13++ Money laundering risk management process ideas in 2021

Home » money laundering Info » 13++ Money laundering risk management process ideas in 2021Your Money laundering risk management process images are ready. Money laundering risk management process are a topic that is being searched for and liked by netizens today. You can Get the Money laundering risk management process files here. Get all free photos.

If you’re looking for money laundering risk management process images information linked to the money laundering risk management process interest, you have come to the ideal site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

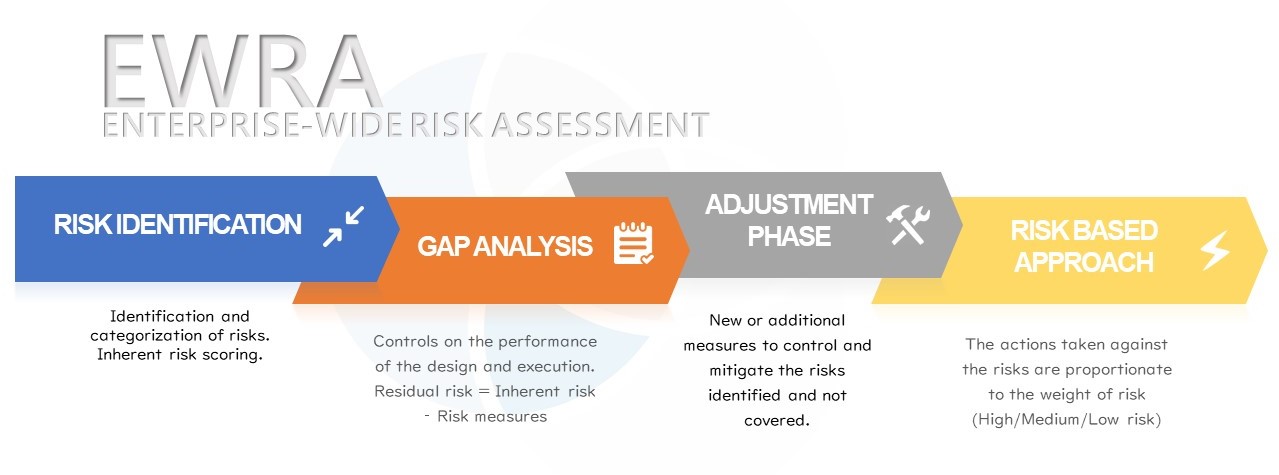

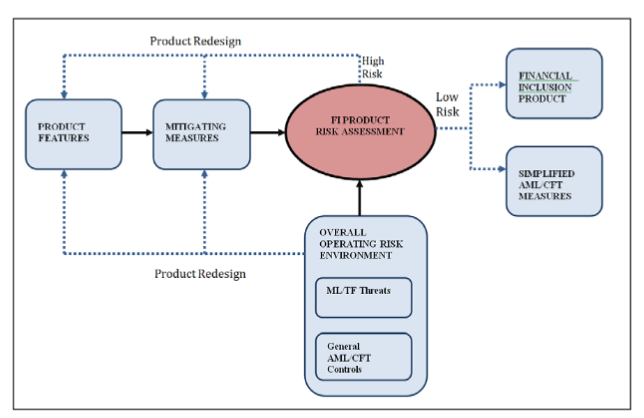

Money Laundering Risk Management Process. A robust risk assessment process is central to maintaining a strong Anti-Money Laundering AML compliance program. Principally it is proceeds of criminal activities such as illicit drugs corruption organized crime fraud sex trade forgery illegal loggingfishing revenue evasion counterfeit money piracy terrorism etc. The Joint Money Laundering Steering Group guidance for example. Information related to money laundering gathered from law enforcement flows to the private sector as risk management guidance advisories and targeted economic sanctions.

Anti Money Laundering Programmes Systems Financetrainingcourse Com From financetrainingcourse.com

Anti Money Laundering Programmes Systems Financetrainingcourse Com From financetrainingcourse.com

Anti Money Laundering Aml Risk Assessment Process. Better reporting of risks v. In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. Ad OSI Provides CGMP Training That Covers FDA Compliance Quality Manufacturing Processes. In recent years banks have taken center stage in the management of increasingly destructive criminal activities particularly money laundering and financial terrorism. Ad OSI Provides CGMP Training That Covers FDA Compliance Quality Manufacturing Processes.

