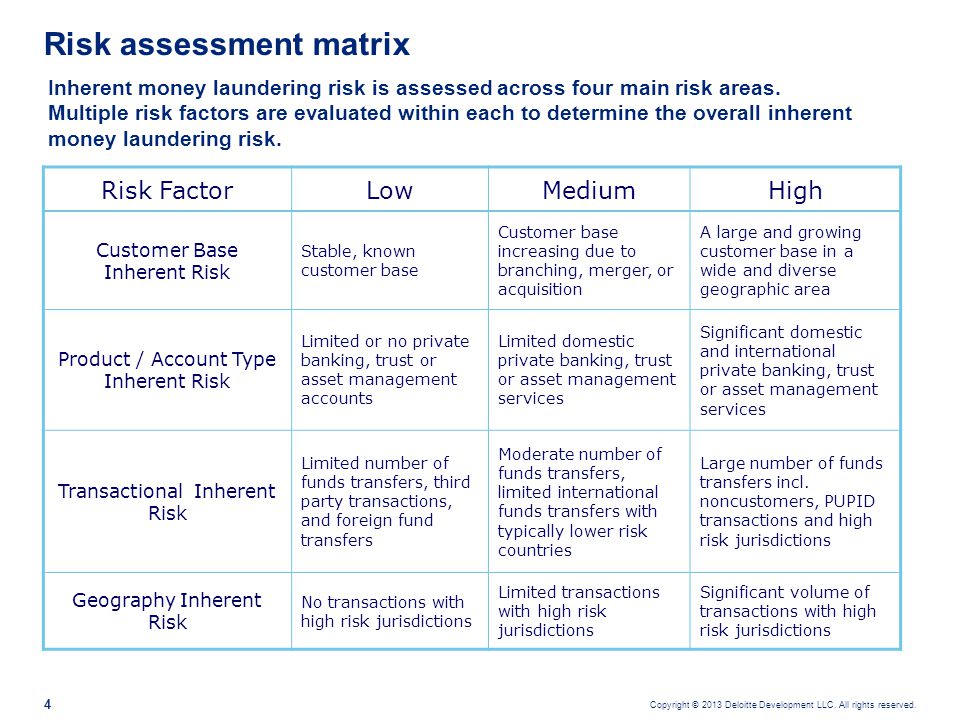

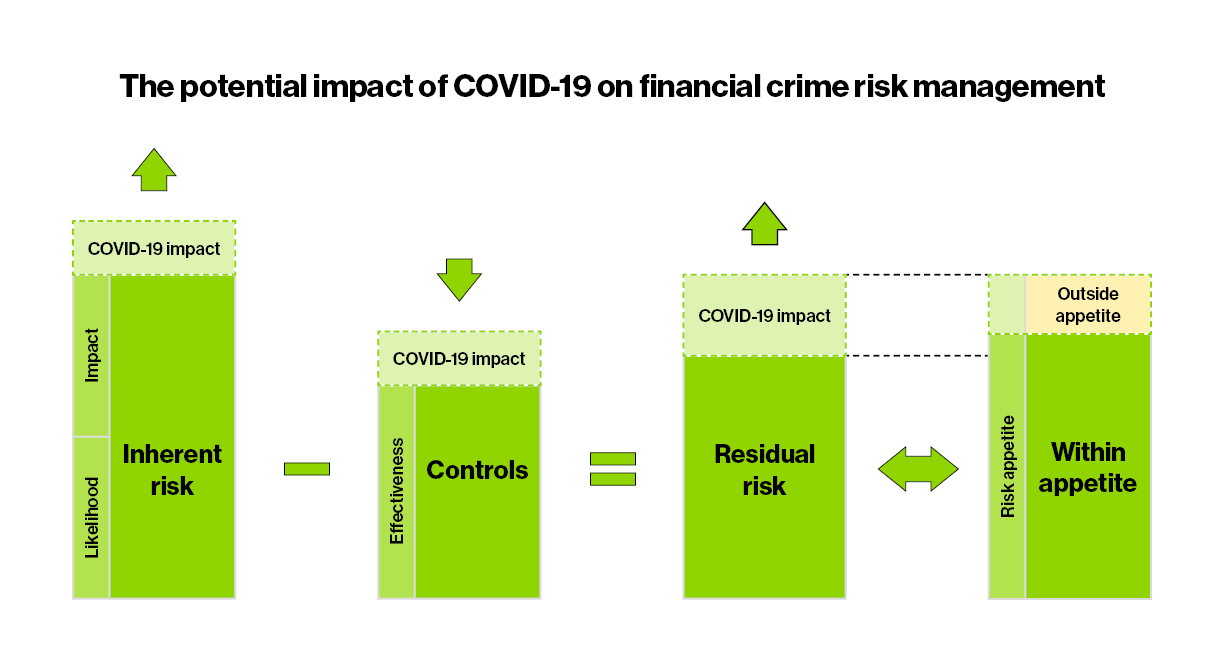

Risk assessment is the basis of applying the risk-based approach in any organization. Introduction Money laundering is the process of criminal proceeds for the secrecy of their illicit source of money. Principles of the Risk-Based Approach. The Anti-Money Laundering Risk Officer MLRO is responsible for designing and monitoring internal AML procedures and policies relating to record keeping reporting risk assessment customer due diligence measures and management control systems. Heshe will also be responsible for organizing and arranging training for the staff on anti-money. Carry out a detailed risk assessment of.

J Forensic Anthropol 1.

Money launderingterrorism financing risk assessment. B Implementation of technology based solutions. Carry out a detailed risk assessment of. The Anti-Money Laundering Risk Officer MLRO is responsible for designing and monitoring internal AML procedures and policies relating to record keeping reporting risk assessment customer due diligence measures and management control systems. With the Pro subscription you can single handedly manage risk assessments for separate business divisions or businesses within a corporate group. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or.

Source: acamstoday.org

Source: acamstoday.org

The professional subscription is for those businesses that manage AMLCFT compliance obligations across multiple branches and want a simple solution for managing money laundering risks. Introduction Money laundering is the process of criminal proceeds for the secrecy of their illicit source of money. Understanding risk within the Recommendation 12 context is important for two reasons. It is the first thing you must do because it determines what measures you need to include in your program. This results in the creation of a customer risk profile or customer risk rating.

Source: service.betterregulation.com

Source: service.betterregulation.com

Introduction Money laundering is the process of criminal proceeds for the secrecy of their illicit source of money. This involves following a number of steps. Business Risk Profile. With the Pro subscription you can single handedly manage risk assessments for separate business divisions or businesses within a corporate group. J Forensic Anthropol 1.

Source: lexology.com

Source: lexology.com

Performing an AML risk assessment enables an organization to understand how and to what extent it is vulnerable to money laundering and terrorist financing. Identify the money laundering risks that are relevant to your business. J Forensic Anthropol 1. C Periodical review of ADs distinct risk profile. Performing an AML risk assessment enables an organization to understand how and to what extent it is vulnerable to money laundering and terrorist financing.

Source: eloquens.com

Source: eloquens.com

Business Risk Profile. Money laundering risk building up in private banks Luxembourg regulator warns 29 Oct 2019 A move into ultra-rich clients combined with growing numbers of non-European customers means that the risk of money laundering in Luxembourgs private banks is increasing the head of the countrys financial regulator told the Luxembourg Times. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. Business Risk Profile.

