17++ Money laundering risk in correspondent banking information

Home » money laundering Info » 17++ Money laundering risk in correspondent banking informationYour Money laundering risk in correspondent banking images are ready in this website. Money laundering risk in correspondent banking are a topic that is being searched for and liked by netizens now. You can Get the Money laundering risk in correspondent banking files here. Find and Download all free images.

If you’re looking for money laundering risk in correspondent banking images information linked to the money laundering risk in correspondent banking keyword, you have visit the right blog. Our site always provides you with hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

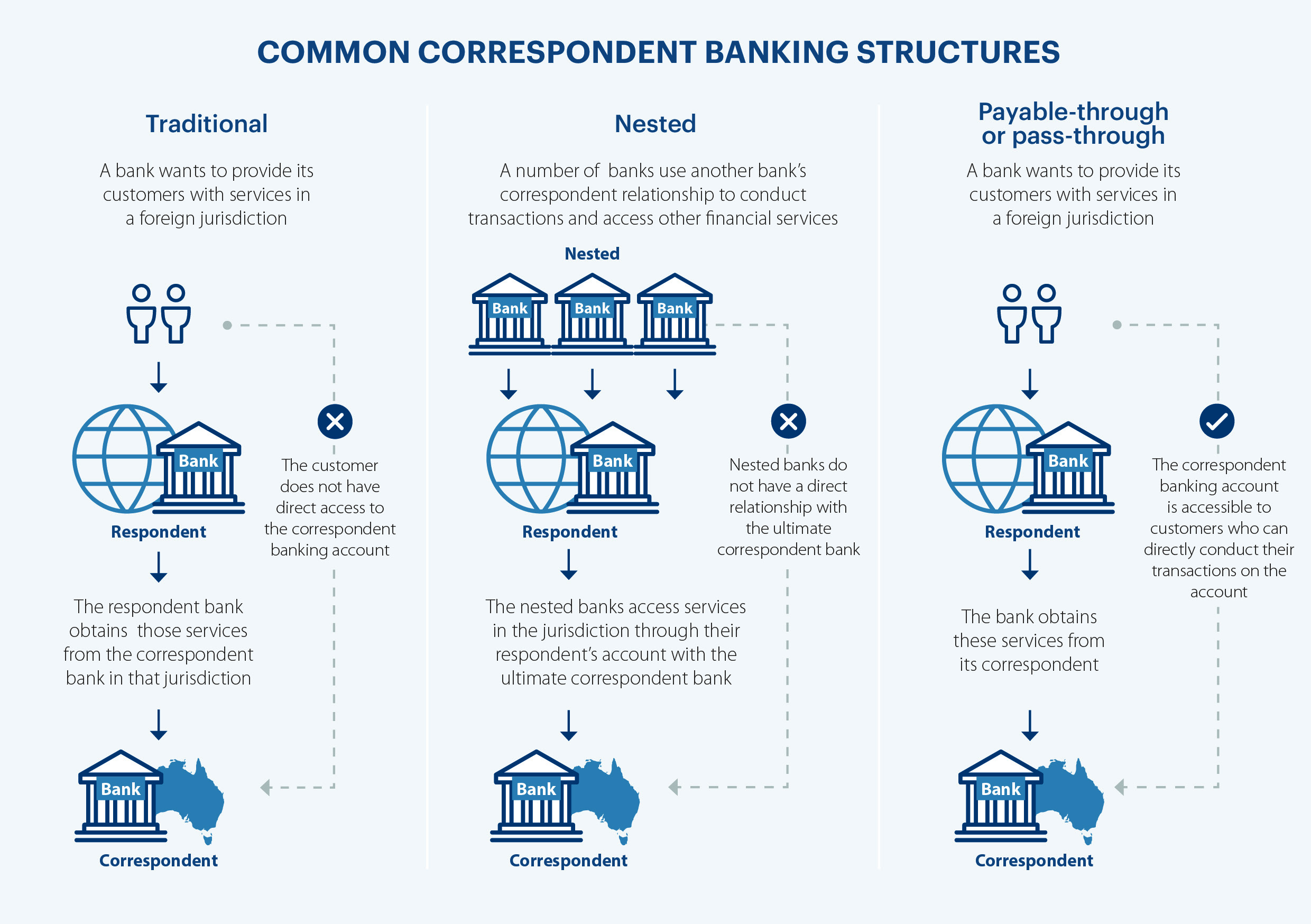

Money Laundering Risk In Correspondent Banking. Correspondent banking can give rise to various risks. Due diligence and red flag implications. The Correspondent Banking Clients Geographic Risk Certain jurisdictions are internationally recognised as having inadequate anti-money. The speed at which payments must be processed also hinders the identification of suspicious transactions.

Focus On The Rising Difficulties Of Carrying Out Correspondent Banking Activities Indeed From indeed.headlink-partners.com

Focus On The Rising Difficulties Of Carrying Out Correspondent Banking Activities Indeed From indeed.headlink-partners.com

Correspondent bank accounts among several negative impacts facilitates. Correspondent banking and its use as a tool for laundering money. The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Correspondent banking can give rise to various risks. The money laundering and terrorist financing risks of correspondent banking. Risks associated with correspondent banking.

What is correspondent banking.

Fundamentals of correspondent banking. Rather than correspondent banking can generate hundreds of thousands of alerts per month. Correspondent banking and its use as a tool for laundering money. Money laundering risk is inherent in correspondent banking. The Basel Committee on Banking Supervision has finalised its revisions to the annex on correspondent banking. Correspondent banking can give rise to various risks.

Source: researchgate.net

Source: researchgate.net

These revisions are included in a new release of the guidelines on the Sound management of risks related to money laundering and financing of terrorism which was first published in January 2014 with a first revised version issued in February 2016. These risks are magnified by the fact that credit institutions have tended not to consider transactions performed on behalf of other institutions as high-risk activity with regard to money