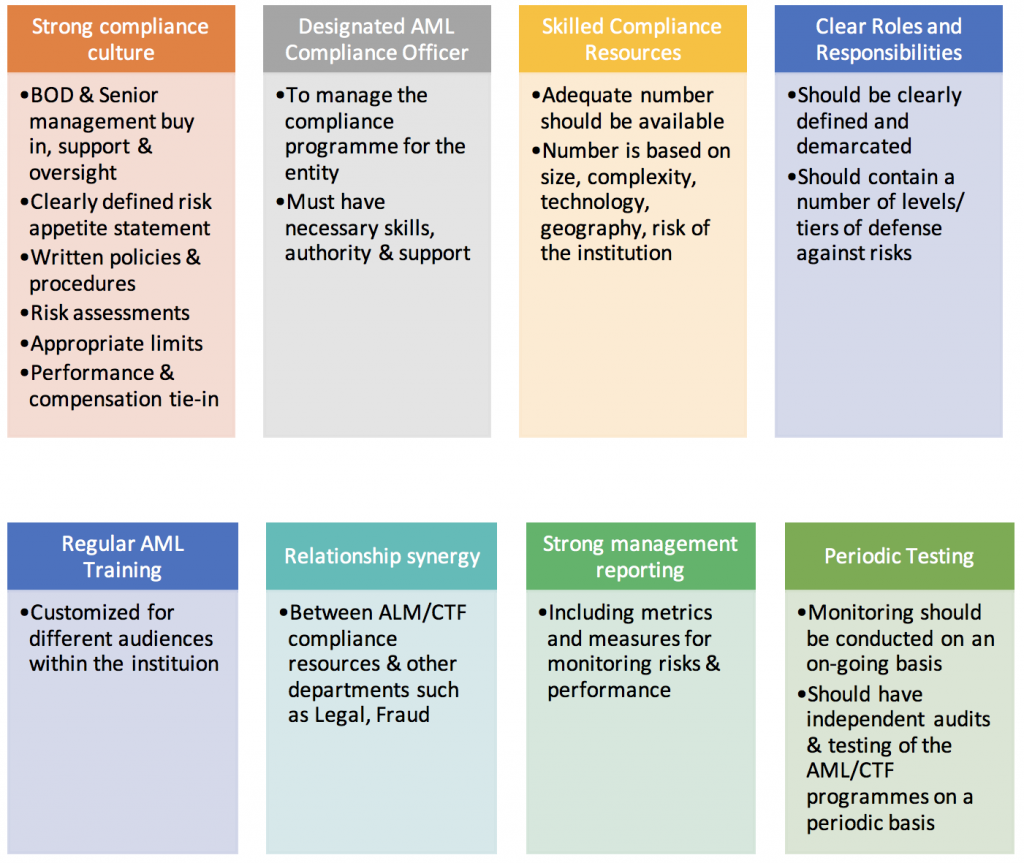

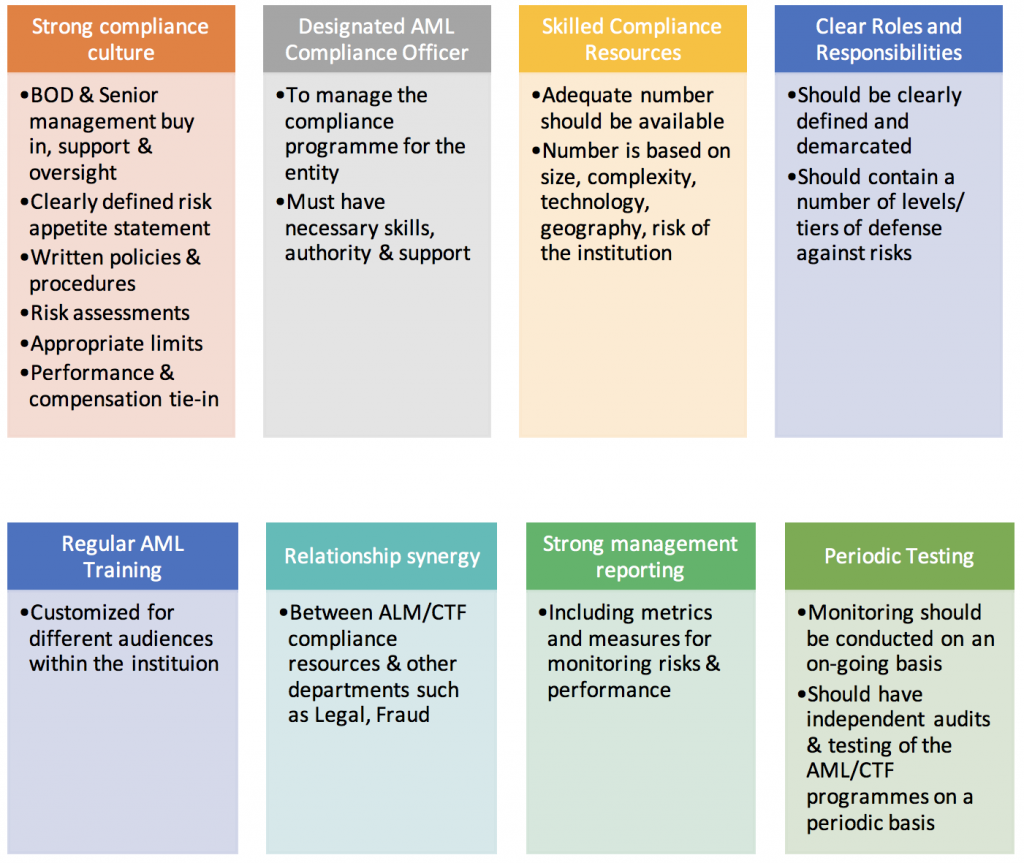

Risk Management Programme Anti-Money Laundering AML and Sanctions Services 1.

Risk Management Programme Anti-Money Laundering AML and Sanctions Services 1. Principally it is proceeds of criminal activities such as illicit drugs corruption organized crime fraud sex trade forgery illegal loggingfishing revenue evasion counterfeit money piracy terrorism etc. Anti Money Laundering Aml Risk Assessment Process. Risk Management Programme Anti-Money Laundering AML and Sanctions Services 1. Money laundering is a process of concealing the true origin and ownership of illegally obtained money. In recent years banks have taken center stage in the management of increasingly destructive criminal activities particularly money laundering and financial terrorism.

Source: financialit.net

Source: financialit.net

Assessing the MLTF risk your business or organisation faces enables. Title 21 CRF Pharmaceutical and Food Processing Courses Delivered Via Cloud Based LMS. Principally it is proceeds of criminal activities such as illicit drugs corruption organized crime fraud sex trade forgery illegal loggingfishing revenue evasion counterfeit money piracy terrorism etc. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. Assessing the MLTF risk your business or organisation faces enables.

Source: acamstoday.org

Source: acamstoday.org

Money laundering risk asset management. Title 21 CRF Pharmaceutical and Food Processing Courses Delivered Via Cloud Based LMS. Which criminals attempt to disguise. Ad OSI Provides CGMP Training That Covers FDA Compliance Quality Manufacturing Processes. Since then the principle was actively promoted by international organizations such as the Wolfsberg.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

