14++ Money laundering risk level ideas in 2021

Home » money laundering idea » 14++ Money laundering risk level ideas in 2021Your Money laundering risk level images are available in this site. Money laundering risk level are a topic that is being searched for and liked by netizens now. You can Get the Money laundering risk level files here. Download all royalty-free vectors.

If you’re searching for money laundering risk level images information related to the money laundering risk level keyword, you have visit the ideal site. Our website frequently provides you with hints for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Money Laundering Risk Level. Your business might be at risk of money laundering from. An alternative range is to use a 5-level rating of Very Low Low Medium High and Very high. This helps the organizations to determine the level of anti-money laundering resources necessary to mitigate that risk. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs From taxguru.in

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs From taxguru.in

Banks need to conduct due diligence on business operations industries customer characteristics and regions in order to obtain adequate complete and truthful customer information as the basis of analyses. Accurately judging the risk level of customer money laundering is an important prerequisite for the risk-based approach. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. RBA - High Level Principles and Procedures. An alternative range is to use a 5-level rating of Very Low Low Medium High and Very high. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or.

Under this recommendation states should designatean authority or mechanism to coordinate actions to assess risk.

An alternative range is to use a 5-level rating of Very Low Low Medium High and Very high. An alternative range is to use a 5-level rating of Very Low Low Medium High and Very high. There is a need for human intervention to really assess whether the cases flagged out by the system are truly bearing money laundering risk. Download pdf 258kb The Guidance on the Risk-Based Approach to combating Money Laundering and Terrorist Financing was developed by the FATF in close consultation with representatives of the international banking and securities sectors. New customers carrying out large one-off transactions a customer whos been introduced to you -. Documentation is necessary to store the results.

Source: service.betterregulation.com

Source: service.betterregulation.com

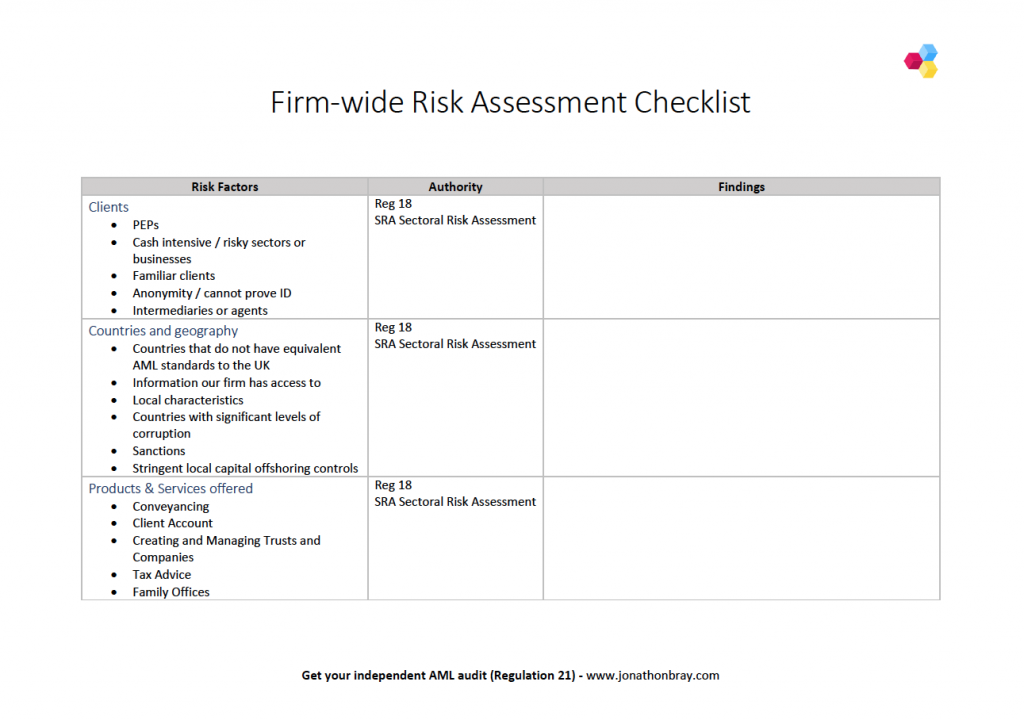

Documentation is necessary to store the results. Annexes to this document contain additional information relating to money laundering terrorist financing risk assessments. Identifying assessing and understanding the risk of money laundering is an essential part of the implementation. Understanding risk within the Recommendation 12 context is important for two reasons. The findings of a money laundering risk assessment will result in individual risk scores for each KRI as well as an aggregate risk score which is the compounded or overall risk that the business presents.