Source: medium.com

Source: medium.com

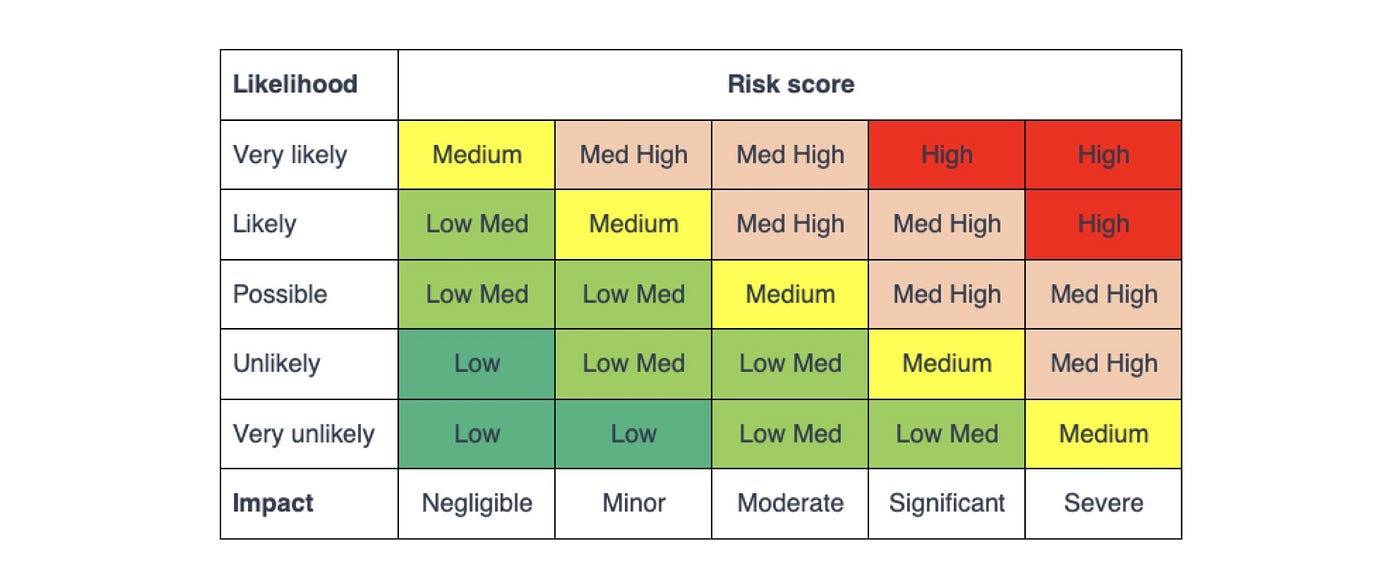

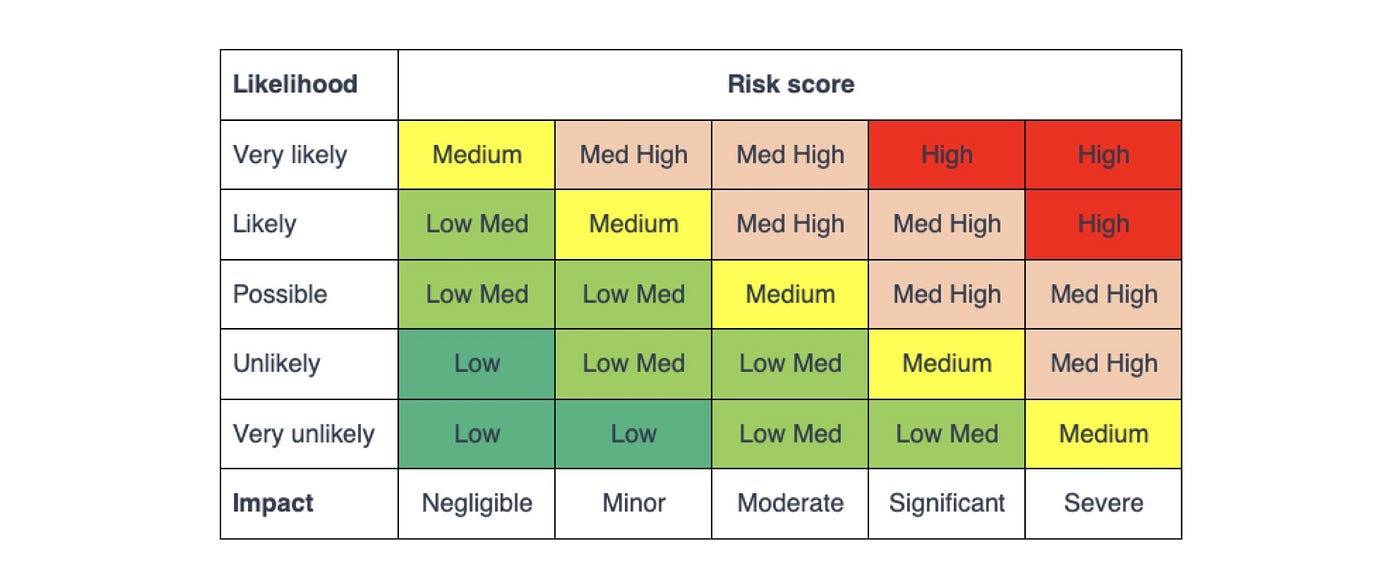

Money launderingterrorism financing risk assessment. Simonovski I Nikoloska S 2016 Profiling of High Risk Profiles of Clients in Order to Prevent Money Laundering and Terrorism. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. This involves following a number of steps.