laundering. Fundamentals of correspondent banking. You will look at the inherent money laundering risks and develop skills that will help you recognise potentially dangerous situations in correspondent banking relationships before they escalate into what could become major events. In conducting due diligence on any Correspondent Banking Client the elements set out below to address specific risk indicators shall be considered as appropriate.

Source: austrac.gov.au

Source: austrac.gov.au

Correspondent Banking Clients Anti-Money Laundering Controls The quality of the Correspondent Banking Clients anti-money laundering and client identification controls including whether these controls meet internationally recognised standards. Correspondent banking is vulnerable to money laundering risk for a host of different reasons including. Anti-money laundering AML. Correspondent banking relationships create significant money laundering and terrorist financing risks because the domestic bank carrying out the transaction has to rely on the foreign bank to identify the customer determine the real owners and monitor such transactions for risks. Correspondent Banking Clients Anti-Money Laundering Controls The quality of the Correspondent Banking Clients anti-money laundering and client identification controls including whether these controls meet internationally recognised standards.

Source: indeed.headlink-partners.com

Source: indeed.headlink-partners.com

Over under and multiple invoicing uboating value gaps. The Correspondent Banking Clients Geographic Risk Certain jurisdictions are internationally recognised as having inadequate anti-money. In conducting due diligence on any Correspondent Banking Client the elements set out below to address specific risk indicators shall be considered as appropriate. The staffs investigation led them to conclude that allowing high-risk foreign banks and their criminal clients access to US. Correspondent banking relationships create significant money laundering and terrorist financing risks because the domestic bank carrying out the transaction has to rely on the foreign bank to identify the customer determine the real owners and monitor such transactions for risks.

Source: elibrary.imf.org

Source: elibrary.imf.org

Foreign jurisdictions with weakinadequate AMLCFT Rules banking. The extent to which an institution will enquire will depend upon the risks presented. FATF noted that financial institutions have increasingly decided to avoid rather than to manage possible money laundering or terrorist financing risks by terminating business relationships with entire regions. FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. Due diligence and red flag implications.