Source: ctmfile.com

Source: ctmfile.com

Inherently high risk for money laundering. This helps the organizations to determine the level of anti-money laundering resources necessary to mitigate that risk. Documentation is necessary to store the results. Countries to identify assess and understand the risks of money laundering and terrorist financing which they face. The first model results from the need to obtain a clients risk level in a first contact in order to support.

Source: bi.go.id

Source: bi.go.id

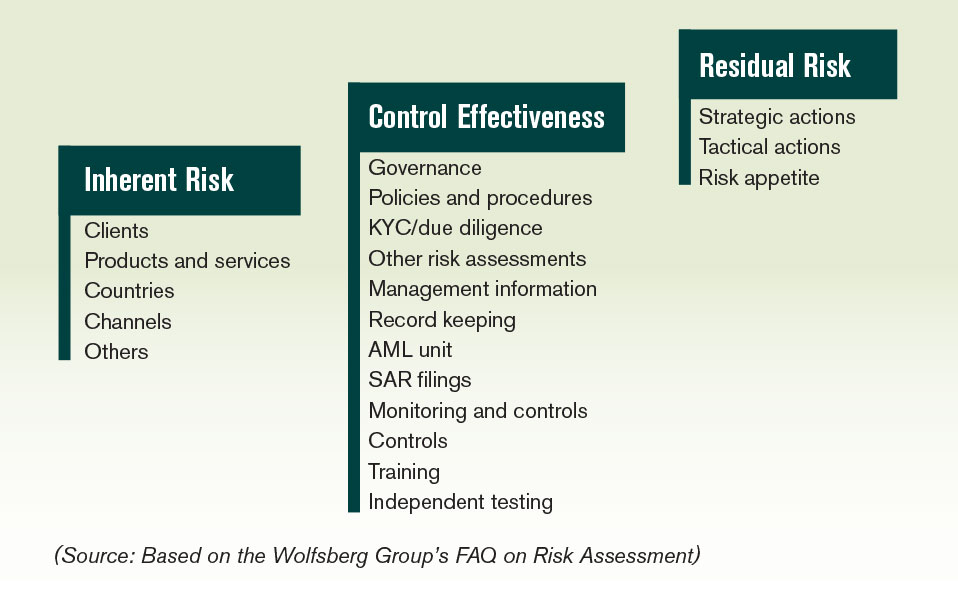

The three main stages involved in the risk assessment process. Accurately judging the risk level of customer money laundering is an important prerequisite for the risk-based approach. Russias overall risk score has fallen from 575 to 560 out of 10 where 10 equals the highest assessed risk of MLTF. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. Documentation is necessary to store the results.

Source: bi.go.id

Source: bi.go.id

This helps the organizations to determine the level of anti-money laundering resources necessary to mitigate that risk. New customers carrying out large one-off transactions a customer whos been introduced to you -. RBA - High Level Principles and Procedures. There is a need for human intervention to really assess whether the cases flagged out by the system are truly bearing money laundering risk. Outcome of the risk assessment.