Source: slideplayer.com

Source: slideplayer.com

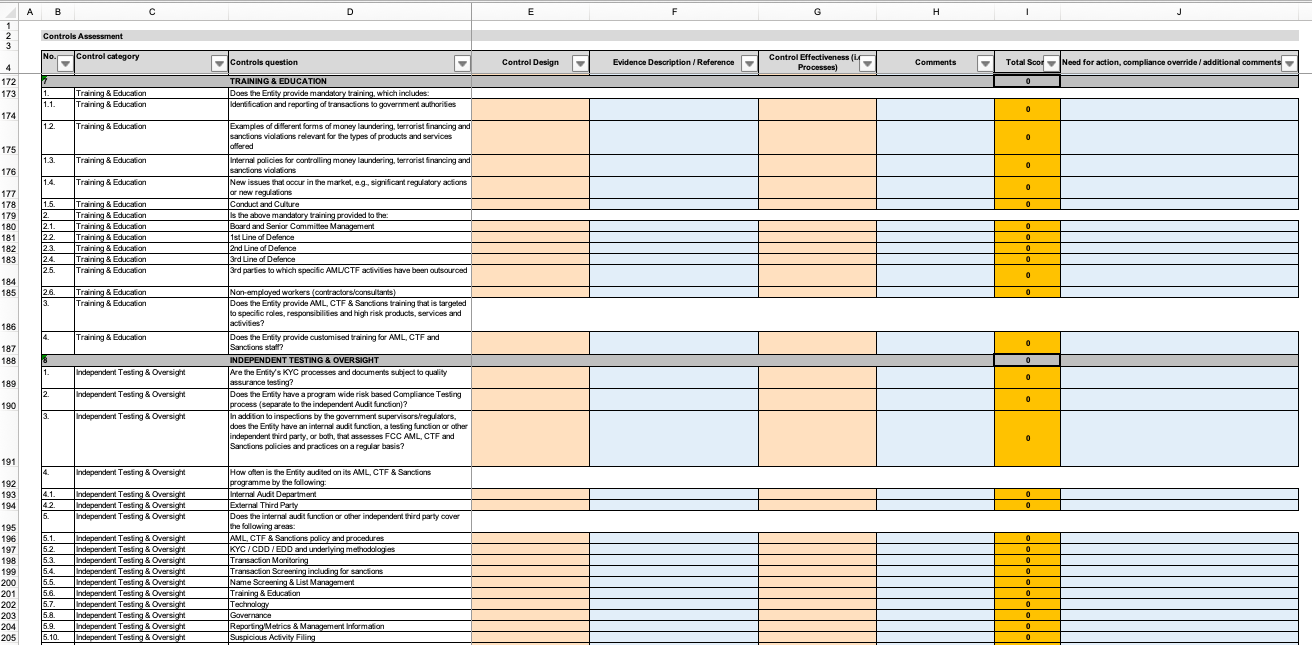

Framework for Managing Risks of Trade Based Money Laundering and Terrorist Financing 7 a Development and implementation of Customer Risk Profiling Framework and Transaction Monitoring System for managing MLTF risks. Framework for Managing Risks of Trade Based Money Laundering and Terrorist Financing 7 a Development and implementation of Customer Risk Profiling Framework and Transaction Monitoring System for managing MLTF risks. J Forensic Anthropol 1. Anti Money Laundering Social Media profile Financial Fraud Fraud Detection Money Laundering Detection Risk profile scoring Anomaly Detection. The findings of a money laundering risk assessment will result in individual risk scores for each KRI as well as an aggregate risk score which is the compounded or overall risk that the business presents.

Source: bi.go.id

Source: bi.go.id

The Anti-Money Laundering Risk Officer MLRO is responsible for designing and monitoring internal AML procedures and policies relating to record keeping reporting risk assessment customer due diligence measures and management control systems. Money launderingterrorism financing risk assessment. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. That requires the performance of customer due diligence. Anti-money laundering AML and fraud-prevention teams are often referred to as two sides of the same coin.

Source: guidehouse.com

Source: guidehouse.com

Inherently high risk for money laundering. In principle the risk-based approach shifts the focus of AML compliance from post-analysis of data to proactive judgment. Anti-money laundering AML and fraud-prevention teams are often referred to as two sides of the same coin. What are considered higher risk customer types for money laundering. Introduction Money laundering is the process of criminal proceeds for the secrecy of their illicit source of money.

Source: bi.go.id

Source: bi.go.id

Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. Part of an institutions risk assessment must include a periodic review of their AML compliance regime. This involves following a number of steps. Identify the money laundering risks that are relevant to your business.

Source: bi.go.id

Source: bi.go.id