Correspondent bank accounts among several negative impacts facilitates. Correspondent banking risk in Trade. You will look at the inherent money laundering risks and develop skills that will help you recognise potentially dangerous situations in correspondent banking relationships before they escalate into what could become major events. FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. Correspondent banks may have no pre-existing relationships with parties with which the respondent transacts making them vulnerable to corruption and money laundering.

Source: slideplayer.com

Source: slideplayer.com

The extent to which an institution will enquire will depend upon the risks presented. Correspondent banks may have no pre-existing relationships with parties with which the respondent transacts making them vulnerable to corruption and money laundering. Due diligence and red flag implications. Over under and multiple invoicing uboating value gaps. FATF noted that financial institutions have increasingly decided to avoid rather than to manage possible money laundering or terrorist financing risks by terminating business relationships with entire regions.

Source: yumpu.com

Source: yumpu.com

These risks are magnified by the fact that credit institutions have tended not to consider transactions performed on behalf of other institutions as high-risk activity with regard to money laundering. Many correspondent banks have simply assumed that their respondents have already performed all of the necessary anti-money laundering controls. Correspondent banking can give rise to various risks. FATF guidelines on correspondent banking AML risk. The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction.

Source: twitter.com

Source: twitter.com

The Basel Committee on Banking Supervision has finalised its revisions to the annex on correspondent banking. Correspondent banking can give rise to various risks. Foreign jurisdictions with weakinadequate AMLCFT Rules banking. Correspondent banking relationships create significant money laundering and terrorist financing risks because the domestic bank carrying out the transaction has to rely on the foreign bank to identify the customer determine the real owners and monitor such transactions for risks. Many correspondent banks have simply assumed that their respondents have already performed all of the necessary anti-money laundering controls.

Source: slideplayer.com

Source: slideplayer.com

Correspondent banking can give rise to various risks. FATF guidelines on correspondent banking AML risk. In conducting due diligence on any Correspondent Banking Client the elements set out below to address specific risk indicators shall be considered as appropriate. These revisions are included in a new release of the guidelines on the Sound management of risks related to money laundering and financing of terrorism which was first published in January 2014 with a first revised version issued in February 2016. Fundamentals of correspondent banking.

Source: researchgate.net

Source: researchgate.net

Correspondent banking relationships create significant money laundering and terrorist financing risks because the domestic bank carrying out the transaction has to rely on the foreign bank to identify the customer determine the real owners and monitor such transactions for risks. These risks are magnified by the fact that credit institutions have tended not to consider transactions performed on behalf of other institutions as high-risk activity with regard to money laundering. More than 90 of these will typically be false positives resulting in high costs and the risk that illicit transactions will be missed. Foreign jurisdictions with weakinadequate AMLCFT Rules banking. Rather than correspondent banking can generate hundreds of thousands of alerts per month.

The speed at which payments must be processed also hinders the identification of suspicious transactions. The staffs investigation led them to conclude that allowing high-risk foreign banks and their criminal clients access to US. FATF noted that financial institutions have increasingly decided to avoid rather than to manage possible money laundering or terrorist financing risks by terminating business relationships with entire regions. Correspondent banks may have no pre-existing relationships with parties with which the respondent transacts making them vulnerable to corruption and money laundering. Correspondent banking risk in Trade.

Correspondent banking is vulnerable to money laundering risk for a host of different reasons including. The Basel Committee on Banking Supervision has finalised its revisions to the annex on correspondent banking. Correspondent banking can give rise to various risks. FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. In conducting due diligence on any Correspondent Banking Client the elements set out below to address specific risk indicators shall be considered as appropriate.

Source: tookitaki.ai

Source: tookitaki.ai

Money laundering risk is inherent in correspondent banking. Foreign jurisdictions with weakinadequate AMLCFT Rules banking. The speed at which payments must be processed also hinders the identification of suspicious transactions. Risks associated with correspondent banking. More than 90 of these will typically be false positives resulting in high costs and the risk that illicit transactions will be missed.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk in correspondent banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.