Source: lexology.com

Source: lexology.com

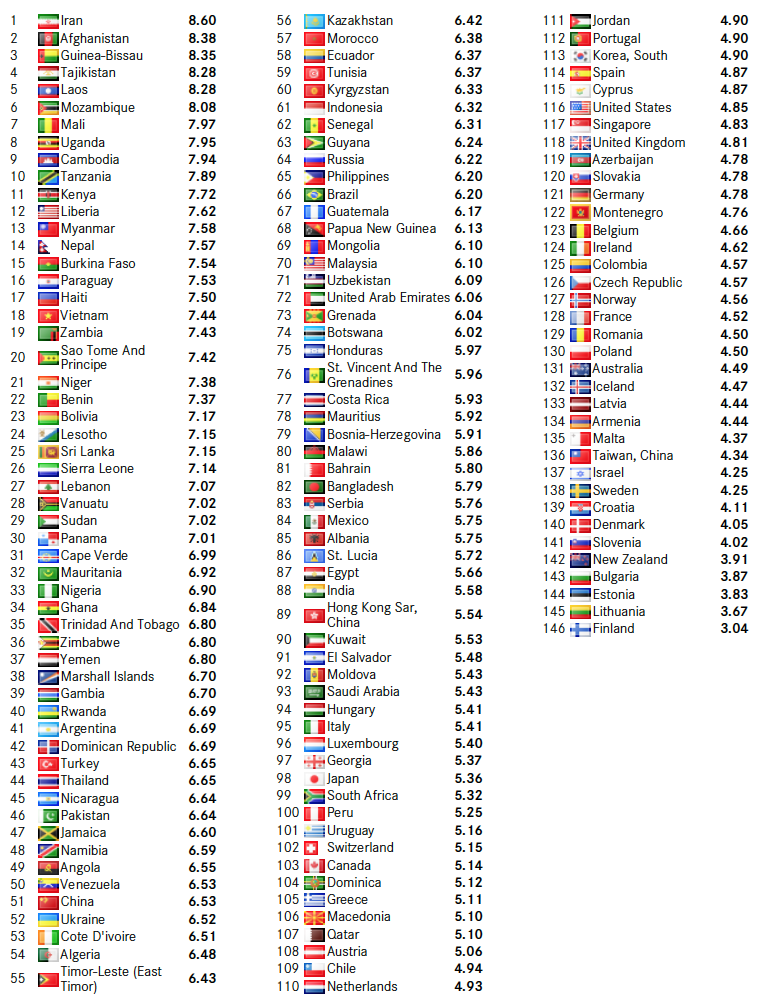

The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. Individual and Aggregate Risk Levels. Countries to identify assess and understand the risks of money laundering and terrorist financing which they face. The three main stages involved in the risk assessment process. AML risk assessment is calculation of the possibilities of money laundering event taking place.

Money launderingterrorism financing risk assessment Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. The findings of a money laundering risk assessment will result in individual risk scores for each KRI as well as an aggregate risk score which is the compounded or overall risk that the business presents. Russias overall risk score has fallen from 575 to 560 out of 10 where 10 equals the highest assessed risk of MLTF. New customers carrying out large one-off transactions a customer whos been introduced to you -.

Source: redalyc.org

Source: redalyc.org

Download pdf 258kb The Guidance on the Risk-Based Approach to combating Money Laundering and Terrorist Financing was developed by the FATF in close consultation with representatives of the international banking and securities sectors. The first model results from the need to obtain a clients risk level in a first contact in order to support. Annexes to this document contain additional information relating to money laundering terrorist financing risk assessments. The three main stages involved in the risk assessment process. Russias overall risk score has fallen from 575 to 560 out of 10 where 10 equals the highest assessed risk of MLTF.

Countries to identify assess and understand the risks of money laundering and terrorist financing which they face. There is a need for human intervention to really assess whether the cases flagged out by the system are truly bearing money laundering risk. Identifying assessing and understanding the risk of money laundering is an essential part of the implementation. Inherently high risk for money laundering. Detection system of suspected cases of money laundering - the Risk Assessment Model of New Entities and Clients and the Risk Assessment Model of Client Behavior.

Source: ec.europa.eu

Source: ec.europa.eu

Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. The first model results from the need to obtain a clients risk level in a first contact in order to support. This helps the organizations to determine the level of anti-money laundering resources necessary to mitigate that risk. It is the first thing you must do because it determines what measures you need to include in your program. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing.

Source: taxguru.in

Source: taxguru.in

Outcome of the risk assessment. Understanding risk within the Recommendation 12 context is important for two reasons. This helps the organizations to determine the level of anti-money laundering resources necessary to mitigate that risk. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. Under this recommendation states should designatean authority or mechanism to coordinate actions to assess risk.

Source: bi.go.id

Source: bi.go.id

Download pdf 258kb The Guidance on the Risk-Based Approach to combating Money Laundering and Terrorist Financing was developed by the FATF in close consultation with representatives of the international banking and securities sectors. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Download pdf 258kb The Guidance on the Risk-Based Approach to combating Money Laundering and Terrorist Financing was developed by the FATF in close consultation with representatives of the international banking and securities sectors. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. The first model results from the need to obtain a clients risk level in a first contact in order to support.

Documentation is necessary to store the results. Annexes to this document contain additional information relating to money laundering terrorist financing risk assessments. Under this recommendation states should designatean authority or mechanism to coordinate actions to assess risk. Documentation is necessary to store the results. RBA - High Level Principles and Procedures.

Source: acamstoday.org

Source: acamstoday.org

Detection system of suspected cases of money laundering - the Risk Assessment Model of New Entities and Clients and the Risk Assessment Model of Client Behavior. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking. Detection system of suspected cases of money laundering - the Risk Assessment Model of New Entities and Clients and the Risk Assessment Model of Client Behavior. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. This helps the organizations to determine the level of anti-money laundering resources necessary to mitigate that risk.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk level by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.