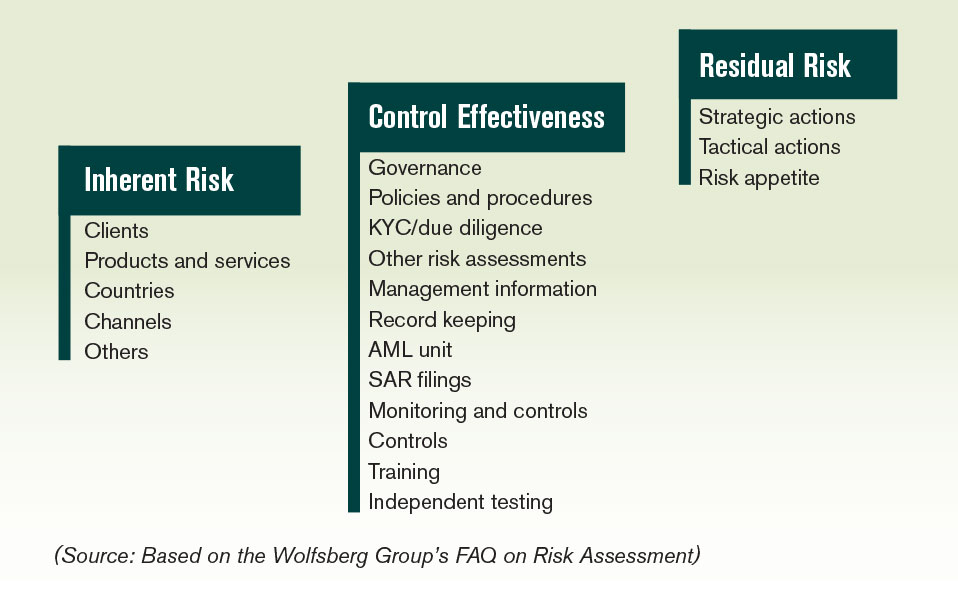

Money laundering risk asset management. Which criminals attempt to disguise. The assessment should provide a comprehensive analysis of AML risks associated with the products and services offered by the lines of business and act as an aggregated estimate of the AML risks across the enterprise. Anti Money Laundering Aml Risk Assessment Process. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or the beneficial owner is a foreign PEP and.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

It is the first thing you must do because it determines what measures you need to include in your program. The Joint Money Laundering Steering Group guidance for example. Principally it is proceeds of criminal activities such as illicit drugs corruption organized crime fraud sex trade forgery illegal loggingfishing revenue evasion counterfeit money piracy terrorism etc. The assessment should provide a comprehensive analysis of AML risks associated with the products and services offered by the lines of business and act as an aggregated estimate of the AML risks across the enterprise. Updated over a week ago A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism.