The professional subscription is for those businesses that manage AMLCFT compliance obligations across multiple branches and want a simple solution for managing money laundering risks. Framework for Managing Risks of Trade Based Money Laundering and Terrorist Financing 7 a Development and implementation of Customer Risk Profiling Framework and Transaction Monitoring System for managing MLTF risks. Anti Money Laundering Social Media profile Financial Fraud Fraud Detection Money Laundering Detection Risk profile scoring Anomaly Detection. Heshe will also be responsible for organizing and arranging training for the staff on anti-money. Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure.

Source: taxguru.in

Source: taxguru.in

Business Risk Profile. Carry out a detailed risk assessment of. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore. The Anti-Money Laundering Risk Officer MLRO is responsible for designing and monitoring internal AML procedures and policies relating to record keeping reporting risk assessment customer due diligence measures and management control systems. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program.

Source: medium.com

Source: medium.com

Anti-money laundering AML and fraud-prevention teams are often referred to as two sides of the same coin. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Simonovski I Nikoloska S 2016 Profiling of High Risk Profiles of Clients in Order to Prevent Money Laundering and Terrorism. Framework for Managing Risks of Trade Based Money Laundering and Terrorist Financing 7 a Development and implementation of Customer Risk Profiling Framework and Transaction Monitoring System for managing MLTF risks. Money launderingterrorism financing risk assessment.

Source: slideshare.net

Source: slideshare.net

Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore. The findings of a money laundering risk assessment will result in individual risk scores for each KRI as well as an aggregate risk score which is the compounded or overall risk that the business presents. Identify the money laundering risks that are relevant to your business. Money laundering risk building up in private banks Luxembourg regulator warns 29 Oct 2019 A move into ultra-rich clients combined with growing numbers of non-European customers means that the risk of money laundering in Luxembourgs private banks is increasing the head of the countrys financial regulator told the Luxembourg Times. This involves following a number of steps.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk profile by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.