Source: pideeco.be

Source: pideeco.be

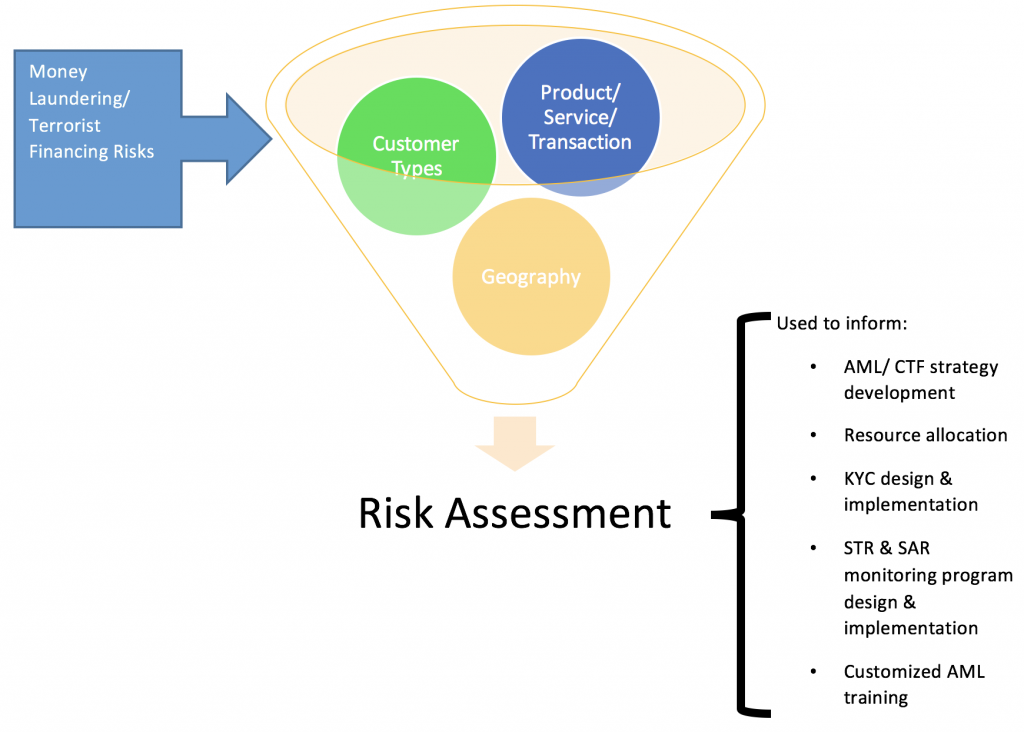

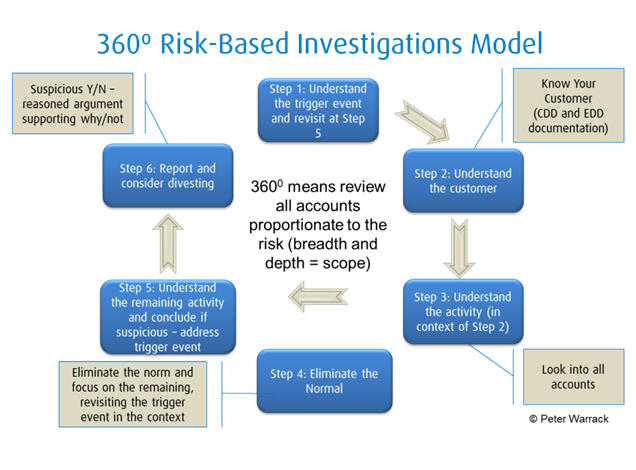

To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. The private sector also is alerted to risks regarding specific individuals entities and transactions through information requests received from law enforcement. Explain policies and procedures a bank should use to manage MLFT risks in situations where it uses a third party to perform customer due diligence and when engaging in correspondent banking. A risk-based approach to anti-money laundering AML facilitates a proactive approach designed to identify and assess relevant risks and justify the investment and deployment of the appropriate countermeasures.

Source: bi.go.id

Source: bi.go.id

Title 21 CRF Pharmaceutical and Food Processing Courses Delivered Via Cloud Based LMS. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The risk-based anti-money laundering AML principle was first promoted by British regulatory authorities.

Source: service.betterregulation.com

Source: service.betterregulation.com

A robust risk assessment process is central to maintaining a strong Anti-Money Laundering AML compliance program. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. Which criminals attempt to disguise. Title 21 CRF Pharmaceutical and Food Processing Courses Delivered Via Cloud Based LMS. The assessment should provide a comprehensive analysis of AML risks associated with the products and services offered by the lines of business and act as an aggregated estimate of the AML risks across the enterprise.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. Principally it is proceeds of criminal activities such as illicit drugs corruption organized crime fraud sex trade forgery illegal loggingfishing revenue evasion counterfeit money piracy terrorism etc. It is a course of by which dirty cash is converted into clean money. Risk Management Programme Anti-Money Laundering AML and Sanctions Services 1. Anti Money Laundering Aml Risk Assessment Process.

Source: taxguru.in

Source: taxguru.in

The Joint Money Laundering Steering Group guidance for example. Principally it is proceeds of criminal activities such as illicit drugs corruption organized crime fraud sex trade forgery illegal loggingfishing revenue evasion counterfeit money piracy terrorism etc. Information related to money laundering gathered from law enforcement flows to the private sector as risk management guidance advisories and targeted economic sanctions. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The assessment should provide a comprehensive analysis of AML risks associated with the products and services offered by the lines of business and act as an aggregated estimate of the AML risks across the enterprise.

Source: bi.go.id

Source: bi.go.id

To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. A risk-based approach to anti-money laundering AML facilitates a proactive approach designed to identify and assess relevant risks and justify the investment and deployment of the appropriate countermeasures. Anti Money Laundering Aml Risk Assessment Process. You can decide which areas of. Creating an AML Sanctions risk framework to organise.

Source: acamstoday.org

Source: acamstoday.org

Risk Management Programme Anti-Money Laundering AML and Sanctions Services 1. Updated over a week ago A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Anti Money Laundering Aml Risk Assessment Process. Title 21 CRF Pharmaceutical and Food Processing Courses Delivered Via Cloud Based LMS. Title 21 CRF Pharmaceutical and Food Processing Courses Delivered Via Cloud Based LMS.

Source: ec.europa.eu

Source: ec.europa.eu

The sources of the cash in precise are felony and the money is invested in a means that makes it appear to be clear cash and conceal the identification of the prison part of the cash earned. Single client view and owner vi. The sources of the cash in precise are felony and the money is invested in a means that makes it appear to be clear cash and conceal the identification of the prison part of the cash earned. You can decide which areas of. Risk Management Programme Anti-Money Laundering AML and Sanctions Services 1.

Source: acamstoday.org

Source: acamstoday.org

The private sector also is alerted to risks regarding specific individuals entities and transactions through information requests received from law enforcement. Better reporting of risks v. Risk management guidelines related to antimoney laundering and terrorist financing issued by the Basel. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. The Guidance aims to enhance the effectiveness of measures to mitigate money laundering risks in respect of tax evasion.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk management process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.